- Home

- »

- Plastics, Polymers & Resins

- »

-

Asia Pacific Flexitank Market Size, Industry Report, 2030GVR Report cover

![Asia Pacific Flexitank Market Size, Share & Trends Report]()

Asia Pacific Flexitank Market Size, Share & Trends Analysis Report By Type (Single Trip, Multi-trip), By Application (Foodstuffs, Wine & Spirits, Oils), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-249-7

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Asia Pacific Flexitank Market Size & Trends

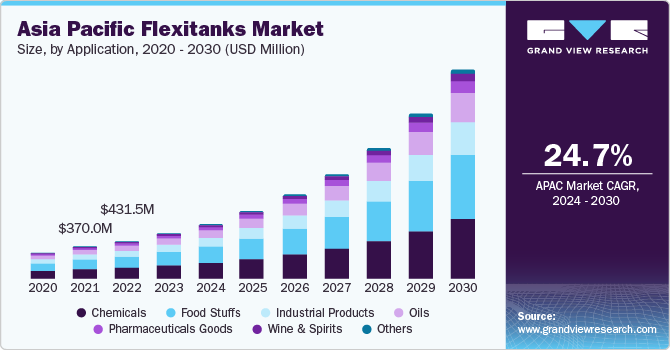

The Asia Pacific flexitank market size was estimated at USD 513.7 million in 2023 and is projected to grow at a CAGR of 24.7% from 2024 to 2030. This growth rate is attributable to the regions two biggest agricultural producers and consumers, China, and India, being present. In addition, because manufacturing costs are lower in China and India, several major US and European corporations have begun outsourcing their production operations to these nations. Thus, during the forecasted period, it is anticipated that the region's need for flexitanks will rise due to the possible growth of the food industry.

A type of equipment for storing liquids, like water or oil, are flexible tanks, also known as flexi-bags and flexi-tanks. Flexible tanks are lighter, rustproof, foldable, and quicker and simpler to assemble than steel tanks, among their many other benefits. A particular kind of bulk liquid bladder pouch or bag called a flexitank enables shippers to pack a significant volume of liquids into dry containers. Flexitanks are designed to safely store liquid contents. They can hold up to 24,000 liters per bag and are made of numerous layers of flexible yet robust plastic film.

Growing commodities trading and these tanks' superior cost-effectiveness over competitors are key selling points for the industry. Trade in commodities is necessary because of differences in the rates of production and consumption across different geographic regions. One of the main drivers of globalization has been the enormous expansion of international trade over the last several decades. Due to increased international trade, customers have access to a greater variety of products worldwide than they would if they were limited to locally produced goods. A wide range of governmental agencies and international organizations have been established in reaction to the constantly growing movement of capital, goods, and services to assist in managing these quickly evolving trends.

In addition, 60% of the world's population lives in the Asia Pacific region, which is the most populated in the world. It is projected that half of Asia Pacific's population lives in urban areas. Since most urban residents prefer to shop for groceries online, this is projected to drive the online grocery business. Thus, during the projected period, increasing urbanization is anticipated to support the expansion of the food and beverage category. The Asia Pacific region has a strong demand for dairy goods such as cheese, butter, and powdered milk, making dairy products one of the most consumed items in the supermarket sector.

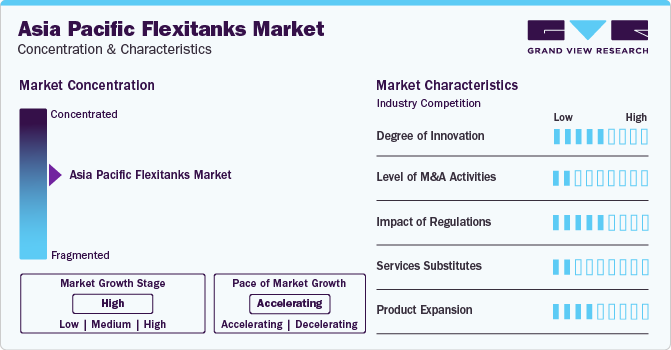

Industry Concentration & Characteristics

The Asia Pacific Flexitank Market is marked by a moderate level of innovation. Although Flexitanks' design, construction, and safety features are always being improved, the underlying technology and functionality are still largely the same. The main areas of innovation are load capacity, environmental impact, and compatibility with different kinds of cargo; however, the rate of innovation is not as high as it may be in certain other industries.

There aren't many merger and acquisition operations in the market. Many small to medium-sized businesses that offer logistics and flexitank manufacturing services define the market. Due to the industry's diversity and the existence of specialized companies, M&A activity is restricted, even though there may be some consolidation initiatives to increase market presence or geographic reach.

Regulations have a moderate effect on the market. To guarantee the safety and integrity of the product, flexitank design, manufacture, and shipping must adhere to international norms and rules. However, the regulatory environment for flexitanks is less complicated than it is for certain other industries, with the main focus being on quality and safety standards instead of tight trade or environmental limitations.

Flexitank alternatives are limited in the market, particularly in sectors like food & beverage, chemicals, and pharmaceuticals that need bulk liquid transportation. Flexitanks are the preferred option for many shippers and logistics providers due to their unique advantages in terms of cost-effectiveness, efficiency, and flexibility, despite the existence of alternative packaging and transportation methods such as drums, IBCs (Intermediate Bulk Containers), and tank containers.

There is a moderate level of product expansion in the market. Variations in flexitank sizes, materials, and accessories can be introduced by manufacturers to meet unique customer demands and target specialized market groups. Innovations could also be made in areas like sustainability, safety features, and compatibility with specific cargoes. But unlike more quickly changing industries, the fundamental technology and functioning of flexitanks stay largely unchanged, restricting the scope of product extension.

Application Insights

The Chemicals segment dominated the market and accounted for the largest revenue share of 28.3% in 2023. Flexitanks are becoming more and more popular among chemical businesses as a replacement for conventional corrugated packaging because of their low cost, strength, and lightweight. Furthermore, recycled polypropylene, ethylene vinyl acetate (EVA), and polyethylene can be used to make flexitanks for the chemical sector, negating the requirement for 100% virgin polymers. This promotes sustainability and further reduces the product's price. Therefore, during the forecast period, it is anticipated that the widespread use of multi-trip flexitanks in the chemical sector and the growing popularity of recycled thermoplastic polymers for chemical applications will propel the growth of the flexitanks market.

The Foods stuff segment held a significant market share in 2023. This growth is attributed to the rising demand for grocery items and the explosive expansion of retail chains, particularly supermarket & hypermarket chains, in emerging nations. Fruit juices, concentrates, vegetable oils, palm oils, fish oils, edible oils, sorbitol, fructose, coconut oils, egg liquid, malt extract, corn oil, sauces, purees, and bakery & confectionery products are just a few of the products in this segment that need to be transported safely in flexitanks.

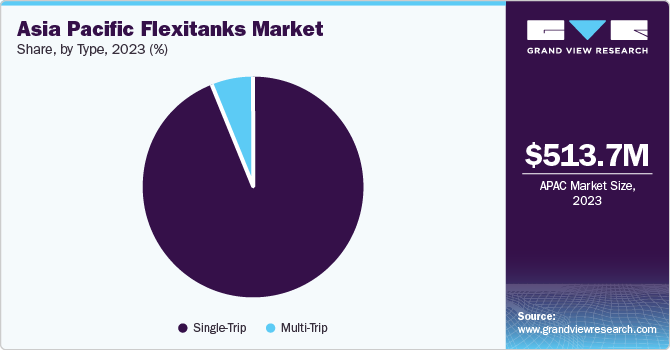

Type Insights

The Multi-trip segment accounted for the largest market share of 79.3% in 2023 due to its excellent sustainability rating and capacity for many reuses, which maximizes Total Cost of Ownership (TCO). These big packages are therefore often more efficient in the logistical context. When shipping non-hazardous liquids, multi-trip flexitanks have several benefits. Installation is simple and takes very little time or labor. Because they may be reused, they are eco-friendly. Their multi-layered construction guards against contamination and guarantees product safety. Finally, they are adaptable and can hold a variety of non-hazardous liquids. Multi-trip flexitanks are a practical and affordable option for bulk liquid transportation because of these advantages.

The Single-trip segment held a significant market share in 2023. Bulk liquid transportation can be made more affordable and easier with the use of single trip flexitanks. Their price, adaptability, and ease of installation make them a desirable option for a range of sectors. Businesses can reduce expenses and guarantee effective and dependable product delivery by selecting single trip flexitanks.

Country Insights

China Flexitank Market Trends

The China Flexitank Market accounted for the largest share of 26.4% in 2023 owing to the rapidly growing international trade activities. The market value is further supported by the availability of multiple ports and advantageous shipping facilities. The need for flexitanks in the nation is also influenced by the increased need for industrial, food, and chemical products worldwide. The significant revenue share of the nation is supported by the existence of significant firms in the region, such as Yunjet Plastic Packaging, Hengxin Plastic Co., Ltd., Full-Pak, Qingdao LAF Packaging Co., Ltd., and Qingdao BLT Packing Industrial Co., Ltd. (BLT).

Japan Flexitank Market Trends

The Flexitank market in Japan held a substantial market share in 2023. Supply-side limitations are less of a problem as exports and industrial production have expanded. The state of employment and income has improved, and business investment has increased. Despite the COVID-19 effects, there has been a moderate increase in the consumption of commodities. Several free trade agreements, such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), have also been signed by Japan; this is anticipated to increase export growth.

India Flexitank Market Trends

The India Flexitank market witnessed a significant market share in 2023. The market expansion is being aided by the existence of significant local and international flexitank players, including Bulk Liquid Solutions Pvt. Ltd. and Rishi FIBC Solutions (P) Ltd. These businesses provide customized, high-quality, recyclable flexitanks. The Gujarat-based company Rishi FIBC Pvt. Ltd. is an Indian producer of flexitanks with a state-of-the-art, fully integrated manufacturing plant that exports its goods to over 36 nations.

Key Asia Pacific Flexitank Company Insights

There are numerous manufacturers, logistics companies, and distributors providing a broad range of Flexitank goods and services defining the Asia Pacific Flexitank Market. The market is fragmented overall, with no single dominant company, even though there can be a few larger enterprises with a sizable market share.

Key players in the market include Qingdao BLT Packing Industrial Co., Ltd. (BLT); Rishi FIBC Solutions Pvt Ltd.; and Bulk Liquid Solutions Pvt. Ltd.

-

Qingdao BLT Packing Industrial Co., Ltd. (BLT) has been offering the most dependable and effective logistical solutions for non-hazardous bulk liquid transportation, the business has been successful in capturing more than 30% of the worldwide market share in the non-hazardous chemical and oil sectors. With more than 500 workers, the BLT Group now has nine foreign offices and more than fifty agents throughout more than 25 countries.

-

Rishi FIBC Solutions Pvt Ltd. offers a fully integrated world-class facility for FIBC, woven, and LDPE container liners, flexitanks, Silo bags, specialty barrier films, BOPP bags, and other products. The company’s ability to produce highly tailored solutions to match client’s demands is made possible by the company's integrated facility. Now, the business operates in over 42 nations. The company manufactures 300,000 Flexitanks, 50,000 Silo bags, 500,000 Container Liners, and 10 million FIBC annually.

ORCAFLEXI SDN BHD; and AZUMA SHIPPING CO., LTD. are the other participants operating in the Asia Pacific flexitank market.

-

Azuma Shipping Co Ltd. carries out activities such as port transportation, maritime transportation, inland navigation, freight vehicle transportation, storage, ship sales and repairs, cargo transportation, customs brokerage, monitoring, and new ship creation and repair consulting.

Key Asia Pacific Flexitank Companies:

- Qingdao BLT Packing Industrial Co., Ltd. (BLT).

- Bulk Liquid Solutions Pvt. Ltd.

- Rishi FIBC Solutions Pvt Ltd.

- Infinity Bulk Logistics Sdn Bhd

- ORCAFLEXI SDN BHD

- FLUIDTAINER FLEXITANK Sdn Bhd

- My Flexitank Industries Sdn. Bhd.

- Global Barrels Industries Pte Ltd

- Singapore Tank Supply Limited.

- AZUMA SHIPPING CO., LTD.

Asia Pacific Flexitank Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 627 million

Revenue forecast in 2030

USD 2.35 billion

Growth rate

CAGR of 24.7% from 2024 to 2030

Base year for estimation

2023

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in thousand units, Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, application

Key companies profiled

Qingdao BLT Packing Industrial Co., Ltd. (BLT).; Bulk Liquid Solutions Pvt. Ltd.; Rishi FIBC Solutions Pvt Ltd.; Infinity Bulk Logistics Sdn Bhd; ORCAFLEXI SDN BHD; FLUIDTAINER FLEXITANK Sdn Bhd; My Flexitank Industries Sdn. Bhd.; Global Barrels Industries Pte Ltd; Singapore Tank Supply Limited.; AZUMA SHIPPING CO., LTD.

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Flexitank Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific flexitank market report based on type and application:

-

Type Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Single-Trip

-

Multi-Trip

-

-

Application Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Food Stuffs

-

Wine & Spirits

-

Chemicals

-

Oils

-

Industrial Products

-

Pharmaceuticals Goods

-

Others

-

-

Asia Pacific Flexitank Market Country Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

China

-

Japan

-

India

-

Australia

-

Singapore

-

Malaysia

-

Rest of Asia Pacific

-

Frequently Asked Questions About This Report

b. The Asia Pacific flexitank market was valued at USD 513.7 million in the year 2023 and is expected to reach USD 627 million in 2024.

b. The Asia Pacific flexitank market is expected to grow at a compound annual growth rate of 24.7% from 2024 to 2030 to reach USD 2.35 million by 2030.

b. The Multi-trip segment led the market and registered the largest market share of 79.3% in 2023. This growth is attributed to due to its excellent sustainability rating and capacity for many reuses, which maximizes the Total Cost of Ownership (TCO).

b. The key market players in the Asia Pacific flexitank market include Qingdao BLT Packing Industrial Co., Ltd. (BLT); and Bulk Liquid Solutions Pvt. Ltd.; Rishi FIBC Solutions Pvt Ltd.; Infinity Bulk Logistics Sdn Bhd; ORCAFLEXI SDN BHD; FLUIDTAINER FLEXITANK Sdn Bhd; My Flexitank Industries Sdn. Bhd.; Global Barrels Industries Pte Ltd; Singapore Tank Supply Limited.; AZUMA SHIPPING CO., LTD.

b. The key factors that are driving the Asia Pacific flexitank market include the region's two biggest agricultural producers and consumers, China and India, being present. In addition, because manufacturing costs are lower in China and India, several major US and European corporations have begun outsourcing their production operations to these nations.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."