- Home

- »

- Plastics, Polymers & Resins

- »

-

Asia Pacific Bag-in-Box Container Market Size, Report, 2030GVR Report cover

![Asia Pacific Bag-in-Box Container Market Size, Share & Trends Report]()

Asia Pacific Bag-in-Box Container Market Size, Share & Trends Analysis Report By Application (Food & Beverage, Industrial Liquids, Household Products), By Capacity, By Material State, By Tap, By Component, By Country, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-054-3

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

APAC Bag-in-Box Container Market Trends

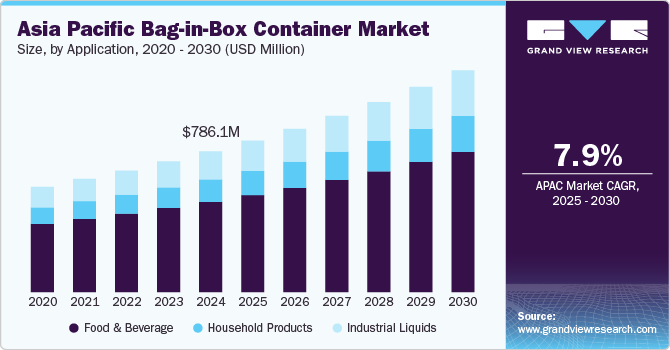

The Asia Pacific bag-in-box container market size was estimated at USD 786.1 million in 2024 and is projected to grow at a CAGR of 7.9% from 2025 to 2030. The market growth can be attributed to the increasing demand from various industries such as food & beverages and household products, and increasing preference for packaged natural food products among consumers is expected to drive the market growth over the forecast period.

The market is experiencing significant growth primarily driven by the rapid expansion of the food and beverage industry across emerging economies such as China, India, and Southeast Asian nations. The increasing adoption of convenient packaging solutions by beverage manufacturers, particularly for products such as fruit juices, dairy, and wine, has been a major catalyst. For instance, companies such as The Coca-Cola Company and local beverage manufacturers in countries such as Thailand and Malaysia have begun utilizing bag-in-box systems for their fountain drink concentrates and post-mix solutions.

The rise of organized retail and the e-commerce boom has created another substantial growth avenue for bag-in-box containers. The packaging format's ability to provide extended shelf life, reduced storage space requirements, and lower transportation costs makes it particularly attractive for online grocery platforms and modern retail chains. Countries such as South Korea and Japan are seeing increased adoption in institutional settings such as hotels, restaurants, and catering services, where the ease of handling and dispensing larger volumes of liquids is particularly valuable.

Environmental consciousness and sustainability initiatives are also playing a crucial role in market growth. Bag-in-box containers typically have a better product-to-package ratio compared to traditional packaging formats, resulting in reduced plastic usage and lower carbon footprint during transportation. This aligns well with strengthening environmental regulations in countries such as Singapore and Japan, where governments are actively promoting sustainable packaging solutions. In addition, the growing industrial sector in countries like Vietnam and Indonesia is driving demand for bag-in-box containers in non-food applications, such as chemicals, lubricants, and industrial fluids, where the packaging format's durability and cost-effectiveness provide significant advantages over conventional packaging options.

Application Insights

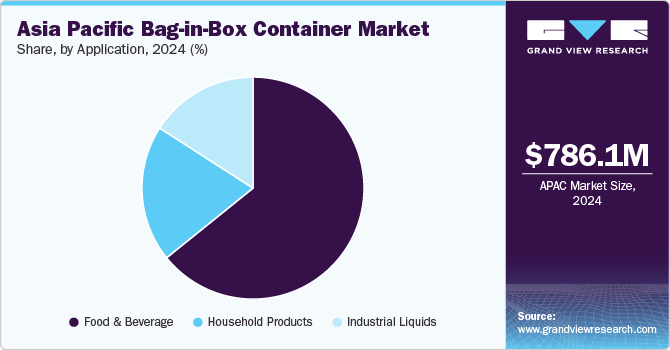

Based on application, the market is segmented into food & beverages, household products, and industrial liquids. The food & beverages segment led the market with the largest revenue share of 64.2% in 2024, owing to an improved lifestyle, higher disposable income, and growing awareness about healthier products among consumers. Moreover, the increasing base of the young population and rising per capita income, coupled with the rising prevalence of alcohol consumption and innovations in packaging design, are expected to increase the market growth over the forecast period.

The household products segment is expected to grow at the fastest CAGR of 8.5% over the forecast period. Rising demand for household products such as fabric softeners and surface cleaners is expected to drive the demand for this product in the household products segment. The product is made available at low prices and provides ease of handling, which is expected to drive the market growth of bag-in-box containers in the region. The use of bag-in-box containers in various applications, including fabric care, floor cleaners, kitchen cleaners, and bathroom cleaners, are likely to drive market growth over the forecast period.

The demand for bag-in-box containers in the industrial liquid segment on account of ease of product handling and usage is expected to drive market growth over the forecast period. The special performance characteristics of plastics such as chemical resistance, rigidity, and strength for packaging products such as oils and lubricants are expected to drive the market growth over the forecast period.

Capacity Insights

Based on capacity, the market is segmented into <1 liter, 1-5 liter, 5-10 liter, 10-20 liter, and > 20 liter. The 5-10-liter segment accounted for the largest revenue share in 2024. The 5-10-liter segment dominated the market space on account of the growing foodservice industry in Asia Pacific, which relies heavily on bulk packaging for cost efficiency and storage space management.

The <1 liter capacity segment is primarily used for small-scale packaging needs, especially for premium beverages like wine, juices, and specialty oils. This segment is favored for single-serve or individual portions, where convenience and portability are key factors. The demand for <1 liter bag-in-box packaging is driven by the growing trend of premiumization in beverages and the rising demand for on-the-go consumption.

The 1-5 liter capacity segment is one of the most versatile and widely used in the bag-in-box market, particularly for beverages such as wine, juices, and liquid dairy products. This size is popular for both household and small business use, offering a balance between volume and convenience.

Material State Insights

Based on material state, the market is segmented into semi-liquid and liquid state products. The semi-liquid state segment accounted for the largest revenue share in 2024. The semi-liquid state includes industrial products such as industrial fluids and petroleum products. Furthermore, household cleaners, liquid detergents, dairy products and others are also present in the semi liquid state.

The semi liquid state materials in industrial applications have higher shelf life compared to liquid state products; hence, the prior is expected to dominate the market over the forecast period.

Tap Insights

Based on tap, the market is segmented into with tap and without tap. The ‘with tap’ segment accounted for the largest revenue share in 2024. The segment with tap refers to bag-in-box packaging that features an integrated tap for easy dispensing of liquid contents. This type of packaging is commonly used for beverages such as wine, juices, and liquid food products, allowing users to pour out the product without removing the bag from the box. Its convenience and ease of use make it a popular choice for both commercial and household applications.

The without-tap segment of bag-in-box containers refers to packaging without an integrated tap, typically used for bulk transportation or storage of liquids and semi-liquids. This type of packaging is often seen in industrial and food service settings where the contents are poured out or transferred to other containers in larger quantities. It provides a cost-effective solution for liquid storage and transportation.

Component Insights

Based on component, the market is segmented into bag, box, and fitment segment. The bag segment accounted for the largest revenue share in 2024. The bag segment consists of flexible, multi-layered bags that store liquids or semi-liquid products. These bags are designed to protect the contents from contamination and oxidation, ensuring product freshness. In addition, they are collapsible, minimizing air exposure and preserving product integrity during dispensing, making them ideal for products such as wine, juices, dairy, and liquid food items.

The box segment serves as the outer, rigid structure that provides mechanical support and protection to the flexible inner bag. Typically made from corrugated cardboard or other paper-based materials, the box ensures the product remains stable during transportation and storage. The box also serves as a branding platform for manufacturers, offering space for labeling and product information. Its design varies based on the product it holds, from standard cube shapes to specialized designs for efficient stacking and storage.

The fitment segment refers to the closures or dispensing systems attached to the bag, such as taps, caps, or spouts. These fitments allow controlled and hygienic dispensing of liquid products without needing to remove the bag from the box. They are critical components for applications such as beverage, dairy, and industrial liquid packaging, where repeated use and portion control are important.

Country Insights

China Bag-in-Box Container Market Trends

The bag-in-box container market in China led the market with the largest revenue share of 45.16% in 2024, owing to the growth of the product in the food & beverage industry. China's dominance in the Asia Pacific market is primarily driven by its massive food and beverage industry, coupled with changing consumer preferences and retail modernization. The country's rapid urbanization and growing middle class have led to increased demand for convenient, portable, and sustainable packaging solutions. For example, major Chinese wine producers such as Changyu Pioneer Wine and Great Wall Wine have adopted bag-in-box packaging for their products, particularly for the domestic market and restaurant industry, where bulk serving is common.

India Bag-in-Box Container Market Trends

The India bag-in-box container market is primarily driven by the country's expanding organized retail sector and the rise of quick-service restaurants (QSRs). Companies such as McDonald's, Subway, and local chains are utilizing bag-in-box packaging for sauces, beverages, and dairy products, appreciating its benefits in terms of extended shelf life and reduced storage space. The wine industry in India, though relatively small, is also contributing to bag-in-box adoption, with vineyards in Nashik and Bangalore regions exploring this packaging format for both domestic markets and exports.

Japan Bag-in-Box Container Market Trends

The bag-in-box container market in Japan is growing due to its expanding beverage industry. The Japanese beverage industry, especially the wine and sake sectors, has widely adopted bag-in-box packaging. For example, major companies such as Suntory and Mercian Corporation have introduced premium wines in 1.5L and 3L bag-in-box formats, which have gained significant market acceptance. This packaging format has also found success in the food service sector, with restaurants and hotels using bag-in-box systems for products such as cooking oils, sauces, and liquid seasonings, contributing to reduced waste and improved storage efficiency.

Key Asia Pacific Bag-in-Box Container Company Insights

The competitive environment of the Asia Pacific market is characterized by the presence of both regional and global players striving to capture market share in various industries, including food, beverages, and non-food applications. Major companies such as Smurfit Kappa, Amcor plc, SIG, and Liquibox are investing heavily in research and development to offer innovative and sustainable packaging solutions, focusing on eco-friendly materials and enhanced barrier properties to meet rising consumer demand for convenience and sustainability. Local players are also emerging, leveraging cost advantages and targeting niche markets, while regulatory standards and increasing environmental concerns drive competition for greener packaging solutions across the region.

Key Asia Pacific Bag-in-Box Container Companies:

- Liquibox

- Smurfit Kappa

- SIG

- Hangzhou Hansin New Packing Material Co., Ltd.

- Logos Pack

- CICH packaging

- CDF Corporation

- Natron Equipment & Spares Pvt. Ltd

- Koldpackindia

- WestRock Company

- DS Smith

View a comprehensive list of companies in the Asia Pacific Bag-in-Box Container Market

Recent Developments

-

In July 2024, SIG launched a recycle-ready bag-in-box packaging for water in Australia, marking a significant advancement in sustainable packaging solutions. This innovative packaging utilizes a mono-polymer composition, specifically SIG Terra RecShield, which eliminates the need for aluminum in the bag's structure, making it fully recyclable according to European CEFLEX guidelines.

-

In February 2023, Sealed Air acquired Liquibox for USD 1.15 billion, a move aimed at enhancing its CRYOVAC brand Fluids & Liquids business. This strategic merger combines two leaders in the flexible packaging industry, allowing Sealed Air to leverage Liquibox's innovative bag-in-box sustainable packaging solutions across various markets, including food and beverage.

Asia Pacific Bag-in-Box Container Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 846.7 million

Revenue forecast in 2030

USD 1,239.1 million

Growth rate

CAGR of 7.9% from 2024 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative Units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Application, capacity, material state, tap, component, country

Regional scope

Asia Pacific

Country scope

China, Japan, India

Key companies profiled

Liquibox; Smurfit Kappa; SIG; Hangzhou Hansin New Packing Material Co., Ltd.; Logos Pack; CICH Packaging; CDF Corporation; Natron Equipment & Spares Pvt. Ltd; Koldpackindia; WestRock Company; DS Smith

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Bag-in-Box Container Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific bag-in-box container market report based on application, capacity, material state, tap, component, and country:

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

Food & Beverage

-

Alcoholic Beverages

-

Wine

-

Beer

-

Others

-

-

Non-Alcoholic Beverages

-

Soft Drinks

-

Juices & Flavored Drinks

-

Water

-

-

Others

-

Tomato Products

-

Milk & Dairy Products

-

Liquid Eggs

-

Edible Oil

-

Others

-

-

-

Industrial Liquids

-

Oils

-

Industrial Fluids

-

Petroleum Products

-

-

Household Products

-

Household Cleaners

-

Liquid Detergents

-

Liquid Soaps & Hand wash

-

Others

-

-

-

Capacity Outlook (Revenue, USD Million; 2018 - 2030)

-

< 1 Liter

-

1-5 Liter

-

5-10 Liter

-

10-20 Liter

-

20 Liter

-

-

Material State Outlook (Revenue, USD Million; 2018 - 2030)

-

Liquid

-

Semi Liquid

-

-

Tap Outlook (Revenue, USD Million; 2018 - 2030)

-

With Tap

-

Without Tap

-

-

Component Outlook (Revenue, USD Million; 2018 - 2030)

-

Bags

-

Box

-

Fitments

-

-

Country Outlook (Revenue, USD Million; 2018 - 2030)

-

Asia Pacific

-

China

-

Japan

-

India

-

Rest of Asia Pacific

-

-

Frequently Asked Questions About This Report

b. The Asia Pacific bag-in-box container market size was estimated at USD 786.1 million in 2024 and is expected to reach USD 846.7 million in 2025.

b. The Asia Pacific bag-in-box container market is expected to grow at a compound annual growth rate of 7.9% from 2025 to 2030, reaching USD 1,239.1 million by 2030.

b. China dominated the Asia Pacific bag-in-box container market with a share of 44.76% in 2024. The Asia Pacific super absorbent polymer market is expected to witness significant growth over the forecast period owing to the growing adoption of products in industry segments such as alcoholic beverages, household cleaners, and milk and dairy products.

b. Some of the key players operating in the Asia Pacific bag-in-box container market include Liquibox; Smurfit Kappa; SIG; Hangzhou Hansin New Packing Material Co., Ltd.; Logos Pack; CICH packaging; CDF Corporation; Natron Equipment & Spares Pvt. Ltd; Koldpackindia; WestRock Company; and DS Smith.

b. The growth of the industry can be attributed to the increasing demand from various industries such as food & beverages and household products, and increasing preference for packaged natural food products among consumers is expected to drive the market growth over the forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."