- Home

- »

- Pharmaceuticals

- »

-

Asia Pacific Biopharma Excipients Market Size Report, 2030GVR Report cover

![Asia Pacific Biopharma Excipients Market Size, Share & Trends Report]()

Asia Pacific Biopharma Excipients Market Size, Share & Trends Analysis Report By Product (Solubilizers & Surfactants/Emulsifiers, Polyols, Carbohydrates, Specialty Biopharma Excipients), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-700-1

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

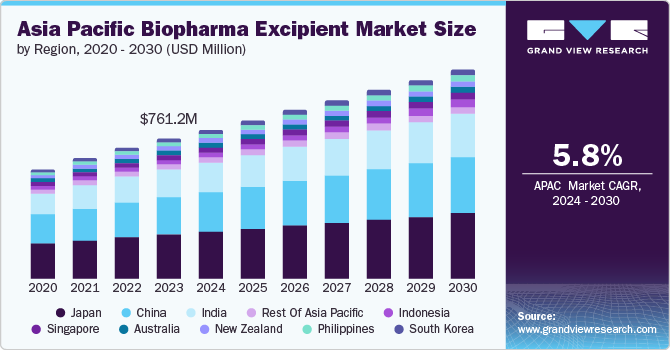

The Asia Pacific biopharma excipient market size was valued at USD 761.2 million in 2023 and is projected to grow at a CAGR of 5.8% from 2024 to 2030. This growth is attributed to the region's expanding pharmaceutical industry, advancements in functional excipients, and the rising use of orphan drugs are fueling robust growth prospects. In addition, the emergence of multifunctional excipients and the shift of pharmaceutical manufacturing to emerging markets such as China and India further enhance these prospects. Furthermore, the burgeoning biosimilar industry in APAC presents new opportunities for excipients used in biopharmaceutical formulations.

Biopharmaceutical excipients play a vital role in improving drug stability and bioavailability of biologics. However, biopharmaceutical excipients do not show any therapeutic activity, some excipients show compatibility with drug substances. Manufacturing, maintenance, and storage of products are usually complex. The additives help drugs maintain their active ingredients and ensure their stability for longer periods. Moreover, to meet the growing demand for new biopharmaceutical excipients, many key companies focus on increasing their production process to launch a wide range of excipients. These excipients are passive spectators as they don’t react to final products; instead, they stabilize them. Some significant biopharmaceutical excipients are cellulose derivatives, polysaccharides, plant derivatives, and synthetic substances. In the healthcare industry, excipients are also used to add an extra layer to medical equipment and devices that are commonly used in surgeries

In addition, some biopharmaceutical excipients are utilized for multiple purposes and can be used for a variety of applications. For instance, hypromellose is utilized as an emulsifying, suspending, coating, and viscosity-increasing agent for medical devices. Therefore, biopharmaceutical excipients are important in drug formulation as carriers for active drug components to their targeted sites.

Furthermore, with the rise of personalized therapies, the demand for excipients that enhance drug efficacy, stability, and targeted delivery has grown. These excipients help improve the bioavailability, solubility, and tonicity of active pharmaceutical ingredients (APIs), making them indispensable in modern drug development. The biopharmaceutical excipients market is evolving rapidly, driven by advancements in biotechnology and the increasing need for more effective and stable drug formulations. The market is projected to grow significantly, reflecting the expanding role of these excipients in improving drug delivery and patient results.

Product Insights

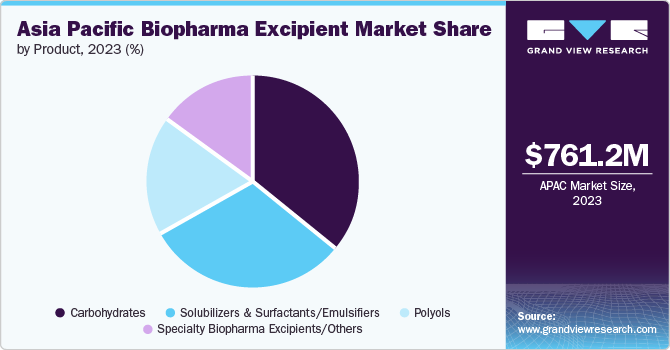

Carbohydrates dominated the market and accounted for the largest revenue share of 35.9% in 2023. It is an excipient made from carbohydrates such as sugar, starch, and fiber. These types of excipients are used as sweeteners, tablets, capsule diluents, and tonicity agents. Dextrose, sucrose, and starch are the most widely used carbohydrates for protein stabilization. Some other carbohydrate excipients comprise trehalose, maltose, galactose, and mannose. In addition, pure carbohydrates, including trehalose, are being used in the creation of biosimilars due to their capacity to increase the end product's yield, stabilize a variety of biologics, reduce aggregation, and enhance the entire biopharmaceutical manufacturing process.

Polyols is expected to grow at a CAGR of 6.1% over the projected years. These are available as sorbitol, maltitol, or isomalt. They have less impact on blood glucose levels, making them preferred among those with diabetes or people seeking to lose weight. They are becoming crucial in the market because of their versatile role in drug formulations. They are significant in protein therapeutics, where they enrich and enhance tonicity and stability, ensuring the integrity of protein-based drugs. They are also present as excipients in the form of tablets, syrups, and elixirs due to their moisture-retaining characteristics and ability to enhance texture.

Country Insights

Asia Pacific biopharma excipient market accounted for a significant revenue share in the global market in the year 2023. The growth in the geriatric population, changes in lifestyle, and increasing urbanization contribute to a higher incidence of non-contagious diseases such as diabetes, cancer, and autoimmune disorders. A wide patient base with unmet needs in Asian countries, combined with the rising diffusion of market participants, is encouraging R&D activities associated with biosimilars in the biopharmaceutical industry.

Japan Biopharma Excipient Market Trends

The biopharma excipient market in Japan dominated the Asia Pacific market with a commanding share of 30.7%. The rising geriatric population and the growing incidence of chronic disorders have driven demand for biopharmaceuticals, resulting in the need for specialized excipients. Due to several key growth factors, Japan has emerged as a dominant player in the biopharma excipient market. Moreover, the country's strong emphasis on high-quality products, often sold at premium prices, has significantly contributed to its dominance in the market.

China Biopharma Excipient Market Trends

China biopharma excipient market rise in R&D, prompt treatment of medications' availability, the development of the healthcare industry, and the rising need for secure, effective medicinal practices and other therapies have led to market expansion for biopharma excipients. In addition, rising government investments in healthcare and the continuous demand for drugs have led to market expansion for biopharma excipients.

India Biopharma Excipient Market Trends

The biopharma excipient market in India is projected to grow in the biopharma excipient market with an anticipated CAGR of 6.5% in the forecast years. The requirement for specified excipients to improve formulation and distribution has grown because of the escalation of Indian biotech companies focusing on developing and enhancing biological drugs, have boosted the market growth in upcoming years.

Key Biopharma Excipient Company Insights

Some of the key companies in the Asia Pacific biopharma excipient market include Signet Excipients Pvt. Ltd., ABITEC, Sigachi Industries, Roquette Frères, Colorcon, Meggle GmbH & Co. KG, CLARIANT, DFE Pharma, SPI Pharma, and IMCD. These companies are focusing on development and gaining a competitive edge in the industry. Therefore, key players are taking several strategic initiatives.

-

Signet Excipients Pvt. Ltd. is a distributor of excipient products for pharmaceutical, nutraceutical, and bio-pharma companies. The company offers a broad range of excipients, including diluents and fillers, sweeteners, disintegrants, binders, surfactants, lubricants, plasticizers, thickeners, and stabilizers. The company’s portfolio features renowned brands such as A-Tab, Cationics, Combilac, Kleptose, Magnesium Oxide, and Lycoat RS.

-

Roquette Frères is a provider of pharmaceutical excipients with an extensive product portfolio that includes starches, proteins, sugars, dietary fibers, polyols, oils, and bioethanol. These products have applications in many industries, such as food and nutrition, pharmaceuticals, nutraceuticals, cosmetics, animal nutrition, and industrial markets.

Key Asia Pacific Biopharma Excipient Companies:

- Signet Excipients Pvt. Ltd.

- ABITEC

- Sigachi Industries.

- Roquette Frères

- Colorcon

- Meggle GmbH & Co. KG

- CLARIANT

- DFE Pharma

- SPI Pharma

- IMCD.

- Spectrum Chemical

- Pharmonix

- BASF SE

Recent Developments

-

In July 2024, Roquette Frères partnered with Bonumose, a leader in developing enzymatic solutions for synthesizing uncommon monosaccharides. With its low-calorie content and extremely low glycemic index, tagatose is a natural sweetener whose development is aimed at advancing. The cooperation looks to increase and improve tagatose's scalability by combining Bonumose's cutting-edge enzymatic technology with Roquette's vast experience in the production of starch and starch-based sweeteners.

-

In February 2024, IMCD acquired the 30% share of Indian specialty chemicals distributor Signet Excipients Private Limited, a distribution partner and formulator of ingredients and specialty chemicals.

Asia Pacific Biopharma Excipient Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 811.6 million

Revenue forecast in 2030

USD 1.1 billion

Growth rate

CAGR of 5.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regional scope

Asia Pacific

Country scope

Japan, China, India, Malaysia, South Korea, Philippines, New Zealand, Australia, Singapore, Indonesia

Key companies profiled

Signet Excipients Pvt. Ltd.; ABITEC; Sigachi Industries.; Roquette Frères; Colorcon; Meggle GmbH & Co. KG; CLARIANT; DFE Pharma; SPI Pharma; IMCD.; Spectrum Chemical; Pharmonix; BASF SE

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Biopharma Excipients Market Report Segmentation

This report forecasts revenue growth at regional and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific biopharma excipient market report based on product and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Solubilizers & Surfactants/Emulsifiers

-

Triglycerides

-

Esters

-

Others

-

-

Polyols

-

Mannitol

-

Sorbitol

-

Others

-

-

Carbohydrates

-

Sucrose

-

Dextrose

-

Starch

-

Others

-

-

Specialty Biopharma Excipients/Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Asia Pacific

-

Japan

-

China

-

India

-

Malaysia

-

South Korea

-

Philippines

-

New Zealand

-

Australia

-

Singapore

-

Indonesia

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."