- Home

- »

- Organic Chemicals

- »

-

Asia Pacific Chromatography Resin Market, Industry Report 2030GVR Report cover

![Asia Pacific Chromatography Resin Market Size, Share & Trends Report]()

Asia Pacific Chromatography Resin Market Size, Share & Trends Analysis Report By End-use (Food & Beverage, Pharmaceutical & Biotechnology), By Type (Natural, Synthetic), By Technique (Ion Exchange, Affinity), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-274-1

- Number of Report Pages: 95

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

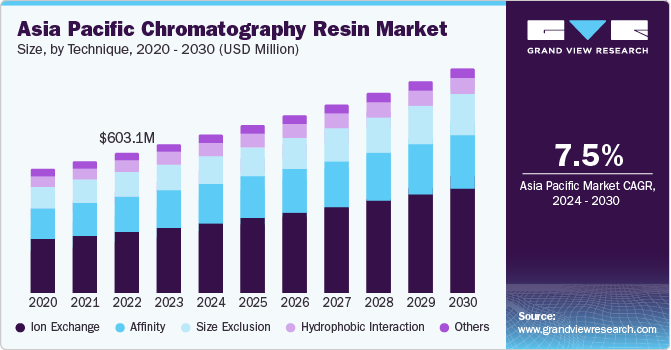

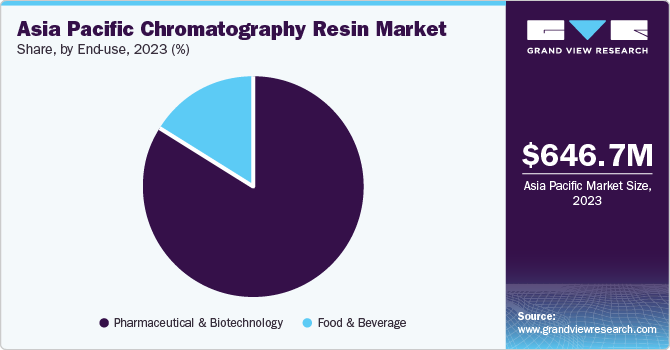

The Asia Pacific chromatography resin market size was estimated at USD 646.7 million in 2023 and is expected to grow at a CAGR of 7.5% from 2024 to 2030. This growth is attributed to a rise in the number of pharmaceutical firms in markets like China and India. Moreover, growing concerns about the safety and quality of foods and beverages are expected to lead to a surge in global food regulations, thereby enhancing the use of chromatography resin in the food and beverage industry for food testing and analysis. The growing footprint of major pharmaceutical companies is also predicted to propel market growth.

Chromatography is a prevalent method in chemistry for separating a mixture by passing it in a solution, suspension, or vapor through a medium that interacts with the components of the mixture, causing them to move at different rates. This movement depends on the properties of the individual molecules, enabling the separation or purification of a unique compound from a complex sample. In liquid chromatography, a resin medium is used to capture and refine antibody fragments, vaccines, and other biomolecules using a stationary phase. This procedure separates a sample into its constituents, facilitating the isolation and purification of molecules. The resin used in chromatography, also referred to as media, is the material utilized to capture and refine monoclonal antibodies (mAbs), antibody fragments, vaccines, and other biomolecules during chromatography separations.

The industry growth is being driven by an increasing demand for therapeutic antibodies for patient treatment. Innovation is being fostered for the product's use in a range of new sectors due to the trend toward chromatography's employment to replace traditional separation methods, such as filtration and distillation.

The Asia Pacific market stands out due to the availability of land and skilled labor at a low cost. Emerging economies, particularly China and India, have benefited from the shift in the global production landscape, which is expected to have a positive impact on global chromatography resin market growth. Regional production levels are likely to be enhanced, and reliance on imports decreased, by increasing government support for domestic manufacturing, presenting attractive opportunities for global manufacturers.

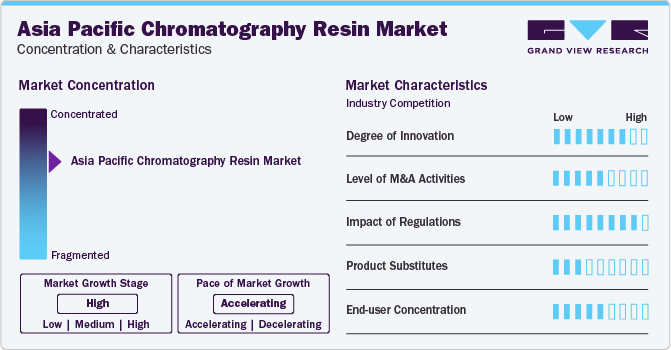

Market Concentration & Characteristics

The market is marked by a high degree of innovation. This market is defined by ongoing R&D activities aimed at enhancing the performance of resins, boosting efficiency, and broadening their use. Innovations encompass the creation of novel chemistries, the refinement of purification methods, and advancements in the manufacturing processes of resins, all driven by the need for greater purity and productivity in the biopharmaceutical and biotechnology sectors.

The market experiences a moderate level of merger and acquisition activities. While there have been cases of consolidation among leading players aiming to broaden their range of products or extend their geographical reach, the market also features specialized firms that concentrate on niche applications or technologies. The moderate level of M&A activities indicates both the possibilities for market consolidation and the persistent growth potential of the sector.

Regulatory factors significantly influence the market, especially in the biopharmaceutical and food industries where the standards for purity and safety are of utmost importance. Regulatory obligations necessitate the use of specific resins with proven performance and compatibility profiles, thereby driving the demand for products that adhere to strict quality and compliance standards. Adherence to regulations is crucial for gaining market access and preserving the trust of customers.

There are few alternatives to chromatography resins, particularly in biopharmaceutical and biotechnology applications, where the purification of biomolecules is of critical importance. Although other purification methods, such as membrane filtration or centrifugation, are available, chromatography resins provide unique advantages in terms of selectivity, resolution, and scalability, making them essential for numerous separation and purification procedures.

Technique Insights

The ion exchange segment dominated the market with a revenue share of 44.2% in 2023. This growth is attributed to technological progress in addressing a wide range of consumer requirements across various sectors. Moreover, the growing understanding of the advantages of ion exchange, along with heightened environmental consciousness, is propelling the market's growth. In addition, R&D investments are leading to ongoing enhancements in ion exchange solutions, boosting their effectiveness and efficiency. As businesses aim to meet changing consumer needs and comply with regulatory norms, this segment is set for consistent growth in the coming years.

The affinity segment held a significant portion of the market share in 2023 due to its broad applicability in numerous biotech applications, such as pharmaceuticals, biomedical research, and bioprocessing. Affinity chromatography resin, a unique medium used in chromatography, a lab method for separating and purifying biomolecules, is designed to leverage specific binding interactions between a target molecule and a ligand fixed on the resin's surface.

Type Insights

The natural segment accounted for the highest market share of 48.5% in 2023. As the focus on environmentally friendly practices intensifies across industries, chromatography resins sourced from nature could become a favored option. The employment of these natural resins in chromatography procedures is in line with the worldwide transition towards more sustainable alternatives, catering to the need for eco-conscious technologies.

The increasing demand for chromatography resin from the natural sector highlights its crucial role in fostering a more sustainable and environmentally friendly environment across various industries. The synthetic segment saw substantial growth in 2023 as the usage of synthetic resin has become prevalent. The industry is anticipated to experience a significant change due to recent advancements in synthetic resin manufacturing technology, which are expected to substantially increase the market share of synthetic resin over the forecasted years.

End-use Insights

The pharmaceutical and biotechnology sector dominated the market and accounted for the largest market share of 82.1% in 2023. This growth is driven by the broad range of uses of chromatography resins in the production of medicines, including the isolation of chemical and biomolecules, the purification of proteins for drug delivery, and diagnostic applications.

The need for chromatography resins is projected to increase due to the growth in monoclonal antibody production and various governmental incentives. The food and beverage industry saw significant growth in 2023. Chromatographic separation resins are used in this sector for the purification and separation of vitamins, amino acids, and other nutritional elements. Furthermore, these resins are relied upon by the food and beverage industry to ensure the safety and quality of their products.

Country Insights

China Chromatography Resin Market Trends

The China chromatography resin market dominated the regional market and accounted for the highest revenue share of 44.1% in 2023 due to the rapid expansion of the pharmaceutical sector, which relies heavily on chromatography resins for a variety of applications. In addition, advancements in chromatography tools have led to increased productivity, suggesting potential for future growth. As a result, economic progress, industrial expansion, and technological advancements are driving market growth.

India Chromatography Resin Market Trends

The chromatography resins market in India registered a notable market share in 2023 driven by the heightened focus on drug discovery by Indian pharmaceutical firms. In addition, the rising public awareness about food quality and safety is expected to stimulate the food & beverage segment, making it the most rapidly growing segment. Furthermore, positive shifts in regional economic conditions are likely to foster the healthcare and pharmaceutical sectors’ growth, thereby promoting the chromatography resin market expansion.

Japan Chromatography Resin Market Trends

The Japan chromatography resin market witnessed significant growth in 2023 primarily driven by the demand from the biotechnology sector, which has been increasingly focusing on enhancing treatments. Moreover, a rise in the usage of treatments is contributing to the increased demand in the country’s chromatography resin market.

Key Asia Pacific Chromatography Resin Company Insights

The Asia Pacific chromatography resins market is populated by several key players offering a broad spectrum of chromatography resin products. Furthermore, several smaller firms specialize in particular resin chemistries or applications. The market's dynamism is fueled by the variety of industries it serves, each with distinct purification needs, and the availability of specialized technologies that serve niche markets.

Key players in the market include Mitsubishi Chemical Corporation; KANEKA Corporation; and Tosoh Corporation.

-

Mitsubishi Chemical Corp. is a producer of performance products and industrial materials, including acrylic acid derivatives, specialty chemicals, solvents, surfactants, petrochemical products, performance polymers, and electronic chemicals. The company operates manufacturing facilities in Kurosaki, Yukkaichi, Mizushima, Sakaide, Kashima, and Tsukuba in Japan. Its resins are used in various sectors, such as industrial water treatment, power generation, wastewater & recovery, chemical catalysts, sugar & sweeteners, food & beverages, and pharmaceuticals

-

Tosoh Corp., a Japanese firm, is engaged in the production of chemicals and specialty products. The company's operations are divided into 13 groups, including petrochemical, specialty, engineering, and chlor-alkali. The chromatography business is part of the bioscience segment within the specialty group. Tosoh Corporation's products cater to a wide range of sectors including petroleum, chemical, construction, automotive, information technology, consumer electronics, and environmental markets

Sunresin New Materials Co., Ltd.; Shimadzu Corporation; and Daicel Corporation are some other participants in the Asia Pacific Chromatography Resins market

-

Shimadzu Corp. provides a variety of products to industries including healthcare (hospitals and clinics), pharmaceuticals, chemicals, aeronautics, food and beverages, education, construction, and others. The company has transformed from a 'local workshop’ to a global entity. After 140 years, it has emerged as one of the leading global manufacturers of analytical instrumentation and diagnostic imaging systems

Key Asia Pacific Chromatography Resin Companies:

- Mitsubishi Chemical Corporation

- Tosoh Corporation

- Sunresin New Materials Co., Ltd.

- KANEKA Corporation

- Qingdao Shenghan Chromatograph Technology Co., Ltd.

- Shimadzu Corporation

- Daicel Corporation

- Anhui Wanyi Science and Technology Co., Ltd.

- Drawell Instrument Co., Ltd.

Recent Developments

-

In February 2024, Shimadzu acquired the Microreactor Business from Activated Research Company (ARC) in the U.S. This strategic move allowed Shimadzu to obtain ARC's business assets, including patents, manufacturing expertise, and sales rights for two microreactor products. The acquisition enhances Shimadzu's competitiveness in the GX segment of gas chromatography.

-

In February 2024, Mitsubishi Chemical Group (MCG) introduced SA916N and SA916F, innovative biodegradable biopolyester resins. These materials, with over 60% biomass content, offer flexibility, high tear strength, and excellent processability. They degrade naturally through microorganisms. Applications include food packaging, plastic bags, and agricultural mulch film.

-

In November 2023, Kaneka Corporation acquired Japan Medical Device Technology Co., Ltd., making it a wholly-owned subsidiary. Kaneka specializes in endovascular catheters used to treat cardiac, peripheral vascular, and cerebrovascular diseases. This acquisition aims to expand Kaneka's presence in treating coronary artery conditions, such as atherosclerosis.

Asia Pacific Chromatography Resins Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 694.3 million

Revenue forecast in 2030

USD 1,037.2 million

Growth rate

CAGR of 7.5% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in thousand liters, revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Type, end-use, technique, country

Key companies profiled

Mitsubishi Chemical Corp.; Tosoh Corp.; Sunresin New Materials Co., Ltd.; KANEKA Corp.; Qingdao Shenghan Chromatograph Technology Co., Ltd.; Shimadzu Corp.; Daicel Corp.; Anhui Wanyi Science & Technology Co., Ltd.; Drawell Instrument Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Chromatography Resins Market Report Segmentation

This report forecasts revenue and volume growth at a country level and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific chromatography resins market report based on, type, end-use, technique, and country:

-

Type Outlook (Volume, Thousand Liters; Revenue, USD Million, 2018 - 2030)

-

Natural

-

Synthetic

-

Inorganic Media

-

-

End-use Outlook (Volume, Thousand Liters; Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical & Biotechnology

-

Food & Beverage

-

-

Technique Outlook (Volume, Thousand Liters; Revenue, USD Million, 2018 - 2030)

-

Ion exchange

-

Affinity

-

Hydrophobic interaction

-

Size exclusion

-

Others

-

-

Country Outlook (Volume, Thousand Liters; Revenue, USD Million, 2018 - 2030)

-

China

-

India

-

Japan

-

South Korea

-

Frequently Asked Questions About This Report

b. The Asia Pacific Chromatography Resin market was estimated at USD 553.9 million in 2023 and is expected to reach USD 587.4 million by 2024.

b. The Asia Pacific Chromatography Resin market is expected to grow at a CAGR of 7.5% from 2024 to reach USD 1,037.2 million by 2030.

b. China dominated the consumption of chromatography resin in Asia Pacific region with a market share of 44.1%. This is attributed to increasing demand for the product from various end-use industries

b. Key companies are adopting several organic and inorganic growth strategies, such as capacity expansion, mergers & acquisitions, and joint ventures, to maintain and expand their market share. For example, In April 2023, Mitsubishi Chemical starts implementation of commercial polycarbonate (PC) resin recycling. By 2030, Mitsubishi Chemical will have an annual processing capacity of 10,000 tons of PC resin recycling material to commercialize the chemical recycling of PC resin.

b. The growth in Asia Pacific Chromatography Resin market is attributable to growing demand for chromatography techniques from pharmaceutical, chemical, food & beverage, and other industries. High investments in R&D in the industry have propelled the development of several products, which have resulted in improved productivity compared to conventional products.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."