- Home

- »

- Advanced Interior Materials

- »

-

Asia Pacific Filtration And Drying Equipment Market, Report, 2030GVR Report cover

![Asia Pacific Filtration And Drying Equipment Market Size, Share & Trends Report]()

Asia Pacific Filtration And Drying Equipment Market Size, Share & Trends Analysis Report By Technology (Centrifuges, Agitated Nutsche Filter-Dryers), By End-use (Food & Beverage, Chemical, Pharmaceutical), By Country (China, India), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-306-6

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Market Size & Trends

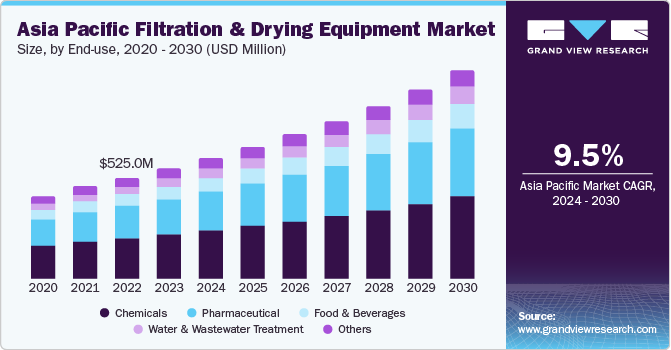

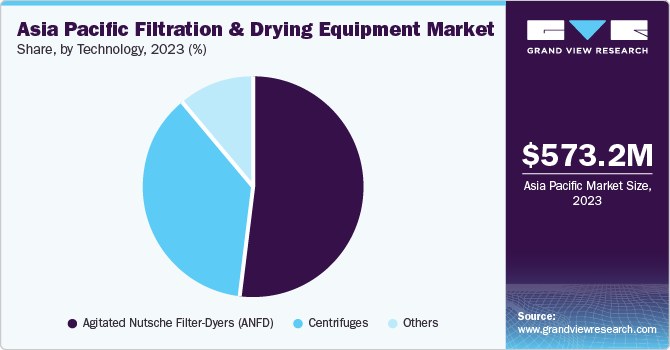

The Asia Pacific filtration and drying equipment market size was estimated at USD 573.2 million in 2023 and is anticipated to grow at a CAGR of 9.5% from 2024 to 2030. The growth of the market can be primarily attributed to the growing food & beverages, pharmaceutical, and chemical end-use industries across the world. Moreover, the increasing investments in the water and wastewater treatment sector for sustainable wastewater management are expected to drive the demand for filtration & drying equipment over the forecast period. Filtration & drying equipment are used for water & wastewater treatment and sewage processing. They are employed to remove particles, such as metal shavings, from industrial lubricants. This equipment is critical for the separation of precious synthetic materials throughout the production process.

According to the India Brand Equity Foundation (IBEF), the pharmaceuticals industry is recognized as the sunrise sector for the economy of the country in the Union Budget-2022. It is predicted to triple in size in the next few years. Moreover, according to the Economic Survey for 2021-2022, the pharmaceutical industry in India is projected to reach USD 65 billion by 2024. The growth of the industry in the country can be attributed to the leadership of domestic manufacturers that offer generic pharmaceutical formulations. Thus, the growing pharmaceuticals industry in India is expected to lead to surged demand for filtration & drying equipment used in it during the forecast period.

The demand for filtration and drying equipment in the Asia Pacific region is fueled by several important factors, including the growing need for advanced manufacturing processes across a range of industries due to the rapid industrialization and economic development of nations such as China, India, Japan, and South Korea. The need for filtration and drying equipment is mostly being driven by industries that are expanding rapidly, including chemicals, food & beverage, water treatment, and pharmaceuticals. The region's pharmaceutical business is expanding quickly due to increased middle-class access to healthcare services, rising healthcare awareness, and a growing population.

According to the World Bank, Asia Pacific is witnessing the fastest population and economic growth in the world. Rapid urbanization, increased government investments, and a rise in consumer spending have led to the region’s economic growth, thereby contributing to the rapid development of major end-use industries. Emerging economies such as China, India, and Japan are the key countries driving the development of pharmaceuticals, chemicals, and food & beverage industries in the APAC.

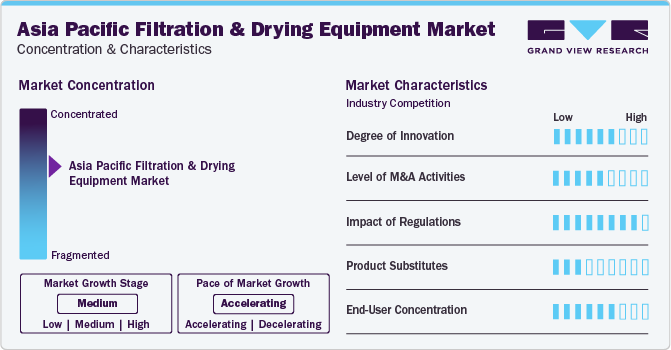

Market Concentration & Characteristics

The Asia Pacific filtration and drying equipment is marked by a high level of innovation. This is primarily due to the industry's constant technological developments. To design and develop cutting-edge filtering and drying solutions that offer improved efficiency, dependability, and durability, manufacturers are making significant investments in R&D.

These cutting-edge solutions are made to specifically address the requirements of different end-use industries, which propels market expansion. For instance, in May 2023, Amar Equipment collaborated with HLE Glasscoat to develop Agitated Nutsche filter dryers (ANFDs). This development aimed to produce state-of-the-art ANFDs to meet a variety of customer requirements and carry out advancements in the chemical processing industry.

The merger and acquisition activities in the market are at a moderate level. As a component of growth strategy, manufacturers are actively seeking strategic alliances, mergers, and acquisitions. These initiatives are meant to provide them with a competitive advantage in the market, boost manufacturing capacity, and broaden their range of products.

By engaging in these kinds of activities, manufacturers can also benefit from the resources and experience of their partners, which strengthens their position in the market. For instance, GMM Pfaudler acquired a glass lining manufacturing facility of De Dietrich Process Systems India Private Limited based in Hyderabad, Telangana in India. The plant, which spreads over 6 acres of land, is equipped with top-notch machinery for producing pressure vessels and glass-lined equipment. This plant has been operational since October 2020.

The product expansion occurring in the market is high due to the industrial sector's tremendous technological developments and expansion. To meet the varied needs of numerous end-use industries, manufacturers are constantly broadening the scope of their product offerings. For instance, in July 2023, ANDRITZ launched decanter centrifuges designed for complex industrial oil recovery applications. ANDRITZ's decanter centrifuge series comprises ATEX Zone 1 and Zone 2 equipment, which are critical for oil and gas applications

End-use Insights

The chemical segment dominated the market and accounted for the largest revenue share of 40.2% in 2023. Filtration and drying equipment are widely used in the chemical industry for processes such as crystallization, by-product separation, and intermediate production. These processes are essential to achieving the necessary qualities and requirements for chemical commodities. The versatility of filtration and drying techniques is demonstrated by their capacity to be customized for a broad range of chemical compounds, including mass-produced chemicals, specialty products, and fine chemicals.

The pharmaceuticals segment held a substantial market share in 2023. In the pharmaceutical industry, filtration and drying equipment is widely utilized for the large-scale manufacture of medications and biological products, as well as for the assessment of suspensions and emulsions and the molecular weight determination of colloids. To reduce production costs, the pharmaceutical industry's filtration and drying equipment, particularly that utilized in the production of high-potency APIs, must merge the filtering and drying process steps into a single device, thereby driving segment growth in the filtration and drying equipment market.

Technology Insights

The Agitated Nutsche Filter-Dyers (ANFD) segment accounted for the largest market share of in 2023 due to its adaptability and effectiveness. They are widely utilized in drying and solid-liquid separation procedures in the chemical and pharmaceutical industries. To improve process control, ANFDs integrate vacuum drying, washing, and filtering into a single device. They are flexible enough to accommodate various procedures and handle a wide range of materials.

The centrifuges held a significant market share in 2023 owing to their wide range of applications in a variety of sectors and their excellent efficiency in separating chemicals. They are widely utilized in industries including wastewater treatment, food & beverage, biotechnology, pharmaceuticals, and chemicals. Centrifuges are becoming popular owing to their advantages, which include high standards and flexibility to different types and temperature ranges. There is an increased demand for centrifuges in the market due to factors such as the pharmaceutical industry's increased R&D expenditures and the adoption of modern technology.

Country Insights

China Filtration And Drying Equipment Market Trends

The filtration & drying equipment market in China accounted for the highest revenue share of 42.7% in 2023. The aging population, growing health consciousness, and increasing total of per capita healthcare spending all contribute to China's pharmaceutical industry's rise. Thus, growing healthcare spending in China is expected to drive the demand for filtration and drying equipment market over the forecast period.

IndiaFiltration And Drying Equipment Market Trends

The India filtration and drying equipment market held a significant market share in 2023. According to the Times of India, the Indian pharmaceutical industry was named the "sunrise sector" for India's economy in the Union Budget for 2022 and is predicted to triple in size over the next three years. By 2024, the pharmaceutical industry in India is predicted to reach a value of USD 65 billion, according to the Economic Survey for 2021-2022. The business has experienced enormous expansion owing to domestic producers' leadership in supplying generic formulations to various markets across the world.

Japan Filtration And Drying Equipment Market Trends

The filtration & drying equipment market in Japan witnessed notable growth in 2023. According to the Japan Chemical Industry Association (JCIA), the chemical industry is the 2nd largest manufacturing industry, followed by the automotive industry. Factors such as rising construction activities, increasing oil refining activities, a growing cosmetics industry, and recovering economic growth are expected to drive the chemicals industry in Japan during the forecasted period.

Key Asia Pacific Filtration And Drying Equipment Company Insights

Various manufacturers employ a range of strategies, including joint ventures, mergers, acquisitions, new product launches, and geographic expansions, to enhance market penetration and meet the evolving technological demands from diverse end-uses, including automotive, machine, construction, aerospace, and metalworking. By making strategic acquisitions, manufacturing business entities are expanding their global reach and gaining a competitive advantage in the market.

Key players in the market include Zhejiang Yaguang Technology Co., Ltd.; Amar Equipment Pvt. Ltd.; and Promas Engineers PVT. LTD.

-

Zhejiang Yaguang Technology Co., Ltd. specializes in pharmaceutical equipment production, sales, and research & development. To gain access to new markets, the company has also created pharmaceutical central equipment in China, such as the first vacuum belt dryer, agitated nutsche filter dryer, and rubber stopper washing machine. The company's product line may be divided into three main categories: Chinese herb equipment, which includes vacuum belt dryers, crushing and packing systems, concentration tanks, etc.

-

Amar Equipment Pvt. Ltd. Offers the design, production, and delivery of continuous reactors, batch reactors, and related systems at high pressure and temperature. Applications for the company's products include R&D, pilot, and manufacturing facilities in the chemical, pharmaceutical, oil & gas, and educational sectors. Pressure reactors and systems, flow reactors and systems, agitated Nutsche filters and dryers, and heating-cooling circulators are just a few of the many items that the company sells.

Tsukishima Kikai Co., Ltd.; HLE Glascoat;and NORITAKE CO., LIMITED are other participants operating in the Asia Pacific filtration & drying equipment market.

- Tsukishima Kikai Co., Ltd. operates under two business segments: the industrial business and the water environmental industry. The production and marketing of sewage treatment and water purification systems, as well as commercial and operational management, are all under the purview of the water environmental business area. Through its operation and maintenance sub-segment, the company provides parts and maintenance services. Its other section, Incineration, provides intermediate treatment for both industrial and non-industrial waste.

Key Asia Pacific Filtration And Drying Equipment Companies:

- Zhejiang Yaguang Technology Co., Ltd

- Promas Engineers PVT. LTD

- Synovatic India

- Tsukishima Kikai Co., Ltd.

- HLE Glascoat

- Amar Equipment Pvt. Ltd.

- NORITAKE CO., LIMITED

- TAPC

- HANSHIN Machinery Co., Ltd.

- Young Tech Co., Ltd.

Recent Developments

-

In August 2023, the leading process equipment manufacturer, HLE Glascoat, announced that it has signed final agreements to gradually acquire a majority stake in Kinam Engineering Industries (Kinam). This move is part of the company's strategy to further solidify its position in the specialized process equipment markets by utilizing cutting-edge technology. Two stages will comprise this strategic purchase. Kinam and its Promoters share the firm's mission, values, and strategic thinking, and this acquisition adds significant value for HLE's shareholders while enabling the company to accelerate its expansion objectives.

-

In May 2023, Amar Equipment collaborated with HLE Glasscoat to create Agitated Nutsche filter dryers (ANFDs). The goal of this collaboration was to create cutting-edge ANFDs that would satisfy a range of client demands and further the development of the chemical processing sector. Amar Equipment and HLE Glascoat's partnership represents a critical turning point in the production and distribution of Agitated Nutsche Filter Dryers (ANFDs). This cooperation is poised to change industry norms by utilizing the manufacturing ability of Amar Equipment and the market brilliance of HLE Glascoat.

Asia Pacific Filtration And Drying Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 626.2 million

Revenue forecast in 2030

USD 1,080.6 million

Growth rate

CAGR of 9.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Technology, end-use, country

Region scope

Asia Pacific

Country Coverage

China; Japan; India; South Korea; Australia

Key companies profiled

Zhejiang Yaguang Technology Co., Ltd; Promas Engineers PVT. LTD; Synovatic India; Tsukishima Kikai Co., Ltd.; HLE Glascoat; Amar Equipment Pvt. Ltd.; NORITAKE CO., LIMITED; TAPC; HANSHIN Machinery Co., Ltd.; Young Tech Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Filtration And Drying Equipment Market Report Segmentation

This report forecasts revenue growth at a region level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific filtration and drying equipment market report based on technology, end-use, and country.

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Centrifuges

-

Agitated Nutsche Filter-Dyers (ANFD)

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical

-

Chemicals

-

Water and Wastewater Treatment

-

Food & Beverages

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Frequently Asked Questions About This Report

b. The Asia Pacific filtration and drying equipment market was valued at USD 573.2 million in the year 2023 and is expected to reach USD 626.2 million in 2024.

b. The Asia Pacific filtration and drying equipment market is expected to grow at a compound annual growth rate of 9.5% from 2024 to 2030 to reach USD 1,080.6 million by 2030.

b. The Agitated Nutsche Filter-Dyers (ANFD) segment accounted for the largest market share of 52.2% in 2023 as they are widely utilized in drying and solid-liquid separation procedures in the chemical and pharmaceutical industries. Furthermore, to improve process control, ANFDs integrate vacuum drying, washing, and filtering into a single device.

b. The key market player in the Asia Pacific filtration and drying equipment market includes Zhejiang Yaguang Technology Co., Ltd; Promas Engineers PVT. LTD; Synovatic India; Tsukishima Kikai Co., Ltd.; HLE Glascoat; Amar Equipment Pvt. Ltd.; NORITAKE CO., LIMITED; TAPC; HANSHIN Machinery Co., Ltd.; Young Tech Co., Ltd.

b. The key factors that are driving the Asia Pacific filtration & drying equipment market include, the growing middle-class population which is more aware of chronic illnesses and spends more on health care due to which the pharmaceutical industry in China, India, and Indonesia is expanding rapidly.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."