Asia Pacific Animal Health Market Size, Share & Trends Analysis Report By Product (Biologic, Pharmaceutical), By Animal Type, By Distribution Channel (Retail, E-Commerce), By End-use, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-280-8

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Asia Pacific Animal Health Market Trends

The Asia Pacific animal health market size was estimated at USD 13.7 billion in 2023 and it is expected to grow at a CAGR of 10.0% from 2024 to 2030. Some of the factors driving this industry include the increasing number of pet owners, rising demand for meat and milk products leading to a growing livestock population, growth in expenditure on animal health and animal welfare, government initiatives encouraging animal wellbeing, and an upsurge in demand for treatment and other health solutions.

Asia Pacific animal health market accounted for 21.9% of the global animal health market revenue in 2023. The large cattle population in the region has a significant impact on the demand for animal health solutions. China & India constitute more than 30.0% of the global population of cattle. In addition, largely populated developing economies have been experiencing unceasing growth in demand for meat and milk products. This results in an increasing livestock population and in turn a greater demand for animal health solutions such as vaccinations, diagnostics, medicinal feed additives, veterinary medicines, and more.

Product Insights

Pharmaceuticals dominated the market with the largest revenue share of 43.6% in 2023. Pharmaceutical products in the animal health industry include a variety of offerings such as parasiticides used in animal medicines to prevent or treat infections caused by parasites such as fleas, ticks, or worms, anti-infective products such as antibacterials, antivirals, antifungals and antiparasitic, anti-inflammatory products used to attain a reduction in redness, swelling, pain in animals, and analgesics.

The diagnostics segment is expected to grow at a CAGR of 12.0 % from 2024 to 2030. One of the vital factors driving this growth is the increasing prevalence of new cases associated with zoonotic diseases. Furthermore, increasing awareness among pet owners regarding the importance of diagnosis and early identification of health issues has also driven the demand for diagnostic solutions in the region.

Animal Type Insights

The production animals segment dominated the market with the largest revenue share in 2023. Constantly increasing need for meat & meat-based food products, milk & milk products have been driving the increase in livestock population across the globe. The presence of economies such as China, India, and Japan, and the significance of meat and milk in cuisines present in these countries have resulted in rapid growth in demand for these over the years. Such aspects have contributed to the rise in revenue generated through animal health solutions designed and developed for production animals.

The companion animal segment is expected to experience a CAGR of 10.5% from 2024 to 2030. Growing pet humanization, increasing awareness regarding health benefits associated with the adoption of companion animals, and growing expenditure by pet parents on preventive measures to maintain the well-being of their pets are some of the factors that are expected to drive market growth in coming years.

End-use Insights

Based on end-use, veterinary hospitals & clinics dominated the market with a 72.0% share in 2023. Veterinary hospitals & clinics offer timely diagnostics and treatments to pets and animals in need while maintaining the right atmosphere equipped with technology-driven systems, medicinal assistance, storage of necessary drugs and pharmaceuticals, diagnosis equipment and more. Many domestic brands and partnership-based organizations with the involvement of multinational companies are investing in these provisions as demand for animal health solutions is constantly increasing in the region.

The point-of-care testing/in-house testing market is expected to grow at a CAGR of 14.5% from 2024 to 2030. This growth can be attributed to multiple aspects such as ease of use, increased accessibility, growing need for in-house testing, rising number of pets and companion animals in the region, and more.

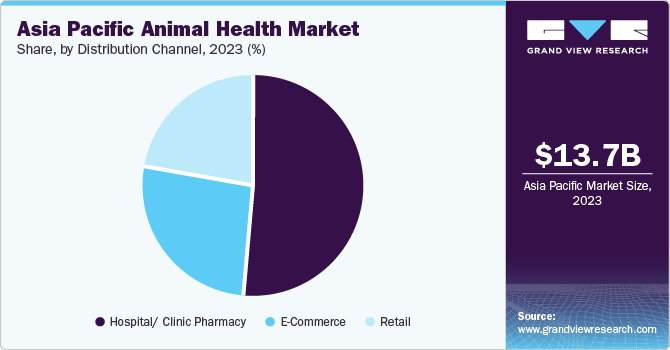

Distribution Channel Insights

Hospital/clinic pharmacies led the market and accounted for 51.2% of the revenue share in 2023. The growth of this category is mainly driven by various factors such as easier accessibility, preventive measures taken by the pet parents, frequent visits of pet owners to hospitals/clinic pharmacies after diagnosis and tests, presence of hospitals/clinics in closer vicinities and residential areas.

E-commerce platforms are expected to grow at a significant CAGR of 10.3% from 2024 to 2030. This is mainly due to the services provided by online shopping platforms such as a hassle-free shopping experience, multiple payment alternatives, doorstep deliveries, easy returns and refunds, detailed product descriptions, availability of reviews posted by previous buyers and more.

Country Insights

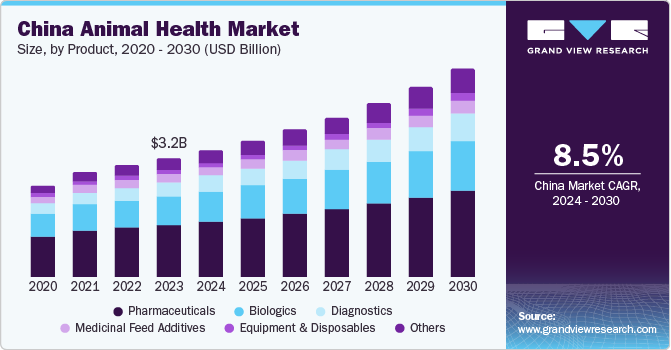

China Animal Health Market Trends

China animal health market held a 23.6% share in 2023. China dominated the regional market owing to multiple factors such as increasing manufacturing base and facilities in China, increasing investments in this region by major players and growing expenditure, and the government’s encouragement and initiatives for R&D activities for animal health.

India Animal Health Market Trends

The animal health market in India is expected to experience a CAGR of 11.9 % from 2024 to 2030. This is mainly due to factors such as growing demand for high-quality and affordable pet care, competitive market scenario leading to rapid execution of growth strategies such as alliances, partnerships, contracts, mergers, and acquisitions by key companies in the industry, and rise in government initiatives.

Key Asia Pacific Animal Health Company Insights

Some of the key companies in the Asia Pacific animal health market include Melodiol Global Health (Creso Pharma), Hester Biosciences Limited; Inmed Animal Health, Vetoquinol, Boehringer Ingelheim International GmbH, Elanco India Pvt. Ltd., Virbac and Ashish Life Science. To attain a competitive edge, key market participants are adopting strategies such as enhanced R&D effort, innovation, cross-continental collaborations.

-

Melodiol Global Health (Creso Pharma) is one of the leading manufacturers and distributors of hemp-based food, topical products like creams & gels and feed supplements for animal health. This Switzerland-based company operates in Europe, Latin America and Asia Pacific markets for animal health.

-

Boehringer Ingelheim GmbH, one of the largest pharmaceutical companies in the world, has been operating in China since 1994. The company has an R&D facility in Shanghai dedicated to research of vaccines for livestock.

Key Asia Pacific Animal Health Companies:

- Melodiol Global Health (Creso Pharma)

- Hester Biosciences Limited

- Inmed Animal Health

- Vetoquinol

- Boehringer Ingelheim International GmbH

- Elanco India Pvt. Ltd.

- Virbac.Ashish Life Science

- Merck Animal Health

- Vetraise Remedies

- Covetrus

- CLOSTAT (Kemin Industries)

Recent Developments

-

In May 2023, Creso Pharma expanded its distribution agreements in the Asia Pacific region, partnering with Gotro Global in Singapore and Providence Animal Health Korea in South Korea to distribute its Green Goo animal care range.

-

In June 2023, the Ministry of Fisheries, Animal Husbandry & Dairying in India, launched a newly developed portal, named NANDI (NOC Approval for New Drug and Inoculation System). The union minister explained that this is one of the government’s initiatives to provide support to researchers and industries while adding yet another significant step toward Digital India.

Asia Pacific Animal Health Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 13.7 billion |

|

Revenue forecast in 2030 |

USD 26.7 billion |

|

Growth Rate |

CAGR of 10.0% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, animal type, end-use, distribution channel |

|

Country scope |

Japan; China; India; Australia; South Korea; Indonesia; Malaysia; Singapore; Thailand; Philippines |

|

Key companies profiled |

Melodiol Global Health (Creso Pharma); Hester Biosciences Limited; Inmed Animal Health; Vetoquinol; Boehringer Ingelheim International GmbH; Elanco India Pvt. Ltd.; Virbac.Ashish Life Science; Merck Animal Health; Vetraise Remedies; Covetrus; CLOSTAT (Kemin Industries) |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Asia Pacific Animal Health Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific animal health market report based on product, animal type, end-use, distribution channel, and country:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Biologics

-

Vaccines

-

Modified/ Attenuated Live

-

Inactivated (Killed)

-

Other Vaccines

-

-

Other Biologics

-

-

Pharmaceuticals

-

Parasiticides

-

Anti-infectives

-

Anti-inflammatory

-

Analgesics

-

Others

-

-

Medicinal Feed Additives

-

Diagnostics

-

Consumables, Reagents & Kits

-

Instruments & Devices

-

-

Equipment & Disposables

-

Critical Care Consumables

-

Anesthesia Equipment

-

Fluid Management Equipment

-

Temperature Management Equipment

-

Rescue & Resuscitation Equipment

-

Research Equipment

-

Patient Monitoring Equipment

-

-

Others

-

Veterinary Telehealth

-

Veterinary Software

-

Livestock Monitoring

-

-

-

Animal Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Production Animals

-

Poultry

-

Swine

-

Cattle

-

Sheep & Goats

-

Fish

-

-

Companion Animals

-

Dogs

-

Cats

-

Horses

-

Others

-

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Veterinary Reference Laboratories

-

Point-of-care Testing/In-house Testing

-

Veterinary Hospitals & Clinics

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Retail

-

E-Commerce

-

Hospital/ Clinic Pharmacy

-

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Indonesia

-

Malaysia

-

Singapore

-

Thailand

-

Philippines

-

Frequently Asked Questions About This Report

b. The Asia Pacific animal health market size was estimated at USD 13.7 billion in 2023 and is expected to reach USD 14.8 billion in 2024

b. The Asia Pacific animal health market is expected to grow at a compound annual growth rate of 10.0% from 2024 to 2030 to reach USD 26.7 billion by 2030

b. The pharmaceuticals segment dominated the market with a share of 43.6% in 2023. The increasing need to prevent or treat infections caused by parasites such as fleas, ticks, or worms, anti-infective are driving the segment growth.

b. Some key players operating in the Asia Pacific animal health market include Melodiol Global Health (Creso Pharma); Hester Biosciences Limited; Inmed Animal Health; Vetoquinol; Boehringer Ingelheim International GmbH; Elanco India Pvt. Ltd.; Virbac.Ashish Life Science; Merck Animal Health; Vetraise Remedies; Covetrus; CLOSTAT (Kemin Industries)

b. Factors such as the increasing number of pet owners, rising demand for meat and milk products leading to a growing livestock population, growth in expenditure on animal health and animal welfare are driving the Asia Pacific animal health market growth

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."