- Home

- »

- Network Security

- »

-

Asia Pacific Cyber Security Market Size, Share Report, 2030GVR Report cover

![Asia Pacific Cyber Security Market Size, Share & Trends Report]()

Asia Pacific Cyber Security Market (2023 - 2030) Size, Share & Trends Analysis Report By Component, By Security Type, By Solution Type, By Services, By Deployment, By Organization Size, By Application, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-150-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Asia Pacific Cyber Security Market Trends

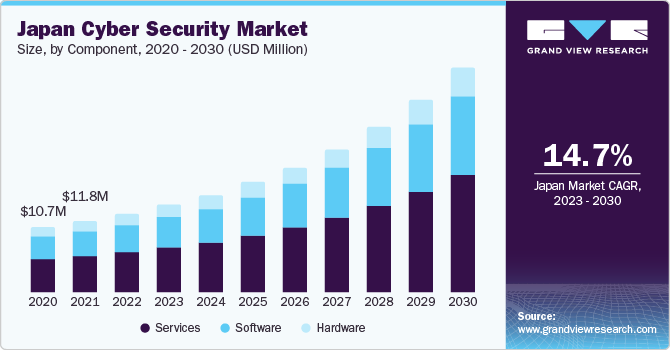

The Asia Pacific cyber security market size was estimated at USD 48.98 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 19.5% from 2023 to 2030. The increasing cyberattacks in Asia Pacific are due to rapid digitalization coupled with low cybersecurity training, regulations, and awareness.Growing internet usage in various countries such as China, India, and Japan contributes to the adoption of cybersecurity solutions. Moreover, as wireless networks for mobile devices have expanded, cybersecurity has become crucial for every organization because of increased data susceptibility.

Presence of a large amount of working-age population in Asia Pacific has increased the proliferation of endpoint devices. Several enterprises struggle to control and maintain visibility of their endpoint devices, thereby impairing the ability to ward off outside attacks and leading to increased security breaches. As per a report published by Ponemon Institute and Adaptiva, an average of 48% of devices per enterprise are subject to cyber risk due to outdated operating systems or undetectable by the IT department of organizations. Enterprises have to monitor several endpoints along with an increasingly diverse array of endpoints. As such, enterprises are implementing advanced endpoint security solutions to identify and mitigate threats on endpoint devices. Thus, driving the growth of the Asia Pacific cyber security market.

Enterprises are investing in integrating artificial intelligence (AI) with endpoint security solutions to identify potential blind spots and plug the endpoint security gaps in encrypted traffic across a plethora of endpoint devices. Solutions such as Extended Detection and Response (XDR) provide enhanced security beyond conventional reactive point security solutions. XDR platforms gather large volumes of security telemetry data and then use technologies such as analytics, artificial intelligence, and machine learning (ML) to predict previously undetected threats and provide solutions by correlating the data collected. Furthermore, XDR platforms help mitigate risk and reduce the Mean Time To Respond (MTTR) by automating responses. Therefore, implementation of XDR platforms in endpoint security solutions is expected to drive the regional demand for cyber security.

Furthermore, due to AI and ML capabilities, XDR platforms offer several advantages over Endpoint Detection and Response (EDR) and Endpoint Protection Platform (EPP) tools, chiefly when it comes to predicting unknown threats and making cybersecurity an autonomous operation. For instance, during the COVID-19 pandemic, NOV. Inc., an oilfield equipment maker, deployed an XDR solution by SentinelOne, a cybersecurity technology provider, to secure its globally distributed workforce across more than 60 countries. Immediately after the deployment, the Singularity XDR solution detected and prevented a cyberattack against the company while also remediating the attack at the same time. Such advancements in cyber security solutions are anticipated to drive cyber security vendors to invest in product innovation and introduce new products to cater to the large working-age population across Asia Pacific, thereby increasing the adoption of cyber security solutions.

Component Insights

The services segment accounted for the largest revenue share of over 42.0% in 2022. Enterprises across APAC are increasingly adopting cyber security solutions based on organizational structure is driving the use of cyber security services across many industries and sectors. It is easy for cybercriminals to target companies because they control a vast array of resources, huge amounts of data, and network connectivity across billions of devices. In an effort to create a strong security framework for mitigating assaults, several firms are subscribing to cyber security services.

The hardware segment is expected to register considerable growth with a CAGR of 21.4% over the forecast period. Cyber security hardware allows investigation, monitoring of end users’ networks and response as users look for higher levels of protection. Cyber security hardware devices, such as Splunk Edge Hub, launched by Splunk Inc., can monitor, investigate, and respond to network activities using various sensors and protocols. This segment is expected to benefit from the increasing adoption of IoT and edge computing in the region.

Security Insights

The infrastructure protection segment accounted for the largest revenue share of over 28% in 2022. Cloud-based service use is rising as a result of technology convergence, and programs like BYOD are predicted to raise infrastructure security risks and vulnerabilities. To ensure responsibility and lower the risk of breaches, businesses must increasingly secure track, and manage user activity. It is anticipated that this will increase demand for infrastructure solutions. Several governments across Asia Pacific are launching cooperative programs to enhance data privacy and lessen unwanted access, driving the demand for infrastructure protection.

Cloud security segment is expected to exhibit the highest CAGR of 22.3% over the forecast period. Growing demand for managed security solutions and increasing adoption of cloud are expected to drive the demand for cloud security solutions. Furthermore, an increase in the number of remote workforces is expected to fuel the segment's growth. Companies operating in the cloud security market are focusing on strengthening their product portfolios to attract potential business clients. Thus, driving the segment growth.

Solution Insights

The IAM segment accounted for the largest revenue share of more than 31% in 2022. IAM solution concentrates on providing logical access control and entitlement management to reduce identity theft. The segment is projected to grow as large businesses and governmental organizations spend more money on security solutions to maintain regulatory compliance and prevent identity theft. Many end-use companies are adopting IAM to reduce digital security risks and create a secure platform for information sharing within the organization in response to the growing problem of unauthorized access.

The IDS/IPS segment is expected to exhibit the highest CAGR of 21.8% over the forecast period. This can be attributed to rising IT security spending and usage of network security products. The rise in cyber dangers and hacking attempts are other factors driving the segment's expansion. An IDS/IPS continuously analyses all network traffic and spots the presence of any malicious activity. These solutions also report to the security administrator and keep information about such dangerous behavior. Thus, driving the segment’s growth.

Services Insights

Professional services segment held the highest market share of 63.08% in 2022. A growing demand for services such as cyber security defense, penetration testing, enterprise risk assessment, and physical security testing is attributed to the increase in professional services adoption. Moreover, organizations heavily rely on professional service providers for expert advice and consultation in implementing cost-effective and appropriate security solutions. Lack of IT security professionals also drives the adoption of these services for employee training. This is contributing to the growing demand for professional services.

Managed services segment is anticipated to expand at a CAGR of 19.0% during the forecast period. Increased need for IT security services to oversee and maintain security solutions is a contributing factor in the market growth. Managed services are a more affordable option than having internal staff handle the job of the company's IT security. Additionally, managed service providers are focused on enhancing security operations and tracking threat trends to prevent cyberattacks.

Deployment Insights

On-premises segment held the highest market share of more than 67% in 2022. As enterprises have confidential databases for business information, businesses prefer on-premises solutions and improvements for data security. Additionally, on-premises deployment offers explicit monitoring and data protection, reducing reliance on other companies. Over the forecast period, it is anticipated that companies' propensity to protect the privacy of their data will continue to drive demand for on-premises deployment in the Asia Pacific cyber security industry.

Cloud segment is anticipated to expand at a CAGR of 21.1% from 2023 to 2030. Cloud-based platforms are more susceptible to data breaches and cybercrimes as cloud computing develops. Due to the expensive on-premises solutions, more businesses and banks are choosing cloud computing. In addition, it is anticipated that the remote working trend will boost the use of cloud storage and sharing. To protect user data and reduce the danger of cyberattacks, are projected to boost the adoption of cloud security solutions.

Organization Size Insights

Large enterprises segment held the highest revenue share of more than 70% in 2022. With the implementation of multiple technologies, large enterprises run the risk of various issues, such as data breaches and hacking. To protect against these risks, several large enterprises include cyber insurance in their business insurance plans. Businesses can get complete protection from a range of technology-related dangers with the help of cyber insurance. Additionally, major firms are adequately protected by data breach insurance, and it helps them respond to intrusions in an efficient manner.

The small and medium enterprises (SMEs) segment is expected to register the highest CAGR of 21.5% through 2030.Due to SMEs' limited financial resources and protection, small and medium-sized firms are more susceptible to cyber-attacks. Additionally, their vulnerability to cyberattacks is increased by a lack of security procedures and employee expertise. SMEs turn to cyber security insurance as a solution to these problems since it shields them from monetary damages brought on by malicious software assaults and data breaches. The costs of credit monitoring, consumer notification, legal fees, and fines are all covered. Thus, SMEs across Asia Pacific are increasingly adopting cybersecurity solutions.

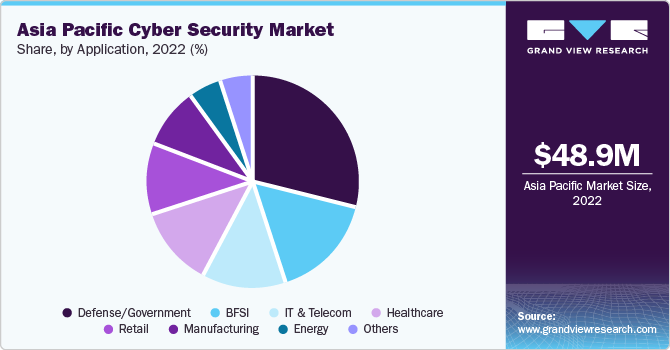

Applications Insights

The defense and government segment held the highest market share of 28.6% in 2022. Government and defense organizations are under a constant security threat from state-sponsored hacktivists due to the confidential nature of the information they possess. As such, several governments in Asia Pacific are making significant investments in strengthening the cyber security of their nations. For instance, in December 2022, the Japanese government announced plans to increase its defense budget to USD 47.18 billion, out of which USD 298.2 million would be allotted for strengthening its defense against cyber-attacks. Such initiatives are expected to boost the demand for cyber security solutions in the defense/government sector.

Healthcare segment is expected to grow at the highest CAGR of 21.3% from 2023 to 2030. Healthcare ecosystem has recently grown more interconnected as a result of the growing integration of Internet of Things (IoT)-enabled medical equipment, Electronic Health Records (EHRs), and other healthcare technology. Moreover, the increased use of cloud-based solutions, connected devices, and smartphones is responsible for the segment's rise. Along with the increased amount of data breaches in the sector, this is driving up the demand for healthcare cyber security solutions.

Country Insights

China held the highest market share of more than 36% in 2022. Chinese government is focusing aggressively on strengthening cybersecurity. The Cyberspace Administration of China has been tasked with the implementation of cyber policies across China and coordination with other agencies. China’s Cyber Security Law and National Security Law reflect a coordinated approach to cyber policies. Thus, driving the demand for cyber security.

India cybersecurity market is expected to register considerable growth at a CAGR of 23.5% over the forecast period.In India, users have limited control over the hardware used for accessing the internet, which poses immense challenges for the national security architecture. As such, the Indian authorities are tackling localized cybercrimes by responding to them on a case-by-case basis. The number of security incidents handled by the Indian Computer Emergency Response Team (CERT-In) has increased significantly over the past few years. Thus, driving the demand for cyber security.

Key Companies & Market Share Insights

Key players maintain an exhaustive product portfolio to maintain a competitive edge, through their product offerings, applications segment they serve, sophistication of their technology, strategy to differentiate their products, and their industry impact. The key strategies include strategic collaborations, partnerships, and agreements; new product developments; capability expansions; mergers & acquisitions; and research & development initiatives. For instance, in August 2023, Radware, a cybersecurity solutions provider, partnered with Spark NZ, a digital services provider based in New Zealand, to provide network and application security services in New Zealand. Spark NZ would market Radware's suite of application and network security solutions in New Zealand due to this partnership. Thus, this strategic initiative is expected to drive the demand in New Zealand.

Key Asia Pacific Cyber Security Companies:

- AVG Technologies

- BAE Systems, Inc

- Broadcom (Symantec Corporation)

- Check Point Software Technologies Ltd.

- Cisco Systems, Inc.

- Dell Technologies Inc.

- FireEye, Inc.

- Fortinet, Inc.

- FUJITSU

- International Business Machines Corporation

- Lockheed Martin Corporation

- McAfee, Corp

- Securelytics

- Sophos, Ltd

- Trend Micro Incorporated

Asia Pacific Cyber Security Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 56.48 billion

Revenue forecast in 2030

USD 196.25 billion

Growth rate

CAGR of 19.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Component, security type, solution type, services, deployment, organization size, application, country

Country scope

China; India; Japan; Australia; New Zealand

Key companies profiled

AVG Technologies; BAE Systems. Inc.; Broadcom (Symantec Corporation); Check Point Software Technologies Ltd.; Cisco Systems. Inc.; Dell Technologies Inc.; FireEye Inc.; Fortinet Inc.; FUJITSU; International Business Machines Corporation; Lockheed Martin Corporation; McAfee Corp.; Securelytics; Sophos Ltd; Trend Micro Incorporated

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Cyber Security Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific cyber security market report based on component, security type, solution type, services, deployment, organization, application, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Security Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Endpoint Security

-

Cloud Security

-

Network Security

-

Application Security

-

Infrastructure Protection

-

Data Security

-

Others

-

-

Solution Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Unified Threat Management

-

IDS/IPS

-

DLP

-

IAM

-

SIEM

-

DDoS

-

Risk and Compliance Management

-

Others

-

-

Services Outlook (Revenue, USD Billion, 2018 - 2030)

-

Professional Services

-

Managed Services

-

-

Deployment Outlook (Revenue USD Billion, 2018 - 2030)

-

Cloud

-

On-premises

-

-

Organization Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Small and Medium Enterprise (SMEs)

-

Large Enterprises

-

-

Applications Outlook (Revenue, USD Billion, 2018 - 2030)

-

IT & Telecom

-

Retail

-

BFSI

-

Healthcare

-

Défense/Government

-

Manufacturing

-

Energy

-

Others

-

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)

-

Asia Pacific

-

India

-

China

-

Japan

-

Australia

-

New Zealand

-

-

Frequently Asked Questions About This Report

b. The Asia Pacific cyber security market was estimated at USD 48.98 billion in 2022 and is expected to reach USD 56.48 billion in 2023.

b. The Asia Pacific cyber security market is expected to grow at a compound annual growth rate of 19.5% from 2023 to 2030 to reach USD 196.25 billion by 2030.

b. The professional services segment held the highest market share of 63.08% in 2022. A growing demand for services such as cyber security defense, penetration testing, enterprise risk assessment, and physical security testing is attributed to the increase in professional services adoption.

b. The key players in the market include BAE Systems, Inc., Broadcom (Symantec Corporation), Centrify Corporations, Check Point Software Technologies Ltd., Cipher, Cisco Systems, Inc., Dell Technologies Inc., FireEye, Inc., Fortinet, Inc., FUJITSU, International Business Machines Corporation, Lockheed Martin Corporation, McAfee, Corp, Sophos, Ltd, and Trend Micro Incorporated.

b. The increasing cyberattacks in the Asia Pacific region is due to the rapid digitalization coupled with low cybersecurity training, regulations, and awareness. Growing internet usage in various countries such as, China, India, and Japan across the Asia pacific drives the adoption of cybersecurity solutions. Moreover, as wireless networks for mobile devices have expanded, cybersecurity has become a crucial component of every organization because of increased data susceptibility.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.