- Home

- »

- Advanced Interior Materials

- »

-

Asia Pacific Gypsum Board Market, Industry Report, 2030GVR Report cover

![Asia Pacific Gypsum Board Market Size, Share & Trends Report]()

Asia Pacific Gypsum Board Market Size, Share & Trends Analysis Report By Product (Wallboard, Ceiling Board), By Application (Pre-engineered Metal Building), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-325-6

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Asia Pacific Gypsum Board Market Trends

The Asia Pacific gypsum board market size was estimated at USD 18.4 billion in 2023 and is projected to grow at a CAGR of 14.0% from 2024 to 2030. This growth can be attributed to the rapid urbanization and industrialization in the region, leading to an increased demand for residential and commercial construction. Furthermore, the growing awareness about the benefits of gypsum board, such as its durability, versatility, and cost-effectiveness, has also contributed to its rising popularity. In addition, government initiatives promoting sustainable construction materials have further propelled market expansion.

The Asia Pacific gypsum board market accounted for a share of 32.9% of the global gypsum board market revenue in 2023. Regulation significantly shapes the gypsum board market in the APAC region, with various countries implementing specific laws and standards to ensure quality, safety, and environmental compliance. For instance, China has strict regulations under the GB/T 9775 standard, which sets comprehensive criteria for the physical and mechanical properties of gypsum boards, influencing manufacturers to enhance product quality. Similarly, India's Bureau of Indian Standards (BIS) prescribes IS 2095 standards, mandating specific requirements for different types of gypsum boards, thus ensuring uniformity and safety across the market. In Japan, the Building Standards Law imposes stringent fire-resistance requirements on construction materials, including gypsum boards, to enhance building safety in earthquake-prone regions. In addition, Australia's National Construction Code (NCC) incorporates regulations that promote the use of eco-friendly and sustainable materials, pushing the gypsum board market towards greener production practices.

Product Insights

The wallboard segment held a share of 51.3% in 2023. Wallboards are commonly used in the construction of ceilings & interior walls. The dominance is attributed to the widespread use of wallboard in both residential and commercial construction due to its ease of installation, cost-effectiveness, and adaptability to various aesthetic finishes. Furthermore, the demand for wallboard is driven by its inherent properties, such as fire resistance, sound insulation, and durability.

The pre-decorated board segment is projected to witness the fastest CAGR of 14.9% from 2024 to 2030. Pre-decorated boards save time and reduce labor costs. This convenience factor, along with the growing demand for aesthetically pleasing interiors, is driving the segment growth. In addition, the increasing trend of sustainable and eco-friendly construction materials is expected to boost the demand for pre-decorated boards, as these boards often incorporate recycled materials and contribute to green building certifications.

Application Insights

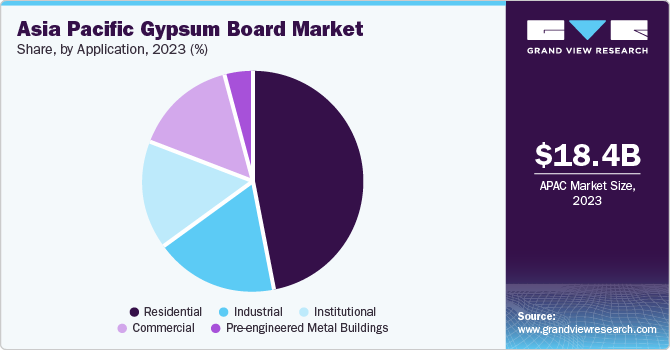

The residential segment accounted for the largest share of 47.0% in 2023. This dominance can be attributed to the extensive use of gypsum boards in the construction of new homes and the renovation of existing ones. Gypsum boards are favoured in residential construction due to their versatility, cost-effectiveness, and ease of installation. They are used in walls, ceilings, and partition systems, providing aesthetic appeal, sound insulation, and fire resistance. The increasing population and rapid urbanization in the region, coupled with government initiatives promoting affordable housing, are expected to drive product demand in the residential sector.

The institutional segment is projected to grow at a CAGR of 14.3% from 2024 to 2030. Institutional buildings include schools, hospitals, government buildings, and other public facilities. The growth in this segment can be attributed to the increasing investments in public infrastructure development in the Asia Pacific region. Gypsum boards are widely used in these buildings due to their durability, fire resistance, and acoustic properties. Furthermore, rising popularity of green building practices in institutional construction is expected to boost the demand for sustainable gypsum board products. As such, the institutional segment is poised for significant growth in the coming years.

Country Insights

ChinaGypsum Board Market Trends

The China gypsum board market held a share of 54.6% of the total regional market revenue in 2023. This dominance can be attributed to the country's rapid urbanization and industrialization, which has led to a surge in construction activities. The Chinese government's initiatives to promote affordable housing and sustainable construction practices have further boosted the demand for gypsum boards. In addition, China is home to several key gypsum board manufacturers, contributing to the country's significant market share. The ongoing development of mega projects and smart cities in China is expected to continue driving the demand for gypsum boards in the country.

India Gypsum Board Market Trends

The gypsum board market in India is projected to witness the fastest CAGR of 14.6% from 2024 to 2030. The growth in India's gypsum board market can be attributed to the country's booming construction industry, driven by increasing investments in residential, commercial, and infrastructure projects. The Indian government's initiatives to promote affordable housing and sustainable construction have also contributed to the rising demand for gypsum boards. Furthermore, the growing awareness about the benefits of gypsum boards over traditional construction materials is expected to boost market growth in India. As such, India presents significant growth opportunities for gypsum board manufacturers in the coming years. In December 2023, Government of India imposed a definitive anti-dumping duty on gypsum board and tiles from China for five years. The duty will range from USD 23.46-47.62 per tonne for Chinese imports, and USD 71.80-91.42 per metric tonne for imports from Oman.

Key Asia Pacific Gypsum Board Company Insights

Some of the key players operating in the market include CNBM, Saint Gobin, KCC, and Knauf:

-

CNBM is the world’s largest gypsum board group that offers a wide range of gypsum board products including high-grade gypsum boards produced by Beijing New Building Materials (Group) Co., Ltd. (BNBM), a subsidiary of CNBM

-

KCC Corp. offers a variety of gypsum board products for the market including general gypsum boards, waterproof gypsum boards used in high humidity conditions, fire-resistant gypsum boards for fireproofing, antibacterial gypsum boards for suppressing the proliferation and growth of mold, and acoustic gypsum boards for soundproofing

Key Asia Pacific Gypsum Board Companies:

- China National Building Material Company Limited (CNBM)

- KCC Corporation

- Knauf Gips KG

- Saint-Gobain Gyproc

- Beijing New Building Material (Group) Co., Ltd.

- BGC Pty. Ltd.

- CHIYODA UTE Co., Ltd.

- Georgia-Pacific Gypsum LLC

- Jason Plasterboard (Jiaxing) Co. Ltd.

- Yoshino Gypsum Co., Ltd.

Recent Developments

-

In March 2024, Etex acquired BGC's plasterboard and fiber cement businesses, solidifying its Australian presence and product offerings

-

In January 2024, Saint-Gobain entered a Memorandum of Understanding (MoU) for a USD 407.1 million investment in Tamil Nadu, encompassing various business segments including gypsum and plasterboard, which will involve a combination of greenfield and brownfield projects across several manufacturing facilities

Asia Pacific Gypsum board Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 45.9 billion

Growth rate

CAGR of 14.0% from 2024 to 2030

Base year for estimation

2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, volume in million square meters, and CAGR from 2024 to 2030

Report coverage

Revenue & volume forecast, competitive landscape, growth factors, trends

Segments covered

Product, application, country

Country outlook

China; India; Japan; South Korea

Key companies profiled

China National Building Material Company Ltd. (CNBM); KCC CORP.; Knauf Gips K; Saint-Gobain; Beijing New Building Material (Group) Co., Ltd.; BGC Pty Ltd.; CHIYODA UTE Co., Ltd.; Georgia-Pacific Gypsum LLC; Jason Plasterboard (Jiaxing) Co. Ltd.; Yoshino Gypsum Co., Ltd.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Gypsum Board Market Report Segmentation

This report forecasts revenue growth regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific gypsum board market report based on product, application, and country:

-

Product Outlook (Volume, Million Square Meters; Revenue, USD Billion, 2018 - 2030)

-

Wallboard

-

Ceiling Board

-

Pre-decorated Board

-

Others

-

-

Application Outlook (Volume, Million Square Meters; Revenue, USD Billion, 2018 - 2030)

-

Pre-engineered Metal Buildings

-

Residential

-

Industrial

-

Commercial

-

Institutional

-

-

Country Outlook (Volume, Million Square Meters; Revenue, USD Billion, 2018 - 2030)

-

China

-

India

-

Japan

-

South Korea

-

Frequently Asked Questions About This Report

b. The global Asia Pacific gypsum board market size was estimated at USD 18.4 billion in 2023 and is expected to reach USD 20.68 billion in 2024.

b. The Asia Pacific gypsum board market is expected to grow at a compound annual growth rate of 14.0% from 2024 to 2030, reaching USD 45.9 billion by 2030.

b. The residential segment accounted for the largest share of 47.0% in 2023 owing to the extensive use of gypsum boards in the construction of new homes and the renovation of existing ones.

b. Key players operating in the market are China National Building Material Company Limited (CNBM), KCC Corporation, Knauf Gips KG, Saint-Gobain Gyproc, Beijing New Building Material (Group) Co., Ltd., and BGC Pty. Ltd.

b. The key factors driving the Asia Pacific gypsum board market include increased demand for residential and commercial construction and rising awareness about its benefits, such as its durability, versatility, and cost-effectiveness.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."