- Home

- »

- Next Generation Technologies

- »

-

Asia Pacific Artificial Intelligence Market, Industry Report 2030GVR Report cover

![Asia Pacific Artificial Intelligence Market Size, Share & Trends Report]()

Asia Pacific Artificial Intelligence Market (2024 - 2030) Size, Share & Trends Analysis Report By Solution (Hardware, Software, Services), By Technology (Deep Learning, Machine Learning), By Function, By End-use, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-291-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

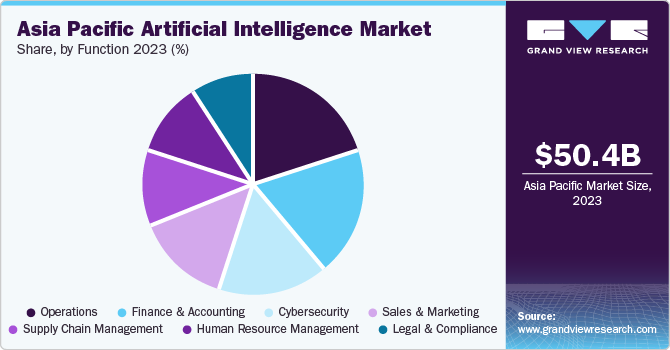

The Asia Pacific artificial intelligence market size was estimated at USD 50.41 billion in 2023 and is projected to grow at a CAGR of 45.7% from 2024 to 2030. Several key factors, including the increasing digitalization across various industries, such as banking, financial services, insurance, healthcare, and telecommunications, drive the market growth. Government initiatives and substantial funding for AI startups and development also contribute to market growth. The rising demand for intelligent virtual assistants and growing 5G infrastructure in this region are further bolstering market growth.

The market accounted for 27.5% of the global market revenue in 2024. With the rapid evolution of AI technology, regulatory frameworks in the region are developing quickly. In response to the evolving landscape of AI and its associated risks, policymakers and regulators are actively reassessing existing frameworks and proposing targeted regulations. China, at the forefront of this movement, established a significant precedent in 2023 with the “Interim Administrative Measures for Generative Artificial Intelligence Services.” This regulation represents the first comprehensive framework designed to govern generative AI services.

Solution Insights

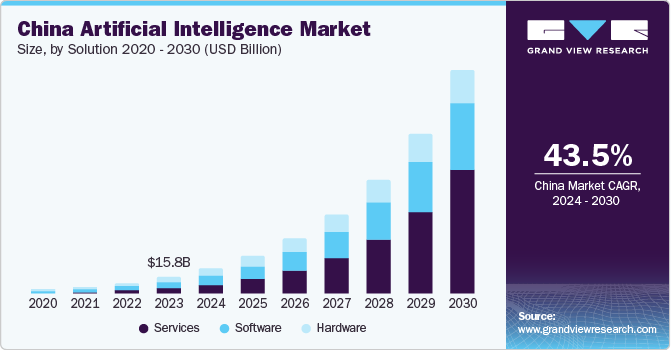

The software segment held the largest revenue share of 35.0% in 2024. This dominance can be attributed to the extensive use of AI software across various industries, including healthcare, telecommunication, automotive, and banking, financial services, & insurance (BFSI). AI software includes core technologies like natural language processing (NLP), deep learning, augmented and virtual reality (AR/VR), and machine learning (ML). The software segment is expected to continue to grow due to the rising demand for AI-integrated systems in the region.

The services segment is predicted to witness the fastest CAGR of 57.3% from 2024 to 2030. This rapid growth can be attributed to the growing need for services that support the implementation and maintenance of AI systems. These services include professional services and managed services. Professional services encompass consulting, system integration, and deployment, while managed services involve ongoing support and maintenance of AI systems. The growth of the services segment is further bolstered by the rising digitalization in various sectors, which is positively influences the utilization of AI-integrated systems. As more organizations adopt AI technologies, the demand for these services is expected to continue to rise.

Technology Insights

The deep learning segment held the largest market share of 26.1% in 2024. This leadership position can be directly attributed to deep learning's proficiency in handling complex and voluminous datasets, a hallmark of the contemporary digital landscape. As a subset of machine learning, deep learning excels at pattern recognition and the ability to deliver customized solutions. It has found extensive applications across various industries, including healthcare, telecommunication, automotive, and BFSI. For instance, tech companies like Google Maps are adopting artificial neural networks (ANN), a key component of deep learning, to improve their route and work on feedback received using ANN. The growth of the deep learning segment is further bolstered by the increasing digitalization in various sectors, which is positively influencing the utilization of AI-integrated systems in the region.

The machine vision segment is predicted to witness the fastest growth rate of 53.6% from 2024 to 2030. Fueled by the rise of 3D systems and AI integration, applications span presence detection, inspection, and grading in harsh environments. This segment's expansion is driven by maturing 2D technology, increasing adoption of 3D solutions by end-user industries, and investments by leading vendors like OMRON. The impact of AI-powered machine vision will reshape industries like robotics, retail, healthcare, and manufacturing, solidifying the segment's robust growth trajectory.

End-use Insights

The advertising & media segment held the largest market share of 18.1% in 2024. This prominence can be attributed to the game-changing impact of AI on both industries. AI plays a crucial role in advertising and media by leveraging data analysis to enable precise targeting and content delivery. This technology significantly enhances productivity and elevates content quality, ultimately facilitating personalized ad experiences.

Healthcare is predicted to grow at the fastest CAGR of 52.8% from 2024 to 2030. Leveraging AI for medical data analysis empowers healthcare professionals with improved diagnostic accuracy and targeted treatment plans. This technology adoption is anticipated to be driven by rising investments in healthcare from the public and private sectors, alongside advancements in pharmaceuticals, research, and overall medical technology.

Function Insights

The operations segment held the largest market share of 21.0% in 2024. This dominance can be attributed to the extensive use of AI in operations across various industries, including retail, manufacturing, BFSI, government, IT and telecommunications, military and defense, transportation and logistics, healthcare, and energy and power. AI plays a pivotal role in augmenting productivity and refining operational standards. This progression contributes to the customization of the operational framework. The growing adoption of AI within the operations sector can be attributed to advancements in research, innovation, and technology.

The sales and marketing segment is predicted to witness the fastest CAGR of 52.6% from 2024 to 2030. AI in sales & marketing is used to help marketers and sales teams provide highly personalized content to their target audience. This technology can significantly boost Key Performance Indicators (KPIs), elevate content quality, and ultimately foster a more tailored customers experience.

Country Insights

China Artificial Intelligence Market Trends

China held the largest revenue share of 36.1% in 2024. This dominance can be attributed to the extensive use of AI across various industries, including healthcare, BFSI, law, retail, advertising, and media. The Chinese government has provided substantial support to the AI sector, positioning it as a crucial component of the country's strategy and a primary area of concentration for global competition. The increased reliance on the digital environment and the internet has increased spending on AI solutions in professional services.

South Korea Artificial Intelligence Market Trends

South Korea is predicted to witness the fastest CAGR from 2024 to 2030. The country has made significant investments in AI technology, viewing it as an essential foundation for both forthcoming technological and economic development. The South Korean government has undertaken several programs to promote the adoption of AI, such as the "I-Korea 4.0" plan, which focuses on nurturing fourth-generation technologies, such as AI.

Key Asia Pacific Artificial Intelligence Company Insights

The Asia Pacific artificial intelligence market indicates a dynamic and competitive structure. Due to significant technological advancements and digitalization across the region, many AI companies have strategically positioned themselves in close proximity. Some key players operating in this market include Google Inc., Microsoft Corporation, and Baidu, Inc.

-

Google Inc. offers a range of products and solutions for the AI industry, including AI processing, machine learning, and applications

-

Baidu, Inc. is a China-based internet-related services and products, and AI company that has been a significant player, especially in the search engine and autonomous driving industries

Key Asia Pacific Artificial Intelligence Companies:

- Google Inc.

- Microsoft Corporation

- NVIDIA Corporation

- Baidu, Inc.

- SenseTime

- Samsung Electronics Co., Ltd.

- IBM Corporation

- Amazon Web Services, Inc.

- Oracle

- Meta

Recent Developments

-

In November 2023, Google introduced a beta edition of its Search Generative Experience (SGE) to streamline searches for generative AI technology. This move reflects the company's strategic focus on expanding its market presence, particularly in Asia Pacific

-

In April 2024, Nvidia revealed its intention to establish a USD 200 million AI center in Indonesia, partnering with local telecommunications powerhouse Indosat Ooredoo Hutchison, marking a strategic move to penetrate the Southeast Asian market

-

In March 2024, Apple opted for Baidu to integrate generative AI technology into its iPhone 16 and other offerings tailored specifically for the Chinese market

Asia Pacific Artificial Intelligence Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 76.7 billion

Revenue forecast in 2030

USD 734.7 billion

Growth rate

CAGR of 45.7% from 2024 to 2030

Base year for estimation

2023

Forecast period

2024 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Solution, technology, end-use, function, and country

Country scope

Japan; China; India; Australia; South Korea

Key companies profiled

Google Inc.; Microsoft Corp.; NVIDIA Corp.; Baidu, Inc.; SenseTime; Samsung Electronics Co., Ltd.; IBM Corp.; Amazon Web Services, Inc.; Oracle; Meta

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Artificial Intelligence Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the Asia Pacific artificial intelligence market report based on solution, technology, function, end-use, and country:

-

Solution Outlook (Revenue, USD Billion, 2017 - 2030)

-

Hardware

-

Accelerators

-

Processors

-

Memory

-

Network

-

-

Software

-

Services

-

Professional

-

Managed

-

-

-

Technology Outlook (Revenue, USD Billion, 2017 - 2030)

-

Deep Learning

-

Machine Learning

-

Natural Language Processing (NLP)

-

Machine Vision

-

Generative AI

-

-

Function Outlook (Revenue, USD Billion, 2017 - 2030)

-

Cybersecurity

-

Finance and Accounting

-

Human Resource Management

-

Legal and Compliance

-

Operations

-

Sales and Marketing

-

Supply Chain Management

-

-

End-use Outlook (Revenue, USD Billion, 2017 - 2030)

-

Healthcare

-

Robot Assisted Surgery

-

Virtual Nursing Assistants

-

Hospital Workflow Management

-

Dosage Error Reduction

-

Clinical Trial Participant Identifier

-

Preliminary Diagnosis

-

Automated Image Diagnosis

-

-

BFSI

-

Risk Assessment

-

Financial Analysis/Research

-

Investment/Portfolio Management

-

Others

-

-

Law

-

Retail

-

Advertising & Media

-

Automotive & Transportation

-

Agriculture

-

Manufacturing

-

Others

-

-

Country Outlook (Revenue, USD Million, 2017 - 2030)

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Frequently Asked Questions About This Report

b. The Asia Pacific artificial intelligence market size was estimated at USD 50.41 billion in 2023 and is expected to reach USD 76.70 billion in 2024

b. The Asia Pacific artificial intelligence market is expected to grow at a compound annual growth rate of 45.7% from 2024 to 2030 to reach USD 734.76 billion by 2030

b. The software held the largest market share of 35.9% in 2023. It can be attributed to the extensive use of AI software across various industries, including healthcare, telecommunication, automotive, banking, financial services, and insurance (BFSI).

b. Some key players operating in the Asia Pacific AI market include Google Inc., Microsoft Corporation, NVIDIA Corporation, Baidu, Inc., SenseTime, Samsung Electronics Co., Ltd., IBM Corporation, Amazon Web Services, Inc., Oracle, Meta

b. Factors such as the increasing digitalization across various industries like banking, financial services, insurance, healthcare, and telecommunications are driving the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.