- Home

- »

- Renewable Chemicals

- »

-

Asia Pacific Essential Oils Market Size, Industry Report 2030GVR Report cover

![Asia Pacific Essential Oils Market Size, Share & Trends Report]()

Asia Pacific Essential Oils Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Orange, Eucalyptus), By Application (Medical, Spa & Relaxation), By Sales Channel, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-307-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Asia Pacific Essential Oils Market Trends

The Asia Pacific essential oils market size was estimated at USD 1.9 billion in 2023 and is projected to grow at a CAGR of 10.0% from 2024 to 2030. Regional economies such as India, China, and Indonesia are pioneers in the essential oils industry, having emerged as the largest exporters of some of the most precious oils and extracts that are known globally, such as champaca extract, jasmine extract, davana oil, frankincense oil, sandalwood oil, and spice oils, among others. The region boasts highly suitable weather conditions for agriculture while also possessing low-cost labor and ample availability of raw materials. These are some of the leading factors acting as drivers for the growth of essential oil production in this region. Moreover, consumers have also become highly aware of the benefits of these oils, not only in health and wellness but also for enriching flavors in food and beverage items. Therefore, the demand for these products has witnessed substantial growth from different sectors.

The Asia Pacific regionaccounted for a revenue share of 7.9% of the global essential oils market in 2023. The rapidly growing GDP in regional economies such as China, Japan, and India, along with the burgeoning population, rise in consumer disposal income, and increasing awareness regarding the beneficial properties of essential oils, are expected to provide promising growth avenues to manufacturers. Furthermore, the popularity of natural and organic ingredients in these products, along with the rising appeal of luxury items for consumers, has acted as another significant driver for industry expansion in the region.

Urbanization, lifestyle changes, and increasingly stressful lives have led consumers to resort to aromatherapy sessions for their emotional and physical well-being, which is a leading application area for essential oils. Furthermore, the strengthening demand for citrus-based essential oils, including lemons and oranges, from consumers has shown extensive growth in several Asia Pacific countries. These products have witnessed a growing proliferation in the personal care and household sectors, as they are widely utilized in the odorants, flavors, and pharmaceutical ingredient segments.

The increasing incorporation of essential oils in food items has become another significant avenue for market advancement. The rising demand for organic processed food & beverage items is expected to contribute to regional industry growth. The introduction of new and exotic flavors, changing food consumption habits, and rising demand for processed foods owing to hectic lifestyles are expected to complement the global market for food flavors. Beverages are anticipated to remain the leading segment for flavors, with the majority of market share contributed by natural flavors.

Increasing consumption of beer and other alcoholic beverages due to modernization trends is expected to expedite the expansion of the flavors market. In addition, the region still possesses a vast untapped potential for product demand as awareness continues to grow about these products. As a result, market players are investing heavily in marketing and promotional activities to boost product awareness and drive sales. The growth of the e-commerce industry presents a highly encouraging scenario for the regional market for essential oils in the coming years.

Product Insights

The orange product segment held the largest revenue share in 2023. Orange is a well-known product regionally due to its high consumption across several economies, and orange oil has attracted significant appeal among manufacturers due to its medical and cosmetic properties. In the medical field, orange oil is used to improve low libido, lower the risk of PMS-related health problems, and fight hypertension, considering its blood-dilating properties. It is also used as a digestion booster on account of its anti-inflammatory and circulation-enhancing features. The high content of vitamin C in orange essential oil makes it ideal for use in cosmetic products. In addition, the antioxidant property of orange oil helps in reducing dark spots and wrinkles, which is the major driving factor for its demand in the personal care industry.

The Acorus calamus oil segment is projected to advance at the fastest CAGR in the market during the forecast period. Acorus calamus essential oil is widely utilized in aromatherapy and perfumery applications. Ayurveda practitioners have been using the oil since ancient times owing to its antioxidant, nervine, cicatrizant, cephalic, circulant, hypothermic, anti-rheumatic, and anti-inflammatory medicinal properties. This is due to the presence of compounds such as asarone, cis-ocimene, and methyl isoeugenol in this plant. Asarone, present in the oil, is known to kill all types of bacteria and pests. Moreover, this essential oil is useful in the treatment of bronchitis, asthma, and cough. According to Indian Ayurveda, it has anesthetic properties that help in alleviating headaches and toothaches. It also relaxes the bowel muscles and eases flatulence. Thus, a range of health benefits is expected to drive segment demand in the coming years.

Sales Channel Insights

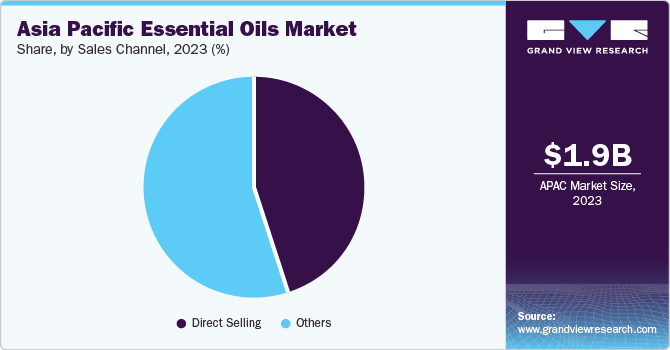

The direct selling segment is projected to expand at a faster CAGR during the projection period. Direct selling presents a primary tactic employed by multi-level marketing companies to sell their products to consumers through agents who are well-informed about the product benefits and their application. Well-known organizations such as dōTERRA create significant awareness through this business model, leading competitors to also recognize direct sales as a viable strategy for driving their growth. The rapidly popularizing trend of wellness and health, along with a preference for organic and natural products and an extensive presence of the female buyer demographic, has helped in driving segment growth in the region.

The other sales channel segment includes sales through retail modes, such as convenience stores, along with online sales. The availability of essential oils in retail outlets helps customers compare products from competing brands and make purchase decisions as per their tastes and preferences. Meanwhile, the rapid growth of the e-commerce industry in the Asia Pacific region has boosted sales of essential oils through the online channel. Companies have launched websites that display their entire product range while offering buyers attractive discounts and offers to boost their sales. This further helps in improving customer loyalty, enabling businesses to strengthen operations.

Application Insights

In terms of application, the spa and relaxation segment held the largest revenue share of 45.2% in 2023. The fast pace of modernization and industrialization in the region has impacted the lifestyle of the regional population, with the increasing prevalence of stress-related issues. As a result, the demand for aromatherapy and spa procedures has become more pronounced, leading to a strong demand for essential oils. In addition, with substantial growth in the working population in the region, there has been an increased focus on wellness and self-care, leading to rising sales of personal care products. Consumers are showing a proclivity to purchase natural products, leading to a proliferation of essential oil manufacturers in this market.

On the other hand, the food & beverages segment is anticipated to experience the fastest CAGR of 10.3% in the market over the forecast period. Growing demand for natural, minimally processed, and safe-to-consume food items globally is a leading factor highlighting the need for floral extracts and essential oils in the food & beverage industry. The antimicrobial property of these ingredients helps in ensuring a longer shelf-life for food items and beverages. The growing focus of manufacturers in this industry on ensuring the freshness of their products for a longer duration without compromising on their quality is expected to play a key role in driving the expansion of the market in this application area.

Country Insights

China Essential Oils Market Trends

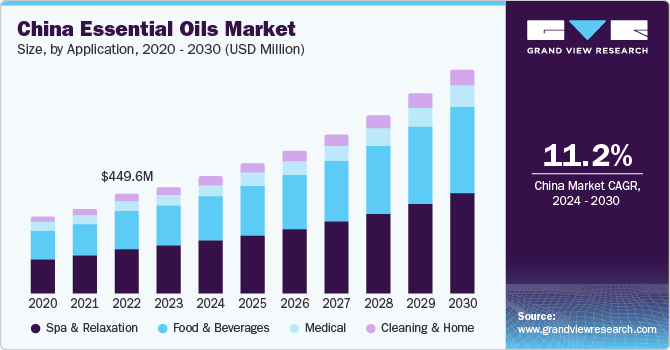

China’s market for essential oil held the leading revenue share of 25.6% in the Asia Pacific region in 2023. China is among the fastest-growing global economies, witnessing strong economic growth due to technological developments, a sizeable population, and ample availability of low-cost labor and raw materials. The increasing working population demographic presents a significant end-user of personal care products, leading to a growing demand for essential oils in the country. Essential oils are also extensively consumed in food & beverage applications in China. The country is projected to witness a high demand for essential oils owing to the presence of well-developed food & beverage and medical industries. Technological advancements in the extraction process, along with the presence of regulations regarding the usage of essential oils in safe volumes, are expected to play a crucial role in shaping the Chinese essential oils business.

India Essential Oils Market Trends

The essential oils market in India is projected to contribute substantially to regional growth during the forecast period. The country is a leading producer of spice oils worldwide and holds a dominant position in the production of mints. The growing popularity of organic ingredient-based products among the country’s large younger demographic has driven companies to adopt innovative techniques and revise their recipes by incorporating natural ingredients. Moreover, rising consumption of natural extract-based carbonated and non-carbonated drinks and extensive purchase of ready-to-eat/ready-to-cook meals owing to the increasing working women population provides notable growth opportunities for the economy’s essential oil producers in food & beverage applications.

Key Asia Pacific Essential Oils Company Insights

The regional market is defined by intensifying competition among organizations such as doTerra, Young Living Essentials, Takasago International, India Essential Oils, and Organic Harvest. These companies are mainly focusing on geographic expansion activities, along with the launch of innovative extraction processes and products, to drive their growth.

-

Takasago International Corporation, headquartered in Tokyo, develops, manufactures, and distributes specialty ingredients worldwide. The company operates through four business segments, namely flavors, fragrances, aroma ingredients, and fine chemicals. The essential oils manufactured by the company are used in their fragrance formulations, as well as being sold to flavor and fragrance houses for further development.

-

doTerra is a major global manufacturer of essential oils headquartered in the United States. The company offers a range of products catering to essential oils and personal care items, as well as offering supplements for digestive health and weight management. Within the essential oils space, the company offers single oils, proprietary blends, and food oils, as well as brands such as Deep Blue, DigestZen, On Guard, dōTERRA Touch, and dōTERRA Breathe. The company has an extensive presence in the Asia Pacific region, in economies such as China, South Korea, Japan, and Singapore.

Key Asia Pacific Essential Oils Companies:

- dōTERRA

- Young Living Essential Oils

- Givaudan

- Symrise

- Takasago International Corporation

- India Essential Oils

- Organic Harvest

- Aroma Treasures

- Springfields Australia

- Auroma

Recent Developments

-

In July 2023, VedaOils by Bo International announced the launch of an expansive cosmetic raw material range for brands involved in the personal care sector. This development would result in personal care companies availing premium quality raw materials to develop effective cosmetic products. Some products in this range include Emollients, such as shea butter, to moisturize the skin; Emulsifiers to formulate haircare and skincare products; as well as stabilizers, thickeners, and conditioners.

-

In December 2022, Dabur India introduced the ‘Odonil Gel Pocket’, thus expanding the company’s Odonil portfolio. The Gel-based air freshener incorporates essential oils that provide a premium fragrance experience. Three variants were announced at the time of launch - Citrus Bloom, Wild Forest, and Floral Valley. The company stated that the product can remove unpleasant odors for as much as a month, thus maintaining a pleasant environment in households.

Asia Pacific Essential Oils Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 3.7 billion

Growth rate

CAGR of 10.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, volume in tons, and CAGR from 2024 to 2030

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, sales channel, country

Country scope

China; India; Japan; Taiwan; South Korea; Singapore; Australia

Key companies profiled

dōTERRA; Young Living Essential Oils; Givaudan; Symrise; Takasago International Corporation; India Essential Oils; Organic Harvest; Aroma Treasures; Springfields Australia; Auroma

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Essential Oils Market Report Segmentation

This report forecasts revenue and volume growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific essential oils market report based on product, application, sales channel, and country:

-

Product Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Acorus Calamus

-

Ajowan

-

Basil

-

Black Pepper

-

Cardamom

-

Carrot Seed

-

Cassia

-

Cedarwood

-

Celery

-

Cinnamon

-

Citronella

-

Ciz-3 Hexanol

-

Clove

-

Cornmint

-

Cumin Seed

-

Curry Leaf

-

Cypress

-

Cypriol

-

Davana

-

Dill Seed

-

De-Mentholised Peppermint

-

Eucalyptus

-

Fennel

-

Frankincense

-

Garlic

-

Ginger

-

Holy Basil

-

Juniper Berry

-

Lavender

-

Lemon

-

Lemongrass

-

Lime

-

Mace

-

Mustard

-

Neem

-

Nutmeg

-

Orange

-

Palmarosa

-

Patchouli

-

Pepper Mint

-

Rosemary

-

Spearmint

-

Tangerine

-

Tea Tree

-

Turmeric

-

Vetiver

-

Ylang Ylang

-

Others

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Medical

-

Pharmaceutical

-

Nutraceuticals

-

-

Food & Beverages

-

Bakery

-

Confectionery

-

Dairy

-

RTE Meals

-

Beverages

-

Meat, Poultry & Seafood

-

Snacks & Nutritional Bars

-

-

Spa & Relaxation

-

Aromatherapy

-

Massage Oil

-

Personal Care

-

Cosmetics

-

Hair Care

-

Skin Care

-

Sun Care

-

Makeup And Color Cosmetics

-

-

Toiletries

-

Soaps

-

Shampoos

-

Men's Grooming

-

Oral Care

-

Baby Care

-

-

Fragrances

-

Perfumes

-

Body Sprays

-

Air Fresheners

-

-

-

-

Cleaning & Home

-

Kitchen Cleaners

-

Floor Cleaners

-

Bathroom Cleaners

-

Fabric Care

-

-

-

Sales Channel Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Direct Selling

-

Others

-

-

Country Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

China

-

India

-

Japan

-

Taiwan

-

South Korea

-

Singapore

-

Australia

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.