- Home

- »

- Medical Devices

- »

-

Asia Pacific Disposable Endoscopes Market, Report, 2030GVR Report cover

![Asia Pacific Disposable Endoscopes Market Size, Share & Trends Report]()

Asia Pacific Disposable Endoscopes Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Gynecology Endoscopes, Laparoscopes, Arthroscopes, Ureteroscopes, Otoscopes), By End-use (Outpatient Facilities, Hospitals), By Country, And Segment Forecasts

- Report ID: GVR-4-68039-956-3

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

The Asia Pacific disposable endoscopes market size was valued at USD 705.6 million in 2023 and is projected to grow at a CAGR of 18.3% from 2024 to 2030. Disposable endoscopes are vital for reducing cross-contamination and improving patient safety during medical procedures. The rising burden of chronic diseases in Asia Pacific, increased healthcare investments, and a growing awareness of infection control drive the demand for these technologies. This trend is expected to accelerate market growth, fueled by the region's expanding need for advanced medical solutions.

The rising number of healthcare-associated infections promotes using disposable endoscopes to improve patient safety and avoid cross-contamination risks. The growing realization among healthcare providers of the significance of infection control further spurs this shift. For instance, in April 2022, the International Nosocomial Infection Control Consortium documented that the prevalence of healthcare-associated infections (HCAIs) in India was around 9.06 infections per 1,000 days for patients in intensive care units (ICUs). There was a notable variance in HCAI rates among various hospitals within the country, ranging from 4.4 to 83.09 percent, significantly above the rates observed in more affluent nations.

Technological advancements in endoscopic devices boost market growth, particularly in the Asia Pacific region, where there’s a push for minimally invasive surgery and a demand for improved, user-friendly endoscopes. For instance, in October 2023, Olympus Corporation announced its EVIS X1 endoscopy system for gastrointestinal (GI) specialists. This system features the GIF-1100 gastrointestinal video scope, intended for examining the upper digestive tract, and the CF-HQ1100DL/I colonovideoscope for the lower digestive tract. These technological improvements have significantly boosted the effectiveness of diagnosing and treating gastrointestinal conditions.

Type Insights

Bronchoscopes segment dominated the market and accounted for a share of 27.9% in 2023. The increase in respiratory diseases such as COPD and asthma is expected to boost the demand for advanced bronchoscopes with improvements such as high-definition imaging. Supportive government policies on infection prevention have also encouraged the use of disposable bronchoscopes, which contributes to market growth. According to the American Medical Association, regarding the prevalence of COPD cases, it was forecasted that in 2020, East Asia and Pacific was expected to have the highest number, reaching 136 million. By 2050, the same region alongside South Asia is expected to rank as the second and third most affected areas, with COPD cases numbering approximately 124 million and 109 million, respectively.

The cystoscopes segment is expected to grow at the fastest CAGR of 22.3% over the forecast period. This is attributable to their superior infection control capabilities, eliminating the risk of cross-contamination associated with reusable devices. In addition, technological advancements have improved disposable cystoscopes' functionality and imaging quality, making them a cost-effective and high-performance option for healthcare providers. Furthermore, the growing emphasis on patient safety and operational efficiency in medical settings will drive market growth.

End-use Insights

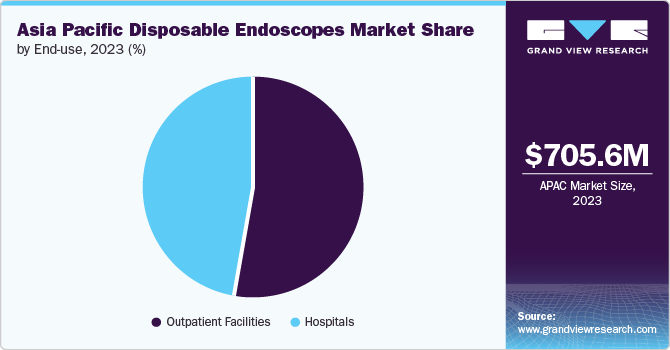

The outpatient facilities segment dominated the market and accounted for a share of 53.3% in 2023 and is expected to grow at the fastest CAGR of 20.0% over the forecast period due to the rising preference for minimally invasive procedures performed in this segment, which aligns well with the use of disposable endoscopes. In addition, the convenience of disposable endoscopes, including their reduced need for cleaning and sterilization, makes them ideal for outpatient clinics where efficiency and quick turnaround are crucial. Moreover, the growing focus on cost-effective and streamlined patient care in outpatient facilities further drives the adoption of disposable endoscopes, supporting their dominance in the market.

The hospital segment is projected to grow significantly over the forecast period due to the higher demand for disposable endoscopes, which improve patient safety and cut infection risks in busy settings. In addition, hospitals are adopting disposable endoscopes to streamline operations and avoid the time and costs associated with reprocessing reusable instruments. Furthermore, integrating advanced disposable endoscopes with superior imaging and diagnostic capabilities aligns with hospitals' ongoing efforts to upgrade medical technologies and improve patient outcomes. For instance, in June 2021, Jiangsu Vedkang Medical Science and Technology and PENTAX Medical Co., Ltd. formed a joint venture known as PENTAX Medical Therapeutics (Jiangsu) to develop single-use, flexible medical endoscopic therapeutic products. This joint venture aimed to use PENTAX's marketing network to deliver advanced single-use devices to customers worldwide. In addition, Vedkang's production, research, and development capabilities were set to strengthen the product offerings.

Country Insights

China Disposable Endoscopes Market Trends

China disposable endoscopes market dominated and accounted for a share of 31.5% in 2023 due to its large and rapidly growing healthcare infrastructure, which invests in advanced medical technologies. In addition, China is focusing on improving infection control practices and patient safety, which is anticipated to drive the adoption of disposable endoscopes to reduce the risk of cross-contamination. Furthermore, China's expanding population and rising prevalence of chronic diseases have intensified the demand for efficient, cost-effective diagnostic tools, further boosting the market for disposable endoscopes. For instance, in February 2023, a comprehensive survey among Chinese residents aged 60 and older showed a national chronic disease prevalence of 81.1%. The study found higher prevalence rates among women, rural residents, and ethnic minorities and notably peaked between ages 80 and 84. Significant regional variations were observed, with Tibet having the highest and Fujian having the lowest rates of chronic diseases.

Thailand Disposable Endoscopes Market Trends

Thailand disposable endoscopes market is expected to grow at the fastest CAGR of 22.2% over the forecast period. This is attributable to the growing emphasis on infection control and patient safety in Thai healthcare facilities, which offer a reliable solution by minimizing the risk of cross-contamination. In addition, the rising prevalence of chronic diseases and the extensive network of outpatient clinics and diagnostic centers contribute to the increased adoption of disposable endoscopes in Thailand.

Key Asia Pacific Disposable Endoscopes Company Insights

Some key companies in the Asia Pacific disposable endoscopes market include Ambu A/S, AirStrip Technologies, Inc., Boston Scientific Corporation, obp Surgical Corporation, Veradigm LLC, Flexicare (Group) Limited, Timesco Healthcare Ltd, and SunMED Medical. Organizations are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Ambu A/S is a medical device company specializing in innovative solutions for anesthesia, single-use endoscopy, and patient monitoring solutions. The company is renowned for developing disposable endoscopes, including bronchoscopy and cystoscopy systems, designed to enhance patient safety and streamline medical procedures. Ambu’s products deliver high-quality imaging and ease of use while minimizing the risk of infection through single-use design.

-

obp Surgical Corporation specializes in creating advanced, single-use medical devices for endoscopy, enhancing safety and efficiency in medical procedures with products such as disposable bronchoscopes and cystoscopes.

Key Asia Pacific Disposable Endoscopes Companies:

- Ambu A/S

- AirStrip Technologies, Inc

- Boston Scientific Corporation

- obp Surgical Corporation

- Veradigm LLC

- Flexicare (Group) Limited

- Timesco Healthcare Ltd

- SunMED Medical

Recent Developments

-

In June 2024, Ambu received FDA approval for its ureteroscopy endoscopy device, which aims to enhance the diagnosis and management of urinary tract disorders. Receiving this clearance was a significant achievement for Ambu and boosted its collection of disposable endoscopes.

-

In April 2021, Olympus Corporation expanded its respiratory products by launching H-SteriScopes, a series of five single-use bronchoscopes with advanced features for accurate patient diagnosis and treatment. The company aims to boost healthcare efficiency and productivity.

Asia Pacific Disposable Endoscopes Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 2.3 billion

Growth rate

CAGR of 18.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end-use, country

Regional scope

Asia Pacific

Country scope

Japan; China; India; Australia; South Korea; Thailand

Key companies profiled

Ambu A/S; AirStrip Technologies, Inc; Boston Scientific Corporation; obp Surgical Corporation; Veradigm LLC; Flexicare (Group) Limited; Timesco Healthcare Ltd; SunMED Medical

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Disposable Endoscopes Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific disposable endoscopes market report based on type, end-use, and country.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Laparoscopes

-

Arthroscopes

-

Ureteroscopes

-

Cystoscopes

-

Gynecology Endoscopes

-

Neuroendoscopes

-

Bronchoscopes

-

Hysteroscopes

-

Laryngoscopes

-

Otoscopes

-

Sigmoidoscopes

-

Duodenoscope

-

Nasopharyngoscopes

-

Rhinoscopes

-

Colonoscopes

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Outpatient Facilities

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.