Asia Pacific Digital Signage Market Size, Share & Trends Analysis Report By Location, By Type, By Component, By Application, By Size, By Content Type, By Technology, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-299-8

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

Asia Pacific Digital Signage Market Trends

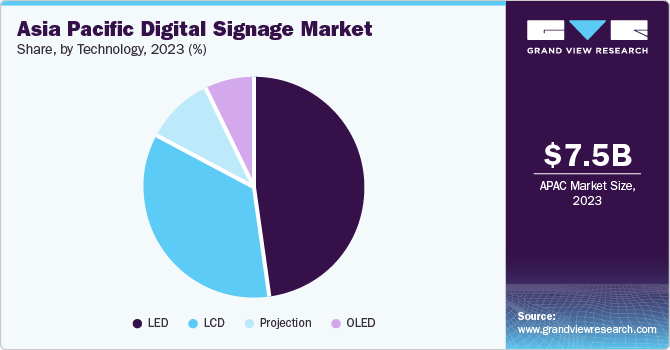

The Asia Pacific digital signage market size was estimated at USD 7.5 billion in 2023 and is projected to grow at a CAGR of 9.5% from 2024 to 2030. This growth can be attributed to the rapid urbanization and digitalization in the region, coupled with the increasing demand for innovative marketing strategies that effectively engage consumers. Furthermore, advancements in technology and the proliferation of high-speed internet have made digital signage more accessible and cost-effective, thereby fueling its adoption across various industries.

The Asia Pacific (APAC) digital signage market accounted for a share of 28.0% of the global digital signage market revenue in 2023. In the dynamic landscape of this market, regulatory compliance is a critical factor that businesses must navigate effectively. For instance, content-specific laws, such as South Korea's Telecommunications Business Act (TBA) and Singapore's Protection from Online Falsehoods and Manipulation Act (POFMA), govern the nature of content that can be displayed. Australia’s Online Safety Act of 2021 has implications for content and safety measures on digital displays. Zoning laws, which vary by region, dictate the placement of digital signs, impacting their visibility.

Furthermore, data privacy laws related to the processing of personal data and cross-border transfers of sensitive and “critical” personal data can influence how operators collect and utilize data. These regulations, while sometimes challenging, can also stimulate innovation by encouraging businesses to develop compliant solutions. Staying abreast of these regulatory developments is crucial for businesses in the market to ensure compliance and seize new opportunities.

Location Insights

The indoor segment held the largest market share of 71.3% in 2023 as there is a high adoption of digital signage in retail spaces, corporate environments, and transportation hubs. These applications leverage digital signage for advertising, wayfinding, and real-time information delivery, ultimately improving customer experience and fostering engagement. In addition, technological advancements are enhancing the interactive and personalized capabilities of indoor digital signage, further propelling its integration. However, challenges persist within the indoor segment, including the need for frequent content updates and higher initial investment compared to traditional signage solutions.

The outdoor segment is expected to witness the fastest CAGR of 10.6% from 2024 to 2030. Outdoor digital signage is primarily used for advertising and public information on billboards, bus stops, and public squares due to its high visibility and reach, which make it an effective platform for advertisers. In addition, improvements in display technology have made outdoor digital signage more durable and visible in various weather conditions, enhancing its appeal. However, the outdoor segment faces challenges, such as regulatory restrictions on placement and content, and the need for robust hardware that can withstand outdoor conditions.

Type Insights

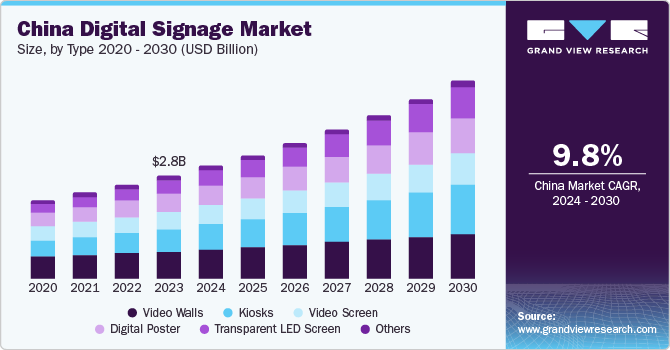

The video walls segment dominated the market in 2023 with a share of 29.1%. These large-scale displays consist of multiple screens seamlessly arranged to create a visually impactful canvas. Video walls find applications in various sectors, including retail, transportation hubs, corporate offices, and public spaces. Their popularity stems from their ability to engage audiences effectively, display dynamic content, and enhance brand visibility. As brands increasingly adopt video walls for marketing and communication, their steady growth is expected to continue.

The transparent LED screens segment is estimated to register the fastest CAGR of 12.5% from 2024 to 2030. Transparent LED screens allow content to be displayed while maintaining transparency, making them ideal for applications where aesthetics and functionality intersect. They find use in retail storefronts, museums, and architectural installations. As technological advancements continue and prices decrease, transparent LED screens are becoming more popular. Their ability to blend seamlessly into physical spaces while delivering captivating visuals positions them for substantial growth in the coming years.

Component Insights

The hardware segment dominated the market with a share of 57.4% in 2023 and is also expected to experience the fastest growth in the coming years. This segment includes the physical components of digital signage systems, such as displays, media players, and mounting equipment. The dominance of the hardware segment can be attributed to the high cost of these components, particularly high-quality displays. Furthermore, rapid technological advancements in display technology and increasing demand for high-resolution, energy-efficient displays are driving the segment growth.

The software segment is projected to experience the second-fastest CAGR of 7.5% from 2024 to 2030. This segment includes the software used to manage and control digital signage systems, including content management systems and device management software. The segment growth is driven by the increasing need for sophisticated software solutions that allow for efficient content management, scheduling, and remote control of digital signage systems. However, the segment growth may be limited by factors, such as the complexity of these software solutions and the need for ongoing software updates and maintenance.

The service segment includes the services related to the installation, maintenance, and support of digital signage systems. While this segment does not hold as large a market share as the hardware and software segments, it plays a crucial role in the market. The growth of this segment is influenced by factors, such as the complexity of digital signage installations and the need for ongoing maintenance and support to ensure the optimal performance of these systems.

Application Insights

The transportation segment dominated the market in 2023 with a share of 18.9%. Digital signage solutions are widely deployed in transportation hubs, such as airports, train stations, and bus terminals. These displays serve multiple purposes, including wayfinding, real-time information updates, advertising, and entertainment. The growth of transportation-related digital signage is driven by increasing passenger volumes, the need for efficient communication, and the desire to enhance the overall travel experience. As more cities invest in smart transportation infrastructure, this segment is expected to continue its rapid expansion.

The healthcare sector is predicted to be the second-fastest-growing application segment with a CAGR of 11.4% from 2024 to 2030. Hospitals, clinics, and medical centers use digital displays for patient communication, wayfinding, appointment reminders, and health education. These screens improve patient engagement, reduce perceived wait times, and enhance overall operational efficiency. As healthcare institutions increasingly adopt technology to streamline processes and enhance patient care, the demand for digital signage solutions will continue to rise. The ability to convey critical information effectively within healthcare settings positions this segment for sustained growth.

Size Insights

The below 32-inch category dominated the market with a share of 39.5% in 2023. These smaller displays find applications in various contexts, including retail point-of-sale displays, menu boards, and information kiosks. Their compact size makes them versatile for both indoor and outdoor settings. The popularity of below 32-inch screens is driven by their affordability, ease of installation, and suitability for localized messaging. As businesses continue to adopt digital signage for targeted communication, this segment is expected to maintain its strong position.

The 32 to 52-inch category represents the fastest-growing segment in terms of revenue. Predicted to have a CAGR of 9.9% from 2024 to 2030, these mid-sized displays are gaining traction. Displays within this range are commonly used in retail stores, corporate offices, and public spaces. They strike a balance between visibility and space efficiency, making them ideal for advertising, wayfinding, and brand promotion. As technological advancements improve display quality and interactivity, businesses are increasingly adopting 32 to 52-inch digital signage solutions. Their versatility and ability to engage audiences position them for substantial growth in the coming years.

Content Type Insights

The non-broadcast content segment dominated the market with a share of 57.2% in 2023. This category includes static and dynamic content that is not directly tied to live broadcasting. Examples include advertisements, informational displays, wayfinding maps, and promotional videos. Non-broadcast content is widely used in retail stores, corporate offices, educational institutions, and public spaces. The popularity of non-broadcast content stems from its versatility, allowing businesses to tailor messages to specific audiences. As companies invest in targeted marketing and communication strategies, this segment is expected to maintain its strong position.

The broadcast content segment is estimated to register the fastest CAGR of 10.3% from 2024 to 2030. Broadcast content includes live feeds, streaming videos, and real-time updates. It is commonly used in transportation hubs, sports venues, and entertainment centers. Examples include news tickers, live event coverage, and emergency alerts. As technology improves and the demand for real-time information grows, broadcast content is becoming increasingly important.

Technology Insights

The LED displays segment held the largest revenue share of 47.8% in 2023 and is projected to expand further at the fastest CAGR from 2024 to 2030. The segment growth can be attributed to the superior brightness, energy efficiency, and longevity offered by LED displays compared to other display types, making them ideal for both indoor and outdoor applications. Furthermore, advancements in LED technology, such as the development of micro-LED and mini-LED displays, are expected to fuel segment growth.

The LCD display segment is projected to experience the second-fastest CAGR of 8.4% from 2024 to 2030. LCDs are widely used in indoor environments due to their high-resolution image quality and cost-effectiveness. The growth of this segment is driven by the growing adoption of digital signage in retail stores, corporate offices, and transportation hubs. However, the growth of LCDs may be limited by their lower brightness and shorter lifespan compared to LED displays.

Country Insights

China Digital Signage Market Trends

The China digital signage market held the largest share of 37.7% in 2023 due to the presence of a large population pool, rapid urbanization, and widespread adoption of digital technology in the country. Furthermore, the Chinese government's initiatives to promote digitalization and smart city projects have contributed to the market growth. However, this growth may be limited by factors, such as regulatory restrictions and the high competition in this market.

India Digital Signage Market Trends

The digital signage market in India is projected to experience the fastest CAGR of 10.3% from 2024 to 2030 due to factors, such as the increasing demand for innovative advertising strategies, growing retail sector, and government's initiatives to promote digitalization. Furthermore, rapid economic growth and increasing purchasing power of consumers in India are expected to fuel the demand for digital signage. However, the high cost of digital signage systems and the lack of high-speed internet connectivity in some areas may limit market growth.

Key Asia Pacific Digital Signage Company Insights

Given the rapid digitalization and urbanization in Asia Pacific, many digital signage producers are located in its close vicinity.

-

LG Electronics Inc. is a South Korean multinational electronics company specializing in various sectors, including digital signage. LG has been a major player in the Asia Pacific digital signage market, especially in the retail and transportation industries

-

Sony Corporation is a Japanese multinational conglomerate corporation that offers a variety of products and solutions for the digital signage industry. Sony’s digital signage solutions are widely used in various sectors, such as corporate, education, and government

Key Asia Pacific Digital Signage Companies:

- LG Electronics

- Sony Group Corporation

- Samsung Electronics Co., Ltd.

- Sharp NEC Display Solutions, Ltd.

- Leyard Optoelectronic Co., Ltd.

- Barco

- Panasonic Holdings Corporation

- Shanghai Goodview Electronics Technology Co., Ltd.

- AUO Corporation

- BrightSign LLC.

Recent Developments

-

In February 2023, Southeast Asia's largest startup hub, True Digital Park West in Bangkok, recently installed 50 LG Electronics LED and digital signage displays with customized webOS software, reflecting LG's expanding B2B presence

-

In March 2024, Panasonic announced that their projection system now illuminates the world's largest permanent architectural projection mapping display on the Tokyo Metropolitan Government Building, aiming to boost the nighttime economy with dynamic content

-

In April 2024, Sony Semiconductor Solutions Corporation (SSS) deployed an edge AI-based vision system at 500 convenience stores in Japan to analyze in-store advertising effectiveness by automatically counting viewers and their dwell time in front of digital signage

Asia Pacific Digital Signage Market Scope

|

Report Attribute |

Details |

|

Revenue forecast in 2030 |

USD 14.1 billion |

|

Growth rate |

CAGR of 9.5% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Location, type, component, application, size, content type, technology, country |

|

Country Scope |

Japan; China; India |

|

Key companies profiled |

LG Electronics; Sony Group Corp.; Samsung Electronics Co., Ltd.; Sharp NEC Display Solutions, Ltd.; Leyard Optoelectronic Co., Ltd.; Barco; Panasonic Holdings Corp.; Shanghai Goodview Electronics Technology Co., Ltd.; AUO Corp.; BrightSign LLC |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Asia Pacific Digital Signage Market Segmentation

This report forecasts revenue growth and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the Asia Pacific digital signage market report based on location, type, component, application, size, content type, technology, and country:

-

Location Outlook (Revenue, USD Million, 2017 - 2030)

-

Indoor

-

Outdoor

-

-

Type Outlook (Revenue, USD Billion; 2017 - 2030)

-

Video Walls

-

Video Screen

-

Transparent LED Screen

-

Digital Poster

-

Kiosks

-

Interactive Kiosks

-

Self-service Kiosks

-

Others

-

-

Others

-

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Software

-

Service

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Retail

-

Hospitality

-

Entertainment

-

Stadiums & Playgrounds

-

Corporate

-

Banking

-

Healthcare

-

Education

-

Transport

-

-

Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Below 32 Inches

-

32 to 52 Inches

-

More than 52 Inches

-

-

Content Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Broadcast

-

News

-

Weather

-

Sports

-

Others

-

-

Non-Broadcast

-

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

LCD

-

LED

-

OLED

-

Projection

-

-

Country Outlook (Revenue, USD Million, 2017 - 2030)

-

Japan

-

China

-

India

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."