- Home

- »

- Food Additives & Nutricosmetics

- »

-

Asia Pacific Amino Acids Market Size, Industry Report, 2030GVR Report cover

![Asia Pacific Amino Acids Market Size, Share & Trends Report]()

Asia Pacific Amino Acids Market Size, Share & Trends Analysis Report By Type, By Source (Plant-based, Animal Based, Chemical Synthesis), By Grade, By End-use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-319-0

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2024 - 2030

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

Asia Pacific Amino Acids Market Trends

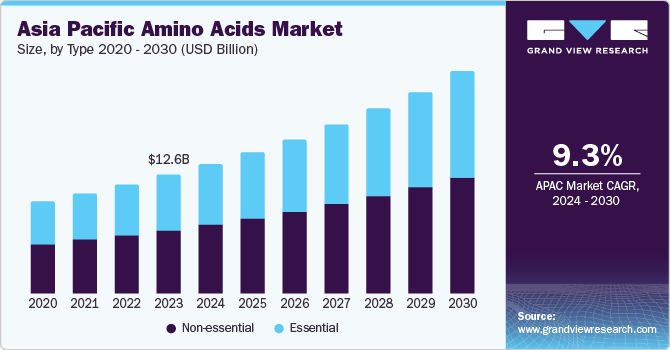

The Asia Pacific amino acids market size was estimated at USD 12.6 billion in 2023 and is estimated to grow at a CAGR of 9.3% from 2024 to 2030. This robust expansion can be attributed to the increasing demand for dietary supplements and functional foods as health consciousness increases among consumers. In addition, the growing pharmaceutical industry in the region is boosting the use of amino acids in drug formulations. The agricultural industry’s increasing use of amino acids as animal feed additives to improve livestock health and productivity further propels market growth. Technological advancements in amino acid production and a growing preference for plant-based amino acids due to the rise of vegetarian and vegan lifestyles also contribute to this dynamic market landscape.

The Asia Pacific amino acids market accounted for a share of 46.4% of the global amino acids market revenue in 2023. The regulatory landscape across the region significantly influences the market, with diverse approaches in different countries. For instance, Japan and Singapore allow food fortification with amino acids without direct regulatory oversight or setting maximum daily limits. On the other hand, Australia and New Zealand have stringent regulations that restrict amino acid use in specifically formulated sports foods, limiting the market's expansion to a niche segment.

Type Insights

The non-essential amino acids segment accounted for over half of the total revenue in 2023. This dominance can be attributed to their wider range of applications. Non-essential amino acids play a crucial role in various industries, including food & beverages, pharmaceuticals, and cosmetics. For instance, non-essential amino acids like glycine and alanine are used as flavor enhancers and sweeteners in food products. In addition, their involvement in protein synthesis makes them valuable additives in animal feed, contributing to the strong performance of this segment.

The essential amino acids segment is expected to grow at a CAGR of 9.5% from 2024 to 2030. This growth is fuelled by a growing focus on health and wellness in the region. Essential amino acids, like lysine and methionine, are vital building blocks for protein and play a critical role in muscle growth, tissue repair, and immune function. As health-conscious consumers increasingly seek out nutritional supplements and fortified foods, the demand for essential amino acids is expected to increase.

Source Insights

The plant-based segment held a share of 43.7% in 2023. This dominance can be attributed to several factors, including rising consumer preference for plant-based diets, driven by health, environmental, and ethical considerations. Plant-based amino acids are derived from sources, such as soy, peas, and other legumes, which are abundant in the region. The increasing awareness about the health benefits associated with plant-based proteins, including lower cholesterol levels, improved heart health, and better digestion, has spurred their demand. The robust infrastructure for agriculture in countries like China and India supports the large-scale production and supply of plant-based raw materials, further consolidating this segment's market leadership.

On the other hand, the fermentation segment is projected to experience the second-fastest CAGR from 2024 to 2030 due to the technological advancements and innovations in fermentation processes, which have made production more cost-effective and scalable. Fermentation, a biotechnological method that utilizes microorganisms to produce amino acids, offers high yield and purity, which is critical for applications in pharmaceuticals, animal feed, and food and beverages. Government initiatives supporting biotechnology and industrial fermentation further propel the segment’s growth, indicating a promising expansion trajectory in the coming years.

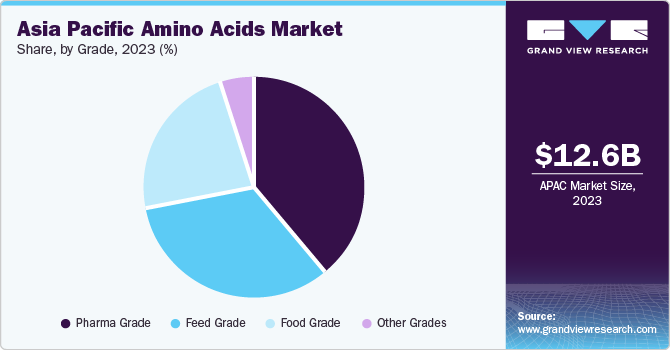

Grade Insights

The pharma-grade segment led the market with the largest revenue share in 2023. This dominance can be largely attributed to the essential role of amino acids in the pharmaceutical industry. Pharma-grade amino acids are integral to the formulation of various medications and health supplements due to their high purity and stringent quality standards. They are used in the production of intravenous (IV) solutions, therapeutic drugs, and parenteral nutrition products. The rising prevalence of chronic diseases, growing healthcare expenditure, and an aging population in the Asia Pacific region have significantly bolstered the demand for high-quality pharmaceutical products, thereby driving the substantial revenue share of the segment.

On the other hand, the feed-grade segment is projected to experience the fastest CAGR of 9.6% from 2024 to 2030. The growing livestock industry and increasing demand for high-quality animal nutrition products primarily drive segment growth. Amino acids, such as lysine, methionine, and threonine, are crucial components in animal feed formulations, enhancing growth rates, feed efficiency, and overall health of livestock. As the demand for meat & dairy products increases in Asia Pacific, driven by increasing population and disposable income levels, the need for effective & efficient feed solutions also increases. In addition, the shift to sustainable and cost-effective animal farming practices encourages the adoption of amino acid-enriched feeds, which contribute to reduced nitrogen emissions and improved animal welfare.

End-use Insights

The food and beverages segment accounted for a share of 29.0% in 2023. This dominance is driven by the rising demand for high-protein diets and health supplements in the region, where consumers are increasingly becoming health-conscious. The growing popularity of functional foods and drinks, which offer additional health benefits beyond basic nutrition, further bolsters the segment's market position. The food industry's innovation in creating diverse and appealing amino acid-enriched products is expected to sustain and potentially expand this segment's revenue share in the future.

The personal care and cosmetics segment is projected to exhibit the fastest CAGR of 9.9% from 2024 to 2030. This rapid growth can be attributed to the increasing consumer preference for products with natural and functional ingredients. Amino acids are integral in formulating skincare and haircare products due to their moisturizing, anti-aging, and repair properties, which cater to the rising demand for effective and safe personal care solutions.

Country Insights

China Amino Acids Market Trends

The Chinaamino acids market held a revenue share of 36.0% in 2023. This dominant position is reflective of China's expansive industrial base and its robust agricultural sector, which demands a high volume of amino acids for animal feed and human nutrition. The country's growing middle-class population also contributes to increased consumption of dietary supplements and functional foods, further bolstering market growth. In addition, China's strategic initiatives to enhance its biotechnology sector have led to advancements in amino acid production technologies, ensuring its stronghold in the market.

Japan Amino Acids Market Trends

The amino acids market in Japan is expected to witness a CAGR of 10.4% from 2024 to 2030. Japan's commitment to innovation and quality in the healthcare and food industries drives this growth. The country's aging population has spurred demand for health-enhancing products, including those enriched with amino acids. Furthermore, Japan's leading position in fermentation technology has been pivotal in producing high-quality amino acids efficiently, catering to both domestic and international markets. This technological edge, combined with a strong export framework, positions Japan as a key player in the regional market expansion.

Key Asia Pacific Amino Acids Company Insights

Some of the key players operating in the APAC amino acids market include Evonik, Adisseo, Archer Daniel Midland, and Ajinomoto:

-

Ajinomoto specializes in amino acid production and food ingredients. Its high-quality amino acids are widely used in food, pharmaceuticals, and animal nutrition

-

Evonik offers innovative solutions for various industries, including animal feed, health, and nutrition. Evonik’s amino acids contribute to sustainable and efficient production practices

Key Asia Pacific Amino Acids Companies:

- Adisseo

- Ajinomoto Co., Inc.

- Archer Daniel Midland Co.

- Evonik Industries AG

- SHV (Nutreco NV)

- Alltech, Inc.

- Kemin Industries

- Lonza Group Ltd.

- Novus International, Inc.

- Prinova Group LLC

Recent Developments in the Asia Pacific Amino Acids Market

-

In August 2023, Adisseo announced the construction of a new powder methionine plant in Fujian Province, China

-

In March 2024, Johnson & Johnson acquired Ambrx Biopharma, Inc., a leader in utilizing proprietary technology for the design and development of next-generation antibody-drug conjugates. Ambrx's approach leverages the power of synthetic amino acids for precise protein therapeutic engineering. This acquisition strengthens both companies' commitment to advancing novel cancer treatments

-

In November 2023, Ajinomoto Co., Inc. strategically acquired Forge Biologics Holdings, aiming to leverage Forge's expertise in gene therapy alongside Ajinomoto's AminoScience platform. This integrated approach holds promise for the development of innovative treatments for rare diseases utilizing the power of amino acids

-

In June 2024, Ajooni Biotech Ltd. entered into a strategic partnership with Avalon Group to develop a Moringa processing project. This collaboration focuses on building infrastructure for sustainable processing of Moringa leaves, a valuable source of essential amino acids. The project will produce Moringa oil for Avalon and oil cake for Ajooni's animal feed products, targeting both domestic and export markets

Asia Pacific Amino Acids Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 23.5 billion

Growth rate

CAGR of 9.3% from 2024 to 2030

Base year for estimation

2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, competitive landscape, growth factors, trends

Segments covered

Type, source, grade, end-use, country

Country scope

China; Japan; South Korea; India; Indonesia; Thailand

Key companies profiled

Adisseo; Ajinomoto Co., Inc.; Archer Daniel Midland Co.; Evonik Industries AG; SHV (Nutreco NV); Alltech, Inc.; Kemin Industries; Lonza Group Ltd.; Novus International, Inc.; Prinova Group LLC

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Amino Acids Market Report Segmentation

This report forecasts revenue and volume growth at regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific amino acids market report based on type, source, grade, end-use, and country:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Essential

-

Histidine

-

Isoleucine

-

Leucine

-

Lysine

-

Methionine

-

Phenylalanine

-

Threonine

-

Tryptophan

-

Valine

-

-

Non-essential

-

Alanine

-

Arginine

-

Asparagine

-

Aspartic Acid

-

Cysteine

-

Glutamic Acid

-

Glutamine

-

Glycine

-

Proline

-

Serine

-

Tyrosine

-

Ornithine

-

Citrulline

-

Creatine

-

Selenocysteine

-

Taurine

-

Others

-

-

-

Source Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Plant-based

-

Animal-based

-

Chemical Synthesis

-

Fermentation

-

-

Grade Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food Grade

-

Feed Grade

-

Pharma Grade

-

Other Grades

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food & Beverage

-

Animal Feed

-

Pet Food

-

Pharmaceuticals

-

Vaccine Formulation

-

Personal Care & Cosmetics

-

Dietary Supplements

-

Agriculture

-

Other End Uses

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

China

-

Japan

-

South Korea

-

India

-

Indonesia

-

Thailand

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."