Asia Pacific Farm Tire Market Size, Share & Trends Analysis Report By Product (Radial, Bias), By Application (Tractors, Harvesters, Irrigation), By Distribution (OEM, Aftermarket), By Country, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-921-0

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

Asia Pacific Farm Tire Market Size & Trends

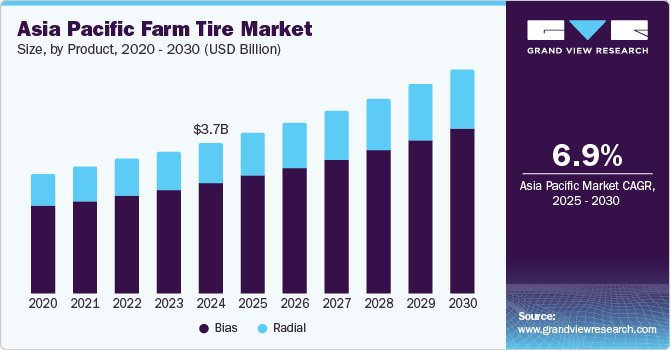

The Asia Pacific farm tire market size was valued at USD 3.70 billion in 2024 and is expected to grow at a CAGR of 6.9% from 2025 to 2030. The market growth can be attributed to increasing agricultural mechanization, and the rising demand for efficient farming practices is central to this expansion. In addition, as farmers invest in advanced machinery to enhance productivity, the need for durable farm tires that can support heavy loads and provide traction on diverse terrains has surged. Furthermore, government initiatives to boost tractor sales and the expansion of agricultural land due to population growth further stimulate market growth in the region.

Farm tires, also called agricultural tires, are specifically designed for use on farming vehicles and equipment such as tractors, harvesters, and sprayers. These tires are engineered to meet the unique challenges of agricultural environments, providing durability, traction, and the ability to carry heavy loads. They feature specialized tread patterns optimized for various field conditions, including mud and uneven terrain, which enhances grip and minimizes slippage. Proper maintenance and inflation are crucial for maximizing their performance and lifespan, ensuring efficient farming operations.

One significant aspect is the increasing adoption of precision farming techniques, which utilize advanced technologies such as GPS and sensors to optimize agricultural output while minimizing environmental impact. This reliance on technology necessitates high-quality farm tires that offer the traction and stability required for heavy machinery in various field conditions. In addition, there is a growing emphasis on sustainable farming practices as consumers demand environmentally friendly food production. This shift encourages using farm tires designed to minimize soil compaction and erosion, supporting eco-conscious agricultural methods.

Furthermore, the ongoing mechanization of farming operations plays a crucial role in market expansion. As farmers invest in modern equipment to enhance efficiency and productivity, the demand for durable farm tires capable of supporting heavy loads continues to rise. Moreover, these trends highlight a robust market for farm tires in the Asia Pacific, driven by technological advancements, sustainability efforts, and an increasing need for mechanized farming solutions. The region's agricultural landscape is evolving, with farmers increasingly relying on specialized vehicles and equipment. This further underscores the importance of high-performance farm tires in meeting these demands.

Product Insights

The bias farm tires held the dominant position in the Asia Pacific market and accounted for the largest revenue share of 73.5% in 2024, which can be attributed to their affordability and widespread usage. Bias tires, which are constructed with overlapping ply sheets, offer enhanced stability in off-road applications, making them ideal for agricultural tasks. In addition, their low cost makes these tires a preferred choice among farmers in countries such as India, where they dominate the market with over 93% share. Furthermore, the increasing demand for tractors and harvesters, coupled with the availability of these tires, supports their continued growth in the region.

Radial farm tires are expected to grow at a CAGR of 6.9% over the forecast period, owing to are gaining traction due to their superior performance characteristics. These tires provide better fuel efficiency, improved traction, and reduced soil compaction, making them suitable for modern agricultural practices. In addition, as farmers increasingly adopt advanced machinery and precision farming techniques, the demand for high-performance radial tires is expected to rise. Furthermore, their ability to support heavier loads while enhancing operational efficiency aligns well with the growing mechanization of agriculture in the Asia Pacific, further driving their market growth.

Application Insights

Tractors led the market and accounted for the largest revenue share of 49.5% in 2024, owing to the increasing mechanization of agriculture. As farmers seek to enhance productivity and efficiency, there is a significant rise in adopting modern tractors equipped with advanced technologies. In addition, government initiatives, including subsidies and incentives, further encourage this trend. Furthermore, the demand for high-performance farm tires is thus bolstered, as these tractors require specialized tires to support their operational capabilities and improve yield.

Implements are expected to grow at a CAGR of 7.1% from 2025 to 2030, primarily driven by farming operations that contribute to market growth. Implements such as plows, seeders, and harvesters are essential for efficient agricultural practices. In addition, as farmers invest in these tools to optimize their operations, the need for robust farm tires that can handle various terrains and heavy loads becomes critical. Furthermore, this trend is amplified by the growing global population and the corresponding demand for food, prompting farmers to adopt high-quality tires that enhance their machinery's performance and longevity in the field.

Distribution Insights

The aftermarket distribution segment dominated the market and accounted for the largest revenue share of 61.6% in 2024, owing to the cost-effectiveness of aftermarket tires. In addition, many farmers opt for these alternatives due to their significantly lower prices, less than OEM tires making them more accessible, especially for those in developing regions. Furthermore, the increasing availability of online sales channels has facilitated easier access to these tires, allowing farmers to find suitable options that meet their needs without incurring high costs.

The OEM distribution segment is expected to grow at a CAGR of 5.9% over the forecast period, driven by the rising demand for new agricultural machinery. As farmers invest in modern equipment to enhance productivity and efficiency, the need for original equipment manufacturer tires that match these machines' specifications becomes crucial. In addition, government initiatives and subsidies promoting agricultural mechanization further support this trend, encouraging farmers to purchase new machinery equipped with OEM tires. Furthermore, this alignment of new technology with high-quality tire solutions is fostering growth in the OEM segment within the Asia Pacific farm tire market.

Country Insights

China Farm Tire Market Trends

China farm tire market dominated the Asia Pacific market and accounted for the largest revenue share of 34.3% in 2024. This growth can be attributed to the rapid modernization of agricultural practices. In addition, the increasing mechanization of farming operations has led to a higher demand for specialized tires that can support advanced machinery such as tractors and harvesters. Furthermore, government initiatives promoting agricultural efficiency and productivity encourage farmers to invest in new equipment, further driving the need for durable, high-performance farm tires.

India Farm Tire Market Trends

The farm tire market in India is expected to grow at a CAGR of 7.3% over the forecast period, owing to rising agricultural mechanization and an expanding middle class. Farmers are increasingly adopting modern machinery to enhance productivity and meet the demands of a growing population. In addition, the affordability of bias tires, which dominate the market, makes them an attractive option for many smallholder farmers. Furthermore, government subsidies for agricultural equipment purchases encourage investments in new technologies, thereby boosting the demand for high-quality farm tires tailored to various farming applications.

Japan Farm Tire Market Trends

The growth of Japan farm tire market can be attributed to advancements in precision agriculture and sustainable farming practices. Japanese farmers increasingly utilize technology such as GPS-guided equipment to optimize crop production while minimizing environmental impact. In addition, this shift towards precision farming necessitates high-performance tires that provide excellent traction and stability for modern agricultural machinery. Furthermore, Japan's focus on sustainable practices is leading to a demand for tires that reduce soil compaction and enhance fuel efficiency, further supporting regional market growth.

Key Asia Pacific Farm Tire Company Insights

Key companies in the Asia Pacific farm tire industry include CEAT LTD., Continental Corporation, JK Tyre & Industries, and others. These companies have adopted various strategies to enhance their competitive edge. These strategies include common partnerships and agreements with local distributors and agricultural equipment manufacturers to facilitate better market penetration. In addition, product development initiatives focus on creating innovative tire solutions tailored to specific agricultural needs, ensuring high performance and durability. Furthermore, companies also engage in joint ventures to expand their manufacturing capabilities and reach, while actively participating in trade shows and exhibitions to showcase their latest offerings and strengthen brand visibility.

-

Apollo Tyres Ltd. focuses on providing high-performance solutions that enhance traction, durability, and fuel efficiency. The company operates in the agricultural tire market, offering specialized products such as the Farmking and VIRAT series, which cater to the diverse needs of farmers across various terrains. Their innovative designs and robust construction make them a preferred choice among agricultural professionals.

-

Bridgestone Corporation produces a variety of agricultural tires that are engineered for optimal performance in demanding farming environments. The company’s products include radial and bias tires designed for tractors, combines, and other agricultural machinery. Operating within the agricultural segment, the company emphasizes innovation and technology to develop tires that provide superior traction, stability, and longevity, meeting the evolving needs of modern agriculture.

Key Asia Pacific Farm Tire Companies:

- Apollo Tyres Ltd.

- Bridgestone Corporation

- CEAT LTD.

- Continental Corporation

- The Goodyear Tire & Rubber Company

- JK Tyre & Industries

- Michelin Tyres

- MRF Limited

- Nexen Tire Corporation

- Yokohama Tire Corporation

- Pirelli

Recent Developments

-

In November 2024, Titan International announced the launch of AgraVantage, a new farm tire product line designed to enhance agricultural productivity. This innovative line features advanced technology to improve traction and durability, catering to farmers' diverse needs. The AgraVantage tires promise to deliver superior performance in various field conditions, ensuring that farmers can rely on robust solutions for their equipment. This initiative underscores Titan's commitment to supporting the agricultural sector with high-quality farm tire options.

-

In August 2024, Firestone Ag, a division of Bridgestone Americas, unveiled a new line of premium farm tires designed for tractors in the U.S. and Canada. The Bridgestone tractor tires feature innovative technologies, including a triple-defense rubber compound for enhanced durability and an Involute lug design that maximizes traction while minimizing soil disturbance. The VX-TRACTOR tire promises 45% more wear life than competitors, reflecting Bridgestone's commitment to agricultural excellence.

-

In August 2023, CEAT Specialty announced the launch of a new farm tire specifically designed for agricultural transport applications at the upcoming Farm Progress Show. This innovative tire enhances farmers' efficiency and performance by providing superior traction and durability on various terrains. CEAT's commitment to meeting the evolving needs of the agricultural sector is evident in this latest offering, which was showcased at the event, highlighting its focus on supporting farm operations with reliable tire solutions.

Asia Pacific Farm Tire Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 3.94 billion |

|

Revenue forecast in 2030 |

USD 5.50 billion |

|

Growth Rate |

CAGR of 6.9% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Report updated |

December 2024 |

|

Quantitative units |

Volume in Thousand Units, Revenue in USD Million, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, distribution, region |

|

Regional scope |

Asia Pacific |

|

Country scope |

China, India, Japan, Australia |

|

Key companies profiled |

Apollo Tyres Ltd.; Bridgestone Corporation; CEAT LTD.; Continental Corporation; The Goodyear Tire & Rubber Company; JK Tyre & Industries; Michelin Tyres; MRF Limited; Nexen Tire Corporation; Yokohama Tire Corporation; Pirelli |

|

Customization scope |

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Asia Pacific Farm Tire Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific farm tire market report based on product, application, distribution and region.

-

Product Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Bias

-

Radial

-

-

Application Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Tractors

-

Harvesters

-

Forestry

-

Irrigation

-

Implements

-

Sprayers

-

-

Distribution Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

OEM

-

Aftermarket

-

-

Country Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

China

-

India

-

Japan

-

Australia

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."