Asia Pacific Biotechnology And Pharmaceutical Services Outsourcing Market Size, Share & Trends Analysis Report By Service (Consulting, Auditing & Assessment), By End-use, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-297-4

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

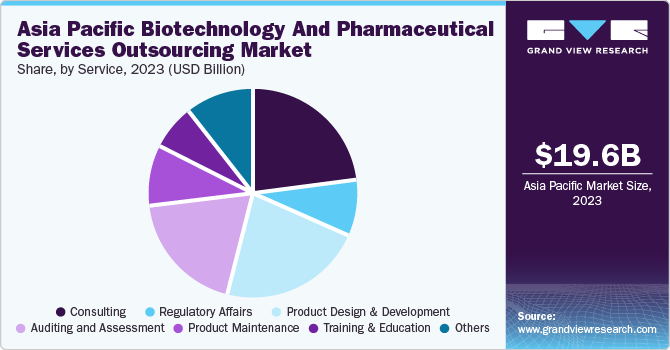

The Asia Pacific biotechnology and pharmaceutical services outsourcing market size was estimated at USD 19.6 billion in 2023 and is expected to grow at a CAGR of 6.26% from 2024 to 2030. The market growth can be attributed to the increasing number of contract research organizations (CROs) and contract development and manufacturing organizations (CDMOs) in countries, such as China and India.

The Asia Pacific biotechnology and pharmaceutical services outsourcing market held a share of 42.4% of the global biotechnology and pharmaceutical services outsourcing market revenue in 2023. Several biotechnology and pharmaceutical companies from developed economies in North America and Europe are opting to outsource various business functions, such as manufacturing, research & development, distribution, drug development, and clinical trials, to contract organizations operating in the region. In recent decades, countries, such as China, India, and Japan, have experienced advancements in industrial infrastructure, availability of technology, and accessibility to resources.

This has resulted in the establishment of outsourcing industry participants who have been running businesses successfully with continuous enhancements. It has also resulted in the availability of experienced professionals, accessibility to innovative technologies, and lower costs of labor and drug development & production. A growing number of contract development and manufacturing organizations (CDMOs) is primarily driving the growth of this market in Asia Pacific. Some of the CDMOs operating in the region are Piramal Pharma Solutions, Syngene International Limited, Sai Life Sciences, and others.

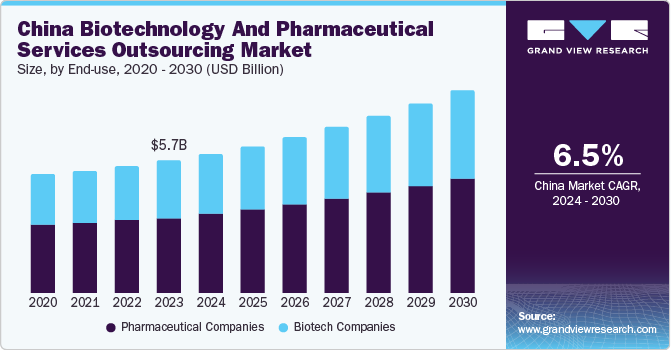

End-use Insights

Based on the end-use, the pharmaceutical companies segment held the highest revenue share of 58.9% in 2023. China has been one of the most preferred locations for many pharmaceutical businesses, in terms of outsourcing research and manufacturing functions. In recent years, India has also been emerging as an alternative for similar services. Positive changes in industrial infrastructure, supportive government initiatives, increasing availability of skilled professionals, and accessibility to advancing technology have attracted many pharmaceutical companies from the U.S., Europe, and other parts of the world.

The biotech companies segment is expected to experience a CAGR of 6.66% from 2024 to 2030. India has been one of the leading manufacturers of generic drugs and exports large amounts of generics to countries, such as the U.S. and others. In recent years, factors, such as lower costs for manufacturing, clinical trials, distribution, world-class facilities provided by CDMOs in the region, the presence of technical expertise, and skilled professionals have driven the growth of this segment.

Service Insights

The consulting services segment dominated the regional market and held a revenue of 23.19% in 2023. Pharmaceutical industry consulting services include clinical development, regulatory affairs, strategic planning, business development, quality management, and more. In addition, aspects, such as R&D, resource management, digital transformation, Environmental, Social, and Governance (ESG), risks & regulations, sales & marketing, and medical technology are also part of consulting services provided by organizations to leading companies in the biotechnology and pharmaceutical industry.

The training & education segment is expected to witness a CAGR of 4.11% from 2024 to 2030. Outsourcing functions, such as employee skill development, learning, and development has been one of the prominent trends as many pharmaceutical companies have been focusing on their core competencies and strengths. Cost-effective outsourcing services offered by organizations in the market, emerging providers of e-learning solutions, and talented instructors have been fueling the segment's growth.

Country Insights

China Biotechnology And Pharmaceutical Services Outsourcing Market Trends

China biotechnology and pharmaceutical services outsourcing market dominated the regional industry and accounted for a share of 29.3% in 2023. This is primarily due to factors, such as lower labor costs, reputation as one of the most preferred alternatives for outsourcing services, and availability of infrastructure. In addition, favorable government policies that have been welcoming pharmaceutical companies to outsource their business functions such as clinical trials and drug development to contractors in China have been driving the market.

India Biotechnology And Pharmaceutical Services Outsourcing Market Trends

The biotechnology and pharmaceutical services outsourcing market in India is expected to experience a significant CAGR of 6.72% from 2024 to 2030. This can be attributed to advancements in industrial infra, availability of world-class facilities, presence of skilled professionals, and lower costs associated with procurement of materials and other business areas.

Key Asia Pacific Biotechnology And Pharmaceutical Services Outsourcing Company Insights

Some of the prominent companies in the Asia Pacific biotechnology and pharmaceutical services outsourcing market include Dr. Reddy’s Laboratories, MSN Laboratories, Syngene International Limited, Aragen Life Sciences Ltd., Bellen, Arlak Biotech Pvt. Ltd., and others. The highly competitive market has been encouraging key companies in the industry to embrace advanced technologies, accommodate changes in manufacturing processes, and develop highly skilled and competitive teams of experts.

-

Syngene International Ltd., one of the prominent research, development, and manufacturing organizations (CRDMOs) in the region, offers services, such as discovery, development, and manufacturing. Primary clients for the company are from industries, such as biotechnology, pharmaceutical, animal health, agrochemicals, and consumer goods

-

Aragen Life Sciences Ltd. is a global research and manufacturing partner for companies operating in the life sciences industry. A key focus area for the company is the development and early-stage discovery of new molecular entities (NMEs). The company operates from six facilities, out of which five are in India and one is located in Morgan Hill, California, U.S.

Key Asia Pacific Biotechnology And Pharmaceutical Services Outsourcing Companies:

- Dr. Reddy’s Laboratories

- MSN Laboratories

- Syngene International Ltd.

- Aragen Life Sciences Ltd.

- Bellen

- Arlak Biotech Pvt. Ltd.

- Gracure Pharmaceuticals Ltd.

- Nvron Life Science

Recent Developments

- In March 2024, Aragen Life Sciences Ltd., one of the CRDMOs from Asia Pacific, operationalized the primary phase of its biologics manufacturing facility located in Bengaluru, India through its subsidiary entity Aragen Biologics Pvt. Ltd.

Asia Pacific Biotechnology And Pharmaceutical Services Outsourcing Market Report Scope

|

Report Attribute |

Details |

|

Revenue forecast in 2030 |

USD 29.5 billion |

|

Growth Rate |

CAGR of 6.26% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Country scope |

China; India; Japan; Australia; South Korea; Thailand |

|

Segments covered |

End-use, service, country |

|

Key companies profiled |

Dr. Reddy’s Laboratories; MSN Laboratories; Syngene International Ltd.; Aragen Life Sciences Ltd.; Bellen; Arlak Biotech Pvt. Ltd.; Gracure Pharmaceuticals Ltd.; Nvron Life Science |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Asia Pacific Biotechnology And Pharmaceutical Services Outsourcing Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific biotechnology and pharmaceutical services outsourcing market report based on end-use, service and country:

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical Companies

-

Biotech Companies

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Consulting

-

Regulatory Consulting

-

Clinical Development Consulting

-

Strategic Planning & Business Development Consulting

-

Quality Management Systems Consulting

-

Others

-

-

Regulatory Affairs

-

Legal Representation

-

Regulatory Writing & Publishing

-

Product Registration & Clinical Trial Applications

-

Regulatory Submissions

-

Regulatory Operations

-

Others

-

-

Product Design & Development

-

Research, Strategy, & Concept Generation

-

Concept & Requirements Development

-

Detailed Design & Process Development

-

Design Verification & Validation

-

Process Validation & Manufacturing Transfer

-

Production & Commercial Support

-

-

Auditing And Assessment

-

Product Maintenance

-

Training & Education

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Thailand

-

Frequently Asked Questions About This Report

b. The Asia Pacific biotechnology and pharmaceutical services outsourcing market size was estimated at USD 19.6 billion in 2023 and is expected to reach USD 20.51 billion in 2024.

b. The Asia Pacific biotechnology and pharmaceutical services outsourcing market is expected to grow at a compound annual growth rate of 6.26% from 2024 to 2030 to reach USD 29.5 billion by 2030.

b. The China dominated the Asia Pacific biotechnology and pharmaceutical services outsourcing market with a share of 29.3% in 2023. This is attributable to advanced healthcare infrastructure, growing number of clinical trials, reduced service cost , and availability of skilled professionals among others.

b. Some key players operating in the Asia Pacific biotechnology and pharmaceutical services outsourcing market include Dr. Reddy’s Laboratories; MSN Laboratories; Syngene International Limited; Aragen Life Sciences Ltd.; Bellen; Arlak Biotech Pvt. Ltd.; Gracure pharmaceuticals ltd.; Nvron Life Science

b. Key factors that are driving the market growth include growing focus on clinical trials, increasing outsourcing trends, reduced service cost, and globalization of clinical trials among others.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."