Asia Pacific Cell Therapy Market Size, Share & Trends Analysis Report By Therapy Type (Allogeneic Therapies, Autologous Therapies), By Therapeutic Area (Oncology, Dermatology), By Country, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-450-4

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

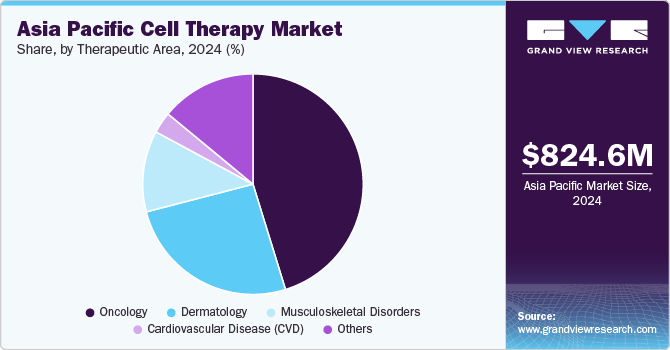

The Asia Pacific cell therapy market size was estimated at USD 824.6 million in 2024 and is expected to grow at a CAGR of 22.49% from 2025 to 2030. The market has witnessed significant growth in recent years, driven by advances in regenerative medicine, increased funding for cell-based research, and a growing focus on precision medicine. Cell therapy, a therapeutic intervention in which living cells are introduced into the body to replace or repair damaged tissues or cells, is rapidly gaining traction in this region, particularly due to its potential to treat various chronic and life-threatening diseases.

The COVID-19 pandemic had a significant impact on the market. In 2020, the pandemic led to disruptions in supply chains and posed challenges for manufacturers & developers of cell therapy products. Moreover, lockdowns, travel restrictions, and logistical issues impacted the availability of raw materials and the transportation of finished products. In addition, several ongoing trials were temporarily halted or delayed due to lockdowns, travel restrictions, and prioritization of healthcare resources for managing the pandemic. This posed challenges for companies in terms of timeline adherence, data collection, and patient recruitment. However, the industry also demonstrated resilience by adapting to virtual methodologies, remote monitoring, and flexible regulatory approaches, allowing some trials to continue amid the challenges.

There is a rising number of clinical studies focusing on the development of cellular therapies. This surge reflects a growing recognition of the potential of cellular therapies across a spectrum of medical conditions and highlights the increasing focus of pharmaceutical companies to explore & harness the therapeutic potential of cells. Furthermore, one significant factor fueling the high number of clinical studies is the promising outcomes observed in early-phase trials. Positive results from initial studies have instilled confidence in the efficacy and safety of cellular therapies, encouraging further exploration & investment. Conditions such as cancer, autoimmune disorders, and degenerative diseases are being targeted, with researchers aiming to unlock the full therapeutic potential of various cell types, including stem cells & immune cells

In addition, the growing acceptance of regenerative medicine by healthcare professionals, regulatory bodies, and patients is a pivotal factor fueling the cell therapy market. As scientific evidence supporting the safety & efficacy of regenerative therapies accumulates, there is an increasing willingness to integrate these innovative approaches into mainstream medical practices. Regulatory agencies are adapting to accommodate the unique challenges & characteristics of cell therapies, expediting approvals, and fostering a more conducive environment for market growth. The collaborative efforts between academic institutions, biotechnology companies, and healthcare providers contribute to accelerating R&D in regenerative medicine.

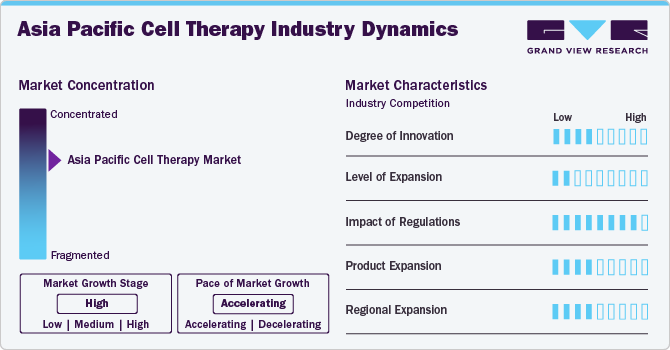

Market Concentrations And Characteristics

The market is witnessing a high degree of innovation, driven by advancements in stem cell research, gene editing technologies like CRISPR, and induced pluripotent stem cells (iPSCs).

The market is experiencing rapid growth due to increased investment in biotechnology, government funding, and rising awareness of cell therapies. A surge in biotech startups and increased investment from pharmaceutical companies are contributing to the market's expansion.

Regulatory frameworks vary across countries in the Asia Pacific region. Japan has a well-defined and expedited pathway for regenerative medicine through its Pharmaceuticals and Medical Devices Agency (PMDA). China's regulatory environment has been improving with the establishment of the National Medical Products Administration (NMPA), while other countries are also developing guidelines to ensure the safety and efficacy of cell therapies.

The market includes a diverse range of cell therapies such as CAR-T therapies, stem cell therapies, and tissue-engineered products. There's a growing interest in developing autologous and allogeneic cell therapy products.

Japan, China, South Korea, and Australia are the primary drivers of the market in the region. Japan is a leader in the commercialization of regenerative medicine, while China is catching up with significant investments in infrastructure and R&D.

Therapy Type Insights

The autologous therapy market accounted for the larger revenue share of 77.32% in 2024. The rising prevalence of chronic diseases such as cancer and cardiovascular disorders, which necessitates advanced treatment options. Increased awareness of personalized medicine and the growing acceptance of regenerative therapies among healthcare professionals are contributing to the demand for autologous therapies. Supportive government policies, funding, and expedited regulatory pathways, especially in countries like Japan and South Korea, have accelerated research and commercialization efforts, further boosting the demand and revenue share of the segment.

The allogeneic therapy segment is projected to witness the higher growth rate over the forecast period. A growing need for scalable, off-the-shelf treatment options to address a wide range of conditions such as cancer, autoimmune diseases, and degenerative disorders. The cost-effectiveness and ease of mass production of allogeneic therapies make them an attractive option compared to autologous treatments. Advancements in cell engineering technologies, such as gene editing and immune cell modification, have enhanced the safety and efficacy of allogeneic therapies, driving market growth.

Therapeutic Area Insights

The oncology segment accounted for the largest revenue share of 45.17% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. Growing awareness and acceptance of cell-based therapies, such as CAR-T cell therapy, have increased adoption, especially for hematological cancers. Substantial government funding, favorable regulatory frameworks, and expedited approval pathways in countries like Japan and China are accelerating the development and commercialization of oncology cell therapies. Technological advancements in cell engineering and gene editing, combined with the emergence of numerous clinical trials, have further boosted innovation in this sector.

The dermatology segment is expected to witness a significant CAGR over the forecast period. Rising awareness and acceptance of regenerative medicine among consumers and dermatologists have contributed to the adoption of cell-based therapies for skin regeneration and repair. Technological advancements in stem cell research and tissue engineering, along with a growing focus on personalized medicine, have enhanced the efficacy and safety of cell therapies for dermatological applications and are further expected to contribute to the segment’s growth over the forecast period.

Country Insights

South Korea cell therapy market has dominated the Asia Pacific market with a share of 52.95% in 2024. This is attributed to due to various strategic initiatives undertaken by local players and international companies. The COVID-19 pandemic led to an increase in stem cell therapies for treating the condition. For instance, in August 2022, Panacell Biotech announced that it would be using Natural Killer (NK) cells, brown Adipose-Derived Stem Cells (ADSC), and exosomes for treating COVID-19 infection. The clinical trial for the same is expected to start soon.

Furthermore, several companies are focusing on cell & gene therapy and tissue-based products. Industry participants are undertaking numerous strategies to remain competitive in the country. For instance, in April 2022, Daewoong Pharmaceutical collaborated with UCI Therapeutics for CAR-NK cell therapy development. Thereby, propelling the demand for Asia Pacific cell therapy market in the region over the forecast period.

The cell therapy market in China is expected to grow over the forecast period, due to increasing demand for ATMPs and the rising attention of industry participants on ATMPs. The companies and authorities operating in the country focus on cell & gene therapy. For instance, in August 2023, China's National Medical Products Administration (NMPA) approved an Investigational New Drug (IND) application for OriCAR-017 from Oricell Therapeutics. This authorized it to study autologous CAR T-cell therapy for patients suffering from advanced multiple myeloma.

Japan cell therapy market is expected to grow over the forecast period. The companies operating in the country are undertaking several initiatives like acquisitions and partnerships to gain a competitive advantage in the cell therapy market. For instance, in October 2021, Takeda Pharmaceutical Company Limited announced the acquisition of GammaDelta Therapeutics Limited to boost the development of allogeneic γδt cell therapies targeting solid tumors. Thus, the increasing efforts by key players to maintain their positions in the industry are expected to boost the cell therapy market in the country.

The cell therapy market in India is expected to grow over the forecast period, due to increasing expansions of cell therapy manufacturing facilities, coupled with growing regulatory approvals for cell therapies in the country. Moreover, the companies operating in other countries are focusing on the cell and gene therapy market in India, which is expected to strengthen the competition in the country. For instance, in May 2023, a U.S.-based company, StemCures, announced that it would set up a manufacturing lab focusing on stem cell therapy in India. Such establishments are anticipated to propel the rivalry in the cell therapy market in India.

Key Asia Pacific Cell Therapy Company Insights

The market players operating in the Asia Pacific are adopting product approval to increase the reach of their products in the market and improve the availability of their products in diverse geographical areas, along with expansion as a strategy to enhance production/research activities. In addition, several market players are acquiring smaller players to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve their competencies.

Key Asia Pacific Cell Therapy Companies:

- Kolon TissueGene, Inc.

- JCR Pharmaceuticals Co., Ltd.

- MEDIPOST

- PHARMICELL Co., Ltd.

- ANTEROGEN. CO., LTD

- Bristol-Myers Squibb Company

- Novartis AG

- Gilead Sciences, Inc.

- Curocell, Inc.

- JW Therapeutics (Shanghai) Co., Ltd.

- STEMPEUTICS RESEARCH PVT LTD

View a comprehensive list of companies in the Asia Pacific Cell Therapy Market

Recent Developments

-

In April 2024, Johnson & Johnson announced that the U.S. Food and Drug Administration (FDA) granted approval for CARVYKTI (ciltacabtagene autoleucel), a CAR T-cell therapy targeting B-cell maturation antigen (BCMA).

-

In April 2024, Bristol Myers Squibb (BMS) and 2seventy Bio, Inc. announced that the U.S. Food and Drug Administration (FDA) approved ABECMA (idecabtagene vicleucel) for adult patients with relapsed or refractory multiple myeloma who have undergone two or more prior lines of therapy.

-

In October 2023, NexCAR19, a Chimeric Antigen Receptor T-cell (CAR-T cell) therapy, received marketing approval from the Central Drugs Standard Control Organization (CDSCO). The NexCAR19 is manufactured by a Mumbai-based immunoadoptive cell therapy company, ImmunoACT.

-

In August 2023, China's National Medical Products Administration (NMPA) approved an Investigational New Drug (IND) application for OriCAR-017 from Oricell Therapeutics. This authorized it to study autologous CAR T-cell therapy for patients suffering from advanced multiple myeloma.

-

In May 2023, a U.S.-based company, StemCures, announced that it would set up a manufacturing lab focusing on stem cell therapy in India.

-

In March 2023, JW Therapeutics initiated a phase 2 clinical trial of relmacabtagene autoleucel injection. The trial aimed to assess the autologous CAR-T cell immunotherapy in 20 people with high-risk Large B-Cell Lymphoma (LBCL).

-

In February 2023, Novo Nordisk A/S and Heartseed, Inc. achieved a significant milestone by administering the first dose to a patient in the phase 1/2 clinical study, known as the LAPiS Study, for HS-001-an investigational cell therapy targeting heart failure. The clinical phase 1/2 of the LAPiS Study would enroll 10 individuals with advanced heart failure caused by an ischemic heart condition.

Asia Pacific Cell Therapy Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 1.01 billion |

|

Revenue forecast in 2030 |

USD 2.77 billion |

|

Growth rate |

CAGR of 22.49% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Therapy type, therapeutic area, region |

|

Regional scope |

Asia Pacific |

|

Country scope |

China; Japan; India; South Korea; Australia |

|

Key companies profiled |

Kolon TissueGene, Inc.; JCR Pharmaceuticals Co., Ltd.; MEDIPOST; PHARMICELL Co., Ltd.; ANTEROGEN. CO., LTD; Bristol-Myers Squibb Company; Novartis AG; Gilead Sciences, Inc.; Curocell, Inc.; JW Therapeutics (Shanghai) Co., Ltd.; Stempeutics Research Pvt. Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Asia Pacific Cell Therapy Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific cell therapy market report based on therapy type, therapeutic area, and region.

-

Therapy Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Allogeneic Therapies

-

Stem Cell Therapies

-

Hematopoietic Stem Cell Therapies

-

Mesenchymal Stem Cell Therapies

-

-

Non-stem Cell Therapies

-

Keratinocytes & Fibroblast-based Therapies

-

Others

-

-

-

Autologous Therapies

-

Stem Cell Therapies

-

BM, Blood, & Umbilical Cord-derived Stem Cells

-

Adipose derived cells

-

Others

-

-

Non-Stem Cell Therapies

-

T-Cell Therapies

-

CAR T Cell Therapy

-

T Cell Receptor (TCR)-based

-

-

Others

-

-

-

-

Therapeutic Area Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Cardiovascular Disease (CVD)

-

Musculoskeletal Disorders

-

Dermatology

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Frequently Asked Questions About This Report

b. The Asia Pacific cell therapy market size was estimated at USD 824.6 million in 2024 and is expected to reach USD 1.01 billion in 2025.

b. The Asia Pacific cell therapy market is expected to grow at a compound annual growth rate of 22.49% from 2025 to 2030 to reach USD 2.77 billion by 2030.

b. Based on therapy type, autologous therapy for Asia Pacific cell therapy market accounted for the largest revenue share in 2024. Increased awareness of personalized medicine and the growing acceptance of regenerative therapies among healthcare professionals contribute to the demand for autologous therapies.

b. Some key players operating in the Asia Pacific cell therapy market include Kolon TissueGene, Inc.; JCR Pharmaceuticals Co., Ltd.; MEDIPOST; PHARMICELL Co., Ltd.; ANTEROGEN. CO., LTD; Bristol-Myers Squibb Company; Novartis AG; Gilead Sciences, Inc.; Curocell, Inc.; JW Therapeutics (Shanghai) Co., Ltd.; Stempeutics Research Pvt. Ltd.

b. The Asia Pacific cell therapy market is driven by advances in regenerative medicine, increased funding for cell-based research, and a growing focus on precision medicine.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."