- Home

- »

- Conventional Energy

- »

-

Asia Pacific Food Grade Carbon Dioxide Market Report, 2030GVR Report cover

![Asia Pacific Food Grade Carbon Dioxide Market Size, Share & Trends Report]()

Asia Pacific Food Grade Carbon Dioxide Market Size, Share & Trends Analysis Report By Application (Freezing & Chilling, Packaging, Carbonation), By Source (Meat, Poultry, Beverages), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-981-1

- Number of Report Pages: 92

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Energy & Power

Market Size & Trends

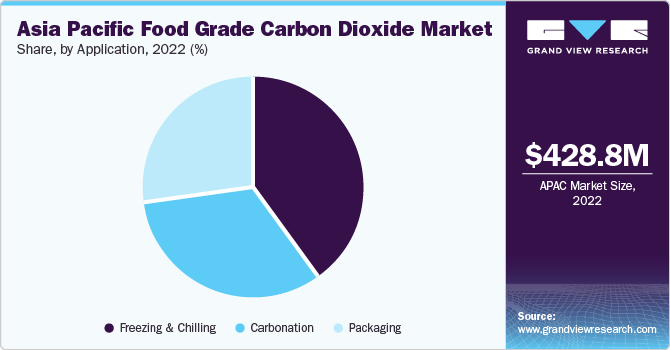

The Asia Pacific food grade carbon dioxide market size was valued at USD 428.8 million in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. Growing demand in the freezing and chilling application stimulated by rising disposable income is expected to drive the growth. Increasing usage of food-grade CO2 for carbonation in carbonated beverage plants is anticipated to result in the growth of the industry. Moreover, the product application in meat processing and modified atmosphere packaging is anticipated to surge in the region during the forecast period.

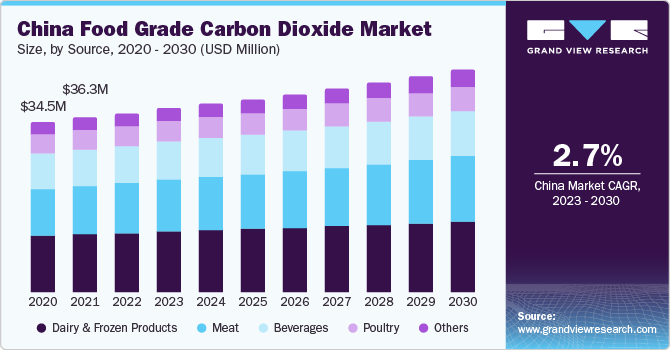

China is one of the major consumers of food-grade carbon dioxide in the Asia Pacific. Increasing demand from the food export industry, coupled with increasing domestic consumption, is expected to augment the market growth over the forecast period. China is one of the world's largest soft drink manufacturers and exporters, which has increased the demand for food-grade carbon dioxide in the country.

The increased demand for food-grade carbon dioxide has increased the competitive rivalry in the country with many domestic and international players trying to capture the increasing demand. For instance, in March 2021, Guanggang Gas acquired Linde Wuhu Carbon Dioxide Company for an undisclosed amount. The acquisition included East China’s largest carbon dioxide plant, with an annual production capacity of 100,000 tons of food and industrial-grade carbon dioxide. The company also announced its plans to expand the facility and add dry ice to its product portfolio.

The growing adoption of carbon dioxide-based refrigeration systems is a positive indicator of the CO2 market in Japan. The consumption of soft drinks in Japan has reduced in the last few years owing to rising awareness concerning their side effects on health. However, companies are investing in R&D and developing healthier alternatives to keep up with the changing preferences of customers in the country.

Application Insights

The freezing & chilling segment accounted for the largest revenue share of 39.7% in 2022. CO2 is used in freezers and heat exchangers as a coolant within the food processing industry. Many food products are required to be at a specific temperature during the production process to ensure the quality of the product. Freezers and chillers are used in such instances to regulate the temperature in the production facility.

Freezers need a coolant gas to operate. Traditionally chlorofluorocarbons (CFCs) and hydro chlorofluorocarbons (HFCs) were used as the coolant gas. However, the use of CFCs and HFCs are being phased out due to the high environmental damage caused by them. Carbon dioxide gas is being used in freezers due to its cooling properties and less harm to the environment.

The packaging segment is expected to grow at the fastest CAGR of 6.8% over the forecast period. The food packaging industry uses carbon dioxide as a flushing gas. Food items generally have a short shelf life as the food gets oxidized and destroyed by bacteria, which makes it inedible. An inert gas is used to flush the food packaging to remove the oxygen present in the container.

Carbon dioxide is injected into beverages to impart a sparkly texture to the drink. Beverages that use carbonation in their production process are sugary carbonated beverages and alcoholic beverages such as beer and sparkling wine. In March 2020, Anheuser-Busch InBev opened its largest brewery in the Asia Pacific. The brewery is located in China and has a production capacity of 1.5 million tons per year.

Source Insights

Based on source, the Asia Pacific food grade carbon dioxide market is divided into dairy and frozen products, beverages, meat, poultry, and others. The dairy and frozen products segment accounted for the largest revenue share of 31.9% in 2022. Carbon dioxide is widely used for packaging, preserving, and maintaining the freshness of dairy and frozen products.

Packaging dairy and frozen products with a carbon dioxide atmosphere slows mold growth in dairy products and prevents rancidity and spoilage during transportation. Vacuum packaging is also used as an alternative to modified atmosphere packaging. It is unsuitable for certain dairy products such as yogurt and cream cheese and is harder to open making them not preferable. The consumption of dairy products is on the rise in the Asia Pacific with many people buying prepackaged dairy products in stores.

The meat segment is anticipated to grow at the fastest CAGR of 6.6% over the forecast period. Meat products are particularly susceptible to spoilage from microbial growth in food products and require active preservation measures to increase their shelf life. Carbon dioxide is used during the packing of the meat to slow down microbial growth. Rising income levels in the region have increased the demand for meat as more people can afford to eat it which has led to increased demand for food-grade CO2 for meat preservation.

The beverage industry is one of the largest consumers of food-grade carbon dioxide in the Asia Pacific as carbon dioxide is used in carbonated beverages. The beverage industry is significantly growing in Asia Pacific with many companies establishing bottling facilities. For instance, in April 2022, PepsiCo completed the construction of its largest bottling plant in India. The plant is located in Bihar and can produce 16.22 million cases of carbonated soft drinks every year.

Carbon dioxide is an essential component in large-scale poultry farming as carbon dioxide is used in every stage of a chicken’s life cycle to maximize production. Carbon dioxide is used as a blanket gas over eggs to regulate their temperature and optimize the hatching time. Carbon dioxide is also used in chicken coops to slow down their metabolism and shorten the time required for chicks to transform into broilers or egg-laying hens.

Food grade carbon dioxide is used in other applications such as a propellant agent in aerosol cans. Many food items such as vinegar, olive oil, fruit creams, and cooking sprays are sold in aerosol cans which propel the food when the valve is opened. Pressurized carbon dioxide is used as a propellant in cans as it does not react with food in the container and does not have a risk of explosion.

Regional Insights

China accounted for a significant revenue share of 38.1% in 2022. China is one of the major consumers of food-grade carbon dioxide in the Asia Pacific. Increasing demand from the food export industry, coupled with increasing domestic consumption, is expected to augment the growth. China is one of the world's largest soft drink manufacturers and exporters, which has increased the demand for food-grade CO2 in the country. The increased demand for food-grade carbon dioxide has increased the competitive rivalry in the country with many domestic and international players trying to capture the increasing demand.

Thailand is expected to grow at the fastest CAGR of 5.4% over the forecast period due to increasing demand for beverages, a growing need for modified atmosphere packaging (MAP), and rising exports of packaged food. The meat industry in Thailand is comparatively small, however, it is high in terms of value. According to a report published by Meat & Livestock Australia (MLA) in 2021, in Thailand, consumption per capita for fish, chicken, pork, beef and sheep was 41.0%, 41.0%, 15.0%, 3.0%, and 0.1% respectively.

The demand for food-grade carbon dioxide has been steadily growing in South Korea on account of the growing carbonation industry with many bottling companies present in the market. Carbonated beverages are witnessing an increasing demand owing to the mass adoption of low-calorie and low-sugar alternatives such as carbonated flavored water and low-calorie cola in the country.

Australia is one of the largest meat producers and exporters in the world, and consequently, has a high demand for food-grade carbon dioxide. Meat is highly vulnerable and can get spoilt due to high amounts of microbial growth, which makes food-grade CO2 a vital part of the meat process industry as it drastically slows down microbial growth and increases the shelf life of meat. The product is required in the meat processing industry from the slaughtering stage to packaging and transportation. Many companies are investing in increasing food-grade carbon dioxide production capacities in the country to cater to the growing demand.

Key Companies & Market Share Insights

The market is moderately consolidated with the presence of various multinational players. It is highly competitive as it requires significant initial investments for new research and development for new entrants. Some of the significant industry players include Linde plc; Air Products Inc.; and Air Liquide. The companies have adopted strategies such as mergers and acquisitions to enhance their market share and expand their networks in the Asia Pacific region. Some prominent players in the Asia Pacific food grade carbon dioxide market include:

-

Air Liquide

-

Air Products and Chemicals, Inc.

-

Coregas

-

Ellenbarrie Industrial Gases

-

IFB Agro Industries Limited

-

Linde plc

-

Messer

-

Sicgil India Limited

-

TAIYO NIPPON SANSO CORPORATION

-

WKS Industrial Gas Pte Ltd

-

Southern Gas Limited

Recent Developments

-

In March 2022, Coregas, an Australian industrial gases organization, collaborated with Xebec Adsorption Inc. to develop and deploy hydrogen technologies aiming to produce lower-cost and lower-carbon hydrogen, which may be achieved by capturing carbon dioxide and can be reused as food grade carbon dioxide.

-

In June 2023, China Energy Investment Corporation (China Energy) launched a giant carbon capture, storage and reuse unit, with a storage capacity of 500,000 tons CO2 annually, in their coal-fired energy plant located in Jiangsu Province, to support carbon neutrality. This 99.99% pure stored CO2 gas will further be used for food packaging as well as carbonation of beverages.

-

In March 2023, BASF announced the use of HiPACT, a high-pressure regenerative carbon dioxide capture and storage technology, in Kashiwazaki Clean Hydrogen/Ammonia Project by INPEX Corporation. This will reduce the carbon dioxide capture cost by up to 35.0%

Asia Pacific Food Grade Carbon Dioxide Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 452.1 million

Revenue forecast in 2030

USD 673.1 million

Growth rate

CAGR of 5.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million, Volume in Kilo Tons and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, application, region

Regional scope

Asia Pacific

Country scope

China; Japan; India; South Korea; Australia; Vietnam; Singapore; Thailand

Key companies profiled

Air Liquide; Linde plc; Air Products and Chemicals, Inc.; TAIYO NIPPON SANSO CORPORATION; Messer; Sicgil India Limited; Ellenbarrie Industrial Gases; IFB Agro Industries Limited; WKS Industrial Gas Pte Ltd; Coregas; Southern Gas Limited

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Food Grade Carbon Dioxide Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific food grade carbon dioxide market based on source, application, and region:

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Dairy & Frozen Products

-

Beverages

-

Meat

-

Poultry

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Freezing & Chilling

-

Packaging

-

Carbonation

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Vietnam

-

Singapore

-

Thailand

-

-

Frequently Asked Questions About This Report

b. The Asia Pacific food grade carbon dioxide market size was estimated at USD 428.8 million in 2022 and is expected to reach USD 452.1 million in 2023.

b. The Asia Pacific food grade carbon dioxide market is expected to grow at a compound annual growth rate of 5.8% from 2023 to 2030 to reach USD 673.1 million by 2030.

b. Freezing & Chilling dominated the Asia Pacific food grade carbon dioxide market with a share of 39.7% in 2022. This can be attributed due to the increasing demand for frozen products in the region stimulating market.

b. Some key players operating in the Asia Pacific food grade carbon dioxide market include Air Liquide, Linde plc, Air Products and Chemicals, Inc., TAIYO NIPPON SANSO CORPORATION, Messer , Sicgil India Limited, Ellenbarrie Industrial Gases, IFB Agro Industries Limited, WKS Industrial Gas Pte Ltd, Coregas, Southern Gas Limited

b. Key factors that are driving the market growth include lack of viable alternatives for carbon dioxide in the market along with an increase in exports of packaged frozen foods from the Asia Pacific region.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."