- Home

- »

- Next Generation Technologies

- »

-

Asia Pacific Generative AI Market Size, Share, Report, 2030GVR Report cover

![Asia Pacific Generative AI Market Size, Share & Trends Report]()

Asia Pacific Generative AI Market Size, Share & Trends Analysis Report By Component (Software, Services), By Technology, By End-use, By Application, By Model, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-196-9

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Asia Pacific Generative AI Market Trends

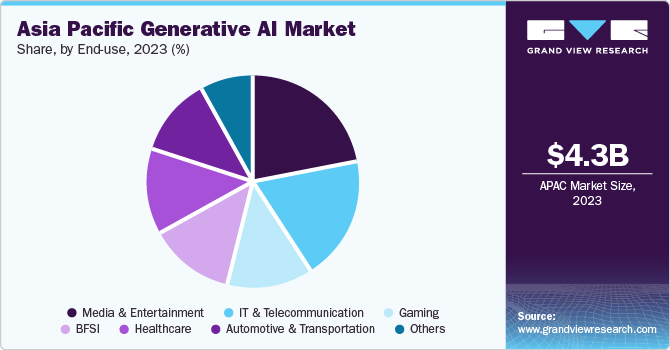

The Asia Pacific generative AI market size was estimated at USD 4.25 billion in 2023 and is expected to grow at a compounded annual growth rate (CAGR) of 37.5% from 2024 to 2030. The increasing internet usage, technological advancement, and government initiatives drive market growth. Asia Pacific has witnessed a significant surge in the adoption of AI technologies across various industries. Generative AI or GenAI, which includes technologies, such as Generative Adversarial Networks (GANs) and other deep learning models, is increasingly utilized for tasks, such as image & video synthesis and content creation. The Salesforce AI Readiness Index 2023 revealed that five of the 12 economies in the report (Australia, Indonesia, Singapore, New Zealand, and Thailand) have improved their overall AI readiness score since 2021.

It is a direct result of the various AI-related initiatives these economies have implemented between 2021 and 2023. Hence, the growing adoption of AI offers a major opportunity for the GenAI market. The availability of vast amounts of data is crucial for training and improving GenAI models. Asia Pacific, with its large and diverse population, provides a rich data source for training models, particularly in areas, such as language processing and computer vision. In addition, cloud storage solutions offer several benefits for GenAI projects. They enable efficient data accessibility and collaboration, allowing teams from across the globe to store and share various datasets. Cloud storage also operates on a pay-as-you-go model that reduces economic restraints and facilitates secure management of sensitive projects.

Cloud providers offer pre-trained models and APIs that simplify the development process, while cloud-based infrastructure optimizes resources and increases business agility. Consequently, cloud storage solutions promote GenAI innovation by allowing companies to explore creative avenues and fuel market growth. Generative AI tools have experienced significant growth due to advancements in deep learning. Generative models use AI, probability, and statistics to create computer-based representations of targeted variables based on previous observations, input, or datasets. These advancements have made deep learning models more intelligent and capable, enabling them to perform complex tasks, such as language translation, image recognition, and content generation, with exceptional precision and effectiveness.

In addition, the demand for more personalized, engaging, and relevant content & experiences has fueled the growth of this market. The Asia Pacific generative AI gaming market is witnessing growth due to an increasing player base and diversification, which has created a demand for immersive and personalized gaming experiences. GenAI technologies, such as procedural content generation and dynamic storytelling, enable the creation of an adaptive game environment that improves player engagement and replicability. In addition, easy availability of hardware and advancements in machine learning algorithms have enabled the integration of AI features, contributing to the overall evolution of gaming experiences in the region. In November 2023, Microsoft announced partnership with Inworld AI, a GenAI startup, to create an 'AI design copilot' system for Xbox game developers.

The collaboration aims to assist console developers in utilizing the potential of GenAI to produce dialogue trees, randomly generated quests, and even write detailed scripts for non-playable characters. The new tools are expected to help boost game developer creativity, simplify development, and enhance player experiences. Generative artificial intelligence (AI) is gaining popularity in cost-sensitive countries, where it plays a vital role in managing IT operations and services. This technology automates tasks related to IT operations, reducing operational costs and optimizing resource utilization. The region, consisting of developed economies, including Australia, Japan, and Singapore, as well as rapidly growing markets, such as India and China, presents diverse IT requirements and challenges. In emerging economies, GenAI is involved in facilitating scalable IT operations.

Some local governments have been actively promoting the use of AI, including GenAI, for developing smart cities. These applications include traffic management, public safety, and urban planning. Singapore is implementing generative AI initiatives for smart cities. In July 2023, Singapore's digital government agencies partnered with Google Cloud to develop GenAI capabilities in the public and private sectors. The Ministry of Communications and Information, the Smart Nation and Digital Government Office (SNDGO), and Digital Industry Singapore lead the "AI Trailblazers" program to employ GenAI to solve 100 real-world issues. Creative industries, including gaming, entertainment, and digital media, have seen extensive usage of GenAI. Content creators use AI algorithms to create realistic images, animations, and other multimedia content. This trend is particularly prominent in countries with strong gaming and entertainment sectors, such as South Korea and Japan.

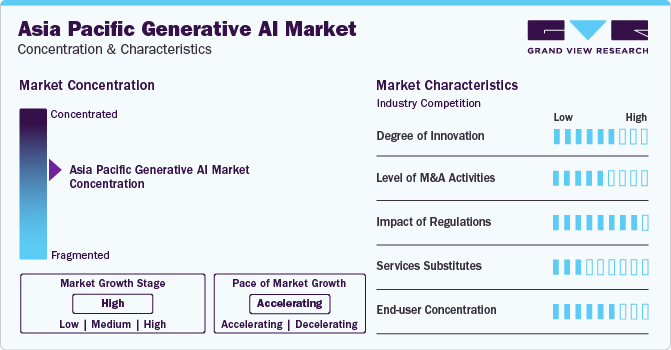

Market Concentration & Characteristics

Asia Pacific generative AI market growth stage is high, and the pace is accelerating. The regional market is characterized by an active and rapidly evolving landscape driven by technological advancements, diverse applications, and a supportive ecosystem. One prominent feature is the increasing adoption of GenAI across various industries, including healthcare, finance, entertainment, and more. The demand for innovative solutions in healthcare, such as medical image synthesis and drug discovery, boosted growth in the region.

Government initiatives and policies supporting AI development influence the growth of the generative artificial intelligence market in the region. Some countries have implemented strategies to promote research, innovation, and the responsible use of AI technologies. These initiatives often include funding, regulatory frameworks, and collaborations between government bodies, academia, and the industry. As governments actively engage in shaping the AI landscape, it contributes to a favorable environment for the regional market growth, fostering innovation and cross-industry collaborations. In January 2024, Accenture announced the expansion of the Generative AI Studios network in Latin America and Asia Pacific to meet the increasing client demand. It sets to enable co-creation, scaling, and experimentation of GenAI solutions leveraging Responsible AI as a foundation, an AI framework to build AI systems. The studios will be in Australia, Argentina, Brazil, China, Japan, India, the Philippines, Mexico, and Singapore.

The market is developing and has a significantly concentrated nature, featuring several global and regional players. Key players are investing in R&D to develop advanced solutions and gain a competitive edge. Moreover, they are entering into partnerships and mergers & acquisitions as the market is characterized by innovation, disruption, and rapid change. According to a study published by the Infosys Knowledge Institute (IKI) in January 2024, companies in Asia Pacific are increasing their investments in GenAI and moving to a higher level of maturity. The study estimates that APAC companies are set to witness the most significant increase up to 140% in 2024. The report forecasts a USD 3.4 billion investment in GenAI across Australia, New Zealand, China, Japan, India, and Singapore.

Component Insights

Based on components, the market is further bifurcated into software and services. The software segment accounted for the largest revenue share of 64.7% in 2023 and is expected to continue to dominate the industry over the forecast period. The growth of the software segment can be attributed to factors, such as rapid adoption of new technologies, increasing investment in AI, emerging economic indicators, rising demand for automation, and a supportive regulatory environment. Generative AI software is expected to play a significant role in various sectors and industries, including manufacturing, gaming, and design. The service segment is anticipated to witness the fastest CAGR from 2024 to 2030.

The segment growth can be attributed to the increasing concerns over fraud detection, data protection, risk factor modeling, and trading prediction. Cloud-based GenAI services are expected to gain popularity as they provide scalability, flexibility, and cost-effectiveness, fueling the segment's growth. In February 2024, Alibaba Cloud launched PAI-EAS, a serverless version of its Platform for AI-Elastic Algorithm Service. It offers a cost-effective solution for deploying and inferring models to individuals and enterprises. Users can access computing resources as required without managing physical or virtual servers. In addition, the serverless version is expected to expand its capabilities in March 2024 to support the deployment of open-source large language models (LLMs) and models from Alibaba's ModelScope.

Technology Insights

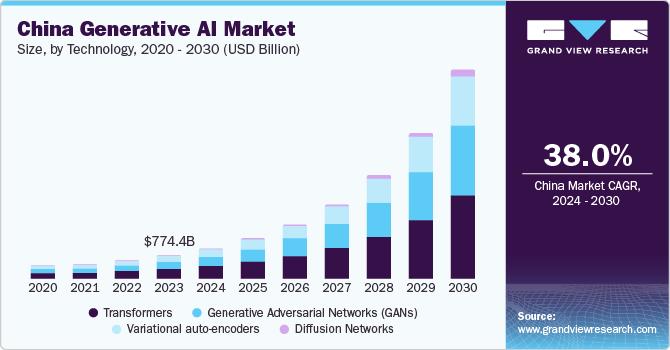

Based on technology, the market is segmented into Generative Adversarial Networks (GANs), transformers, variational auto-encoders, and diffusion networks. The transformers segment held the largest revenue share in 2023. It can be attributed to the rapid digitization of businesses, increasing number of government initiatives in AI, and rising adoption of AI applications. On the other hand, the diffusion networks segment is expected to witness the fastest CAGR from 2024 to 2030. An increasing demand for more advanced and diverse generative models capable of synthesizing high-quality and realistic content across various domains, such as images, videos, text, and music, drives segment growth.

Its refinement mechanism allows diffusion networks to produce high-resolution and realistic outputs across various modalities, making them attractive for applications requiring control over generated content or maintaining consistency. Image generation is now crucial for various industries, including BFSI, healthcare, media & entertainment, automotive & transportation, and defense, as it offers high value to businesses, government, and the public. Diffusion networks are an improved alternative to GANs as they can generate a significantly higher diversity of images with little effort in training while handling noise better. Using diffusion networks for GenAI can unlock unique capabilities, such as creating diverse images, rendering text in various artistic styles, and animation.

End-use Insights

Based on end-use, the market is segmented into media & entertainment, BFSI, IT & telecommunications, healthcare, automotive & transportation, and others. The others sub-segment further comprises security, aerospace & defense. The media & entertainment segment accounted for the largest revenue share in 2023 and is projected to grow at a significant CAGR from 2024 to 2030. The increasing adoption of GenAI for better advertisement and campaign journalism will drive the demand for this technology in the media & entertainment industry. In February 2024, Microsoft announced its plan to collaborate with news organizations to introduce generative AI. The collaboration includes media platforms, such as Semafor and other news organizations. This collaboration aims to aid journalists in utilizing generative GenAI for content production. Microsoft aims to help these organizations establish and refine policies and procedures for the responsible use of AI in their news gathering and business practices.

The BFSI segment is expected to witness the fastest CAGR from 2024 to 2030. The segment growth is attributed to enhancing customer experiences and simplifying complex data analysis and risk management. The banking and finance industry is rapidly undergoing digital transformation, with countries, such as China, Japan, and Singapore leading in AI innovation. Fintech startups are adopting GenAI to improve risk assessment, fraud detection, customer experience, and financial forecasting, introducing innovative solutions and disrupting traditional financial institutions.

Application Insights

The Natural Language Processing (NLP) segment dominated the market in 2023 and is projected to grow at a significant CAGR from 2024 to 2024. The use of NLP technologies is rapidly increasing as platforms, such as Siri, Alexa, and Google Search, gain popularity due to their ability to significantly enhance automation and decision-making processes across various industries. Integrating generative AI in education is seen as a tool for personalized learning and improved educational outcomes. It offers significant potential for the education industry; however, implementing it in developing regions like Asia Pacific requires a comprehensive approach that balances policy development, research, infrastructure improvement, teacher training, social dialogues, and cultural localization. According to the United Nations Educational, Scientific and Cultural Organization (UNESCO), the convergence of the Sustainable Development Goals (SDGs), the Education 2030 Agenda, and GenAI in Asia Pacific presents an opportunity to harness technology for advancing education, fostering innovation, and promoting sustainable development. By leveraging the transformative potential of GenAI in education, stakeholders can work toward achieving the shared goal of providing inclusive, equitable, and quality education for all while empowering individuals and communities to prosper in the digital age.

The computer vision segment is anticipated to grow at the fastest CAGR from 2024 to 2030. The growing investment in digital infrastructure, such as cloud computing and 5G networks, is strengthening the foundation for deploying computer vision solutions at scale in Asia Pacific. Improved connectivity, processing power, and storage capacity enable real-time visual data analysis, helping applications, such as smart surveillance, autonomous vehicles, and remote diagnostics.

Model Insights

The large language model segment dominated the market in 2023 and is projected to grow at a significant CAGR from 2024 to 2030. The segment growth can be attributed to the growing need for NLP technologies in various applications, such as chatbots, content production, virtual assistants, translation services, and more. Large language models are at the forefront of this trend as they can understand and produce text resembling human-like language. Companies and organizations use these models to improve customer interactions, automate processes, conduct large-scale textual data analysis, and drive innovation across multiple industries.

The multimodal generative model is expected to witness the fastest CAGR from 2024 to 2030. The demand for real-time processing of multimodal data is increasing rapidly, driven by various applications, such as autonomous vehicles, surveillance, and augmented reality (AR). Innovations in hardware and algorithms have enabled systems that can analyze and respond to multimodal inputs with low latency. The growing trend of human-AI collaboration emphasizes the need for multimodal AI systems to enhance human capabilities. This collaboration encourages the cooperation of human intuition and AI's analytical potential, creating a partnership that maximizes the benefits of both entities.

Regional Insights

China dominated the industry with a share of 23.6% in 2023 and is projected to grow at a CAGR of 38.0% from 2024 to 2030 due to accelerating adoption across traditional industries, such as manufacturing, retail, telecoms, and healthcare, and the development of AI computing power. The China Center for Information Industry Development (CCID) reports that GenAI technology, which is driven by large language models, such as OpenAI's ChatGPT, has been adopted by around 15% of businesses in China. The retail and telecom sectors are leading in AI adoption, with rates of 13% and 10%, respectively, followed by healthcare and manufacturing, with rates of 7% and 5% in 2023.

India Generative AI Market Trends

The GenAI market in India is expected to witness significant growth during the forecast period due to skill development in the AI sector, incremental research on the newest technologies, and support through government intervention. According to the National Association of Software and Service Companies (NASSCOM), the number of startups in India specializing in GenAI doubled between 2021 & 2022 and 2023 & 2024. Private investments in AI were estimated to total around USD 8 billion from 2013 to 2022, with USD 3.24 billion raised in 2022.

Key Asia Pacific Generative AI Company Insights

Some of the key players operating in the market include Alibaba Cloud; Baidu, Inc.; Amazon Web Services, Inc.; IBM; and Microsoft

-

Alibaba Cloud is a provider of cloud computing and artificial intelligence services to enterprises, developers, and government organizations in over 200 countries and regions. The company is dedicated to offering dependable and secure cloud computing and data processing capabilities as part of its online solutions

-

Amazon Web Services (AWS) offers a variety of solutions and services for GenAI. These offerings are tailored to assist organizations in innovating and scaling GenAI applications with enterprise-grade security, privacy, and access to industry-leading foundation models. AWS provides tools, such as Amazon Bedrock, Amazon SageMaker, NVIDIA GPU-powered Amazon EC2 instances, AWS Trainium, and AWS Inferentia to facilitate the development and scaling of GenAI applications

-

Huawei Technologies Co., Ltd., MOSTLY AI Inc. are some of the other market participants in the Asia Pacific generative AI market.

-

Huawei Technologies Co., Ltd. offers GenAI solutions tailored for various industries, using advanced algorithms and deep learning techniques. Their offerings include AI-generated content, and data augmentation services

- MOSTLY AI Inc. is a technology company providing AI-based software, IT, and IT consulting services. The company’s Synthetic Data Platform leverages deep neural networks to simulate representative and realistic data at scale and retains valuable information from it while making it impossible to re-identify any individual, due to the in-built privacy mechanism

Key Asia Pacific Generative AI Companies:

The following are the leading companies in the Asia Pacific generative AI market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these Asia Pacific generative AI companies are analyzed to map the supply network.

- Huawei Technologies Co., Ltd.

- Alibaba Cloud

- Baidu, Inc.

- Google LLC

- Amazon Web Services, Inc.

- IBM

- Microsoft

- Genie AI Ltd.

- MOSTLY AI Inc.

- D-ID

Recent Developments

-

In August 2023, Google Cloud announced a partnership with AI21 Labs, an Israel-based company for NLP that develops AI systems. AI21 Labs uses AI/ML infrastructure by Google Cloud to accelerate its model training and inference. It is one of the first partners to offer generative AI capabilities on top of BigQuery

-

In October 2023, Baidu launched ERNIE 4.0, a next-gen model with powerful AI capabilities. ERNIE Bot can understand complex requests and generate text, images, and videos in minutes with a simple prompt and image input

-

In May 2023, Tata Consultancy Services (TCS) announced an extended partnership with Google Cloud. As a part of this partnership, TCS introduced a new product called TCS Generative AI. Using Google Cloud's generative AI capabilities, TCS Generative AI develops and deploys custom business solutions designed to accelerate growth and transformation

Asia Pacific Generative AI Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.56 billion

Revenue forecast in 2030

USD 37.55 billion

Growth rate

CAGR of 37.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, technology, end-use, application, model, region

Regional scope

Asia Pacific

Country scope

China; India; Japan; Australia

Key companies profiled

Huawei Technologies Co., Ltd.; Alibaba Cloud; Baidu, Inc.; Google LLC; Amazon Web Services, Inc.; IBM; Microsoft; Genie AI Ltd.; MOSTLY AI Inc.; D-ID

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Generative AI Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the Asia Pacific generative AI marketreport based on, component, technology, end-use, application, model, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Software

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Generative Adversarial Networks (GANs)

-

Transformers

-

Variational auto-encoders

-

Diffusion Networks

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Media & Entertainment

-

BFSI

-

IT & Telecommunication

-

Healthcare

-

Automotive & Transportation

-

Gaming

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Computer Vision

-

NLP

-

Robotics and Automation

-

Content Generation

-

Chatbots and Intelligent Virtual Assistants

-

Predictive Analytics

-

Others

-

-

Model Outlook (Revenue, USD Million, 2017 - 2030)

-

Large Language models

-

Image & Video generative models

-

Multi-modal generative models

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Singapore

-

-

Frequently Asked Questions About This Report

b. The Asia Pacific generative AI market size was estimated at USD 4.25 billion in 2023 and is expected to reach USD 5.56 billion in 2024

b. The Asia Pacific generative AI market is expected to grow at a compound annual growth rate of 37.5% from 2024 to 2030 to reach USD 37.55 billion by 2030.

b. China dominated the industry with a share of 23.6% in 2023 and is projected to grow at a significant CAGR over the forecast period due to accelerating adoption across traditional industries such as manufacturing, retail, telecoms, and healthcare and the development of artificial intelligence (AI) computing power.

b. Some key players operating in the Asia Pacific generative AI market include Huawei Technologies Co., Ltd., Alibaba Cloud, Baidu, Inc., Google LLC, Amazon Web Services, Inc., IBM, Microsoft, Genie AI Ltd., MOSTLY AI Inc., and D-ID

b. The increasing prevalence of internet usage, technological advancement, and government initiatives drive market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."