- Home

- »

- Automotive & Transportation

- »

-

Asia Pacific Automotive Collision Repair Market, Report, 2030GVR Report cover

![Asia Pacific Automotive Collision Repair Market Size, Share & Trends Report]()

Asia Pacific Automotive Collision Repair Market Size, Share & Trends Analysis Report By Vehicle (Light-duty Vehicle, Heavy-duty Vehicle), By Product (Paints & Coatings, Consumables), By Service Channels (DIY, DIFM), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-292-2

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

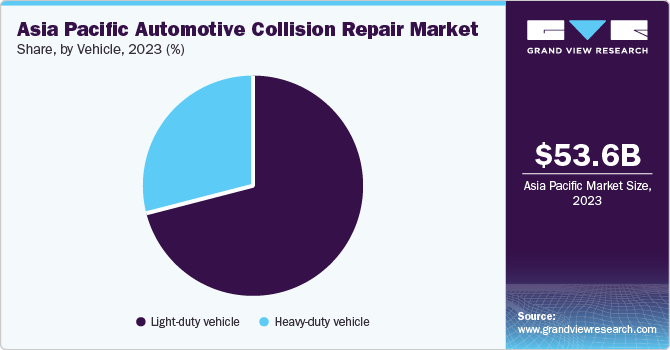

The Asia Pacific automotive collision repair market size was estimated at USD 53.59 billion in 2023 and is anticipated to grow at a CAGR of 3.6% from 2024 to 2030. The market encompasses all services and products related to the repair and refurbishment of vehicles after they have been involved in accidents or collisions. Several factors, such as the number of cars on the road, frequency, and severity of accidents, technological advancements in automotive materials and construction, and the evolving landscape of insurance and regulatory requirements, influence the growth and dynamics of this market.

In countries such as India and China, the frequency of road accidents is significantly high due to the high number of vehicles operating on congested roads, which fuels the growth of the market. According to the Ministry of Road Transport and Highways India, around 460,000 accidents were reported in 2022, which includes light-duty and heavy-duty vehicles.

The automotive industry is at the forefront of technological innovation, with vehicles becoming increasingly sophisticated, which brings growth opportunities for the repair market, especially with the integration of Advanced Driver Assistance Systems (ADAS) and electric vehicles. Repair shops provide premium pricing and differentiation strategies from competitors based on the availability of specialized equipment and the skill set of their employees.

Furthermore, insurance companies play a significant role in the market, often directing repair procedures, parts sourcing, and pricing. Regulations mandating the use of OEM parts further influence the market dynamics, potentially increasing costs and ensuring high-quality repairs that benefit consumers and enhance road safety.

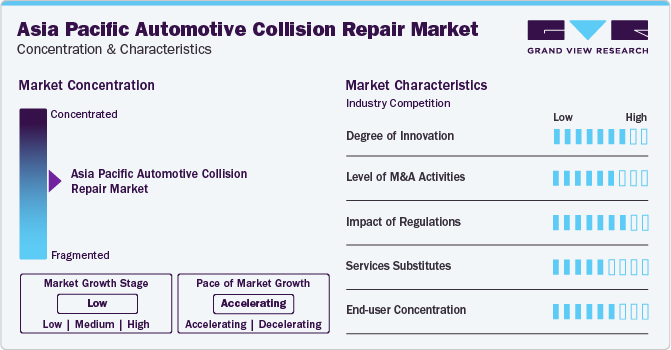

Market Concentration & Characteristics

The Asia Pacific automotive collision repair market growth stage is low and the pace of industry growth is accelerating. The industry is characterized by a high degree of innovation due to the integration of technology and digitalization in the automotive sector. With the use of advanced lightweight and durable materials such as carbon fiber, repair shops require new techniques and equipment to enhance the quality of service.

The companies operating in the industry are involved in a high level of mergers and acquisitions (M&A) activities. Companies seek strategic partnerships to expand their reach and enhance product and service portfolios. For instance, in June 2023, Magna International Inc. completed the acquisition of Veoneer HoldCo, LLC to expand its geographic footprint and provide advanced technological solutions to its customers in the automotive industry.

The impact of regulations on the industry is high due to the rules concerning the disposal of hazardous materials like paint and other solvents, and emissions from repair shops push the industry towards more environmentally friendly and sustainable practices.

Product Insights

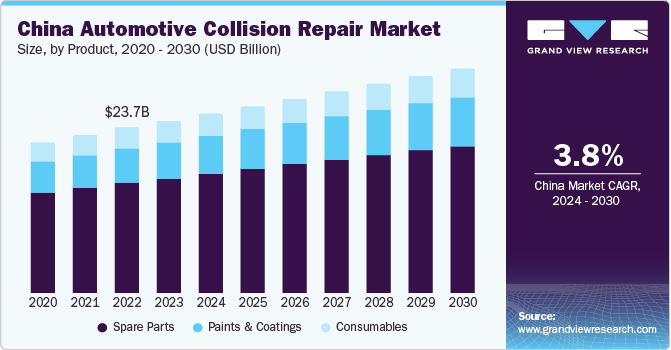

The spare parts segment dominated the market in 2023. The segment includes crash parts, restoration materials, repair materials, and other tools. The demand for spare parts for repair and maintenance grows as the average age of vehicles on the road increases. The high number of accidents in the region causes damage to multiple parts of the vehicle, such as grilles, bumpers, dents, scratches, and others, which fuels the demand for spare parts.

The paints & coatings segment is anticipated to grow at the fastest CAGR over the forecast period. Paints & coatings play a vital role in both the aesthetic and protective aspects of vehicle repair and an increase in the consumer demand for high-quality finishes leads to the segment’s growth. Innovations in color-matching technology have greatly improved the ability to replicate the original paint color and finish, enhancing customer satisfaction. For instance, in September 2020, Nippon Paint India launched the n-Max series of refinish paints designed for use in body shops and collision repair centers to establish enduring collaborations with distributors providing cutting-edge technology at competitive rates while also offering additional valuable services.

Vehicle Insights

The light-duty vehicle segment dominated the market and accounted for 71.1% of revenue share in 2023. The light-duty vehicles segment includes passenger cars, SUVs, and light trucks. This segment is substantially growing due to the high number of such vehicles on the road and their frequency of involvement in collisions compared to heavier vehicles is significantly higher.

The heavy-duty vehicles segment is expected to grow at a significant CAGR over the forecast period. The segment includes trucks, buses, construction equipment, and large multi-axle vehicles. The increasing number of wear and tear in these vehicles, endured during logistics and transportation, accounts for the growth of the market.

Service Channels Insights

The OE (handled by OEMs) segment accounted for the largest market revenue share in 2023. The segment involves using parts and components made by the original vehicle manufacturer for repairs, ensuring that the repaired vehicle maintains its original specifications and safety features. Consumer preferences and awareness of quality and safety also contribute to the segment's growth. Vehicle owners, especially those with newer or premium vehicles, often prefer OEM parts for repairs to maintain their vehicle's value and performance.

DIY (Do It Yourself) is anticipated to register the fastest CAGR over the forecast period. The segment is driven by vehicle owners' rising interest in undertaking repair projects. The availability of DIY kits and detailed how-to videos on the internet makes it easier for consumers to handle repair projects. DIY segment is cost-saving, and consumers can choose between OEM parts according to their budget and preferences.

Country Insights

China Automotive Collision Repair Market Trends

The automotive collision repair market in China accounted for the largest revenue share of 46.1% in 2023. According to the International Trade Administration, China is the largest automotive market in the world and an increase in vehicle population leads to a higher number of traffic accidents or collisions that boosts the demand for repair services. The automotive insurance industry in China has been growing, making it easier and cheaper for vehicle owners to afford collision repairs. Additionally, China accounted for over 14% of the global automotive collision repair market in 2023 and is expected to grow significantly over the forecast period.

India Automotive Collision Repair Market Trends

The India automotive collision repair market is anticipated to register the fastest CAGR over the forecast period. According to Nikkei Asia, the Indian automotive market surpassed Japan in 2022 and is now the third-largest market in the world. Increasing middle-class disposable income leads to a higher vehicle ownership rate. With dense traffic conditions and relatively high rates of road accidents, a rise in the repair market is anticipated. In March 2023, Lifelong India Pvt Ltd. acquired GoMechanic under its Servizzy entity to expand their presence in the automotive service and repair industry.

Key Asia Pacific Automotive Collision Repair Company Insights

Some of the key companies operating in the market are 3M, Robert Bosch GmbH, and others.

-

3M provides a comprehensive range of abrasive products, adhesives, fillers, paints and coatings, and others. 3M serves a broad market, catering to both professional collision repair centers and DIY enthusiasts through a wide distribution network.

-

Robert Bosch GmbH provides high-quality vehicle repair services for all types of models. Bosch Car Service, an independent car service workshop, offers a range of services using their advanced automotive technology and diagnostic equipment from routine maintenance to more extensive repair.

Key Asia Pacific Automotive Collision Repair Companies:

- 3M

- Continental AG

- Denso Corporation.

- FORVIA Faurecia

- Honeywell International Inc

- IAC Group

- Magna International, Inc.

- Mitsuba Corp.

- Ochre Media Pvt Ltd.

- ODU GmbH & Co.KG

- Robert Bosch GmbH

- Tenneco Inc.

Recent Developments

-

In October 2022, Magna International Inc. and Guangdong Huatie-Tongda Express Train Systems Inc. (Huatie) entered into a joint venture agreement in China. The aim of the joint venture was to provide innovative seating solutions to automotive manufacturers.

-

In September 2022, Robert Bosch GmbH launched DAS 3000 (Driver Assistance Systems) calibration tool, an innovative solution designed to calibrate advanced driver assistance systems in vehicles, The DAS 3000 system is a part of Bosch’s broader range of workshop equipment aimed at supporting automotive repair and maintenance professionals.

-

In October 2021, 3M launched the world’s lightest performance spray gun in India used to spray metallic and solid colors on vehicles. The performance spray gun is versatile, efficient, and can deliver exceptional finishes with a wide range of coatings. The light-weight design of the product reduces the fatigue of the users and allows greater control and comfort.

Asia Pacific Automotive Collision Repair Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 55.75 billion

Revenue forecast in 2030

USD 68.48 billion

Growth rate

CAGR of 3.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Vehicle, product, service channels, country

Country scope

China, Japan, India

Key companies profiled

3M; Continental AG; Denso Corporation.; FORVIA Faurecia; Honeywell International Inc; IAC Group; Magna International; Inc.; Mitsuba Corp.; Ochre Media Pvt Ltd.; ODU GmbH & Co.KG; Robert Bosch GmbH; Tenneco Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Asia Pacific Automotive Collision Repair Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific automotive collision repair market report based on vehicle, product, service channels and country.

-

Vehicle Outlook (Revenue, USD Billion, 2018 - 2030)

-

Light-duty vehicle

-

Heavy-duty vehicle

-

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Paints & Coatings

-

Consumables

-

Spare Parts

-

-

Service Channels Outlook (Revenue, USD Billion, 2018 - 2030)

-

DIY (Do It Yourself)

-

DIFM (Do it for Me)

-

OE (handled by OEMs)

-

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)

-

China

-

Japan

-

India

-

Frequently Asked Questions About This Report

b. The Asia Pacific automotive collision repair market size was estimated at USD 53.59 billion in 2023 and is expected to reach USD 55.75 billion in 2024

b. The Asia Pacific automotive collision repair market is expected to grow at a compound annual growth rate of 3.6% from 2024 to 2030 to reach USD 68.48 billion by 2030

b. The light-duty vehicle segment dominated the Asia Pacific automotive collision repair market with a share of 71.1% in 2023. The increasing number of vehicles on the road and their frequency of involvement in collisions compared to heavier vehicles driving the segment growth.

b. Some key players operating in the Asia Pacific automotive collision repair market include 3M, Continental AG, Denso Corporation., FORVIA Faurecia, Honeywell International Inc, IAC Group, Magna International, Inc., Mitsuba Corp., Ochre Media Pvt Ltd., ODU GmbH & Co.KG, Robert Bosch GmbH, Tenneco Inc.

b. Factors such as the number of cars on the road, the frequency and severity of accidents, technological advancements in automotive materials and construction, and the evolving landscape of insurance and regulatory requirements are driving the market's growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."