- Home

- »

- Clinical Diagnostics

- »

-

Asia Pacific Clinical Laboratory Services Market, Industry Report, 2030GVR Report cover

![Asia Pacific Clinical Laboratory Services Market Size, Share & Trends Report]()

Asia Pacific Clinical Laboratory Services Market Size, Share & Trends Analysis Report By Test Type, By Service Provider, By Application, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-300-0

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

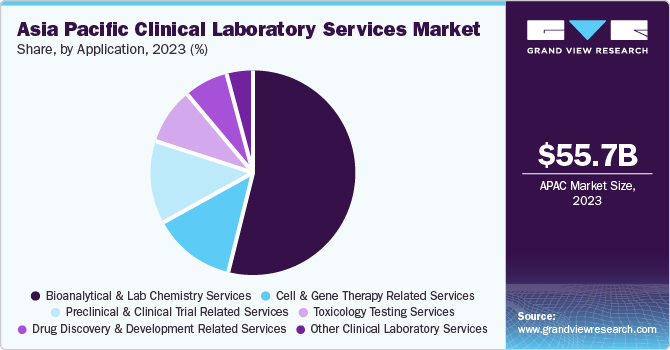

The Asia Pacific clinical laboratory services market size is estimated at USD 55.7 billion in 2023 and is projected to grow at a CAGR of 4.4% from 2024 to 2030. Market demand is expected to surge due to unmet medical needs, economic growth, and scientific advancements. A favorable regulatory environment in high-growth nations is attracting foreign investors, while government healthcare benefits, increased awareness, and a willingness to pay for quality care are driving market growth.

The Asia Pacific region accounted for 23.9% revenue share of the global clinical laboratory services market in 2023. The Asia-Pacific region is expected to experience rapid growth in the market due to several factors, including unmet medical needs, positive economic growth, and increasing scientific research.

The United Nations Fund for Population Activities predicts that the number of older people in the Asia-Pacific region will triple by 2050, reaching 1.3 billion individuals. Thailand, Japan, and China are experiencing a significant aging population driven by declining fertility rates and increasing life expectancies. This demographic shift is driving demand for clinical laboratory services in geriatric care, disease management, and health monitoring. Targeted healthcare policies and research funding are addressing health disparities faced by older women.

Geographic expansion strategies undertaken in the Asia Pacific market by major U.S.-based players to strengthen their position are anticipated to drive market growth further. This expansion will not only increase their market share but also enhance their capabilities to cater to the growing demand for clinical laboratory services in the region. For instance, in March 2024, Charles River Laboratories and the NUS Yong Loo Lin School of Medicine extended their gene therapy manufacturing alliance, providing high-quality plasmid DNA for engineered stem cells in cancer therapy.

Test Type Insights

In 2023, clinical chemistry tests dominated the market with a revenue share of over 60.0%, with its extensive range of tests analyzing body fluids like urine, plasma, and serum. These tests play a crucial role in diagnosis and are poised for increased demand due to rising life expectancy. The market is expected to grow as challenges in innovating tests for chronic diseases drive innovation; however, technological advances, POC testing, and alternative sampling methods are anticipated to help the market landscape further.

Medical microbiology and cytology tests are expected to experience the fastest CAGR of 9.5% over the forecast period. These tests diagnose and control diseases caused by nosocomial and infectious infections, driving regional demand further. Clinical microbiology laboratory services, including microbial culture analysis, are in high demand due to rising cases of contagious diseases.

Service Provider Insights

In 2023, hospital-based laboratories dominated the market and are expected to retain dominance. This is driven by the high volume of patient tests conducted in hospitals, particularly for complex and severe disease conditions. The growing number of hospitals integrating laboratories into their premises and outreach programs is also contributing to the growth of this segment.

Clinic-based laboratories are expected to experience the fastest CAGR of 5.7% over the forecast period, driven by increasing demand for diagnostic testing, chronic disease prevalence, and lab equipment advancements. The adoption of Point-of-Care Testing (POCT) and integration of Laboratory Information Systems (LIS) with Electronic Health Records (EHRs) is enhancing workflow efficiency and data sharing, fueling the market’s growth.

Application Insights

In 2023, bioanalytical and laboratory chemistry services accounted for the largest application segment in terms of revenue share. In the Asia-Pacific region, these services utilize various techniques, including chromatography, mass spectrometry, and molecular biology, to meet diagnostic requirements. These services are crucial in drug development, concentration, and metabolite assessment. Providers employ validated methods to analyze biological samples for various applications.

The toxicology testing services segment is anticipated to exhibit rapid growth with a projected CAGR of 9.8% over the forecast period. More extensive laboratories prioritize turnaround time, requiring cost-benefit analyses. Pharmacogenetic testing helps predict adverse drug reactions, while therapeutic drug management optimizes drug doses. Furthermore, segment growth is aided by the growing pharmaceutical industry, increased government healthcare spending, and rising drug approvals and clinical trials.

Country Insights

China Clinical Laboratory Services Market Trends

The China clinical laboratory services market held the largest market share of 30.3% in the Asia Pacific region in 2023. This large share is driven by unmet medical needs, economic growth, and scientific advancements. A favorable regulatory environment attracting foreign investment, boosting demand, government healthcare initiatives, increased awareness, and a willingness to invest in quality healthcare are key drivers of growth in China.

Australia Clinical Laboratory Services Market Trends

The high burden of diseases in the country is expected to create growth opportunities in the clinical laboratory services market in Australia. The country is experiencing a growing prevalence of diseases, including diabetes, cardiovascular disorders, and other conditions. A notable example is atrial fibrillation, the most common type of irregular heartbeat, which affects over 500,000 people in Australia, according to the Baker Heart and Diabetes Institute.

Japan Clinical Laboratory Services Market Trends

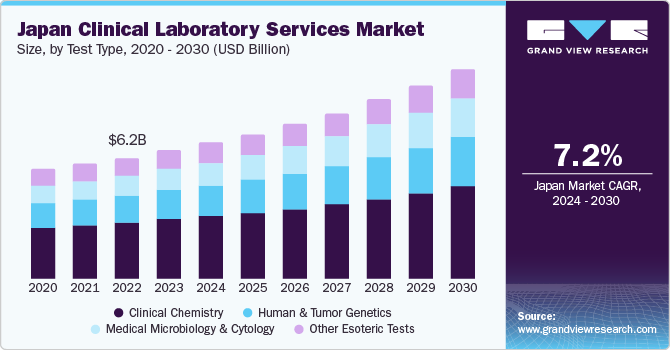

The Japan clinical laboratory services market is expected to grow at a lucrative CAGR of 7.2% over the forecast period. This growth is driven by the demand for tests, a growing geriatric population, and increasing reimbursement rates. Over 50% of the market is hospital-based, and the country’s elderly population is susceptible to various diseases.

Key Asia Pacific Clinical Laboratory Services Company Insights

The Asia-Pacific market is characterized by intense competition, driven by the rapid advancements in medical microbiology and cytology tests and the growing need for timely and accurate diagnosis. In response, leading players in the market are actively pursuing strategic initiatives to expand their market share and maintain their competitive edge.

Some key players operating in this market include Abbott Laboratories, ARUP Laboratories, Inc., OPKO Health, Inc., and Bioscientia Healthcare GmbH.

-

Abbott Laboratories, a leading player in the Asia-Pacific industry, is recognized for its innovative medical solutions. With a patient-centric approach, Abbott offers cutting-edge diagnostic tools and devices, enhancing healthcare standards through early detection, accurate diagnosis, and minimally invasive treatments.

-

ARUP Laboratories is a leading player in the Asia-Pacific market, recognized for its excellence in diagnostic services. Focusing on precision, accuracy, and efficiency, ARUP offers a comprehensive range of laboratory services.

Key Asia Pacific Clinical Laboratory Services Companies:

- Abbott Laboratories

- ARUP Laboratories, Inc

- OPKO Health, Inc.

- Bioscientia Healthcare GmbH

- Charles River Laboratories International, Inc.

- NeoGenomics Laboratories, Inc.

- Healthscope Limited

- Laboratory Corporation of America Holdings

Recent Developments

-

In March 2024, Abbott Laboratories launched GLP Systems Track, an innovative automation solution for laboratories in India, to accelerate automation and meet high-volume demands.

-

In September 2023, Shimadzu, a Japanese medical equipment manufacturer, began producing high-end testing equipment for hospitals in China, marking the first time it made such products outside Japan.

-

In February 2023, Siemens Healthineers and Unilabs partnered to improve patient care in the Asia-Pacific clinical laboratory services market.

Asia Pacific Clinical Laboratory Services Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 75.2 billion

Growth rate

CAGR of 4.4% from 2024 to 2030

Base year for estimation

2023

Historical Data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Test type, service provider, application, country

Country scope

Japan, China, India, Australia, RoAP

Key companies profiled

Abbott Laboratories; ARUP Laboratories, Inc.; OPKO Health, Inc.; Bioscientia Healthcare GmbH; Charles River Laboratories International, Inc.; NeoGenomics Laboratories, Inc.; Healthscope Limited; Laboratory Corporation of America Holdings

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Clinical Laboratory Services Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific clinical laboratory services market report based on test type, service provider, application, and country:

-

Test Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Human & Tumor Genetics

-

Clinical Chemistry

-

Medical Microbiology & Cytology

-

Other Esoteric Tests

-

-

Service Provider Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital-based Laboratories

-

Standalone Laboratories

-

Clinic-based Laboratories

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Bioanalytical & Lab Chemistry Services

-

Toxicology Testing Services

-

Cell & Gene Therapy Related Services

-

Preclinical & Clinical Trial Related Services

-

Drug Discovery & Development Related Services

-

Other Clinical Laboratory Services

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Japan

-

China

-

India

-

Australia

-

RoAP

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."