- Home

- »

- Medical Devices

- »

-

Asia Pacific Breastfeeding Accessories Market, Report, 2030GVR Report cover

![Asia Pacific Breastfeeding Accessories Market Size, Share & Trends Report]()

Asia Pacific Breastfeeding Accessories Market Size, Share & Trends Analysis Report By Product (Breastmilk Storage & Feeding, Postpartum Recovery Accessories), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-305-2

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

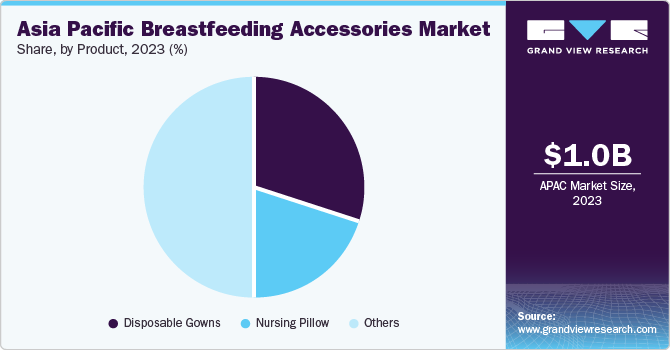

The Asia Pacific breastfeeding accessories market size was estimated at USD 1.07 billion in 2023 and is projected to grow at a CAGR of 6.40% from 2024 to 2030. The demand for breastfeeding accessories is increasing owing to the rise in awareness about the benefits of breastfeeding among new mothers in the Asia Pacific region. Furthermore, governments across various countries have been promoting breastfeeding as the best source of nutrition for infants. Initiatives such as the Baby-Friendly Hospital Initiative (BFHI) by WHO and UNICEF have also supported the market growth.

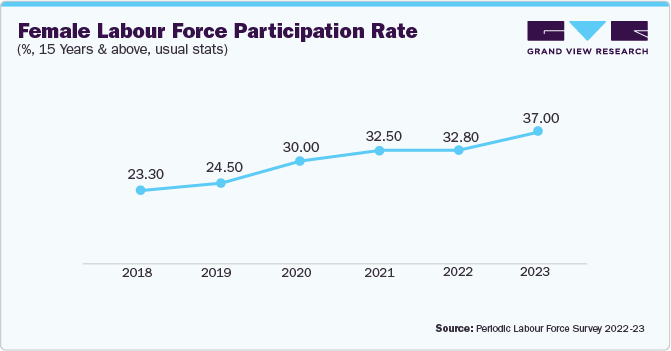

The rise in the number of employed women across the Asia Pacific has fueled an increase in the demand for breastfeeding accessories, making breastfeeding handier for working mothers. According to the Periodic Labour Force Survey Report for 2022-23, released by the Ministry of Statistics and Programme Implementation on October 9, 2023, there has been a notable rise in women's participation in the workforce in India, with the Female Labour Force Participation Rate climbing by 4.2 percentage points to 37.0% in 2023. Products like breast pumps, nursing covers, and nipple shields are particularly popular among working women to help them continue breastfeeding after returning to work. These factors are propelling the market growth.

The rising technological advancements in breastfeeding accessories are making them more convenient and user friendly. Innovations in breast pumps made them quieter, more portable, and more efficient, thereby increasing their adoption among new mothers. For instance, in November 2023, Pigeon launched the GoMini Plus, its second-generation electric breast pump, designed specifically for today's busy mothers. This revolutionary product, crafted with dedication and supported by extensive research in breastfeeding, offers an unparalleled pumping experience. The GoMini Plus sets new standards for ease and comfort for nursing mothers.

The rise in online shopping has simplified the process for consumers to find a broad selection of breastfeeding accessories. E-commerce websites provide benefits such as doorstep delivery, hassle-free returns, and a diverse range of products, motivating an increased number of consumers to buy breastfeeding accessories through the internet. Furthermore, the rapid urban development and shifts in living habits, particularly in developing countries such as China and India, have fueled the expansion of the market for breastfeeding accessories. Urban residents increasingly seek out products that offer convenience and save time, which has led to a surge in demand for a range of breastfeeding accessories.

Market Concentration & Characteristics

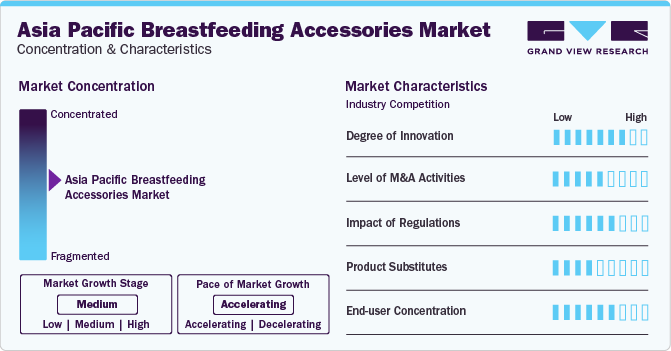

The Asia Pacific market is experiencing a significant growth phase, with the speed of market expansion increasing rapidly. This market is marked by a robust innovation culture, highlighted by the innovation of wearable and hands-free breast pumps. Moreover, the integration of technology into breastfeeding accessories, like intelligent breast pumps that sync with mobile apps, enables mothers to efficiently manage and record their breastfeeding routines, milk production, and feeding schedules.

The Asia Pacific market is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. The increasing demand for innovative and user-friendly breastfeeding accessories drives this trend. Major healthcare companies and medical device manufacturers are keen on expanding their product portfolios and enhancing their technological capabilities through strategic acquisitions.

The Asia Pacific market is experiencing a growing level of regulatory scrutiny, driven by concerns regarding patient safety, efficacy, and the quality of medical devices and products associated with breastfeeding. Moreover, policies that encourage breastfeeding, such as maternity leave extensions and the establishment of breastfeeding-friendly workplaces, indirectly influence the demand for breastfeeding accessories. As more mothers opt to breastfeed due to supportive regulations, the demand for products that facilitate breastfeeding, such as breast pumps, nursing pads, and nipple creams, increases. This creates a positive market environment for manufacturers and retailers of breastfeeding accessories.

Although no direct substitutes exist for breastfeeding accessories, a range of products, such as formula milk, donor milk, and animal-sourced milk, can be used to attain comparable results. In some instances, these products might function as alternatives to breastfeeding accessories.

The focus on end-users plays a crucial role in the market for breastfeeding accessories. The selection of distribution channels for these accessories can vary based on the density of the target audience. The availability of these products might be tailored to consumer preferences, offered in specialty shops, drugstores, online outlets, or via healthcare professionals.

Product Insights

The breastmilk storage & feeding segment led the market with the largest revenue share of 19.01% in 2023. Due to the increasing female workforce in the Asia Pacific region, the demand for practical and effective breastfeeding solutions has increased. Breastmilk storage bags and containers allow working mothers to store milk for later use, enabling them to continue breastfeeding despite their hectic schedules. Moreover, the maternity breaks are short and new mothers return to work soon after giving birth, these factors are driving the demand for breastmilk storage & feeding products. For instance, as per a report by National Bureau of Statistics indicates that, as of 2022, there were 320 million employed women, representing 43.2 percent of the total workforce.

The postpartum recovery accessories segment is anticipated to witness at the fastest CAGR over the forecast period. This growth can be attributed to an increasing awareness of the importance of postpartum care, a rising number of childbirths. In many developing regions, birth rates remain high. These regions are also experiencing increased access to healthcare and a rising middle class, which can afford postpartum recovery accessories. As awareness grows in these populations, demand is expected to rise. For instance, the birth rate for India in 2024 is 16.750 births per 1000 people. These factors are expected to propel the segment growth over the forecast period.

Country Insights

China Breastfeeding Accessories Market Trends

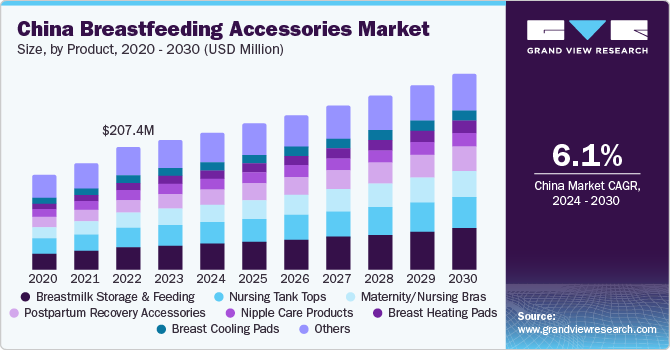

The breastfeeding accessories market in China accounted for the second largest share of the Asia Pacific market in 2023. As urbanization and lifestyle patterns evolve, there's an increased focus on convenience and effectiveness, encouraging demand for breastfeeding accessories like portable breast pumps and nursing covers that enable breastfeeding while on the move.

Japan Breastfeeding Accessories Market Trends

The Japan breastfeeding accessories market is moderately competitive, with the presence of some major companies offering breastfeeding accessories. Moreover, the widespread availability of e-commerce platforms grants convenient access to a diverse array of breastfeeding accessories, fueling sales and market expansion in Japan.

India Breastfeeding Accessories Market Trends

The breastfeeding accessories market in India held the largest share in Asia Pacific market in 2023. The increase in the birth rate is expected to drive the segment’s growth. For instance, according to the Pew Research Center, the birth rate in India is 2.0 births per woman in 2023. Further, market for breastfeeding accessories in India is also anticipated to increase because of increasing awareness campaigns in the country.

Market Driving Factors

Factors

Impact

Description

Rise in Disposable

Income in Asia Pacific region

High

-

Increased Purchasing Power

-

Higher disposable incomes also shift consumer preferences towards premium, high-grade breastfeeding accessories.

Online retailing

High

- Online retailing has made breastfeeding accessories more accessible to a wider audience across the Asia Pacific region.

Rapid urbanization and changing lifestyles

High

- Urban lifestyle often demands more flexible and time- efficient solutions for breastfeeding, leading to a higher demand for breastfeeding accessories.

Al integration in

breastfeeding products

High

- Al technologies enhance the functionality, convenience, and effectiveness of breastfeeding accessories, making them more appealing to new parents in the region.

Rise in government initiatives

Medium

- Government initiatives often include campaigns to raise awareness about the benefits of breastfeeding for both infants and mothers. By promoting breastfeeding as the preferred method of infant nutrition, these campaigns can increase demand for breastfeeding accessories.

Key Asia Pacific Breastfeeding Accessories Company Insights

The breastfeeding accessories market in the Asia Pacific region is growing with opportunities for new entrants. This expansion is largely fueled by a growing recognition of breastfeeding's advantages, an upsurge in the workforce participation of mothers, and supportive government policies encouraging breastfeeding practices. Furthermore, the introduction of technologically advanced breastfeeding accessories, like intelligent breast pumps, is creating openings for newcomers.

Key Asia Pacific Breastfeeding Accessories Companies:

- Medela AG

- Ameda, Inc.

- Koninklijke Philips N.V.

- Pigeon Corporation

- Spectra Baby

- Lavie Mom

- Motif Medical

- Mayborn Group Limited

Recent Developments

-

In December 2023, Pigeon Singapore and LyondellBasell have collaborated to integrate CirculenRenew polymers into baby feeding bottles

-

In November 2023, Pigeon launched its much-anticipated second-generation GoMini Electric Breast Pump, the GoMini Plus. Specifically designed for today's busy mothers, this revolutionary advancement assures a pumping experience unlike any other, perfectly suited to the dynamic lifestyles of modern moms

-

In April 2023, Pigeon has introduced an innovative nursing nipple known as "The third generation of New SofTouch," aiming to enhance the breastfeeding experience. This design facilitates smoother and more comfortable tongue movement for babies, promoting a seamless transition between breastfeeding and bottle feeding, thereby minimizing nipple confusion

Asia Pacific Breastfeeding Accessories Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.14 billion

Revenue forecast in 2030

USD 1.66 billion

Growth Rate

CAGR of 6.40% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, Country

Country scope

China, Japan, India, South Korea, Australia, and Thailand

Key companies profiled

Medela AG; Ameda Inc.; Koninklijke Philips N.V.; Pigeon Corporation; Spectra Baby; Lavie Mom; Motif Medical; Mayborn Group Limited

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Breastfeeding Accessories Market Report Segmentation

This report forecasts revenue growth in Asia Pacific and country levels and provides an analysis of the latest industry trends from 2018 to 2030 in each of the sub-segments. For this study, Grand View Research has segmented the Asia Pacific breastfeeding accessories market report based on product, and country:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Nipple Care Products

-

Breast Shells

-

Breast Pads

-

Breastmilk Preparation and Cleaning Products

-

Breastmilk Storage and Feeding

-

Coolers

-

Others

-

-

Perineal Cooling Pads

-

Breast Heating Pads

-

Breast Cooling Pads

-

Baby Weighing Scales

-

Maternity/Nursing Bras

-

Nursing Tank Tops

-

Lactation Massager

-

Breast Pump Carry/Tote Bags

-

Postpartum Recovery Accessories

-

Disposable Gowns

-

Nursing Pillow

-

Others

-

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Frequently Asked Questions About This Report

b. The Asia Pacific breastfeeding accessories market size was estimated at USD 1.07 billion in 2023 and is expected to reach USD 1.14 billion in 2024.

b. The Asia Pacific breastfeeding accessories market is expected to grow at a compound annual growth rate of 6.40% from 2024 to 2030 to reach USD 1.66 billion by 2030.

b. The India dominated the breastfeeding accessories market with a share of 21.74% in 2023. This is attributable to presence of a large target audience and increasing awareness campaigns in this country.

b. Some key players operating in the Asia Pacific breastfeeding accessories market include Medela AG, Ameda Inc., Koninklijke Philips N.V., Pigeon Corporation, Spectra Baby, Lavie Mom, Motif Medical, and Mayborn Group Limited

b. Key factors that are driving the Asia Pacific breastfeeding accessories market growth include an increase in women’s employment rate, development in healthcare infrastructure in emerging economies, an increase in the number of milk banks, and rising user awareness about breastfeeding accessories.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."