- Home

- »

- Next Generation Technologies

- »

-

Asia Pacific Electric Vehicle TCI Market Size, Report, 2030GVR Report cover

![Asia Pacific Electric Vehicle Testing, Inspection, And Certification Market Size, Share & Trends Report]()

Asia Pacific Electric Vehicle Testing, Inspection, And Certification Market Size, Share & Trends Analysis Report By Service Type, By Sourcing Type, By Application, By Vehicle Type, By Industry, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-293-9

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

The Asia Pacific electric vehicle testing, inspection, and certification market size was estimated at USD 399.2 million in 2023 and is projected to grow at a CAGR of 15.4% from 2024 to 2030. The market growth is due to technological advancements in the electric vehicle sector and a high surge in the sales of electric vehicles. As the demand for electric vehicles continues to expand, testing, inspection, and certification (TIC) services are expected to become increasingly important for manufacturers, suppliers, and consumers. Governments are also playing a crucial role in this sector by setting standards and regulations to ensure that only safe and reliable electric vehicles are made available in the market.

As the adoption of electric vehicles grows, TIC assesses and verifies that the components of EVs meet the necessary environmental standards and regulations, including evaluating the vehicles’ energy efficiency, emissions during production and use, battery recycling processes, and overall environmental impact. Governments have been actively promoting the use of electric vehicles to reduce greenhouse gas emissions, leading to an increased demand for TIC services to ensure these vehicles contribute positively to the environment.

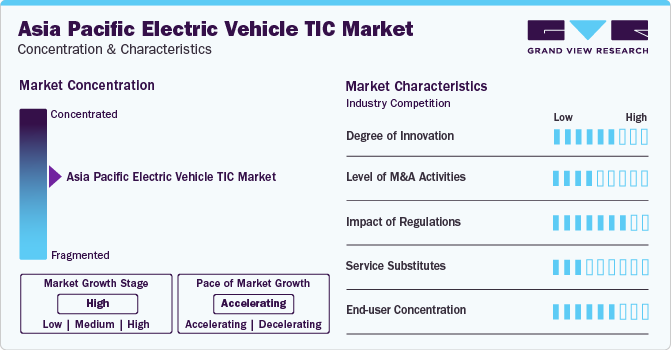

Market Concentration & Characteristics

The industry growth stage is high, and the pace is accelerating. The EV TIC services industry is characterized by several key factors, reflecting the region’s growing focus on electric mobility and the associated regulatory, safety, and performance standards. An increase in the growth of the EV industry directly impacts the demand for TIC services to ensure safety and quality.

The degree of innovation in the TIC services is continuously evolving to meet the demands of the growing EV industry. Asia Pacific is witnessing rapid adoption of electric vehicles, driven by favourable government policies, increasing environmental awareness, and advancements in EV technology.

The impact of regulations is significantly high due to the growing implementation of new standards and rules by the government in the electric vehicles industry. The evolving regulatory landscape requires TIC service providers to continuously innovate to offer services that ensure compliance with the latest standards. Strict emission regulations have been implemented by governments to combat air pollution, and therefore, multiple initiatives have been executed to increase the sales of electric vehicles in the country. As per the Government of Japan, by 2035, all newly sold cars are planned to be environmentally friendly and electric to reduce harmful emissions.

Service Type Insights

Based on service type, the testing segment led the market with the largest revenue share of 72.8% in 2023. The rapid growth in the sales of electric and hybrid vehicles is fuelling the need for and importance of the testing segment in the EV industry. The segment involves various tests to evaluate the safety, efficiency, and performance of electric vehicles and their components. To provide accurate and precise data, the adoption of Artificial Intelligence (AI) and Machine Learning (ML) in the testing methods has been significant.

The certification segment is expected to register at the fastest CAGR during the forecast period. Certification services involve assessing products to ensure they meet specific standards or requirements of the regulatory authorities. Aspects such as vehicle safety, battery performance, safety, and environmental impact are critically covered in the certification.

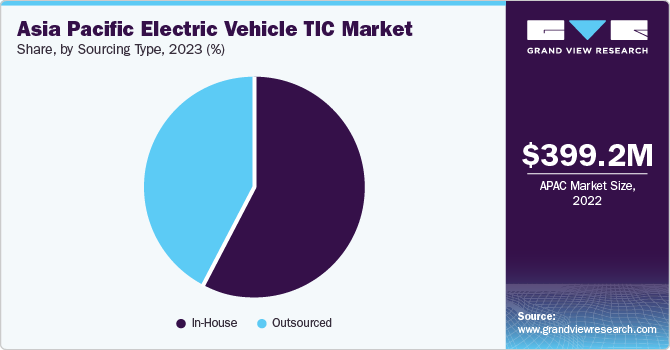

Sourcing Type Insights

Based on sourcing type, the in-house segment led the market with the largest revenue share of 58.5% in 2023. In-house TIC of EVs is becoming increasingly popular among major automotive manufacturers. The in-house TIC activities help manufacturers have direct control over the quality assurance processes, allowing for immediate feedback and advancements to ensure that products meet the required standards and regulations. Companies on a large scale and with significant resources have TIC services in-house, which can be cost-efficient in the long run.

The outsourced segment is projected to register at the fastest CAGR over the forecast period. Manufacturers and suppliers often rely on external organizations to examine and conduct tests that provide them with expertise and services per the standards. EV manufacturers get access to the specialized knowledge of third-party firms and advanced testing infrastructure and more easily navigate the complex regulatory landscape across different regions and markets.

Application Insights

Based on application, the safety and security segment led the market with the largest revenue share of 51.7% in 2023. EVs undergo comprehensive testing and safety checks before users use them on public roads. A series of tests are conducted to ensure the safety of the EV’s batteries under various conditions, such as overcharging, high temperature, physical impact, and others. Crucial systems like Advanced Driver-assistance Systems (ADAS) and drive control systems are evaluated for the safety of the consumers.

The connectors segment is projected to register at the fastest CAGR over the forecast period. Electric vehicle connectors are vital components that facilitate reliable electrical connections between various vehicle parts, such as the battery pack, electric motor, and charging system. Given the critical role of connectors in ensuring the safety, efficiency, and performance of EVs, the TIC services for this segment focus on rigorous testing and certification to meet industry standards and regulatory requirements.

Vehicle Type Insights

Based on vehicle type, the battery electric vehicle (BEV) segment accounted for the largest share of 30.4% in 2023. The BEV segment is at the forefront of the shift towards cleaner and more sustainable transportation options. The TIC services for the BEV segment are crucial to ensure these vehicles meet safety and regulatory standards before they are released for the users to use. The unique challenges posed by the BEVs are addressed by the TIC services to make it safe and certified.

The fuel cell electric vehicle (FCEV) segment is projected to grow at a significant CAGR over the forecast period. The government’s increasing emphasis on zero emissions and sustainable transportation options has elevated the market growth of FCEVs in the automotive sector. TIC services ensure the safety of hydrogen fuel cells that generate electricity to power the vehicle’s electric motor.

Industry Insights

Based on industry, the automotive segment led the market with the largest revenue share of 53.2% in 2023. The Electric Vehicle Testing, Inspection, And Certification Market in the automotive segment is increasing due to increased sales of electric vehicles, including BEVs, PHEVs, and FCEVs. TIC services are estimated to grow significantly as the manufacturers of premium brands producing EVs continuously work on new technologies to provide high-quality EV models. BMW AG is set to launch all-electric Neue Klasse models in 2025. The launch is expected to boost the company's ongoing transformation of digitalization and electrification.

The defence segment is projected to grow at a significant CAGR over the forecast period. Integrating electric and hybrid vehicles for military operations is increasing rapidly to enhance sustainability. The safety and reliability of EVs are vital, and TIC services focus on ensuring that vehicles can operate in multiple terrains and under extreme conditions. For instance, in March 2024, the Indian Army introduced electric buses and other armoured vehicles. The cantonments is anticipated to have an infrastructure related to electric vehicles that ensure a greener operational environment.

Country Insights

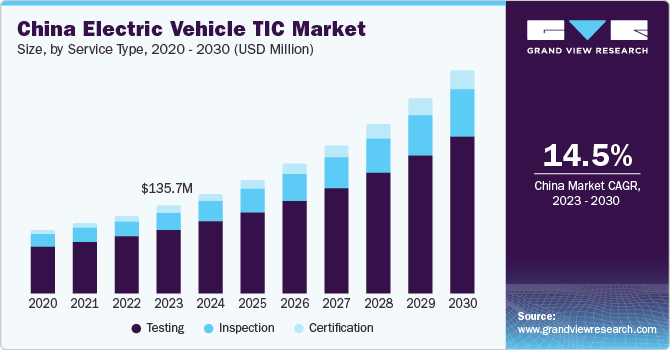

China Electric Vehicle Testing, Inspection, And Certification Market Trends

The electric vehicle testing, inspection, and certification market in China accounted for the largest revenue share of 34.0% in 2023. The government of China has implemented a range of incentives and regulations to boost the EV market, including subsidies for EV buyers, mandates for vehicle manufacturers, investment in charging infrastructure, and others.

India Electric Vehicle Testing, Inspection, And Certification Market Trends

The India electric vehicle TIC market is anticipated to witness at the fastest CAGR over the forecast period. The EV market is growing rapidly, fuelled by the government’s push for cleaner modes of transportation, increasing consumer awareness regarding environmental issues, and improvements in EV infrastructure. The Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme by the government boosts the adoption of EV in the country and therefore is expected to accelerate the demand for TIC services.

Key Asia Pacific Electric Vehicle TIC Company Insights

Some of the key players operating in the market include SGS Société Générale de Surveillance SA., Bureau Veritas, TÜV SÜD and CHINA QUALITY CERTIFICATION CENTRE CO., LTD. and Intertek Group plc.

-

SGS Société Générale de Surveillance SA. offers comprehensive testing and certification solutions for electric vehicles, batteries, and charging infrastructure. The company provides high quality of services designed to ensure safety, performance, and regulatory compliance of EVs and their components

-

Bureau Veritas provides wide array of testing and certification services for the automotive industry in electric vehicles. The company focuses on safety, quality, and environmental standards that helps their clients to navigate the regulatory landscape of different markets

-

TÜV SÜD focuses strongly on automotive safety and quality and offers specialized services for electric vehicles, including battery testing, charging infrastructure certification, and vehicle homologation. The company is committed towards creating a sustainable and safer world

Key Asia Pacific Electric Vehicle TIC Companies:

- Bureau Veritas

- CHINA QUALITY CERTIFICATION CENTRE CO., LTD.

- DEKRA

- Element Materials Technology

- iASYS Technology Solutions

- Intertek Group plc

- SGS Société Générale de Surveillance SA.

- TÜV Rheinland

- TÜV SÜD

- UL LLC.

Recent Developments

-

In September 2023, TÜV SÜD collaborated with an engineering service provider, SEGULA Technologies Group. The aim of the collaboration was to provide a one-stop shop for manufacturers of electric vehicles to navigate the process of getting vehicles approved for various markets

Asia Pacific Electric Vehicle TIC Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 455.8 million

Revenue forecast in 2030

USD 1076.2 million

Growth rate

CAGR of 15.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service type, sourcing type, application, vehicle type, industry, country

Regional scope

Asia Pacific

Country scope

China; Japan; India; South Korea; Australia

Key companies profiled

Bureau Veritas; CHINA QUALITY CERTIFICATION CENTRE CO., LTD.; DEKRA; Element Materials Technology; iASYS Technology Solutions; Intertek Group plc; SGS Société Générale de Surveillance SA.; TÜV Rheinland; TÜV SÜD; UL LLC.

Customization scope

Avail customized purchase options to meet your exact research needs. Explore purchase options

Pricing and purchase options

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Asia Pacific Electric Vehicle Testing, Inspection, And Certification Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the Asia Pacific electric vehicle TIC marketresearch report based on the service type, sourcing type, application, vehicle type, industry, and country.

-

Service Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Inspection

-

Testing

-

Battery Testing

-

Electric E-Motor Testing

-

Electromagnetic Compatibility (EMC) Testing

-

Component Testing

-

-

Certification

-

-

Sourcing Type Outlook (Revenue, USD Million, 2018 - 2030)

-

In-House

-

Outsourced

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Safety and Security

-

Connectors

-

Communication

-

EV Charging

-

-

Vehicle Type Outlook (Revenue, USD Million, 2018 - 2030)

-

BEV

-

PHEV

-

FCEV

-

Others

-

-

Industry Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Aerospace

-

Defence

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Frequently Asked Questions About This Report

b. Some key players operating in the Asia Pacific electric vehicle TIC market include Bureau Veritas, CHINA QUALITY CERTIFICATION CENTRE CO., LTD., DEKRA, Element Materials Technology, iASYS Technology Solutions, Intertek Group plc, SGS Société Générale de Surveillance SA., TÜV Rheinland, TÜV SÜD, and UL LLC

b. Factors such as technological advancements in the electric vehicle sector and a surge in sales are driving the market's growth.

b. The Asia Pacific electric vehicle testing, inspection, and certification market size was estimated at USD 399.2 million in 2023 and is expected to reach USD 455.8 million in 2024

b. The Asia Pacific electric vehicle testing, inspection, and certification market is expected to grow at a compound annual growth rate of 15.4% from 2024 to 2030 to reach USD 1,076.2 million by 2030

b. The testing segment dominated the Asia Pacific automotive collision repair market with a share of 72.4% in 2023. The rapid growth in the sales of electric and hybrid vehicles is fuelling the need for and importance of the testing segment in the EV industry.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."