- Home

- »

- Next Generation Technologies

- »

-

Asia Pacific Eyewear Market Size, Industry Report, 2030GVR Report cover

![Asia Pacific Eyewear Market Size, Share & Trends Report]()

Asia Pacific Eyewear Market Size, Share & Trends Analysis Report By Product (Contact Lenses, Spectacles, Sunglasses), By Distribution Channel (E-commerce), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-297-1

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Asia Pacific Eyewear Market Size & Trends

The Asia Pacific eyewear market size was estimated at USD 43.27 billion in 2023 and is expected to grow at a CAGR of 10.5% from 2024 to 2030. A growth in expenditure on eye health, an increase in awareness about regular eye examinations, and a rise in income levels have contributed to the growth of this market. In addition, increasing availability of ophthalmic treatments and advancements in technology related to the diagnosis and treatment of common ophthalmic disorders have also influenced the industry's growth. Furthermore, the presence of domestic as well as international brands in the regional market has fueled market growth.

Asia Pacific eyewear market held a 23.6% share of the global eyewear market revenue in 2023. The development in infrastructure, technology, healthcare, and resources have positively impacted the developing countries in the region, such as China, India, and Japan. In addition, factors, such as changes in lifestyle, rapid urbanization, growing need for ophthalmic treatments, and increasing prevalence of common eye disorders, such as myopia, astigmatism, presbyopia, and hyperopia, are driving the demand for eye examinations and eyewear products in the region.

In developing countries like India, hospitals, charitable trusts, and social welfare organizations regularly conduct low-cost or free-of-cost eye examination campaigns. These campaigns bring together experts and examiners for the diagnosis and treatment of eye problems. Such initiatives significantly impact the regional market growth.

The entry of international brands in Asia Pacific, with a specific strategy of promoting eyewear as a fashion accessory, has driven the market growth. Brand awareness and increased brand visibility attained by distribution through mall stores, specialty stores dedicated to fashion accessories, and online retailing have also resulted in an upsurge in demand for eyewear, such as sunglasses and spectacle lenses.

Product Insights

The spectacles segment dominated the market with a revenue share of 73.1% in 2023. A substantial percentage of the population in developing countries, such as India, has been facing severe vision deficiencies. According to The Lancet Global Health, approximately 21 million people in India suffer from visual impairments. In addition, a lack of awareness regarding corrective measures for visual inaccuracies adds to the problem. However, in recent years, government campaigns and initiatives by private organizations have resulted in the growing availability of examinations and distribution of spectacles.

The sunglasses segment is expected to experience a CAGR of 11.6% from 2024 to 2030 due to the increased availability of branded and premium-range products. In addition, the growing expenditure on fashion accessories and personal care and the presence of e-commerce platforms that offer lucrative deals and discounts on a range of products is further fueling market growth. Diverse customer preferences have encouraged domestic and international brands to deliver newly designed products constantly.

Distribution Channel Insights

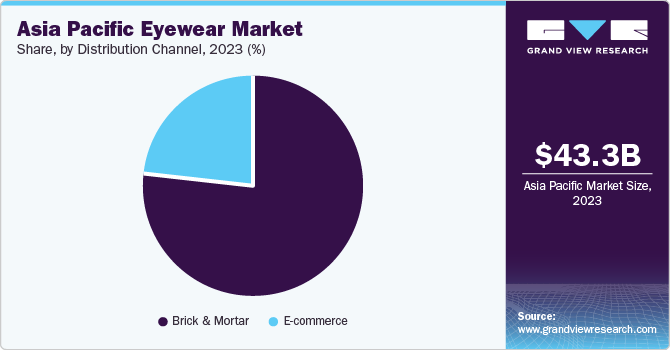

Based on the distribution channel, the brick-and-mortar segment dominated the market and accounted for a share of 76.8% in 2023. Though online shopping is increasingly preferred by customers, a large group of buyers still prefers an offline shopping experience through brick-and-mortar stores. This is mainly due to the experience where they can personally examine the quality of the product material, color, and texture, and take immediate possession of it after purchase.

The e-commerce segment is expected to experience a significant CAGR of 12.1% from 2024 to 2030. It is primarily due to the increasing penetration of smartphone technology, growing accessibility to the internet, rising availability of eyewear through e-commerce platforms, and several alternatives offered by these platforms. In addition, services provided by the e-commerce platforms, such as doorstep delivery, return & refund, customer assistance before & after purchase, detailed reviews by previous buyers displayed on the website, and innovative offerings, such as virtual try-ons, further fuel the segment growth.

Country Insights

China Eyewear Market Trends

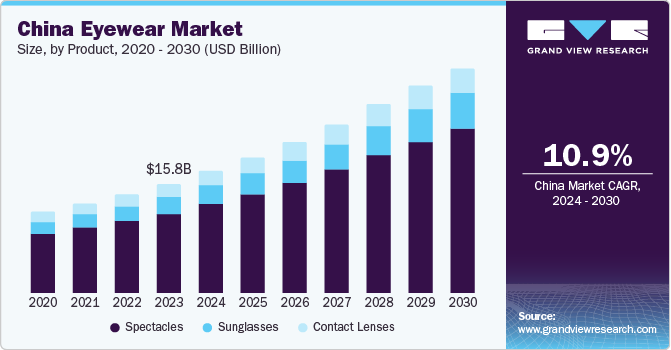

The eyewear market in China accounted for a dominant revenue share of 42.6% in 2023. The presence of a large geriatric population, growing prevalence of ophthalmic disorders in children & young adults, and increasing volume of eye examinations leading to the need for eyewear and vision treatments have propelled the market growth. In addition, the growing availability of a diverse range of products offered by domestic and international brands in the country has driven the product demand.

India Eyewear Market Trends

The India eyewear market is expected to experience a CAGR of 11.9% from 2024 to 2030. The growing demand for eyewear products in India is primarily driven by a large number of people suffering from visual impairments and increasing acceptance of eyewear products as fashion accessories by young buyers. The availability of luxury eyewear products offered by renowned international brands also drives market demand.

Key Asia Pacific Eyewear Company Insights

Some of the key and emerging companies in the Asia Pacific eyewear market include CHARMANT Group, Essilor, HOYA Corporation, JINS Eyewear U.S., Inc., Seiko Optical Products Co., Ltd., PRADA S.P.A., and others. Companies adopt multiple strategies, such as innovation, collaboration, expansion, product diversification, post-purchase assistance, and more, to gain a competitive advantage over other players.

-

Lenskart offers a wide range of products, such as spectacles, contact lenses, sunglasses, and other vision-related products. The company has a network of more than 1400 stores across 175 locations in India. It offers products for a variety of customer needs including fashion and technology

-

Reliance Retail, one of the subsidiaries of renowned Reliance Industries, has expanded its eyewear business through multiple acquisitions in recent years. It primarily offers a premium and luxury range of eyewear products in the Indian market. The company has a presence in more than 30 cities in India

Key Asia Pacific Eyewear Companies:

- Essilor

- HOYA Corporation

- JINS Eyewear US, Inc.

- Seiko Optical Products Co., Ltd.

- PRADA S.P.A.

- Lenskart

- Bolon

- SAFILO GROUP S.P.A.

- Huawei Device Co., Ltd.

- Reliance Retail

Recent Developments

-

In May 2024, Huawei launched its latest innovation-backed product, Eyewear 2, in China. The rectangular semi-framed eyewear is powered by UV400 protective lenses. It is also equipped with slimmer temples, silicon-made adjustable nose pads, an ergonomic arch, an open acoustics design, a dual-mic layout, enhanced battery capacity, magnetic charging, compact case folds, and touch controls

-

In March 2024, Reliance Retail, one of the top companies in multiple industries, such as consumer goods, fashion, electronics, and e-commerce, acquired LensCrafters, an eyewear brand owned by an Italian company Luxottica Group. The acquisition was processed through DLF, which was running a chain of LensCrafters stores across the country under a franchise arrangement

Asia Pacific Eyewear Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 87.29 billion

Growth Rate

CAGR of 10.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Country scope

Japan; China; India; Australia; South Korea; Singapore; Vietnam

Segments covered

Product, distribution channel, country

Key companies profiled

Essilor; HOYA Corp.; JINS Eyewear US, Inc.; Seiko Optical Products Co., Ltd.; PRADA S.P.A.; Lenskart; Bolon; SAFILO GROUP S.P.A.; Huawei Device Co., Ltd.; Reliance Retail

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Eyewear Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific eyewear market report based on product, distribution channel and country:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Contact Lenses

-

Premium Contact Lenses

-

Mass Contact Lenses

-

-

Spectacles

-

Spectacle Frames

-

Spectacle Frames, by Type

-

Premium Spectacle Frames

-

Mass Spectacle Frames

-

-

Spectacle Frames, by Style

-

Round

-

Square

-

Rectangle

-

Oval

-

Others

-

-

-

Spectacle Lenses

-

-

Sunglasses

-

Sunglasses, by Lens Type

-

Polarized Sunglasses

-

Non-Polarized Sunglasses

-

-

Sunglasses, by Lens Material

-

CR-39

-

Polycarbonate

-

Polyurethane

-

Others

-

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Brick And mortar

-

E-commerce

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Singapore

-

Vietnam

-

Frequently Asked Questions About This Report

b. The Asia Pacific eyewear market size was estimated at USD 43.27 billion in 2023.

b. The Asia Pacific eyewear market is expected to grow at a compound annual growth rate of 10.5% from 2024 to 2030 to reach USD 87.29 billion by 2030.

b. The spectacles segment held the largest revenue share in 2023 due to a substantial percentage of the population in developing countries, such as India, has been facing severe vision deficiencies.

b. Some key players operating in the Asia Pacific eyewear market include Essilor; HOYA Corp.; JINS Eyewear US, Inc.; Seiko Optical Products Co., Ltd.; PRADA S.P.A.; Lenskart; Bolon; SAFILO GROUP S.P.A.; Huawei Device Co., Ltd.; Reliance Retail

b. Factors such as an increase in awareness about regular eye examinations, and a rise in income levels have contributed to the growth of this market

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."