Market Size & Trends

The Asia Pacific engineering services outsourcing market size was estimated at USD 835.6 billion in 2023 and is anticipated to expand at a CAGR of 24.0% from 2023 to 2030. This expansion is propelled by a combination of economic, technological, and strategic factors. Furthermore, the strategic decision by companies to outsource engineering services, driven by cost-efficiency and access to specialized expertise, has significantly contributed to this upward trajectory.

The Asia Pacific region accounted for 41.0% of the revenue share of the global engineering services outsourcing market in 2023. Regulation significantly shapes the APAC engineering services outsourcing market, influencing both its growth and operational dynamics. For instance, India's Information Technology Act of 2000, amended in 2008, imposes stringent data protection and cybersecurity requirements, compelling outsourcing firms to invest heavily in compliance infrastructure.

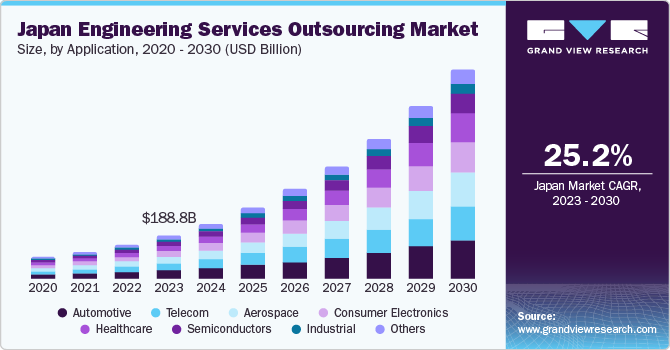

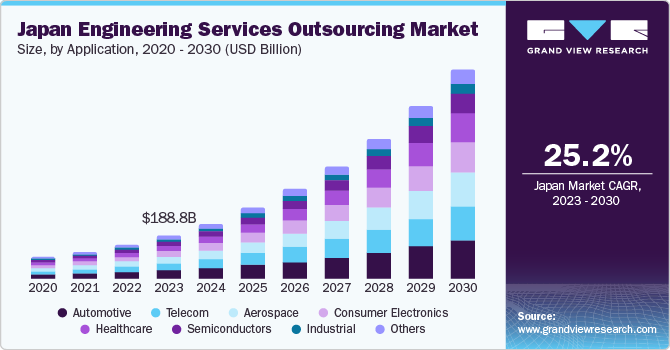

Application Insights

The automotive sector secured the largest revenue share of 20.1% in 2023. This dominance is primarily driven by the escalating demand from automotive manufacturers for advanced and enhanced connectivity solutions, fueling the growth of the automotive engineering services outsourcing (ESO) market. These solutions cater to a variety of needs, including navigation, smart infotainment, passenger safety, and remote diagnostics. In addition, government initiatives promoting the adoption of green vehicles to mitigate harmful emissions are further boosting the automotive ESO market. The industry has significantly evolved, transitioning from providing mechanical services to incorporating advanced technology solutions such as Artificial Intelligence (AI) and the Internet of Things (IoT).

The healthcare sector is projected to experience the most rapid revenue growth, with a CAGR of 27.0% from 2023 to 2030. The Asia Pacific region is expected to lead the global expansion in the healthcare regulatory affairs outsourcing market over the next decade, driven primarily by China and India. In the long term, engineering firms are increasingly turning to outsourcing as a strategy to reduce costs, enhance efficiency, and bolster expertise.

Service Insights

The testing services segment captured the largest revenue share, 31.4%, in 2023. This dominance is largely due to the growing necessity for creating and redesigning product prototypes with enhanced optimization and error-free processes. The increasing emphasis on the testing component in recent years stems from the need for high-quality prototype development. Outsourcing testing services has become increasingly popular to minimize manual intervention and reduce turnaround times. Consequently, the testing services segment has experienced significant growth, underscoring the strong inclination of consumers to outsource various services as a cost-cutting measure.

The design services segment is projected to experience the fastest revenue growth, with a CAGR of 26.3% from 2023 to 2030. This growth is driven by the increasing collaboration between Original Equipment Manufacturers (OEMs) and Engineering Service Providers (ESPs), advancements in global R&D, and the rising demand for integrating cutting-edge technologies into product offerings. The ESO market has been expanding as businesses increasingly seek to outsource various services to reduce costs. The ESO industry is transitioning from core engineering services to embedded engineering solutions, which encompass automation, analytics, and IoT. In addition, technological advancements have facilitated the emergence of Platform-as-a-Service (PaaS) models with integrated IT solutions.

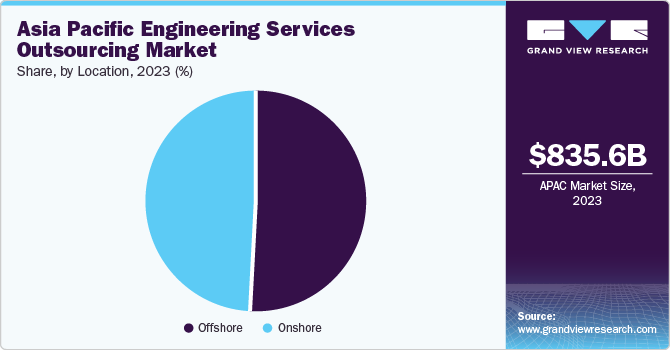

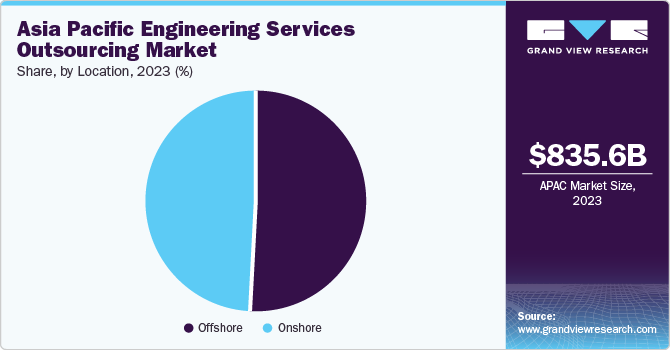

Location Insights

The offshore services segment dominated the market with a 51.0% revenue share in 2023. This significant presence is primarily due to the rising local demand for outsourcing, a robust manufacturing infrastructure, and the cost advantages in developing countries like China and India. The offshore model's continuous growth mirrors a strong consumer inclination towards outsourcing various services to reduce costs. The ESO industry has evolved, shifting focus from basic engineering services to advanced embedded engineering solutions that integrate analytics, automation, and IoT. In addition, technological advancements have facilitated the development of PaaS strategies with comprehensive IT solutions.

The onshore services segment is expected to experience the fastest revenue growth, with a CAGR of 26.2% from 2023 to 2030. This rapid expansion is driven by factors such as cultural and linguistic compatibility, proximity to client headquarters, and streamlined communication. Leading ESO industry players have integrated various delivery models into their business strategies, driven by the globalization of research and development (R&D) operations. The market has witnessed a significant shift in engineering service requirements, moving from mechanical and non-core tasks to core competencies in targeted markets. This evolving approach to product lifecycle development underscores the strategic importance of ESPs within the supply chains of OEMs.

Country Insights

China Engineering Services Outsourcing Market Trends

China engineering services outsourcing market held the largest revenue share of 32.6% in the Asia Pacific region in 2023. This dominance is driven by its robust manufacturing infrastructure, cost advantages, and growing domestic outsourcing demand. As the world's largest e-commerce market, China accounts for over half of all global transactions. In 2020, its online retail transactions exceeded 710 million digital consumers, amounting to USD 2.29 trillion, with forecasts predicting a rise to USD 3.56 trillion by 2024. In addition, the issuance of the Antitrust Guidelines for the Platform Economy by China's State Council in February 2021 aims to foster sustainable growth in e-commerce.

India Engineering Services Outsourcing Market Trends

The engineering services outsourcing market in India is predicted to grow at a CAGR of 25.7% from 2023 to 2030. The growth in this segment can be attributed to factors such as the increasing complexity of engineering projects, which has sparked the demand for engineering service outsourcing.

Key Asia Pacific Engineering Services Outsourcing Company Insights

Some of the key players operating in the market include TCS, Wipro, HCL, and L&T:

-

Tata Consultancy Services (TCS) is a major player in the APAC engineering services outsourcing industry, offering a wide range of services, including designing, prototyping, system integration, and testing.

-

L&T Technology Services Limited is another prominent industry leader in the APAC engineering services outsourcing industry, providing comprehensive and innovative solutions across various sectors.

Key Asia Pacific Engineering Services Outsourcing Companies:

- Tata Consultancy Services (TCS)

- Infosys Limited

- Wipro Limited

- HCL Technologies Ltd.

- Tech Mahindra Limited

- Capgemini SE

- Accenture

- Cognizant

- Alten Group

- LTI (Larsen & Toubro Infotech)

Recent Developments

-

In April 2024, Accenture strategically expanded its capabilities in Japan by acquiring CLIMB, a leading technology services provider specializing in system integration, IT infrastructure management, and operations. This acquisition bolsters Accenture's ability to serve global organizations in Japan with the critical skills needed to navigate the evolving technological landscape.

-

In August 2023, Carlyle, a global investment firm, announced a strategic partnership with Quest Global, a leading engineering services provider. Carlyle will acquire a minority stake in Quest Global to fuel inorganic growth and global expansion. Carlyle will collaborate with Quest Global's management on M&A strategy, integration, and client relationship development.

-

In December 2023, TT Electronics, a prominent player in the global engineered technology and manufacturing solutions arena, announced that their Dongguan facility has secured FDA registration. This approval, granted via the premarket approval (PMA) supplement evaluation process, allows the facility to manufacture Class IIa devices for its global medical OEM clientele.

Asia Pacific Engineering Services Outsourcing Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2023

|

USD 835.6 billion

|

|

Revenue forecast in 2030

|

USD 3,725.8 billion

|

|

Growth rate

|

CAGR of 24.0% from 2023 to 2030

|

|

Base year for estimation

|

2022

|

|

Historic data

|

2018 - 2021

|

|

Forecast period

|

2023 - 2030

|

|

Quantitative units

|

Revenue in USD million/billion and CAGR from 2023 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, trends

|

|

Segments covered

|

Application, services, location, country

|

|

Key companies profiled

|

Tata Consultancy Services (TCS); Infosys Limited; Wipro Limited; HCL Technologies Ltd.; Tech Mahindra Limited; Capgemini SE; Accenture; Cognizant; Alten Group; LTI (Larsen & Toubro Infotech)

|

|

Customization scope

|

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Asia Pacific Engineering Services Outsourcing Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific engineering services outsourcing market report based on application, services, location, and country:

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Aerospace

-

Automotive

-

Industrial

-

Consumer Electronics

-

Semiconductors

-

Healthcare

-

Telecom

-

Others

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Designing

-

Prototyping

-

System Integration

-

Testing

-

Others

-

Location Outlook (Revenue, USD Billion, 2018 - 2030)

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)