- Home

- »

- Advanced Interior Materials

- »

-

Asia Pacific Fuel Dispenser Market Size, Share Report, 2030GVR Report cover

![Asia Pacific Fuel Dispenser Market Size, Share & Trends Report]()

Asia Pacific Fuel Dispenser Market Size, Share & Trends Analysis Report By Product (Submersible, Suction), By Application (Petrol, Diesel, Compressed Natural Gas), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-185-6

- Number of Report Pages: 70

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Asia Pacific Fuel Dispenser Market Trends

“2030 Asia Pacific fuel dispenser market value to reach USD 2.25 billion”

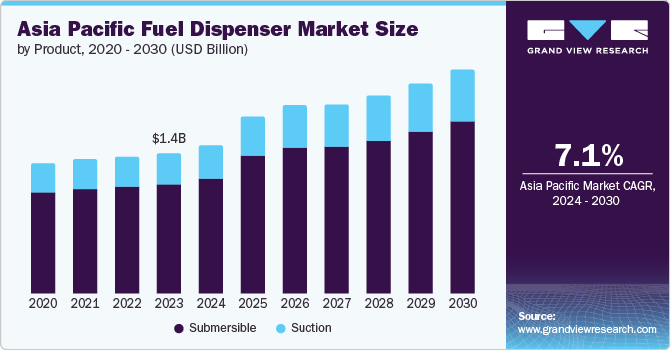

The Asia Pacific fuel dispenser market size was valued at USD 1.41 billion in 2023 and is projected to grow at a CAGR of 7.1% from 2024 to 2030. The increasing population, rapid urbanization and growing demand for vehicles in the region is contributing to the growth of fuel dispensers’ market in Asia pacific. Other drivers contributing to the fuel dispenser market growth are increasing population, infrastructural developments, rising disposable income, and improvement in standard of living of people. The demand for automotive industry is rising at a rapid pace, as increasing number of people are buying vehicles which leads to increase in demand for fuels such as petrol, diesel, and Compressed Natural Gas (CNG).

The passenger vehicles market in Asia is witnessing significant growth. More than 40 million passenger cars were sold in 2023 in the region, out of which 26 million of passenger cars were sold in China and 4.1 million were sold in India. The growing demand of people for passenger vehicles is fueling the growth of fuel and fuel dispenser market in Asia pacific region.

The recent technological advancements in fuel dispensers are expected to drive the growth. The adoption of a tech-driven fuel dispenser system which offers contactless payment systems, user-friendly interactive service displays, and touchscreen interfaces is further expected to propel the market growth. Moreover, the introduction of other alternatives to petrol and diesel, like hydrogen, liquefied natural gas or compressed natural gas is expected to enhance the consumer refueling experience as they emits less pollution and offers more fuel economy.

Product Insights

In 2023, the submersible segment dominated the market and accounted for largest revenue share of 77.7%, owing to its low maintenance cost, fast fueling, low noise and reliability. Submersible pumps make use of pumps fused in the tank, which transport fuels to the system operating in the station. Submersible pumps are more widely used by the competitors as the failure rate is very low.

Thesuction segment is expected to witness the fastest CAGR of 7.6% during the forecast period. The suction system offers more efficiency than submersible systems, owing to higher suction rate and dispensing capabilities. Moreover, suction pumps are designed for efficient fluid transfer and produce higher efficiency in terms of energy consumption.

Application Insights

In 2023, the petrol/gasoline segment dominated the market and accounted for largest revenue of 652.3 million in 2023, owing to increasing demand for energy and more usage of motor vehicles due to rising disposable income. The growing demand for vehicles running on petrol in emerging countries like India, China and Indonesia is fueling the growth as petrol offers more smooth and comfortable driving experience and faster pick-up. The rising younger population is demanding more petrol-led automobiles as it offers good performance and easily availability of fuel.

The Compressed Natural Gas (CNG) segment is expected to witness the fastest CAGR of 7.9% during the forecast period. The key drivers of CNG are low fuel price, higher mileage and eco-friendlier. The growing awareness among consumers and initiatives by governments to protect the environment is also driving the growth of CNG vehicles. China, India has been trying to control its carbon emission for many years as by use of diesel and petrol vehicles harmful gases are released into environment. In addition, India’s target to achieve net zero emission target by 2070 is expected to have a significant positive impact on the CNG fuel.

Regional Insights

The Asia pacific fuel dispenser market has witnessed a significant growth owing to rise in population and growing disposable income which in turn is expected to drive the demand for fueling stations and dispenser systems in the region.

In 2023, China dominated the market, capturing a significant market revenue share 40.10%, owing to rising number of adoption of vehicles by people and rise in disposable income. Moreover, china is hub to major players in fuel dispenser market. The growing gross domestic product (GDP) and infrastructural development in the country is expected to drive the fuel dispenser market.

India fuel dispenser market is expected to witness the fastest CAGR of 8.0% during the forecast period. The demand is driven by the increasing per capita income of people and rising awareness among people towards conserving the environment. Moreover, India has one of the highest youth population and growing desire for vehicles in the segment could lead to a significant growth in the fuel and fuel dispenser market.

China Fuel Dispenser Market Trends

The submersible segment in china dominated the market in 2023, and accounted for the largest revenue share of 77.06%, owing to the less cost of installation and faster fueling. The dealers in fuel dispenser market in China demands submersible pumps compared to other pumps, as they offer more durability and reliability, has less services cost and versatility across various applications.

The suction segment is expected to witness the fastest CAGR of 7.2% during the forecast period, as it offers high suction and dispensing capacities. They can handle a wide range of flow rates while making performance consistency. Moreover, the technological advancements in suction pumps and addressing past limitations are expected to drive the market growth.

Key Asia Pacific Fuel Dispenser Company Insights

Some of the key companies in the Asia Pacific fuel dispenser market include Gilbarco Inc.; Dover Fueling Solutions; Scheidt & Bachmann; Tatsuno Corporation.

-

Gilbarco Inc., (Gilbarco Veeder-Root), is a supplier of point of sales systems, fuel dispensers, payment systems, merchandising & support services.

-

Tatsuno Corporation is a Japanese manufacturer of fuel dispensers and other solutions to retail commercial fueling customers all around the world.

Key Asia Pacific Fuel Dispenser Companies:

- Gilbarco Inc.

- Dover Fueling Solutions (Wayne Fueling Systems LLC) - (acquired)

- Dover Fueling Solutions (Tokheim) - (acquired)

- Tatsuno Corporation

- Tominaga Mfg. Company

- Scheidt & Bachmann

- Bennett Pump Company

- Beijing Sanki Petroleum Technology Co. Ltd.

- Neotec

- Korea EnE Co., Ltd.

- Censtar Science & Technology Co., Ltd.

Recent Developments

-

In January 2024, Dover Fueling Solutions announced the acquisition of a Canadian company in integrated point of sale (POS), Bulloch Technologies.

-

In January 2024, Veeder-Root announced the launch of Red Jacket 4 HP Submersible Turbine Pump (STP). The solution expanded the organization’s STP portfolio and offers reduced power consumption, high throughput and high reliability.

Asia Pacific Fuel Dispenser Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.5 billion

Revenue forecast in 2030

USD 2.25 billion

Growth Rate

CAGR of 7.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

Asia Pacific

Country scope

China, India, Japan, Australia

Key companies profiled

Gilbarco Inc.; Dover Fueling Solutions; Tatsuno Corporation; Tominaga Mfg. Company; Scheidt & Bachmann; Bennett Pump Company; Beijing Sanki Petroleum Technology Co. Ltd.; Neotec; Korea EnE Co., Ltd.; Censtar Science & Technology Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Fuel Dispenser Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia pacific fuel dispenser market report based on product, application and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Submersible

-

Suction

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Petrol/Gasoline

-

Diesel

-

Compressed Natural Gas(CNG)

-

Others

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

Rest of Asia Pacific

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."