- Home

- »

- Conventional Energy

- »

-

Asia Pacific Gas Turbine Market Size, Industry Report, 2030GVR Report cover

![Asia Pacific Gas Turbine Market Size, Share & Trends Report]()

Asia Pacific Gas Turbine Market Size, Share & Trends Analysis Report By Technology (Combined Cycle, Open Cycle), By Capacity (<=200 MW, >200 MW), By End-use (Industrial, Power & Utility), By Application, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-247-1

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

Market Size & Trends

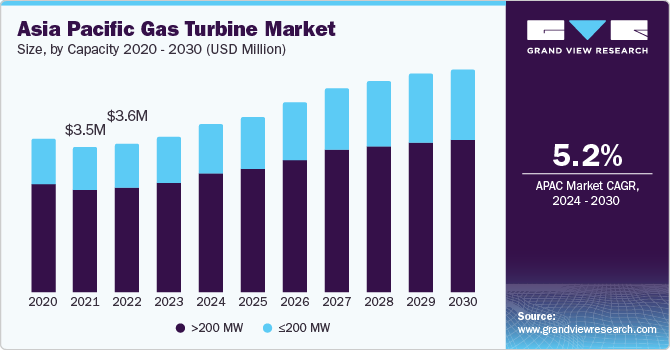

The Asia Pacific gas turbine market size was estimated at USD 3.79 billion in 2023 and is anticipated to expand at a CAGR of 5.2% from 2024 to 2030. This growth is driven by the necessity of effective power-producing infrastructure. Improved efficiency gas turbine sales have increased in East Asia. In addition, the rapid expansion of the industrial sectors in China, India, and South Korea has increased demand for industrial turbines in the area. As labor and utility costs are low in China, the country has become a hub for the establishment of heavy equipment, oil and gas, and process firms. This has contributed to the gas turbine market's penetration in the region.

An engine known as a gas turbine spins turbine blades to produce mechanical energy by heating a mixture of fuel and ambient air to a very high temperature. In addition, the mechanical energy powers a generator, which generates electrical energy. The energy sector is seeing rapid technological developments, and this, together with a shift in emphasis toward distributed power production technologies, is driving the market forward.

The main purpose of gas turbines is to generate electricity. It is far more expensive to operate a basic cycle turbine power plant to provide the industry with electricity than it is to buy it from outside. Consequently, combined cycle power plants-which are more efficient-are used the most. One type of combined cycle power plant that can be used to generate both mechanical drive and electricity is the CHP plant. Major drivers of market expansion include the paradigm change in developed and developing countries like the US, Japan, India, and China from coal-based to gas-based power generation, as well as government policies that encourage the construction of gas-based power plants.

Furthermore, due to the expansion of the food, chemical, and paper & pulp sectors as well as the adoption of combined heat and power systems in APAC nations, the industrial gas turbine market in the Asia Pacific region is expected to increase significantly throughout the projected period. Throughout the projected period, these factors are anticipated to strengthen the gas turbine market. However, the cost-effectiveness of renewable energy sources like solar and wind replaces that of conventional energy sources fueled by fossil fuels. Particularly in the power production sector, this tendency may lead to a decline in the need for gas turbines. In addition, several gas turbines are nearing the end of their useful life, which emphasizes the necessity of replacing or renovating them. In the near run, this may prove to be expensive and time-consuming, which would decrease the need for additional gas turbines.

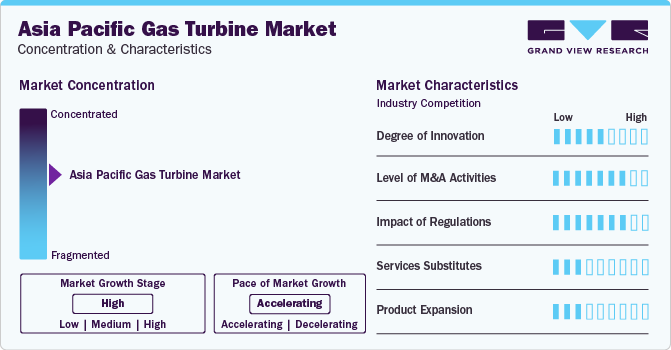

Market Concentration & Characteristics

The Asia Pacific gas turbine market is marked by a moderate level of innovation. Although gas turbine technology has advanced, especially in terms of increasing performance, cutting emissions, and increasing efficiency, the mature state of the technology has limited innovation when compared to other industries.

There is a significant level of merger and acquisition activity in the market. Major firms in the business frequently participate in mergers and acquisitions to extend their product portfolios, reach new markets, or consolidate market share due to the industry's growing level of rivalry and demand for technological knowledge. The need to take advantage of economies of scale and obtain a competitive edge is what's driving this trend.

The market is significantly impacted by regulations, especially those that deal with emissions and environmental requirements. The market for gas turbines with increased efficiency and reduced emissions is driven by stricter emissions limitations and regulatory mandates for cleaner energy sources. Adherence to these regulations is crucial for gaining entry into markets and preserving competitiveness.

There aren't many substitutes for gas turbines available on the market, particularly in sectors like utilities and oil and gas where they are crucial for producing electricity. Although renewable energy and energy storage technologies are becoming more popular, gas turbines are still essential because of their dependability, adaptability, and capacity to supply backup power and system stability.

There is a low level of product expansion in the market. Turbine designs, fuel flexibility, and digitalization features can be altered by manufacturers to satisfy unique client demands and take advantage of new market trends. However, compared to more quickly changing industries, the gas turbine's basic technology and uses remain relatively stable, restricting the degree of product expansion.

Capacity Insights

The >200 MW segment emerged as a significant capacity segment in this market with a revenue share of more than 71.02% in 2023. The demand in this market is mostly driven by the expansion of power generation operations worldwide as well as the trend in some of the world's largest economies from coal-to-gas-based power plants. Large and heavy-duty turbines are mostly needed because of the expanding population and fast urbanization, especially in the developing Asia Pacific countries. In addition to producing electricity, heavy industries and cement production make extensive use of turbines. China and India are experiencing a surge in demand for electricity due to their large populations.

The ≤200 MW turbines held a significant market share in 2023. This growth is attributed to the reduced turbines' weight, which makes the product perfect for offshore areas where the power-to-weight ratio is a crucial consideration when choosing where to install a turbine unit. It is anticipated that the oil and gas sector will pick up steam. Because small turbines are compatible with a variety of operating and environmental circumstances, the oil and gas industry uses them extensively. Over the next several years, a favorable prognosis for the major small gas turbine end-use sectors is anticipated to present a sizable growth opportunity for the category.

End-use Insights

The power & utility segment accounted for the largest revenue share of approximately 90.0% in 2023. This growth is attributed to the growing global need for electricity. The majority of the world's major nations are anticipated to transition from coal-based technologies to gas-based power generation as a result of growing environmental concerns about the emissions from coal. Furthermore, it is anticipated that the market for distributed power, one of the main uses for gas turbines, will expand significantly in the upcoming years. The global energy mix's growing proportion of distributed power is being caused by rising investments and new installations, which is predicted to drive the gas turbine industry.

The Industrial segment witnessed significant growth in the market in 2023 owing to strict emission regulations. In addition, the demand for gas turbines in industrial applications is positively impacted by decreasing natural gas costs as well. The demand has historically been predominantly driven by the expansion of industrial activity worldwide. The market for gas turbines is expanding due to the expansion of industrial sectors and rising captive power plants. The industrial market is experiencing a surge in demand for gas turbines due to multiple measures aimed at promoting the manufacturing sector.

Technology Insights

The combined cycle segment accounted for the largest market share of 87.04% in 2023. Power companies can extract significantly more power from the same amount of natural gas due to combined cycle power plants' high efficiency. Comparing these turbines to open-cycle technology, they also use less fuel to generate the same amount of energy production. Moreover, the market for combined cycle technology will grow during the projected period due to the increased need for large-capacity gas-based power plants to meet the rising demand for electricity in various regions.

The Open cycle segment held a substantial market share in 2023. Open-cycle gas turbines are preferred over small-scale installations because of their advantage in terms of installation space needs. However, it is expected that their significant energy losses will prevent segment expansion because of lower efficiency over the projected time. Moreover, an increase in industrial activity is anticipated to spur the development of open-cycle gas turbine technology during the forecasted period.

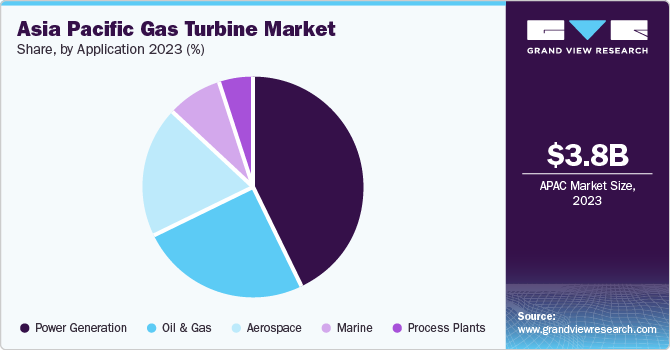

Application Insights

The Power Generation segment dominated the market and accounted for the largest revenue share of 43.06% in 2023. Due to their efficiency and adaptability, gas turbines are widely employed in the power production industry, making them a desirable solution for supplying the expanding energy demand. The growing global demand for power is one of the main development drivers.

The Oil & Gas segment held a significant market share in 2023. This growth is attributed to the rise in energy consumption and technological developments. The growing need for energy is one of the main factors propelling the gas turbine industry. The world's population is expanding, and so is the energy demand. Energy consumption in the oil and gas sector is significant, and gas turbines are a productive means of producing power for drilling, pumping, and processing activities.

The Aerospace segment witnessed substantial growth in 2023. Gas turbines are widely employed as aircraft propulsion engines in the aerospace industry. One of the primary drivers of aerospace growth is the increasing demand for air travel throughout the world. Gas turbines are perfect for this use because of their great power and efficiency, which enables commercial aircraft to travel farther on less fuel.

Country Insights

China Gas Turbine Market Trends

The China Gas Turbine Market accounted for the largest market share of 38.1% in 2023. This growth is attributed to an increase in environmental worries about power facilities that use coal. The existence of developing nations like China and India, along with the accessibility of affordable labor and raw materials, encourages multinational corporations to grow their regional operations. China now imports a large amount of natural gas, but throughout the forecast period, it is expected that aggressive investments in drilling technologies and hydraulic fracturing will enable the nation to satisfy its energy and power needs from natural gas and spur the rise of gas turbines.

Japan Gas Turbine Market Trends

The Gas Turbine Market in Japan witnessed a significant market share in 2023. Natural gas imports are a growing trend in Japan, where plans to develop gas turbines are steadily increasing. Throughout the projected period, strict rules aimed at decreasing the nation's reliance on nuclear power generation are expected to open up new opportunities for gas turbine providers.

India Gas Turbine Market Trends

The India Gas Turbine Market held a substantial share in 2023. Steam turbines are fierce competitors for gas turbines, which hinders the former's national expansion. Furthermore, home and industrial uses account for the majority of India's natural gas imports. The nation has a relatively small percentage of gas turbines compared to its Asian rivals.

Key Asia Pacific Gas Turbine Company Insights

There are a few key companies that hold a substantial share of the market in the Asia Pacific gas turbine industry. These businesses are now recognized as leaders in the fields of engineering, producing, and servicing gas turbines. The market as a whole is dominated by the supremacy of established industry giants, notwithstanding the presence of certain smaller firms and specialty markets.

Key players in the market include Bharat Heavy Electricals Limited; Kawasaki Heavy Industries, Ltd.; and Mitsubishi Power, Ltd.

-

Bharat Heavy Electricals Limited primarily concentrates on manufacturing equipment for power plants. The company is also involved in developing, producing, testing, commissioning, and servicing a broad range of goods. The business provides services to the oil and gas, water, defense, electricity, and transportation sectors.

-

Kawasaki Heavy Industries, Ltd. is divided into seven business segments: rolling stock, energy system & plant engineering, motorcycle & engine, rolling stock, precision machines & robots, ship & offshore structure, and others. Using its in-house developed technologies, the company's energy system & plant engineering branch produces gas turbine generation systems and jet engines.

Shanghai Electric Gas Turbine Co., Ltd.; and Hanwha Power Systems are other participants operating in the Asia Pacific Gas Turbine Market.

-

Hanwha Power Systems deals in turbo compressors as their primary products. The company also creates cutting-edge power generation technologies such as the sCO2 (supercritical CO2) engine and the oxy-fuel gas turbine. The company was established in 1977 and has supplied more than 4,000 turbo compressors to customers worldwide during the previous few decades.

Key Asia Pacific Gas Turbine Companies:

- Bharat Heavy Electricals Limited

- Kawasaki Heavy Industries, Ltd.

- Mitsubishi Power, Ltd.

- Shanghai Electric Gas Turbine Co., Ltd.

- Nanjing Turbine & Electric Machinery (Group) Co., Ltd.

- Doosan.

- Hanwha Power Systems

- TRIVENI ENGINEERING & INDUSTRIES LIMITED

- IHI Power Systems Co., Ltd.

- HEXGEN ENERGY CORP

Recent Development

-

In February 2024, Kawasaki Heavy Industries (Kawasaki) and Symbio signed a Memorandum of Understanding (MOU) to collaborate on the development of fuel cell systems for various vehicles, including construction equipment. By signing this MOU, Kawasaki, and Symbio hope to combine Symbio's competence in fuel cell technology for cars with Kawasaki's network in construction equipment and its development and manufacturing experience for high-pressure hydrogen gas valves. Both businesses will investigate how fuel cell systems might be used for mobility’s, such as construction machinery solutions that may be planned by clients.

-

In August 2023, an agreement on "Potential Collaboration Opportunities in Green Hydrogen and Derivatives in the Hydrogen Value Chain" was signed by Bharat Heavy Electricals Ltd. (BHEL) and Greenstat Hydrogen India Pvt. Ltd. (GHIPL). In the presence of Mr. Upinder Singh Matharu, Director (Power), Mr. Jai Prakash Srivastava, Director (ER&D) & Director (Finance) - Addl. Charge, Mr. Jeewan Prakash Gupta, MD, GHIPL, and other senior officials of BHEL, Mr. S Prabhakar, GM & Head (Coal to Chemicals), and Mr. Sturle Harald Pedersen, Chairman, signed the Memorandum of understanding. This Memorandum of Understanding will support the nation's "National Hydrogen Mission," which seeks to make India a leader in this field.

Asia Pacific Gas Turbine Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.09 billion

Revenue forecast in 2030

USD 5.40 billion

Growth rate

CAGR of 5.2% from 2024 to 2030

Base year for estimation

2023

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in MW, Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, Volume forecast, competitive landscape, growth factors, and trends

Segments covered

Technology, capacity, end-use, application.

Key companies profiled

Bharat Heavy Electricals Limited; Kawasaki Heavy Industries, Ltd.; Mitsubishi Power, Ltd.; Shanghai Electric Gas Turbine Co., Ltd.; Nanjing Turbine & Electric Machinery (Group) Co., Ltd.; Doosan.; Hanwha Power Systems; TRIVENI ENGINEERING & INDUSTRIES LIMITED; IHI Power Systems Co., Ltd.; HEXGEN ENERGY CORP.

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Gas Turbine Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific Gas Turbine market report based on Technology, capacity, end-use, and application

-

Technology Outlook (Volume, MW; Revenue, USD Million, 2018 - 2030)

-

Open Cycle

-

Combined Cycle

-

-

Capacity Outlook (Volume, MW; Revenue, USD Million, 2018 - 2030)

-

≤200 MW

-

>200 MW

-

-

End-use Outlook (Volume, MW; Revenue, USD Million, 2018 - 2030)

-

Power & Utility

-

Industrial

-

-

Application Outlook (Volume, MW; Revenue, USD Million, 2018 - 2030)

-

Oil & Gas

-

Power Generation

-

Marine

-

Aerospace

-

Process Plants

-

-

Country Outlook (Volume, MW; Revenue, USD Million, 2018 - 2030)

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Frequently Asked Questions About This Report

b. The Asia Pacific gas turbine market was valued at USD 3.79 billion in the year 2023 and is expected to reach USD 4.09 billion in 2024.

b. The Asia Pacific gas turbine market is expected to grow at a compound annual growth rate of 5.2% from 2024 to 2030 to reach USD 5.40 billion by 2030.

b. The combined cycle segment accounted for the largest market share of 87.04% in 2023. Power companies can extract significantly more power from the same amount of natural gas due to combined cycle power plants' high efficiency.

b. The key market player in the Asia Pacific gas turbine market includes Bharat Heavy Electricals Limited; Kawasaki Heavy Industries, Ltd.; Mitsubishi Power, Ltd.; Shanghai Electric Gas Turbine Co., Ltd.; Nanjing Turbine & Electric Machinery (Group) Co., Ltd.; Doosan.; Hanwha Power Systems; TRIVENI ENGINEERING & INDUSTRIES LIMITED; IHI Power Systems Co., Ltd.; HEXGEN ENERGY CORP.

b. The key factors that are driving the Asia Pacific gas turbine market include, the necessity of effective power-producing infrastructure. Improved efficiency gas turbine sales have increased in East Asia. In addition, the rapid expansion of the industrial sectors in China, India, and South Korea has increased demand for industrial turbines in the area.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."