- Home

- »

- Clothing, Footwear & Accessories

- »

-

Asia Pacific Footwear Market Size, Industry Report, 2030GVR Report cover

![Asia Pacific Footwear Market Size, Share & Trends Report]()

Asia Pacific Footwear Market Size, Share & Trends Analysis Report By Type (Athletic, Non-athletic), By End-use (Men, Women, Children), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-205-3

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Asia Pacific Footwear Market Size & Trends

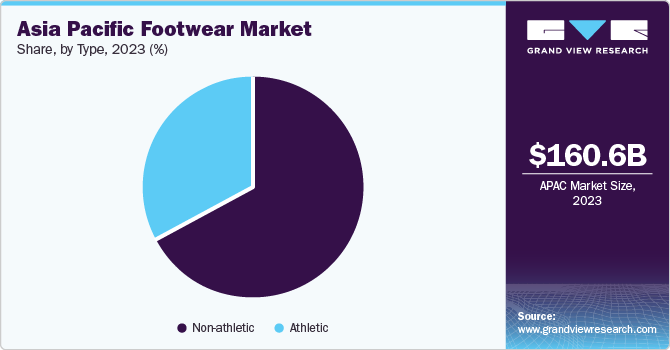

The Asia Pacific footwear market size was estimated at USD 160.59 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 5.1% from 2024 to 2030. The market is driven by growing sales facilitated by e-commerce, extensive spending on advertising by footwear brands, and the rising demand for athletic footwear. Furthermore, the increasing instances of lifestyle-related health issues, such as stress and obesity, are pushing an increasing number of people to engage in sports and fitness activities, which is fueling the demand for comfortable and stylish footwear.

The Asia Pacific market accounted for a share of nearly 40% of the global footwear market in 2023. The footwear industry in the region is labor-intensive and is affected by various factors such as land resources, labor costs, material supply, environmental protection, and sales markets. Consequently, in pursuit of profit maximization, major consumer markets, footwear manufacturers, wholesalers, and retailers worldwide are shifting their focus to lower-cost countries, leading to constant movement of global shoemaking bases. Japan, Taiwan, India, and China are lucrative markets for footwear in Asia Pacific. Rising disposable income and improved living standards of the consumers are key factors accelerating product demand in these countries.

The growing popularity of events such as Ultra-Trail du Mont-Blanc (UTMB) is also encouraging more people to participate in sports. UTMB has witnessed a 68% increase in the number of applications in the last three years. In 2019, the event received more than 26,000 applications for only 10,000 spots available. Currently, there are about 4,300 races and 10,000 events worldwide that are certified and recognized by the International Trail Running Association (ITRA). In China, in the last five years, the number of trail running events grew from almost zero to 1,500 in 2019.

The increasing number of females participating in sports is also driving the demand for footwear, mainly shoes. Several organizers offer discounts on membership to first-time female participants. For instance, The Loon Mountain Race offered discounts to first-time female participants, and the Barr Trail Mountain Race makes it a point to award equal prize money to men and women.

Market Concentration & Characteristics

The Asia Pacific footwear industry is characterized by moderate degree of innovation, with businesses continuously focusing on differentiating themselves through unique experiences and offerings. Rapid product development and evolving fabric selection have changed sports footwear to a great extent. Lightweight shoes with high durability are a major trend seen in the industry. Product sales are highly driven by brand awareness, shopping frequency, and expenditure of different buyers. Furthermore, extensive brand campaigns by leading sportspersons such as Lionel Messi, Neymar, and Luis Suárez. This is one of the major factors expected to drive the demand for footwear among consumers.

The industry is also characterized by a high level of merger and acquisition (M&A) activity by the leading players.The collaboration of footwear manufacturers with high-profile designers enables companies to cater to consumers inside as well as outside the gym. Thus, footwear is outpacing the overall apparel and footwear industry.

End-user concentration is a significant factor in the Asia Pacific footwear industry.The increasing number of individuals participating in outdoor activities, such as hiking, marathons, and camping, is one of the major factors boosting the demand for footwear. An increase in the number of videos posted by footwear enthusiasts or sports professionals on social media platforms-like YouTube, Instagram, and Facebook-is expected to attract consumers. Moreover, buyers are also willing to pay a premium price for footwear with additional features, such as being waterproof and lightweight, which, in turn, is likely to boost the footwear industry growth.

Type Insights

The non-athletic footwear category accounted for a revenue share of 67.1% in 2023. The growth of this segment can be attributed to the increasing trend of casual wear in offices in countries such as Japan, Australia, and China. The growing emphasis on work-life balance by various government agencies and companies in the region is resulting in the increasing the adoption of non-athletic footwear in the region.The non-athletic footwear category comprises a range of products, including heels, boots, sneakers, sandals, floaters, and loafers, which have piqued consumers’ interest.

The athletic footwear category in the region is projected to grow at a CAGR of 6.1% from 2024 to 2030. With sports fashion gaining popularity among consumers, the trend of athletic footwear is further gaining steam and companies in the market are focusing on catering to evolving consumer demands.The demand for footwear for various ball sports is growing owing to rising interest in sports such as basketball and soccer. In China, there were nearly 300 Billion active basketball players in 2018, according to the Chinese Basketball Association. Moreover, the growing trend of athleisure among the younger population is driving the sales of athletic footwear.

End-use Insights

The men’s footwear category accounted for a revenue share of 57.8% in 2023.The dominance of men in sports is acting as a major driver for segment growth. The growing trend of athleisure among consumers in the region, coupled with the increasing penetration of international players such as Nike and Adidas, is also supporting the increased demand for footwear among men.

The women’s footwear market in the region is projected to grow at a CAGR of 5.7% from 2024 to 2030. The growing number of female working population and high demand for comfortable and fashionable wear is anticipated to boost segment growth. Product launches, collaborations, expansion into new markets, and innovations in sustainable footwear by manufacturers have been driving the women’s segment. For instance, Veja Footwear Company made its debut in the Indian market with women’s V-10 sneaker series in collaboration with Bhaane, a multi-brand store.

Country Insights

The footwear industry in Asia Pacific is driven by the growing participation of women and children in sports, thus resulting in the increased demand for stylish and effective footwear solutions. The growth of the athleisure industry in the region has also influenced the footwear market in recent years.

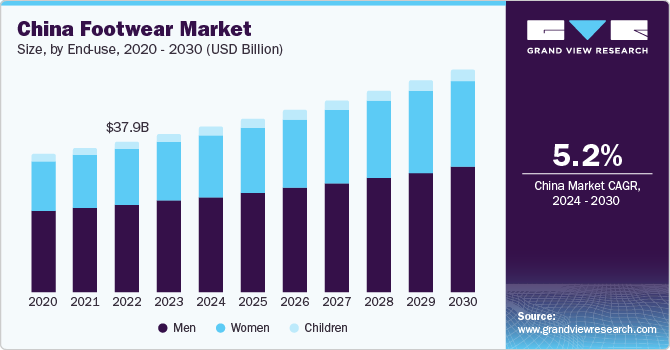

China Footwear Market Trends

The footwear market in China is expected to grow at a CAGR of 5.2% from 2024 to 2030, owing to presence of several manufacturers has resulted in the availability of a variety of product options for consumers in the country.Government efforts to encourage an active lifestyle among the population is also boosting the demand for footwear in the country, particularly athletic footwear. For instance, China has been increasingly promoting winter sports as it is expected to host the Winter Olympic Games in 2022. The Government of China had also planned to open more than 2,000 schools by 2020 and increase the strength of such schools by 5,000 until 2025 in an attempt to promote winter sports. Such efforts trends are anticipated to boost the demand for athletic footwear over the forecast period.

India Footwear Market Trends

The footwear market in India is projected to grow at a CAGR of 5.6% from 2024 to 2030. According to a report by Invest India, the country is the second-largest consumer and producer of footwear in the world and is projected to increase 8 folds by 2030. The purchasing behavior of consumers has been changing dramatically owing to the rise in their disposable and per capita incomes. The impact of Western culture has also driven consumer behavior, which can be seen in the rising popularity of styles like Derby shoes made from full-grain Argentinian leather or reliable Oxford shoes.

Key Asia Pacific Footwear Company Insights

The Asia Pacific footwear market is characterized by the presence of renowned brands as well as small-to-midsized players, who offer a selected range of footwear and mostly serve regional customers. The impact of the established players on the market is quite high as a majority of them have vast distribution networks across the region to reach out to their widespread customer bases. The key players operating in the Asia Pacific market are focusing on strategic initiatives such as product launches, collaborations, acquisitions, participation in events, and expansions in order to drive revenue growth and reinforce their market positions.

Key Asia Pacific Footwear Companies:

- Nike, Inc.

- Adidas AG

- Puma

- Geox S.p.A.

- Skechers

- ASICS

- VF Corp

- New Balance

- Under Armour

- Kering Group

Asia Pacific Footwear Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 168.32 billion

Revenue forecast in 2030

USD 226.75 billion

Growth rate

CAGR of 5.1% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end-use, country

Regional scope

Asia Pacific

Country scope

India; China; Japan; Australia; South Korea

Key companies profiled

Nike, Inc.; Adidas AG; Puma; Geox S.p.A.; Skechers; ASICS; Kering Group; New Balance; Under Armour; Kering Group

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Footwear Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis on the latest trends in each of the sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific footwear market report based on type, end-use, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Athletic

-

Non-athletic

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Men

-

Women

-

Children

-

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Frequently Asked Questions About This Report

b. The Asia Pacific footwear market size was estimated at USD 160.59 billion in 2023 and is expected to reach USD 168.32 billion in 2024.

b. The Asia Pacific footwear market is expected to grow at a compound annual growth rate of 5.1% from 2024 to 2030 to reach USD 226.75 billion by 2030.

b. China dominated the Asia Pacific footwear market with a share of nearly 25% in 2023. This is attributable to the country's vast working population and the increasing participation rates in various sporting activities.

b. Some key players operating in the Asia Pacific footwear market include Nike, Inc., Adidas AG, Puma, Geox S.p.A., Skechers, ASICS, Kering Group, New Balance, Under Armour, and Kering Group.

b. Key factors that are driving the market growth include growing sales facilitated by e-commerce, extensive spending on advertising by footwear brands, and the rising demand for athletic footwear.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."