- Home

- »

- Electronic Devices

- »

-

Asia Pacific Earphones And Headphones Market, Report 2030GVR Report cover

![Asia Pacific Earphones And Headphones Market Size, Share & Trends Report]()

Asia Pacific Earphones And Headphones Market Size, Share & Trends Analysis Report By Product, By Price Band, By Technology, By Distribution Channel, By Application, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-289-4

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

Market Size & Trends

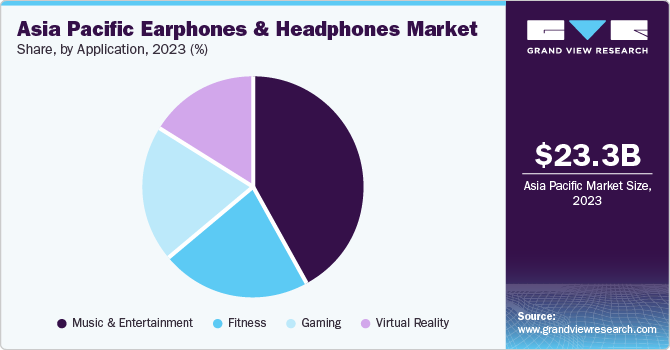

The Asia Pacific earphones and headphones market size was estimated at USD 23.3 billion in 2023 and is anticipated to grow at a CAGR of 16.1% from 2024 to 2030. This growth is driven by technological advancements, increasing adoption of wireless technology, and the rise of True Wireless Stereo (TWS) earbuds.

Asia Pacificaccounted for 32.6% revenue share of the global earphones and headphones market in 2023. The market is witnessing a surge in growth, driven by the increasing adoption of smartphones, tablets, and other multimedia devices. As more people turn to these devices for entertainment, they also seek high-quality audio solutions to enhance their listening experience, which has led to a growing demand for earphones and headphones, with consumers seeking products that offer superior sound quality, comfort, and innovative features.

Another key factor driving growth is the rise of wireless technology. Wireless earbuds, in particular, have become increasingly popular among consumers who value the convenience of a tangle-free music experience. With the ability to stream music wirelessly, these earbuds offer freedom and flexibility that traditional wired earbuds cannot match.

Consumers also seek products with advanced features that can enhance their listening experience. Fitness tracking and noise cancellation features are becoming increasingly popular among consumers who want to stay active and focused while listening to music. To meet this demand, manufacturers are introducing innovative products with advanced features such as noise cancellation, gesture recognition, and fitness tracking.

Some key players in the market are well-positioned to capitalize on these trends, introducing innovative products with advanced features that resonate with consumers. With their reputation for quality and innovation, these companies will likely continue to drive growth of the APAC earphones and headphones market over the next few years.

Product Insights

In 2023, earphones dominated the market with a share of over 50.0% of the total revenue, driven by heightened demand for wireless earbuds, owing to their portability, affordability, and seamless integration with smartphones. The rapid growth of smartphones in the region has boosted adoption, as consumers use them extensively for music listening.

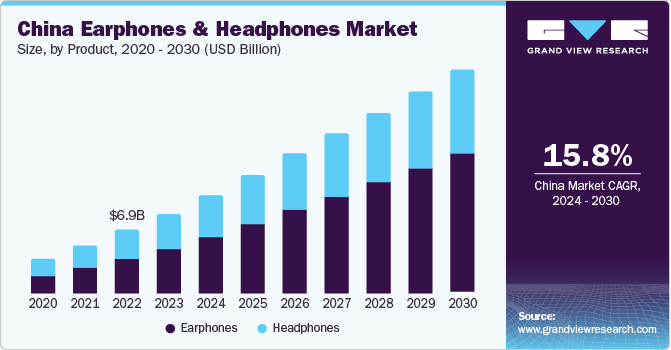

The headphones segment is expected to experience lucrative growth with a CAGR of 14.1% over the forecast period due to the popularity of gaming and virtual reality applications. The region’s large gaming population, particularly in China, drives demand for immersive sound effects. The pandemic’s acceleration of streaming services and media consumption also fuels demand for headphones, making it a lucrative market.

Price Band Insights

The USD 50-100 segment emerged dominant, generating 43.0% of the total revenue share in 2023. This is due to the fact that many products from top brands in this category offer high-quality audio and stylish designs that meet consumer demands. Moreover, the growing demand for better audio quality and economic factors have further contributed to the dominance of this segment.

On the other hand, the < 50 USD segment is expected to experience lucrative growth, with a CAGR of 16.2% over the forecast period. This growth is driven by the entry of numerous small brands introducing innovative products with advanced features at competitive prices, making them more accessible to a broader range of consumers seeking affordable options without compromising on quality.

Technology Insights

In 2023, wireless technology led the market and is projected to grow at the fastest CAGR of 17.3% over the forecast period. Advances in wireless products have shifted the headphones category from home audio to premium portable AV, driving demand. Furthermore, the introduction of wireless earbuds has boosted sales, fueling the growth of the wireless segment.

The wired technology segment is expected to experience steady growth over the forecast period. This growth is driven by the continued adoption of traditional technology and the widespread availability of wired earphones and headphones in regions like China and India. The wired segment remains popular due to its affordability and the enduring demand for high-quality audio experiences.

Distribution Channel Insights

The online segment led the market in 2023 and is projected to grow at the fastest CAGR of 17.9% over the forecast period. This rapid growth is fueled by the rising popularity of e-commerce platforms, which offer consumers a convenient and extensive shopping experience. Online marketplaces like Amazon, JD.com, and Alibaba have made it easier for consumers to purchase earphones and headphones from various brands and models. Moreover, the proliferation of social media and influencer marketing has boosted brand awareness and driven sales through online channels.

The offline segment is expected to experience significant growth from 2024 to 2030, owing to the continued presence of brick-and-mortar stores and the persistent preference of specific consumer segments for in-store shopping experiences when purchasing audio devices. While online platforms have gained popularity, offline retail outlets remain vital in providing consumers with a physical shopping experience, allowing them to interact with products and demonstrations before purchasing.

Application Insights

Music and entertainment held the largest market share, accounting for 21.2% of the total revenue in 2023, driven by the widespread adoption of music streaming services and improved internet penetration. The Asia-Pacific region’s diverse consumer preferences and availability of various music platforms contributed to the growth. Online music streaming services like Spotify and Apple Music, popular among young consumers, further boosted demand for earphones and headphones.

Virtual reality (VR) is anticipated to exhibit the most rapid growth, with a projected CAGR of 17.6% from 2024 to 2030. The increasing adoption of VR technology in gaming, healthcare, and other industries is driving demand for VR-compatible earphones and headphones. The region’s tech-savvy population and rising popularity of immersive gaming experiences are fueling this growth, with ongoing research and development in VR applications in healthcare and education expected to boost market growth further.

Country Insights

China Earphones And Headphones Market Trends

The China earphones and headphones market held the largest market share in 2023, accounting for 37.4% of the total revenue in 2023, owing to its remarkable manufacturing capabilities and consumer demand. The country’s massive production capacity and rapid economic growth, driven by industrial output, exports, and consumer demand, have made it a leading supplier of industrial and consumer products, including audio accessories, in the Asia-Pacific market.

India Earphones And Headphones Market Trends

The growth of earphones and headphones market in India in driven by the emergence of new, local vendors like boAt. BoAt’s focus on product research and development, particularly in the TWS segment, helped meet the growing demand for wireless technology. Other key factors contributing to the market’s growth include the increasing adoption of work-from-home and hybrid work cultures, rapid development of e-commerce and social media, and government support for the industry.

Australia Earphones And Headphones Market Trends

The Australia earphones and headphones market is expected to experience rapid growth, registering a CAGR of 18.3% from 2024 to 2030. Driven by consumer demand, the market is expected to grow in the coming years, propelled further by the increasing use of portable music devices and the popularity of wireless listening. Furthermore, factors such as the rising disposable income and the need for portability are also expected to drive the growth.

Key Asia Pacific Earphones And Headphones Company Insights

The key players are focusing on product innovations, technological advancements, and geographical expansions to cater to evolving consumer preferences. The market is witnessing a competitive landscape with strategic partnerships and emphasis on research and development to meet growing demand.

Some key players operating in this market include Apple Inc.; Audio-Technica Corporation; and Bose Corporation.

-

Apple Inc., offerings include Beats products, such as wireless headphones and earphones. These products deliver high-quality audio experiences with stylish designs and advanced features that seamlessly integrate with its ecosystem of devices and services.

-

Bose Corporation’s diverse range of headphones and earphones includes noise-canceling over-ear headphones and wireless earbuds, catering to various consumer preferences.

Key Asia Pacific Earphones And Headphones Companies:

- Apple Inc.

- Audio-Technica Corporation

- Bose Corporation

- Koninklijke Philips N.V.

- GN (Netcom) Jabra

- Harman International

- JVCKENWOOD Corporation

- Sony Electronics Asia Pacific Pte Ltd.

- Sennheiser electronic SE & Co. KG

Recent Developments

-

In January 2024, Philips introduced the A6219 GO headphones, featuring next-generation Bluetooth and a Powerfoyle solar cell that can provide up to 80 hours of playtime from a single charge. The headphones are designed for comfort and ruggedness, with washable and breathable ear cups and IP55 water resistance.

-

In January 2024, Sennheiser electronic SE & Co. KG launched the HD 490 PRO reference studio headphones, designed for music production, mixing, and mastering. The headphones feature a wide, spatial sound stage, precise sound reproduction, and two types of ear pads for producing and mixing applications.

-

In June 2023, Apple unveiled the Beats Studio Pro wireless headphones, a premium over-ear offering with improved design, active noise cancellation, and sound quality. The headphones feature adaptive ANC, transparency mode, and support for Dolby Atmos and lossless audio.

Asia Pacific Earphones And Headphones Market Scope

Report Attribute

Details

Market size value in 2023

USD 23.3 billion

Revenue forecast in 2030

USD 66.5 billion

Growth rate

CAGR of 16.1% from 2024 to 2030

Base year for estimation

2023

Historical Data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, price band, technology, distribution channel, application, country

Country scope

Japan; China; India; Australia; South Korea; RoAP

Key companies profiled

Apple, Inc.; Audio-Technia Corporation; Bose Corporation; Koninklijke Philips N.V.; GN (Netcom) Jabra; Harman International; JVCKENWOOD Corporation; Sony Electronics Asia Pacific Pte Ltd.; Sennheiser electronic SE & Co. KG

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Earphones And Headphones Market Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific earphones and headphones market report based on product, price band, technology, distribution channel, application, and country:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Earphones

-

Headphones

-

-

Price Band Outlook (Revenue, USD Million, 2018 - 2030)

-

< USD 50

-

USD 50-100

-

> USD 100

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Wired

-

ANC

-

Other Wired Technologies

-

-

Wireless

-

ANC

-

Bluetooth

-

NFMI

-

Smart headphones

-

Other Wireless Technologies

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Fitness

-

Gaming

-

Virtual Reality

-

Music & Entertainment

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

RoAP

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."