Market Size & Trends

The Asia Pacific construction films market was valued at USD 12.3 billion in 2023 and is expected to grow at a CAGR of 6.4% from 2024 to 2030. The market demand was significantly propelled by the increasing plastic consumption in commercial and residential buildings. These construction films serve various purposes, such as vapor barriers, gas barriers, and building enclosures. Furthermore, the rising awareness of sustainable building practices has led to an increase in green buildings. Hong Kong and Singapore, in particular, have seen substantial growth in energy-efficient green buildings.

In addition, the recycling of plastic waste offers huge potential for film producers. There are several construction film applications where recycled plastic films can be used without compromising the requirements. China imports most of the global plastic waste. Furthermore, manufacturers have increasingly focused on innovative technologies that comply with regulations and building standards. They have invested in advanced plastic film designs for unique infrastructures creating demand for products with better specifications.

Moreover, environmental authorities in Malaysia and Indonesia have increasingly combatted negative perceptions of plastics used in the industrial sector through media campaigns. This push for sustainable plastic materials manufacturing processes has positively impacted the construction films market in the region.

Type Insights

Low-Density Polyethylene (LDPE) and LLDPE (Linear Low-Density Polyethylene) secured the dominant market share in 2023. This growth can be attributed to the rapidly increasing utilization of electronic devices. These construction films are used as protective covers, insulation, and moisture barriers in electric components. In addition, the surge in the packaging industry, driven by hygiene and safety concerns, has resulted in substantial market growth, particularly for LLDPE. These films are known for their impact strength, tensile properties, and puncture resistance and are widely used in packaging films.

High-density polyethylene (HDPE) construction films are expected to emerge as the fastest-growing segment at a CAGR of 6.6% over the forecast period. HDPE films are extensively applied in agriculture, including greenhouse covers, mulching films, and irrigation systems. Additionally, the rising population and changing consumption patterns have led to an increased demand for packaged goods that require durability and versatility. Moreover, HDPE films are employed in nuclear facilities owing to their resistance to UV radiation, infrared emissions, and robustness that enhances safety and security.

Function Insights

Protection films accounted for the dominant market share with 32.8% in 2023. These films are used to safeguard surfaces during construction, transportation, and installation. They shield against scratches, abrasions, and environmental damage, ensuring the longevity of structures and materials. Additionally, protection films enhance the safety and durability of building components. They prevent damage to glass, metal, and painted surfaces during handling, shipping, and assembly. During manufacturing processes, these films prevent scratches on appliances, electronics, and automotive parts.

Bonding films are expected to emerge with the fastest CAGR over the forecast period owing to the region’s rapid urbanization and infrastructure development including buildings, bridges, and transportation networks. These films are extensively applied for joining materials, such as glass, metal, and composite panels. Additionally, bonding films contribute to energy-efficient structures by providing thermal insulation and reducing air leakage which aligns with sustainable construction practices. These films are lightweight, durable, and structurally sound components and help simplify assembly processes, reduce labor costs, and enhance manufacturing efficiency across automotive, electronics, and aerospace industries.

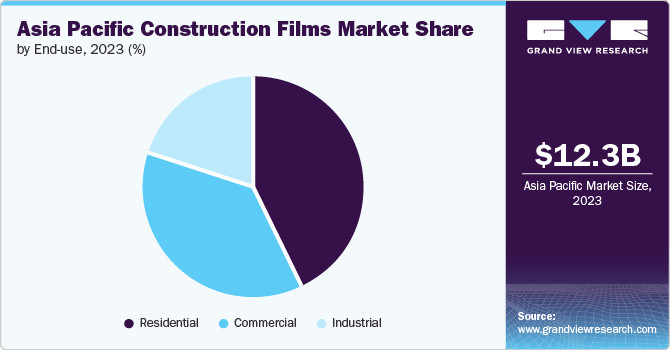

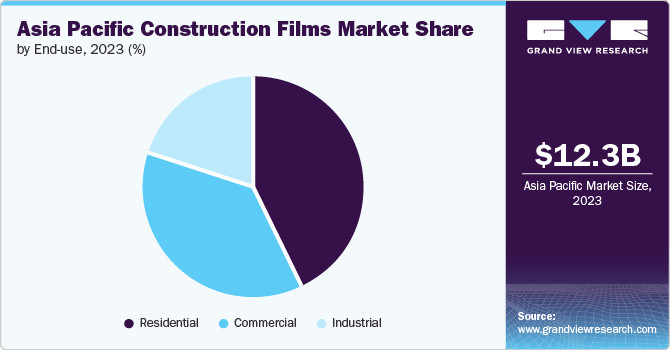

End-use Insights

The residential end use accounted for 42.7% in the regional market share in 2023 owing to the burgeoning urban population and increased disposable incomes. Residential construction films are applied in roofing, insulation, and moisture protection. Additionally, the market has witnessed homeowners and builders increasingly prioritize energy-efficient and sustainable homes. This has led to a surging demand for construction films that serve as vapor barriers, insulation, and protective coatings, enhancing building longevity and efficiency.

The commercial end use is projected to emerge substantially during the forecast period. Construction films protect surfaces during installation, reducing damage risks. This aligns with commercial buildings, including offices, retail spaces, and hotels, that increasingly prioritize safety and security. Additionally, plastic films for windows, facades, and insulation have significantly contributed to energy savings and sustainability, ensuring longevity and performance.

Country Insights

The China construction films market held the largest market share in 2023. The country's ongoing urbanization process has primarily fueled the demand for construction films used for infrastructure development in both residential and commercial projects. These films are highly durable, moisture-resistant, and environmentally friendly. Furthermore, China’s government has actively promoted and supported film industry development. Measures such as tax breaks for film production and investments in modern studios and equipment have encouraged significant growth.

The construction films market in India is expected to emerge as the fastest-growing segment at a CAGR of 6.6 during the forecast period owing to the ongoing urbanization. Construction films are highly durable, resistant to moisture, and environmentally friendly. Moreover, the Indian government has actively invested in large-scale infrastructure projects. Major allocations in the 2023-24 Budget included funds for road transport, railways, and housing. For instance, the Pradhan Mantri Awas Yojana-Urban (PMAY-U) aims to provide “Housing for All,” which led to growth in the construction films market.

Key Asia Pacific Construction Films Company Insights

The Asia Pacific construction films industry is consolidated. Prominent players such as Eastman Chemical Company, Extron Engineering Oy, and others have actively implemented strategic alliances, mergers, and acquisitions to strengthen their market presence.

-

Eastman Chemical Company is a global specialty materials company that produces a wide range of advanced materials, chemicals, and fibers. Their innovations span various sectors, including agriculture, consumer goods, personal care, transportation, and textiles. The company’s product lineup includes well-known materials such as Tritan copolyester, Cristal copolyester, and Naia cellulosic fibers.

-

Extron Engineering Oy specializes in the intelligent design and manufacturing of high-tech extrusion components, units, and production lines. The company focuses on creating safe, future-proof solutions for plastic production including plastic film, automatic seal-inserting tools for various pipe fittings, and other extrusion products.

Key Asia Pacific Construction Films Companies:

- Eastman Chemical Company

- BASF SE

- Extron Engineering Oy

- POLIFILM

- TORAY INDUSTRIES, INC.

- Xiamen Changsu Industrial Co., Ltd.

- DuPont

- Xiamen Leadkit Group Co., Ltd.

- Dana Poly, Inc

- Kuber Polyfilm

- Barflex Polyfilms Pvt Ltd.

Recent Development

-

In February 2023, Eastman Chemical Company completed the acquisition of Ai-Red Technology (Dalian) Co., Ltd., a manufacturer and supplier specializing in paint protection and window film for both automotive and architectural applications in the Asia Pacific region. This strategy demonstrates the company’s commitment to driving growth within the Performance Films sector and the paint protection and window film markets.

Asia Pacific Construction Films Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 13.3 billion

|

|

Revenue forecast in 2030

|

USD 19.4 billion

|

|

Growth Rate

|

CAGR of 6.4% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Volume in Kilotons, Revenue in USD million and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Type, function, end use, country

|

|

Country scope

|

China, India, Japan, Australia, South Korea, Indonesia, Vietnam

|

|

Key companies profiled

|

Eastman Chemical Company; BASF SE; Extron Engineering Oy; POLIFILM; TORAY INDUSTRIES, INC.; Xiamen Changsu Industrial Co., Ltd.; DuPont; Xiamen Leadkit Group Co., Ltd.; Dana Poly, Inc; Kuber Polyfilms; Barflex Polyfilms Pvt Ltd.

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Asia Pacific Construction Films Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific construction films market report based on type, function, and end use, and country.

-

Type Outlook (Volume in Kilotons, Revenue, USD Million, 2018 - 2030)

-

LDPE & LLDPE

-

HDPE

-

PP

-

PET

-

PA

-

PVC

-

Polyvinyl Butyral (PVB)

-

Others

-

Function Outlook (Volume in Kilotons, Revenue, USD Million, 2018 - 2030)

-

Bonding

-

Protection

-

Insulation

-

Glazing

-

Soundproofing

-

Others

-

End Use Outlook (Volume in Kilotons, Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

Country Outlook (Volume in Kilotons, Revenue, USD Million, 2018 - 2030)

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Indonesia

-

Vietnam