- Home

- »

- Healthcare IT

- »

-

Asia Pacific Clinical Trials Market Size, Industry Report 2030GVR Report cover

![Asia Pacific Clinical Trials Market Size, Share & Trends Report]()

Asia Pacific Clinical Trials Market Size, Share & Trends Analysis Report By Phase, By Study Design, By Indication, By Sponsor, By Service Type, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-279-7

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Asia Pacific Clinical Trials Market Trends

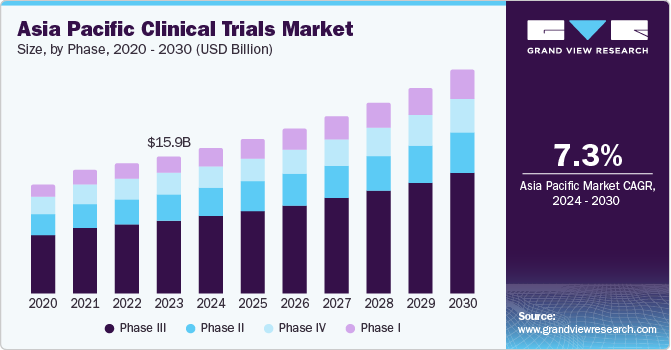

The Asia Pacific clinical trials market size was estimated at USD 15.9 billion in 2023 and it is projected to grow at a CAGR of 7.3% from 2024 to 2030. This projected growth can be attributed to various aspects, such as the shift of biopharmaceutical companies from developed countries to other regions like Asia Pacific, disease variations in developing economies, and government support in multiple countries. In addition, factors such as the adoption of new technology in clinical research, the shifting trend towards personalized medicine, and the increasing prevalence of chronic diseases are further expected to propel the market growth.

In 2023, the clinical trials market in Asia Pacific accounted for a 19.7% share of the global clinical trials market revenue. Many biopharmaceutical companies are shifting their clinical trial businesses from developed countries to regions like Asia Pacific, owing to rising costs associated with clinical trials. These countries offer cost savings and quick patient recruitment. Furthermore, developing countries in the Asia Pacific region possess significant disease variation, which presents an opportunity for biopharmaceutical companies to perform clinical trials for rare diseases. Asia Pacific also provides greater economic benefits to biopharmaceutical companies as governments in countries such as Singapore and China allocate funds to promote biomedical research.

Multiple companies from developed economies are outsourcing clinical trials to countries such as India, China, and South Korea. The evolving business model of outsourcing R&D activities among key global companies is expected to increase the demand for clinical trial services in the region, owing to the cost efficiency offered by CROs in countries such as India and China. In addition, the presence of several contract research organizations (CROs) in the region that provide high-cost efficiency has also contributed to the growth of the clinical trials industry in the area. Asia Pacific hosts a growing pool of scientific & development expertise, enabling rapid adoption of advanced technologies & quality clinical outsourcing services.

Phase Insights

The phase III category led the market in 2023 and accounted for 53.2% of the aggregated revenue. Phase III trials are known to be more complex than other trials. Though the number of drugs used in this phase is relatively low, the complexity associated with this phase is the highest. In addition, the failure rate in this phase is the highest as the sample size and study design require complex dosing at an optimum level. Usually, authorities ask for phase III clinical data for the approval of new drugs, which makes it more significant.

On the other hand, the revenue generated through phase I trials is expected to experience a growth of 9.0% from 2024 to 2030. Phase I studies assess the safety of a device or drug and involve the evaluation of tolerability and pharmacokinetics of molecules. It determines the effect of a device or drug on humans, including the way it is absorbed, metabolized, and excreted.

Study Design Insights

The interventional studies category dominated the market in 2023 and accounted for 82.9% of the aggregated revenue. Interventional studies are categorized based on the intervention to be studied, including drug or biologic, behavioral, surgical procedure, and devices. There has been a significant rise in interventional studies performed over time. The greater accuracy and relevance of observational studies have made them a preference for many companies.

The observational studies segment is expected to experience a CAGR of 7.3% from 2024 to 2030. Observational studies are conducted to discover the cause-effect relationship between factors impacting the outcome and the specific outcome without any control of the experimenter. The growing emphasis on observational studies might generate hypotheses that may have been unable to be discovered through other means.

Indication Insights

Based on indication segment, oncology dominated the Asia Pacific market in 2023 and accounted for 36.4% of the aggregated revenue. The pharmaceutical industry is spending substantial resources on clinical developments associated with oncology therapy. In addition, the number of people diagnosed with cancer is expected to increase significantly in the next eight years. The increasing prevalence of different sorts of cancer and the growing number of new cases are expected to fuel the R&D investments associated with oncology.

The autoimmune/inflammation segment is expected to witness a CAGR of 7.4% from 2024 to 2030. This is mainly due to the constant increase in the prevalence of autoimmune diseases. Furthermore, lifestyle changes & aging population are expected to increase the number of newly diagnosed cases associated with autoimmune diseases. This has resulted in noteworthy growth in R&D activities related to the category. Some of the most prevailing health issues related to autoimmune diseases include type 1 diabetes, rheumatoid arthritis, multiple sclerosis, lupus, psoriasis, Crohn’s disease, and scleroderma.

Service Type Insights

Based on service type, the revenue generated through the laboratory services segment was the largest and accounted for 34.5% of the aggregated revenue. One of the key drivers for the growth of this segment is the advantages associated with the usage of laboratory services in clinical trials. These services contribute significantly to research efforts by ensuring strict adherence to quality control and regulatory requirements.

Moreover, by employing state-of-the-art technology and leveraging skilled expertise, these services offer crucial support and resources that enhance the overall conduct of clinical trials. Laboratory services are also vital in upholding quality control standards and ensuring adherence to regulatory requirements. On the other hand, the patient recruitment category is anticipated to register a CAGR of 7.5% from 2024 to 2030.

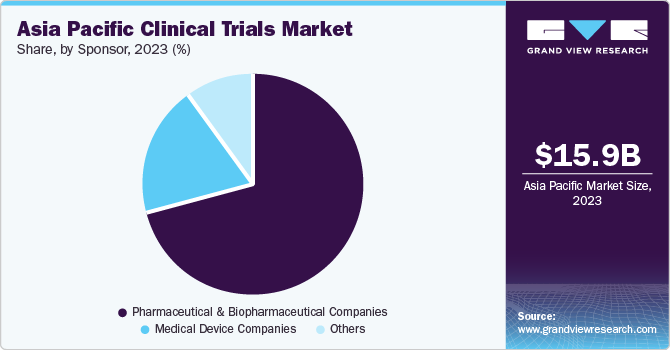

Sponsor Insights

Based on sponsor, pharmaceutical & biopharmaceutical companies held the largest market share and accounted for 70.5% of the aggregated revenue in 2023. This is primarily due to the growing interest of the pharmaceutical industry in research and development. In recent years, pharmaceutical & biopharmaceutical companies have been funding several clinical trials to support their core competencies, such as drug development, discovering treatments, and launching various medical devices.

Furthermore, pharmaceutical & biopharmaceutical companies are expected to experience a CAGR of 7.6% from 2024 to 2030. This is mainly due to increasing investments by industry leaders in the region owing to the attainment of cost reductions and easier patient recruitment.

Country Insights

China Clinical Trials Market Trends

The China clinical trials market dominated the Asia Pacific region in 2023 in terms of revenue with a share of 30.9%. One of the key drivers for the growth of clinical trials in China is cost-efficiency delivered by contract research organizations. Many key market participants from developed economies have chosen service providers from China to outsource the clinical trial processes.

South Korea Clinical Trials Market Trends

In addition, the South Korea clinical trials market is anticipated to experience rapid growth from 2024 to 2030. The extensive support of the Korean government for the R&D industry and clinical trials is anticipated to boost market growth.

Key Asia Pacific Clinical Trials Company Insights

Some key companies in the Asia Pacific clinical trials sector include Labcorp, Wuxi AppTec, Pfizer Inc., Sun Pharmaceutical Industries Ltd., GSK plc, and IQVIA Inc.

Key Asia Pacific Clinical Trials Companies:

- Labcorp

- Wuxi AppTec

- Pfizer Inc.

- Sun Pharmaceutical Industries Ltd.

- GSK plc,

- IQVIA Inc

- F. Hoffmann-La Roche Ltd

- Novartis AG

- AstraZeneca

- Eli Lilly and Company

Recent Developments

-

In January 2024, Wuxi AppTec, one of the leading companies in contract research and development, announced the launch of its new manufacturing site in Taixing. With this newly formed facility, the company has expanded its total reactor volume in terms of Solid-Phase Peptide Synthesis (SPPS) to 32,000 liters.

Asia Pacific Clinical Trials Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 15.9 billion

Revenue forecast in 2030

USD 26.0 billion

Growth rate

CAGR of 7.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Country scope

Japan; China; India; Australia; South Korea; Thailand

Segments covered

Phase, study design, indication, service type, sponsor, country

Key companies profiled

Labcorp; Wuxi AppTec; Pfizer Inc.; Sun Pharmaceutical Industries Ltd.; GSK plc; IQVIA Inc; F. Hoffmann-La Roche Ltd; Novartis AG; AstraZeneca; Eli Lilly and Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Clinical Trials Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the Asia Pacific clinical trials market report based on phase, study design, indication, service type, sponsor, and country.

-

Phase Outlook (Revenue, USD Billion, 2018 - 2030)

-

Phase I

-

Phase II

-

Phase III

-

Phase IV

-

-

Study Design Outlook (Revenue, USD Billion, 2018 - 2030)

-

Interventional

-

Observational

-

Expanded Access

-

-

Indication Outlook (Revenue, USD Billion, 2018 - 2030)

-

Autoimmune/Inflammation

-

Interventional

-

Observational

-

Expanded Access

-

-

Pain Management

-

Interventional

-

Observational

-

Expanded Access

-

-

Oncology

-

Interventional

-

Observational

-

Expanded Access

-

-

CNS Conditions

-

Interventional

-

Observational

-

Expanded Access

-

-

Diabetes

-

Interventional

-

Observational

-

Expanded Access

-

-

Obesity

-

Interventional

-

Observational

-

Expanded Access

-

-

Cardiovascular

-

Interventional

-

Observational

-

Expanded Access

-

-

Others

-

Interventional

-

Observational

-

Expanded Access

-

-

-

Service Type Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Regulatory Affairs

-

Site Identification, Selection and Management

-

Drug Logistics

-

Laboratory Services

-

Patient Recruitment and Retention

-

Data Management

-

Others

-

-

Sponsor Outlook (Revenue, USD Billion, 2018 - 2030)

-

Pharmaceutical & Biopharmaceutical Companies

-

Medical Device Companies

-

Others

-

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

Frequently Asked Questions About This Report

b. The Asia Pacific clinical trials market size was estimated at USD 15.9 billion in 2023 and is expected to reach USD 16.9 billion in 2024

b. The Asia Pacific clinical trials market is expected to grow at a compound annual growth rate of 7.3% from 2024 to 2030 to reach USD 26.0 billion by 2030

b. The interventional segment dominated the market, with a share of 82.9% in 2023. Many companies prefer observational studies because of their greater accuracy and relevance.

b. Some key players operating in the Asia Pacific clinical trials market include Labcorp; Wuxi AppTec; Pfizer Inc.; Sun Pharmaceutical Industries Ltd.; GSK plc; IQVIA Inc; F. Hoffmann-La Roche Ltd; Novartis AG; AstraZeneca; Eli Lilly and Company

b. Factors such as the adoption of new technology in clinical research, the shifting trend towards personalized medicine, and the increasing prevalence of chronic diseases are driving the Asia Pacific clinical trials market growth

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."