- Home

- »

- Plastics, Polymers & Resins

- »

-

Asia Pacific Bio Plasticizers Market, Industry Report, 2030GVR Report cover

![Asia Pacific Bio Plasticizers Market Size, Share & Trends Report]()

Asia Pacific Bio Plasticizers Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Epoxidized Soybean Oil, Castor Oil-based Plasticizers), By Application (Packaging Materials, Consumer Goods, Automotive & Transport), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-232-8

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Asia Pacific Bio Plasticizers Market Trends

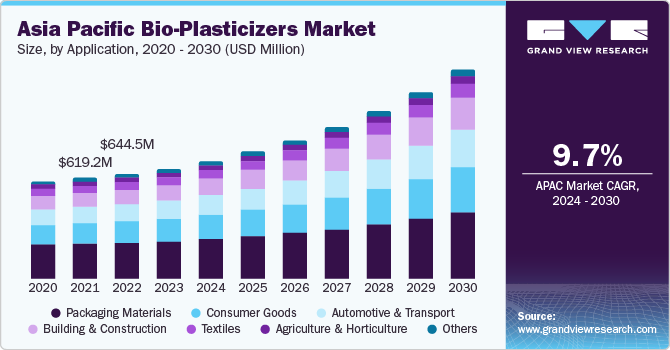

The Asia Pacific bio plasticizers market size was estimated at USD 677.24 million in 2023 and is anticipated to grow at a CAGR of 10.1% from 2024 to 2030. The production landscape of bio-plasticizers is likely to shift toward emerging economies, including China and India, which is expected to drive market growth in the area. Furthermore, it is anticipated that regional bio-plasticizer production will increase as a result of fast industrialization and government backing for homegrown manufacturing. This will create profitable prospects for producers of bio-plasticizers worldwide.

Bio plasticizers are used in the packaging sector to improve the finished product's look while offering an environmentally responsible alternative.

The market is being propelled by a surge in demand for flexible PVC across various applications and a ban on specific plasticizers. The market is also advancing from the high consumption of consumer goods and the boom in construction activities in the region. In addition, ongoing research into bio-based plasticizers and the emergence of new applications are expected to open up numerous growth opportunities. Furthermore, the rise in collaborations and partnerships between bio-plasticizer manufacturers and end-use industries is noteworthy. The expansion of the packaging industries in the Asia-Pacific region is also fueling the demand for bio-plasticizers. For instance, The Packaging industry in India is anticipated to reach $ 204.81 billion by 2025, registering a CAGR of 26.7%, thereby driving the growth of the market in the country.

The global bio plasticizers market industry is dominated by end users' growing demand for eco-friendly plastics and plastic manufacturers' growing concerns about sustainability. Concerns about climate change are becoming more and more of a global issue. As stated, plastics are used in many different industries including textiles, building & construction, logistics, healthcare, aviation, and packaging there is a growing need for sustainability over the long term due to the effects on the environment and society. Sustainable plastics manufacturing processes are also anticipated to have a beneficial economic impact by fostering resource efficiency, reducing waste and pollution, and driving market growth.

Market Concentration & Characteristics

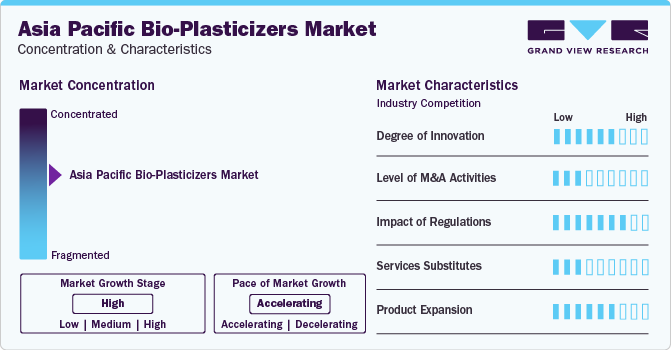

The Asia Pacific bio plasticizers market exhibits a moderate to high level of innovation due intricacy of creating bio-based alternatives to conventional plasticizers means that, although research and development are still underway in the field of bio plasticizers to increase their performance and sustainability, the rate of innovation is not as quick as in certain other fields.

The level of merger and acquisition is limited in the market. This is due to several factors, including the market's abundance of small and medium-sized businesses, the absence of significant firms' attempts at consolidation, and the regulatory uncertainty surrounding bio-based products.

The market is significantly impacted by regulations. There's a growing need for bio-based alternatives due to rules aiming at limiting the usage of plasticizers based on phthalates and growing environmental concerns. The region's adoption of bio-plasticizers is further fueled by regulatory actions that support sustainability and the use of renewable resources.

The market is experiencing moderate product expansion. The market is currently dominated by a small number of major manufacturers providing both conventional and bio-based choices, despite some diversification and the introduction of new bio-based plasticizer products. However, there may be room for more product expansion in the future as demand for sustainable solutions rises and environmental challenges become more widely recognized. For instance, in February 2024, DIC Corporation unveiled a new antifoaming agent specifically designed for electric vehicle (EV) lubricating oils, which is devoid of perfluoroalkyl and polyfluoroalkyl substances (PFASs). This innovative product showcases remarkable antifoaming capabilities, thermal stability, and durability, surpassing the challenges faced by PFAS-free alternatives in the past.

Application Insights

The packaging material accounted for the largest market share of 34.02% in 2023. The expansion of bio-plasticizer-based plastics in the market is driven by their widespread use in packaging sectors, such as food and beverage, personal care, films and sheets, and household care products. Consumer preference for sustainable packaging and increasing global landfill pollution issues are significant factors contributing to the growth of bio-plasticizer-based packaging products. During the pandemic, there has been a shift in demand towards food packaging applications due to the closure of restaurants and food service outlets.

The consumer goods sector held a substantial market share in 2023, significantly contributing to the growth of bio-plasticizer-based plastics. Key consumer goods under this segment include electronic devices, household appliances, and others. Various products, like vacuum cleaners, loudspeakers, touch-screen computer cases, and mobile cases, are made from biodegradable plastics, thereby driving the demand of the bio plasticizers.

In addition, the automotive segment experienced remarkable growth in 2023 due to the utilization of bio-plasticizer-based plastics in applications such as under-the-hood mechanisms and interior parts. Bioplastics are highly effective in reducing carbon footprint due to their high bio-based content. They offer high gloss, excellent color ability, impact resistance, dimensional stability, and UV resistance. The use of bio-plasticizers helps decrease the overall vehicle weight, which in turn reduces transportation costs.

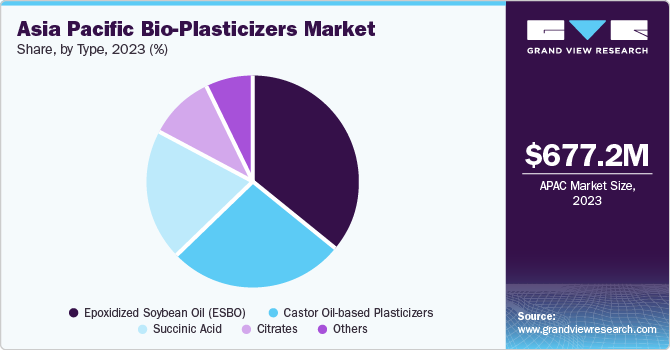

Type Insights

The Epoxidized Soybean Oil (ESBO) led the market and accounted for the largest revenue share of 36.08% in 2023. Numerous factors, including health and environmental concerns as well as regulatory restrictions related to traditional plasticizers, are responsible for this growth. Growing public awareness of the harm that conventional plasticizers cause to the environment and human health has positively impacted the market for ESBO. Manufacturers are gradually switching to bio-based substitutes as a result. To improve the flexibility and durability of plastic products, especially those containing polyvinyl chloride (PVC), which are used in a variety of industries such as consumer goods, packaging, and construction, ESBO, a plasticizer made from soybean oil, is applied.

Castor oil-based plasticizers registered a substantial market share in 2023 owing to their great performance, non-toxicity, biodegradability, and sustainable sourcing, castor oil-based bio-plasticizers are in more demand.

Furthermore, succinic acid witnessed notable growth in 2023. Succinic acid is perfect for producers who prioritize environmental sustainability because it can be obtained from a variety of renewable sources, the most popular being sugarcane and corn. Many countries have put laws into place to restrict the use of specific plasticizers, particularly those made from petroleum or those that include dangerous compounds. For instance, in Indonesia, Jakarta and Bali have implemented bans on plastic at the city-level. In addition, there is an Extended Producer Responsibility (EPR) law being developed and is currently in progress. Consequently, there is now a greater need for substitute plasticizers, including succinic acid-based plasticizers.

Country Insights

China Bio Plasticizers Market Trends

The bio plasticizers market in China dominated the Asia Pacific market and accounted for the highest revenue share of 41.21% in 2023. The growth in the bio-plasticizers market can be attributed to increasing demand across various sectors, such as packaging, automotive and transport, agriculture, consumer goods, building and construction, and textiles. China's significant consumption of non-alcoholic beverages contributes to the demand for bio-plasticizers in the packaging industry, while its high consumption of packaged food products further boosts the market.

India Bio Plasticizers Market Trends

The India bio plasticizers market held a notable revenue share in 2023, due to factors like population growth, increased apparel consumption, and foreign investments. The market is expected to grow further as demand for bio-plasticizers increases across medical, consumer goods, packaging, textiles, automotive, and agriculture applications. Additionally, government initiatives to reduce single-use plastics will likely drive demand for bio-plasticizers.

Japan Bio Plasticizers Market Trends

The bio plasticizers market in Japan experienced substantial growth in 2023, primarily driven by demand for packaging and consumer goods. Key factors influencing market growth include public concerns about plastic waste, China's refusal to import plastic trash from Japan, and the rising prevalence of diseases among the aging population, which increases the demand for medical devices and, consequently, bio-plasticizers.

Key Asia Pacific Bio Plasticizers Company Insights

There are various small to medium-sized enterprises present in the Asia Pacific disposable gloves market that offer a wide range of bio-based plasticizer products. Although there are significant market players, the involvement of numerous smaller companies and startups also plays a role in the market's fragmented state. Moreover, the market's fragmentation is influenced by regional disparities in demand patterns and regulatory environments.

Key players in the market include DIC Corporation; Aekyung Chemical; and Zhejiangjiaao Enprotech Stock Co., Ltd.

-

DIC Corporation operates in three primary business segments: packaging & graphics, color & display, and functional foods. Leveraging its expertise in organic pigments and synthetic resins, key components in printing inks, DIC has developed a diverse product line. The company aims to fulfill societal and customer needs while exploring new businesses to tackle local and global challenges.

-

Aekyung Chemical focuses on manufacturing basic organic chemicals, such as phthalic anhydride, plasticizers, maleic anhydride, itaconic acid, polyol, and bio-diesel. Primarily serving the Korean market with limited international reach, the company's products cater to various industries.

JiangXi East Huge Dragon Chemical Co., ltd; and Hebei Jingu Plasticizer Co. Ltd. are some other participants in the Asia Pacific Bio Plasticizers market

-

Hebei Jingu Plasticizer Co. Ltd., a major player in China's lubricants and chemical industry, consists of Hebei Jingu Plasticizer Co., LTD., Hebei Jingu Recycling Resources Development Co., LTD, and Hebei Jingu New Energy Co., LTD. This company operates multiple production lines, including Epoxy Fatty Acid Methyl Ester, Fatty Acid Methyl Ester (Biodiesel, Methyl Oleate, Epoxidized Soybean Oil, Methyl Palmitate, Chlorinate Palmitic Acid Methyl Ester, Methyl Oleate, Plant-Based Polyols, and Refine Glycerine.

Key Asia Pacific Bio Plasticizers Companies:

- DIC Corporation

- Zhejiangjiaao Enprotech Stock Co., Ltd.

- Aekyung Chemical

- JiangXi East Huge Dragon Chemical co.,ltd

- Hebei Jingu Plasticizer Co. Ltd.

- UPC Technology Corp.

- Toling Corporation (m) sdn bhd

- KLJ GROUP

- Hanwha Chemical

- Cargill Inc.

- Avient Corporation

Recent Developments

-

In February 2024, DIC Corporation has recently announced the development of a revolutionary epoxy resin curing agent. This new agent provides heat resistance of up to 200°C and is also recyclable, while still retaining the traditional benefits of epoxy resins, such as outstanding heat resistance, durability, and mechanical properties. The curing agent helps to tackle the recycling challenges that thermosetting plastics face by allowing for remolding and reusability. Additionally, it assists in reshaping epoxy products, which decreases environmental impact throughout their life cycle and helps to achieve carbon neutrality objectives.

-

In December 2023, Aekyung Chemical has acquired LG Chem's 50% stake in VPCHEM, which has given the company a production base in Vietnam. This acquisition has enabled Aekyung Chemical to gain control of the only facility in Vietnam that is capable of manufacturing plasticizers, and it has increased the company's annual production capacity to 660,000 tons. Currently, Aekyung Chemical has a production capacity of 550,000 tons, with 400,000 tons in Korea and 150,000 tons in China. This strategic move has allowed the company to focus on producing and supplying eco-friendly plasticizers for North America and Europe, as well as general-purpose and functional plasticizers for China and Vietnam.

Asia Pacific Bio Plasticizers Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 724.63 million

Revenue forecast in 2030

USD 1.29 billion

Growth rate

CAGR of 10.1% from 2024 to 2030

Base year for estimation

2023

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, application

Country scope

China; India; Japan; South Korea; Indonesia; Thailand

Key companies profiled

DIC Corporation; Zhejiangjiaao Enprotech Stock Co., Ltd.; Aekyung Chemical; JiangXi East Huge Dragon Chemical co.,ltd; Hebei Jingu Plasticizer Co. Ltd.; UPC Technology Corp.; Toling Corporation (m) sdn bhd; KLJ GROUP; Hanwha Chemical; Cargill Inc.; Avient Corporation.

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Bio Plasticizers Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific bio plasticizers market report based on type, and, application:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Epoxidized Soybean Oil (ESBO)

-

Castor Oil-based Plasticizers

-

Citrates

-

Succinic Acid

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Packaging Materials

-

Consumer Goods

-

Automotive & Transport

-

Building & Construction

-

Textiles

-

Agriculture & Horticulture

-

Others

-

-

Country Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Indonesia

-

Thailand

-

-

Frequently Asked Questions About This Report

b. The Asia Pacific bio plasticizers market was valued at USD 677.24 million in the year 2023 and is expected to reach USD 724.63 million in 2024.

b. The Asia Pacific bio plasticizers market is expected to grow at a compound annual growth rate of 10.1% from 2024 to 2030 to reach USD 1.29 billion by 2030.

b. The epoxidized soybean oil (ESBO) accounted for the largest market share of 36.08% in 2023. This growth is due to several factors such as environmental and health concerns, and regulatory requirements associated with traditional plasticizers.

b. The key market player in the Asia Pacific bio plasticizers market includes DIC Corporation; Zhejiangjiaao Enprotech Stock Co., Ltd.; Aekyung Chemical; JiangXi East Huge Dragon Chemical co.,ltd; Hebei Jingu Plasticizer Co. Ltd.; UPC Technology Corp.; Toling Corporation (m) sdn bhd; KLJ GROUP; Hanwha Chemical; Cargill Inc.; Avient Corporation.

b. The key factors that are driving the Asia Pacific bio plasticizers market include, an increase in regional bio-plasticizer production and reduction in import dependency due to rapid industrialization and government backing for homegrown manufacturing, creating a profitable prospects for producers of bio-plasticizers worldwide, thereby driving the market growth

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.