- Home

- »

- Electronic & Electrical

- »

-

Asia Pacific Gaming Market Size, Industry Report, 2030GVR Report cover

![Asia Pacific Gaming Market Size, Share & Trends Report]()

Asia Pacific Gaming Market (2024 - 2030) Size, Share & Trends Analysis Report By Device (Mobile, Console, Computer), By Type (Offline, Online), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-481-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Asia Pacific Gaming Market Size & Trends

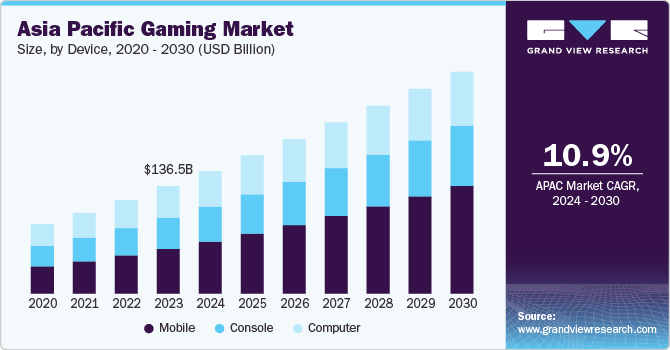

The Asia Pacific gaming market size was estimated at USD 136.5 billion in 2023 and is expected to grow at a CAGR of 10.9% from 2024 to 2030. The Asian gaming market is experiencing robust growth driven by several key factors that enhance accessibility, technological advancements, and changing consumer behaviors. Mobile gaming is at the forefront of this expansion, particularly in the Southeast Asian gaming market, where the proliferation of affordable smartphones and increased internet penetration have made gaming more accessible. As of 2023, smartphone adoption in the region reached approximately 78%, with projections suggesting it could rise to 90% by 2030, further bolstering the mobile gaming sector.

Investments in cloud gaming technologies are also on the rise. These technologies provide users with seamless experiences across devices without the need for high-end hardware. This trend is particularly beneficial in regions where gamers cannot access expensive consoles or PCs. The introduction of cloud-based services is expected to broaden the gaming options available to consumers.

There is an increasing focus on creating localized content that resonates with diverse cultural backgrounds across Asia. Game developers are tailoring their offerings to reflect regional preferences, which enhances player engagement and satisfaction. For instance, games with anime-inspired art styles are particularly popular in Japan, while historical mobile strategy games resonate well in China and South Korea. The integration of augmented reality (AR), virtual reality (VR), and artificial intelligence (AI) technologies is transforming the gaming experience. These innovations create immersive environments that captivate players and enhance gameplay dynamics, further driving interest in online gaming across the region.

Technological innovations also play a crucial role in the market's growth. The introduction of high-speed internet, including 5G networks, enhances user experience by reducing latency and improving download speeds, which is vital for mobile gaming applications. This technological shift allows developers to create more sophisticated games that can be played seamlessly across various devices. Furthermore, cloud gaming and virtual reality advancements open new avenues for immersive gaming experiences, attracting a broader audience. The youth demographic in Asia-Pacific significantly influences market trends, as younger consumers exhibit a strong affinity for mobile and social gaming. This demographic shift increases demand for games and shapes the types of games that gain popularity. Social interaction through gaming platforms fosters community engagement, making gaming a lifestyle choice rather than just entertainment.

eSports is gaining traction as a significant growth driver within the gaming industry. The intersection of mobile gaming and eSports has led to increased viewership and participation in competitive gaming events, which attract substantial sponsorship and investment from various sectors. For instance, tournaments for popular games like Garena Free Fire have drawn millions of viewers, highlighting the potential for monetization through advertising and sponsorships.

Investments in cloud gaming technologies are also on the rise, providing users with seamless experiences across devices without the need for high-end hardware. This trend is particularly beneficial in regions where gamers may not have access to expensive consoles or PCs12. The introduction of cloud-based services is expected to broaden the scope of gaming options available to consumers. There is an increasing focus on creating localized content that resonates with diverse cultural backgrounds across Asia. Game developers are tailoring their offerings to reflect regional preferences, which enhances player engagement and satisfaction4. For instance, games with anime-inspired art styles are particularly popular in Japan, while historical mobile strategy games resonate well in China and South Korea. The integration of augmented reality (AR), virtual reality (VR), and artificial intelligence (AI) technologies is transforming the gaming experience. These innovations create immersive environments that captivate players and enhance gameplay dynamics, further driving interest in online gaming across the region.

Furthermore, regulatory hurdles present another layer of complexity for the gaming industry in Asia. Varied regulations across different countries can create confusion for developers and publishers looking to enter new markets. Issues such as age restrictions, content censorship, and taxation can limit the types of games that can be offered or increase operational costs, making it challenging for companies to navigate the regulatory landscape effectively.

Device Insights

In terms of device usage for gaming, mobile gaming had the largest share in Asia Pacific gaming market with revenue exceeding USD 55 billion in 2023. The mobile gaming market in Asia is experiencing significant growth driven by several key factors. High smartphone penetration is a primary catalyst, as affordable smartphones have become widely accessible, allowing a diverse range of consumers to engage with mobile games. This accessibility enables players to enjoy gaming experiences at their convenience, whether at home or on the go. As of 2023, the Asia-Pacific region accounted for 50% of global mobile gaming revenue, underscoring its dominance in the industry and the increasing number of mobile gamers, which exceeds 1.5 billion across the region.

Improving internet infrastructure, particularly the rollout of 4G and 5G networks, enhances the mobile gaming experience by providing faster download speeds and reduced latency. This technological advancement allows for smoother gameplay and supports real-time multiplayer interactions, which are essential for competitive gaming. Countries like South Korea have seen significant improvements in mobile game performance due to these upgrades, further driving user engagement.

Cultural preferences also play a crucial role in shaping the mobile gaming landscape. Developers are increasingly creating localized content that resonates with regional audiences, such as anime-inspired games in Japan and historical strategy games in China. This cultural alignment fosters a deeper connection with players and encourages higher engagement levels. Additionally, monetization strategies such as free-to-play models with in-app purchases have proven effective in attracting a broad audience while generating revenue for developers. This model lowers the barrier to entry for new players, allowing them to explore games without upfront costs.

The young demographic in Asia is a vital driver of mobile gaming growth. With a large population of tech-savvy youth eager to engage in digital entertainment, the demand for innovative and interactive gaming experiences continues to rise. As social elements become increasingly integrated into games-such as multiplayer capabilities and community features-mobile gaming is solidifying its place as a dominant form of entertainment across the region.

Console games were also popular in Asia with the introduction of advanced gaming consoles such as PlayStation 5 and Xbox Series X. These consoles offer enhanced graphics, faster load times, and features such as ray tracing. These innovations attract gamers looking for superior gaming experiences and are expected to drive demand further as new technologies like augmented reality (AR) and virtual reality (VR) become more integrated into gaming consoles.

Exclusive game titles also significantly influence consumer purchasing decisions. Major console manufacturers like Sony, Microsoft, and Nintendo frequently release exclusive games that can only be played on their platforms. Titles such as "The Legend of Zelda" and "Final Fantasy XVI" create a strong incentive for gamers to invest in specific consoles to access these unique experiences, thereby boosting console sales.

Computer gaming was also very popular in Asia and is expected to grow at a CAGR of 7.9% over the forecast period. The region boasts a vast and diverse consumer base, with countries like China, Japan, and South Korea at the forefront of gaming innovation. China alone has over 600 million gamers, with a substantial portion engaging in online PC games. This diversity allows gaming companies to tailor their offerings to meet various preferences and spending capacities across different demographic.

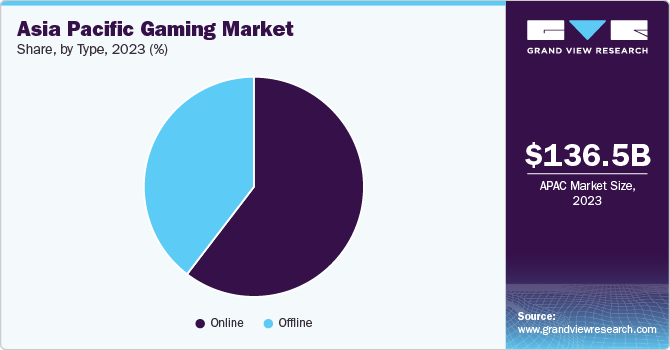

Type Insights

The offline gaming market in Asia exceeded USD 8 billion in 2023 and is expected to grow at a CAGR of 9.2% over the forecast period. Cultural preferences play a significant role, as many gamers in the region enjoy traditional gaming experiences that emphasize storytelling and immersive gameplay. Genres such as role-playing games (RPGs) and adventure games often thrive offline, allowing players to engage deeply with the content without the distractions of online connectivity.

Accessibility of gaming hardware is another critical driver. The increasing availability of affordable gaming consoles and PCs has made it easier for consumers to invest in offline gaming setups. This trend is particularly evident in countries like China and India, where rising disposable incomes enable more households to purchase gaming devices, fostering a larger offline gaming community.

Moreover, social aspects of offline gaming, such as local multiplayer experiences, enhance its appeal. Many players prefer gathering with friends and family for cooperative or competitive gameplay sessions, which create a sense of community and shared enjoyment. Events like gaming tournaments and LAN parties also promote offline engagement, further solidifying the social dimension of gaming in Asia.

Game development focus on single-player experiences is another factor driving offline gaming. Many developers are investing in high-quality single-player titles that provide rich narratives and expansive worlds to explore, catering to gamers who prefer immersive experiences without the need for an internet connection. This focus on storytelling and character development attracts players who seek depth in their gaming experiences.

Market segmentation plays a role, as certain demographics may have limited access to reliable internet services or prefer not to engage in online environments due to concerns about security or privacy. This creates a consistent demand for offline gaming options that can be enjoyed without the need for constant connectivity.

The Asia online gaming market is expected to grow at a CAGR of 13% from 2024 to 2030 and reach a market value of USD 130 billion in 2030. Smartphone penetration is a critical factor fueling online gaming growth. The widespread availability of affordable smartphones has democratized access to gaming, enabling a vast demographic to participate in mobile gaming. As many consumers now own smartphones capable of supporting advanced gaming applications, mobile games have become the most accessible form of gaming across the region. This shift has led to a significant increase in casual gamers who enjoy quick sessions on their devices.

Social integration within gaming platforms enhances user engagement. Many online games incorporate social features such as chat functions, friend lists, and community events that encourage players to connect with one another. This social aspect not only enhances the gaming experience but also fosters a sense of community among players, making online gaming more appealing.

Country Insights

China has the largest gaming market in Asia with a revenue of USD 70 billion in 2023. One of the primary drivers is the rapid growth of eSports, which has become a significant segment of the gaming industry. The increasing popularity of competitive gaming events attracts millions of viewers and participants, fostering a vibrant community that enhances engagement with various gaming platforms. This trend is supported by favorable government policies that recognize eSports as an official sport and promote its development as part of the broader entertainment industry.

The proliferation of mobile gaming is another significant driver. With over 668 million gamers in China, mobile games account for a substantial portion of the gaming market. The accessibility of smartphones and the popularity of mini-games within social platforms like WeChat have contributed to this growth, making gaming more integrated into daily life. Additionally, the rise of affordable smartphones has democratized access to gaming, allowing a broader audience to participate.

Japan gaming market is expected to grow at a CAGR of 12% over the forecast period. Japan is renowned for its cutting-edge technology, which significantly enhances the gaming experience. The widespread availability of high-speed internet and advanced mobile infrastructure supports seamless gameplay, particularly for online and mobile gaming. The rollout of 5G technology is expected to further improve connectivity, enabling more immersive gaming experiences, including real-time multiplayer interactions and enhanced augmented reality (AR) and virtual reality (VR) applications.

Gaming is an essential part of Japanese culture, with a rich history of game development that has produced iconic franchises and characters. This cultural attachment creates a loyal consumer base that actively engages with both domestic and international titles. The strong presence of major gaming companies like Nintendo, Sony, and Bandai Namco bolsters this market, as they continue to innovate and release popular games that resonate with local players.

The gaming market in South Korea is also expected to witness significant growth at a CAGR of 12.5% over the forecast period. The South Korean government actively supports the gaming industry through favorable policies, tax incentives, and funding programs aimed at fostering innovation and development. Initiatives to ease regulations around gaming, such as lifting the shutdown law that restricted playtime for minors, have created a more conducive environment for growth. Increasing disposable incomes and improved living standards have led to higher spending on entertainment, including video games. As more consumers are willing to invest in gaming hardware and software, the market continues to expand.

Key Asia Pacific Gaming Company Insights

The gaming market is dominated by several multibillion-dollar companies, including Sony, Microsoft, Nintendo, Tencent, and Electronic Arts. These companies invest heavily in research and development to innovate and enhance their offerings. For instance, Sony's PlayStation 5 leads the console market with significant sales figures, while Microsoft's Xbox Series X and Nintendo Switch also maintain strong positions. The competition among these giants drives continuous improvements in gaming technology and content.

Key Asia Pacific Gaming Companies:

- Tencent Holdings Ltd

- NetEase

- Bandai Namco Entertainment

- Sony Corporation

- Nintendo Co. Ltd

- Nexon

- NCSoft

- Netmarble Corporation

- Asiasoft Corporation Public Company Limited

- IGG Inc.

- Com2uS Corporation

- Krafton

- Pearl Abyss

- Garena SEA Group

- Kingsoft Corporation Ltd

Asia Pacific Gaming Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 155.26 billion

Revenue forecast in 2030

USD 281.54 billion

Growth rate

CAGR of 10.9% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Device, type, country

Regional scope

Asia Pacific

Country scope

China; Japan; India; South Korea; Indonesia

Key companies profiled

Tencent Holdings Ltd; NetEase; Bandai Namco Entertainment; Sony Corporation; Nintendo Co. Ltd; Nexon; NCSoft; Netmarble Corporation; Asiasoft Corporation Public Company Limited; IGG Inc.; Com2uS Corporation; Krafton; Pearl Abyss; Garena SEA Group; Kingsoft Corporation Ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Gaming Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the Asia Pacific gaming market report based on device, type, and country:

-

Device Outlook (Revenue, USD Billion, 2018 - 2030)

-

Mobile

-

Console

-

Computer

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Frequently Asked Questions About This Report

b. The Asia Pacific gaming market size was estimated at USD 136.5 billion in 2023 and is expected to reach USD 155.25 billion in 2024.

b. The Asia Pacific gaming market is expected to grow at a compound annual growth rate of 10.9% from 2024 to 2030 to reach USD 281.5 billion in 2030.

b. The mobile gaming segment dominated the Asia Pacific gaming market, with a revenue share of 42.5% in 2023.

b. Some key players operating in the Asia Pacific gaming market include Iovate Health Sciences, Abbott, Quest Nutrition, PepsiCo, Cliff Bar, The Coca-Cola Company, MusclePharm, The Bountiful Company, Post Holdings, BA Sports Nutrition, Cardiff Sports Nutrition, Jacked Factory, Orgain.

b. Key factors driving the Asia Pacific gaming market's growth include enhanced accessibility, technological advancements, and changing consumer behaviors. Additionally, the higher adoption of smartphones adoption further bolsters the gaming sector in Asia Pacific.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.