- Home

- »

- Specialty Glass, Ceramic & Fiber

- »

-

Asia Pacific Flat Glass Market Size, Industry Report, 2030GVR Report cover

![Asia Pacific Flat Glass Market Size, Share & Trends Report]()

Asia Pacific Flat Glass Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Tempered, Laminated, Insulated), By Application (Architectural, Automotive), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-852-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Asia Pacific Flat Glass Market Size & Trends

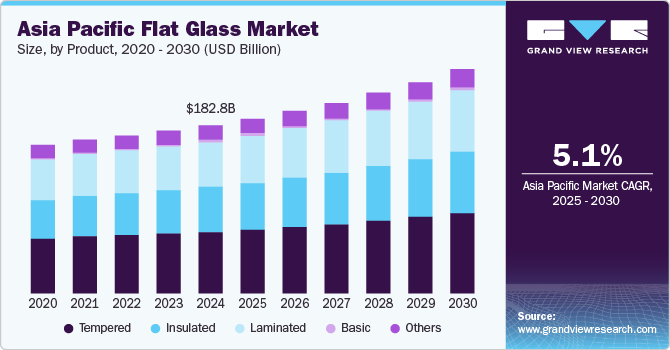

The Asia Pacific flat glass market size was valued at USD 182.8 billion in 2024 and is expected to grow at a CAGR of 5.1% from 2025 to 2030. This growth is attributed to the booming construction industry, particularly in China and India, which is a significant contributor due to rapid urbanization and infrastructural development. Furthermore, increasing demand for energy-efficient buildings and renewable energy projects such as solar installations further drives the market. Moreover, government initiatives promoting green building practices and advancements in automotive glass technology also play crucial roles in expanding regional market opportunities.

Flat glass, also called plate or sheet glass, is crafted from various raw materials, including silica sand, soda ash, and limestone, producing a smooth and uniformly thick product. Its applications span across multiple industries, such as automotive, construction, consumer electronics, and furniture. Flat glass is essential for solar energy systems as it shields photovoltaic modules from environmental elements.

Furthermore, its use in the furniture sector for tabletops and decorative panels is growing. Due to its clarity and safety features, flat glass is crucial for windshields and side windows in the automotive industry. It shatters into small, blunt pieces upon impact, reducing injury risks. Moreover, flat glass enhances the aesthetics of vehicle interiors through its application in instrument panels and touchscreens. In electronics, it is a durable surface for display screens in devices such as smartphones and televisions while also being utilized in camera lenses and various optoelectronic components.

The versatility of flat glass makes it a cost-effective choice that requires minimal maintenance, offers long-lasting durability, and provides excellent optical clarity across diverse applications. As industries increasingly adopt flat glass for its functional and aesthetic benefits, its market presence continues to expand significantly.

Product Insights

Tempered glass dominated the Asia Pacific flat glass industry and accounted for the largest revenue share of 36.9% in 2024 attributed to its enhanced safety and durability features. Tempered glass is known for its ability to withstand high impact and thermal stress, making it ideal for various applications, especially in the construction and automotive sectors. In addition, the stringent building regulations in countries such as Japan, which mandate the use of safety glass in high-rise buildings and earthquake-resistant structures, further bolster its demand. Furthermore, the rising trend of modern architectural designs that favor large glass facades and open spaces contributes significantly to the increasing adoption of tempered glass products across the region.

The laminated products are expected to grow at a CAGR of 5.4% over the forecast period, owing to their superior safety and acoustic insulation properties. Laminated glass is increasingly used in automotive and architectural applications to protect against shattering and enhance soundproofing. Furthermore, the growth in electric vehicle production has led manufacturers to incorporate laminated glass in windshields and sunroofs for improved safety features. Moreover, the rising awareness of energy efficiency and sustainability has prompted builders to choose laminated glass for its ability to reduce noise pollution and enhance energy performance in buildings.

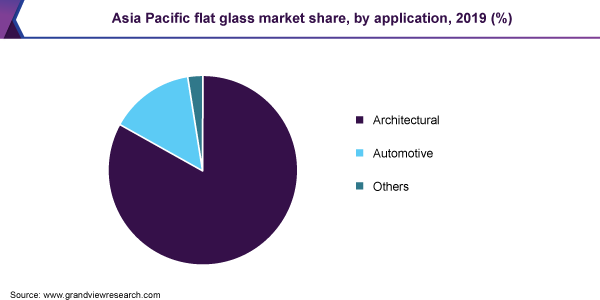

Application Insights

The architectural application segment dominated the market and accounted for the largest revenue share of 71.7% in 2024, driven by rapid urbanization and significant infrastructure development, particularly in countries such as China and India. In addition, the demand for flat glass is driven by its extensive use in modern construction, including windows, facades, and interior partitions, which enhance both aesthetics and energy efficiency. Moreover, government initiatives promoting green building practices and stringent energy-efficiency standards further support this trend, increasing the consumption of energy-efficient glass products. As a result, the architectural sector is poised for continued expansion in the region.

The automotive application segment is expected to grow at a CAGR of 4.7% from 2025 to 2030, owing to the rising production of vehicles, particularly electric vehicles (EVs). Due to its safety features and clarity, the automotive industry increasingly utilizes flat glass for windshields, windows, and sunroofs. Furthermore, glass technology advancements enable the integration of lightweight and solar-control glass into vehicle designs, enhancing energy efficiency and passenger comfort. Moreover, with major manufacturers ramping up production in response to growing consumer demand, this segment is expected to see significant growth as automotive innovations evolve.

Country Insights

China flat glass market dominated the Asia Pacific market and accounted for the largest revenue share of 55.5% in 2024 attributed to the country's aggressive urbanization and infrastructure development initiatives. Furthermore, with the government implementing extensive construction projects, including smart cities and high-rise buildings, the demand for flat glass in architectural applications is surging. Moreover, China's position as the world's largest automotive market further fuels this growth, as flat glass is essential for vehicle manufacturing.

India Flat Glass Market Trends

Theflat glass market in India is expected to grow at a CAGR of 6.9% over the forecast period, owing to rapid urbanization and increasing investments in infrastructure. Government initiatives to boost housing and commercial projects are creating a robust demand for flat glass in construction applications such as windows and facades. In addition, the growing popularity of green buildings, which utilize energy-efficient materials, also contributes to this trend. Furthermore, the rise in automotive production, particularly electric vehicles, enhances the need for flat glass in vehicles. These dynamics collectively support the growth of the flat glass market in India.

Key Asia Pacific Flat Glass Company Insights

Some of the key players in the Asia Pacific flat glass industry include BG, China Glass Holdings Limited, Fuyao Group, and others. These companies are adopting various strategies to enhance their market presence. These strategies include forming strategic partnerships to leverage shared resources, technological advancements, and market access, enabling companies to expand their product offerings and reach new customers. Furthermore, new product launches are a crucial focus, with companies developing innovative glass solutions that cater to the growing demand for energy-efficient and value-added products.

-

Asahi India Glass Limited (AIS) produces automotive safety glass, float glass, and architectural processed glass, catering to both the automotive and construction sectors. The company operates through three strategic business units: Automotive Glass, Architectural Glass, and Consumer Glass. Furthermore, it offers consumer solutions under brands such as AIS Glasxperts and Windshield Experts, focusing on delivering high-quality glass solutions for diverse applications.

-

China Glass Holdings Limited manufactures float, automotive, and energy-efficient architectural glass, serving domestic and international markets. Operating in segments such as construction, automotive, and solar energy applications, the company emphasizes innovation and quality in its offerings. The company also invests in advanced technologies to enhance its product portfolio and meet the growing demand for high-performance flat glass solutions.

Key Asia Pacific Flat Glass Companies:

- AGC, Inc.

- Asahi India Glass Limited.

- BG

- China Glass Holdings Limited

- Fuyao Group

- Guardian Industries

- Jinjing (Group) Co., Ltd.

- KIBING GROUP

- Nippon Sheet Glass Co., Ltd

- Saint Gobain

- SCHOTT AG

- Xinyi Glass Holdings Co. Ltd.

Recent Developments

-

In November 2024, AGC announced the launch of its innovative photovoltaic glass, a significant advancement in flat glass technology. This new product directly integrates solar energy generation capabilities into building materials, promoting sustainability and energy efficiency. Designed for various architectural applications, AGC's photovoltaic glass enhances aesthetic appeal and contributes to reducing carbon footprints. This development reflects AGC's commitment to developing sustainable flat glass solutions that meet modern energy demands while supporting eco-friendly construction practices.

-

In February 2024, Saint-Gobain Glass India announced its collaboration with Xynteo's Build Ahead Coalition to enhance decarbonization in the Indian construction sector. This partnership aims to promote low-carbon building materials, including flat glass, as part of efforts to achieve net-zero emissions by 2070. The initiative was launched during "The Exchange" event in New Delhi, bringing together industry leaders to discuss sustainable practices. Saint-Gobain's commitment to reducing carbon footprints through innovative glass solutions underscores its role in fostering sustainable construction practices in India.

Asia Pacific Flat Glass Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 190.4 billion

Revenue forecast in 2030

USD 244.4 billion

Growth Rate

CAGR of 5.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

November 2024

Quantitative units

Volume in Kilotons; Revenue in USD Million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

Asia Pacific

Country scope

China, India, Japan, Australia, South Korea, Thailand

Malaysia, Indonesia, New Zealand, Vietnam

Key companies profiled

AGC, Inc.; Asahi India Glass Limited.; BG; China Glass Holdings Limited; Fuyao Group; Guardian Industries; Jinjing (Group) Co., Ltd.; KIBING GROUP; Nippon Sheet Glass Co., Ltd; Saint Gobain; SCHOTT AG; Xinyi Glass Holdings Co. Ltd.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Flat Glass Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific flat glass market report based on product, application, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Basic

-

Tempered

-

Laminated

-

Insulated

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Architectural

-

Automotive

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Thailand

-

Malaysia

-

Indonesia

-

New Zealand

-

Vietnam

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.