Asia Pacific Digital Health Market Size, Share & Trends Analysis Report By Technology (Tele-healthcare, mHealth), By Component (Software, Hardware, Services), By Application, By End-use, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-916-3

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Asia Pacific Digital Health Market Trends

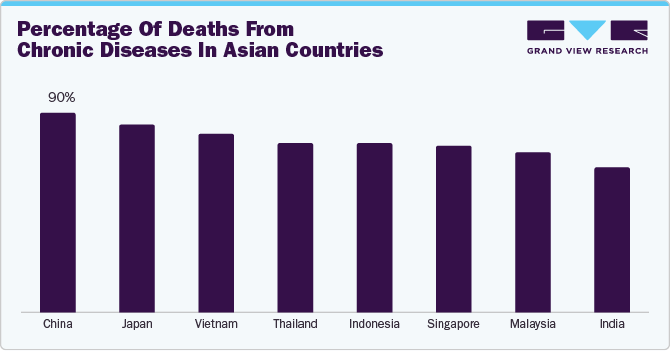

The Asia Pacific digital health market size was estimated at USD 59.59 billion in 2023 and is expected to grow at a CAGR of 23.1% from 2024 to 2030. Factors, such as favorable government initiatives and increasing strategic alliances, rising penetration of smartphones & tablets, increasing focus on patient-centric healthcare solutions, growing geriatric population, and rising prevalence of chronic diseases, are driving market growth. For instance, according to a study published by the Journal of Medical Internet Research in March 2023, in Japan, over 90% of adults aged 75 years or above have one chronic disease. Among those, around 80% have multiple chronic diseases.

Rising smartphone penetration, improved 5G network coverage, and increasing demand for remote patient monitoring are expected to boost the adoption of digital health platforms. For instance, according to The Mobile Economy Asia Pacific 2023, in the APAC region, there are several rapidly expanding markets for 5G, notably India, which is expected to incorporate ten million 5G connections by 2023. Furthermore, it is anticipated that by 2030, there will be around 1.4 billion 5G connections in APAC, accounting for 41% of the overall mobile connections. The growing usage of smartphones and internet connectivity has increased dependency on fitness, health, and medical applications in this region. This has resulted in a significant boost in market growth.

Furthermore, the rising incidence of chronic conditions, such as diabetes, Alzheimer's, cancer, and cardiovascular diseases, and a growing demand for fitness trackers and long-term patient monitoring solutions drive the market growth. For instance, according to the World Cancer Research Fund International, the cancer incidence rate in men in China is 2,464,015. Similarly, according to the International Diabetes Federation, 90 million people had diabetes in Southeast Asia in 2021. Furthermore, patients are shifting their focus to telehealth owing to movement restrictions and lockdowns due to the COVID-19 pandemic. For instance, MyDoc, a telehealth platform headquartered in Singapore, witnessed a 160% growth in daily active users in 2020.

Many patients, doctors, and government bodies increasingly adopt telehealth & telemedicine. Telehealth facilitates access to healthcare through specific applications & video consultations and enables communication between patients & doctors in remote locations, eliminating the need to visit hospitals or clinics. Video consultations are increasing, as they enable patients to avail medical services from their medical professional over the phone, which helps avoid unnecessary doctor visits and the process of booking appointments & commuting, thereby reducing unnecessary costs. For instance, in May 2023, Telstra Health launched Australia's first Fast Healthcare Interoperability Resources (FHIR) native virtual care solution-Virtual Health Platform-to enhance overall clinical efficiency.

Furthermore, rising government initiatives to promote digital health solutions and high adoption of advanced technology for remote health management are also anticipated to accelerate market growth in APAC. For instance, a collaboration between three government agencies in Thailand led to the developing of an IT system and mobile phone application to connect healthcare services provided by 116 government hospitals. This project has enabled Thai physicians to share medical information online, providing benefits, such as long-distance study in medical sciences, telepathology consultations, telecardiology, and teleradiology. Considering that Thailand has almost 900 government hospitals, the program has ample potential to expand in the coming years.

Several technologically advanced connected medical devices secured approval in recent years. This includes wearable devices, mobile apps, and iPad-based diagnostic tools. The approvals and launch of these technologically advanced devices into the market may aid growth. For instance, in September 2023, Lotte Healthcare, a South Korean company, entered the market by launching its personalized healthcare management platform, Cazzle.

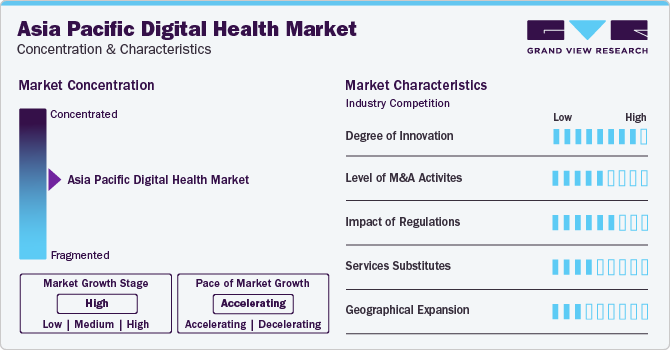

Market Concentration & Characteristics

The digital health market is characterized by a high degree of innovation. Remote Patient Monitoring (RPM) revolutionizes healthcare delivery by enabling providers to track patients’ health status without physical visits to healthcare facilities. This innovative approach expands access to healthcare services, particularly for individuals in remote areas or with limited mobility. For instance, in June 2023, Kakao Corporation, a South Korean internet company, collaborated with Dexcom to set up a global digital diabetes management service

A diverse range of growth strategies are adopted by companies to strengthen their market positions and revenues, further facilitating market growth. For instance, in September 2023, Health Innovations, a consortium of practicing medical doctors affiliated with the GP+ cooperative, acquired AskDr, a Singapore-based digital health startup, to enhance patient care and empower individuals to manage their health journeys actively

Different countries or regions have different regulations for digital health technologies. These regulations can impact market access, growth, and compliance. For instance, the Ministry of Public Health regulates health matters in Thailand, including medical devices and digital health activities. In addition, the Thai FDA and its Medical Device Control Division, which enforces the Medical Device Act, are under the Ministry of Public Health. The Ministry of Digital Economy and Society also enforces the PDPA and Cybersecurity Act for digital health. Two regulatory authorities monitor digital health in Thailand

The common service substitute for digital health is traditional in-person healthcare consultations, which involve physical visits to clinics, hospitals, or other healthcare facilities and paper-based medical records & communication, in which patient information can be exchanged through physical documents and face-to-face interactions

Several market players are expanding their business to new countries to strengthen their market position and product portfolio. For instance, in October 2023, Fujitsu, a digital transformation company, collaborated with Global Health Ltd., a digital health solutions company. The collaboration aimed to make available Global Health's complete range of software solutions to 13 countries in the Asia Pacific healthcare industry

Technology Insights

The telehealthcare segment dominated the market with the highest revenue share of 43.2% in 2023. An increase in the number of patients suffering from conditions requiring long-term care (LTC), including Alzheimer's disease, cancer, diabetes, and cardiovascular diseases, is one of the significant factors driving the segment growth. For instance, As per the "Alzheimer's Patients Demand Insight Report" in Beijing, it is estimated that around 15.07 million people aged 60 years or above in China are suffering from dementia, out of which 9.83 million have been diagnosed with Alzheimer's disease. Furthermore, LTC conditions are a major economic burden on hospitals & clinics, expected to drive the demand for telehealthcare services for remote monitoring and physician consultation of LTC patients.

The mHealth segment held the second-highest revenue share in 2023. Increasing trend of preventive healthcare & rising funding for mHealth startups are other factors boosting the market growth. Government initiatives, such as awareness programs and R&D funding for healthcare IT, are anticipated to boost market growth. For instance, in February 2024, the “Health On Us” app was launched in Telangana, India. This app provides two main services-care at the center and care at home. Furthermore, continuous improvements in mobile app functionality by manufacturers are driving segment growth.

End-use Insights

The patients segment dominated the market with a revenue share of 34.1% in 2023. Rising government initiatives and the launch of healthcare apps are anticipated to boost market growth. For instance, in July 2023, Singapore's Ministry of Health (MOH) launched the Industry Transformation Map (ITM) 2025 for healthcare, an update to the initial ITM launched in 2017. The new plan aims to strengthen various aspects of Singapore's healthcare industry, including research and innovation, healthcare workforce retention, digital systems, and partnerships. Furthermore, the shift toward patient-centered care and increased awareness of health management apps among individuals drives market growth.

The providers segment accounted for a significant share in 2023 and is expected to maintain its share throughout the forecast period. Many healthcare providers are adopting digital solutions to provide remote consultations, personalized treatment plans, and evidence-based therapies. This has made it easier for healthcare providers to work together and offer care across different settings. Moreover, these digital tools help providers save time on administrative tasks and communicate more effectively. As a result, innovative technologies, such as telemedicine and digital therapeutics, are becoming more popular in healthcare.

Component Insights

The services component segment accounted for the largest revenue share of 37.8% in 2023. An increase in the number of companies providing outsourcing services to healthcare facilities is anticipated to drive market growth over the forecast period. The growing trend of software upgrades to include a wider range of healthcare applications also contributes to the segment growth. Services such as installations, education & training, and upgradation depend on developing these platforms. For instance, in November 2023, Versicles Technologies, a Kerala startup, introduced a first-of-its-kind digital health kiosk that offers basic diagnostics, such as blood sugar, blood pressure, and heart conditions, with accuracy in multiple languages and at low prices, bringing healthcare facilities to the doorstep.

The software segment is expected to register the fastest CAGR throughout the forecast period. Increasing demand for reducing the rising medical costs, growing need for accurate & timely information procurement, and rising patient care costs are among the key factors responsible for the growth of the software market. The adoption of various software, such as EHRs/EMRs, has significantly increased owing to the assistance provided to healthcare systems. Periodic software upgrades are necessary to keep up with digital trends.

Application Insights

The diabetes segment dominated the market with the largest revenue share of 24.3% in 2023. The increasing prevalence of diabetes and the adoption of digital health solutions, such as smartphone apps for monitoring glucose levels and wearable devices that track physical activity and provide real-time health data, enable patients to actively engage in managing their diabetes. For instance, according to the International Diabetes Federation, 206 million people had diabetes in the Western Pacific region in 2021. Digital health technologies offer innovative solutions to address the needs of individuals with diabetes. For instance, MySugr, Diabetes: M, Glucose Buddy, Beat Diabetes, OneTouch Reveal, and Diabetes are some of the digital health solutions that help with diabetes monitoring.

The obesity segment is expected to register the second-fastest CAGR from 2024 to 2030. Lack of physical activity and unhealthy eating habits are the major factors contributing to increased prevalence of obesity. For instance, according to the WHO, in Southeast Asia, about 6.6 million children under the age of 5 years and one in five adults are overweight. Digital health technologies offer personalized interventions, including mobile applications for tracking dietary intake and wearable devices for monitoring physical activity, which has been driving the growth of this segment. MyFitnessPal, MyNetDiary, Noom, YAZIO, LoseIt, and MyPlate are some food-tracking apps that help manage diet plans.

Country Insights

India Digital Health Market Trends

The India digital health market is projected to experience significant growth over the forecast perioddue to the rising number of internet users, favorable government initiatives, and an increasing number of consumers using remote digital health services. For instance, in May 2023, the National Health Authority of India announced that over 100 health programs and digital health applications have been integrated into the Ayushman Bharat Digital Mission ecosystem. Moreover, leading hospitals in India, such as Narayana Hrudayalaya, Apollo, and AIIMS, have recognized the potential of telemedicine services and are supporting their broader implementation in the country, further driving the market growth.

China Digital Health Market Trends

The digital health market in China accounted for the highest revenue share in 2023. Increasing smartphone penetration and a rise in the number of digital health providers drive the market growth in this country. For instance, the number of active smartphone users in China was 974.7 million in 2022. Furthermore, Tencent, an internet-based technology and cultural enterprise that operates WeChat in mainland China, is developing a network of affiliated hospitals where users can easily schedule appointments, track their follow-up medical check-ups, and settle medical bills.

Singapore Digital Health Market Trends

The Singapore digital health market is projected to witness considerable growth in the coming years. Singapore is one of the first countries to adopt digital health in APAC. Telemedicine and EHR have been deployed in the country for over a decade. Singapore, as well as Australia, have one of the most advanced and largest networks of EMR systems. Moreover, Australia is a developed country with robust electronic and telecommunication technology.

Key Asia Pacific Digital Health Company Insights

Key companies adopt various strategies, including mergers & acquisitions, partnerships & collaborations, and new product launches, to increase their share and strengthen their position in the market. For instance, in September 2023, Apollo Hospitals Group inaugurated its Apollo Telehealth services, such as TeleICU and TeleEmergency, at nine plants operated by the National Thermal Power Corporation (NTPC) across India. Some of the key players operating in the market include Veradigm, Telefonica S.A., Apple Inc., Epic Systems Corporation, McKesson Corporation, Vodafone Group, AT&T, and Google, Inc.

Key Asia Pacific Digital Health Companies:

- Veradigm LLC

- Apple Inc.

- McKesson Corporation

- Telefonica S.A.

- Epic Systems Corporation

- QSI Management, LLC

- AT&T

- QSI Management, LLC

- Airstrip Technologies

- Google, Inc.

- Vodafone Group

- Samsung Electronics Co. Ltd

- Orange

- Qualcomm Technologies, Inc.

- HiMS

- Computer Programs and Systems, Inc.

- IBM Corporation

- Softserve

- CISCO Systems, Inc.

Recent Developments

-

In June 2023, FUJIFILM India launched its mobile application, ‘FUJIFILM Connect.’ The app provides healthcare professionals with a comprehensive solution for managing the service and support of their medical diagnostic devices. In addition, it delivers real-time push notifications to keep users informed and updated

-

In May 2023, Ora, a Singapore-based telehealth platform, raised USD 10 million in Series A funding. It is the largest telehealth Series A funding round in Southeast Asia

-

In May 2023, Ubie, a health-tech startup in Japan, partnered with Google’s Android platform, "Health Connect (Beta)," to provide better medical services to users. Ubie AI Symptom Checker enables users to receive improved disease information by sharing their blood sugar levels on Health Connect (Beta). By sharing data, users can benefit from more accurate symptom-related questions, which can help them make better medical decisions

-

In March 2023, The Australian Digital Health Agency launched My Health, a consumer mobile application powered by My Health Record. With the app, users can easily access important health information, which enables them to have more control over their health journey and take an active role in managing their daily health activities

Asia Pacific Digital Health Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 72.28 billion |

|

Revenue forecast in 2030 |

USD 252.01 billion |

|

Growth rate |

CAGR of 23.1% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Technology, component, application, end-use, and country |

|

Regional scope |

Asia Pacific |

|

Country scope |

China; Japan; India; South Korea; Singapore; Australia |

|

Key companies profiled |

Veradigm LLC; Apple Inc.; Telefonica S.A.; McKesson Corp.; Epic Systems Corp.; QSI Management, LLC; AT&T; Vodafone Group; Airstrip Technologies; Google, Inc.; Samsung Electronics Co. Ltd.; HiMS; Orange; Qualcomm Technologies, Inc.; Softserve; Computer Programs & Systems, Inc.; IBM Corp.; CISCO Systems, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Asia Pacific Digital Health Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific digital health market report based on technology, component, application, end-use, and country:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Tele-healthcare

-

Tele-care

-

Activity Monitoring

-

Remote Medication Management

-

-

Tele-health

-

LTC Monitoring

-

Video Consultation

-

-

-

mHealth

-

Wearables & Connected Medical Devices

-

Vital Sign Monitoring Devices

-

Heart Rate Monitors

-

Activity Monitors

-

Electrocardiographs

-

Pulse Oximeters

-

Spirometers

-

Blood Pressure Monitors

-

Others

-

-

Sleep Monitoring Devices

-

Sleep trackers.

-

Wrist Actigraphs

-

Polysomnographs

-

Others

-

-

Electrocardiographs Fetal and Obstetric Devices

-

Neuromonitoring Devices

-

Electroencephalographs

-

Electromyographs

-

Others

-

-

-

mHealth Apps

-

Medical Apps

-

Women's Health

-

Menstrual Health

-

Pregnancy Tracking & Postpartum Care

-

Menopause

-

Disease Management

-

Others

-

-

Chronic Disease Management Apps

-

Diabetes Management Apps

-

Blood Pressure and ECG Monitoring Apps

-

Mental Health Management Apps

-

Cancer Management Apps

-

Obesity Management Apps

-

Other Chronic Disease Management Apps

-

-

Personal Health Record Apps

-

Medication Management Apps

-

Diagnostic Apps

-

Remote Monitoring Apps

-

Others (Pill Reminder, Medical Reference, Professional Networking, Healthcare Education)

-

-

Fitness Apps

-

Exercise & Fitness

-

Diet & Nutrition

-

Lifestyle & Stress

-

-

-

Services

-

Monitoring Services

-

Independent Aging Solutions

-

Chronic Disease Management & Post-Acute Care Services

-

-

Diagnosis Services

-

Healthcare Systems Strengthening Services

-

Others

-

-

-

Digital Health Systems

-

EHR

-

E-prescribing Systems

-

-

Healthcare Analytics

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Hardware

-

Services

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Obesity

-

Diabetes

-

Cardiovascular

-

Respiratory Diseases

-

Neurology

-

Others

-

-

End-use Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Patients

-

Providers

-

Payers

-

Other

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

China

-

Japan

-

India

-

Australia

-

Singapore

-

South Korea

-

Frequently Asked Questions About This Report

b. The Asia Pacific digital health market size was estimated at USD 59.59 billion in 2023 and is expected to reach USD 72.28 billion in 2024.

b. The Asia Pacific digital health market is expected to grow at a compound annual growth rate of 23.1% from 2024 to 2030 to reach USD 252.01 billion by 2030.

b. Tele-healthcare dominated the Asia Pacific digital health market with a share of 43.2% in 2023. This is attributable to high internet usage, increased penetration of smartphones, and the growing adoption of digital communication and information technologies for virtual home health services.

b. Some key players operating in the Asia Pacific digital health market include Apple Inc.; AirStrip Technologies; Allscripts; Google Inc.; Orange; Qualcomm Technologies Inc.; Mqure; Samsung Electronics Co. Ltd.; Telefonica S.A.; Vodafone Group; Cerner Corporation; and McKesson Corporation.

b. Key factors that are driving the Asia Pacific digital health market growth include increasing adoption of digital healthcare, favorable initiatives, and technological advancements for developing innovative digital solutions.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."