- Home

- »

- Advanced Interior Materials

- »

-

Asia Pacific Aluminum Extrusion Market, Industry Report, 2030GVR Report cover

![Asia Pacific Aluminum Extrusion Market Size, Share & Trends Report]()

Asia Pacific Aluminum Extrusion Market Size, Share & Trends Analysis Report By Product (Pipes & Tubes, Rods & Bars, Shapes), By Application (Building & Construction, Electrical & Energy), By Country And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-250-4

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Market Size & Trends

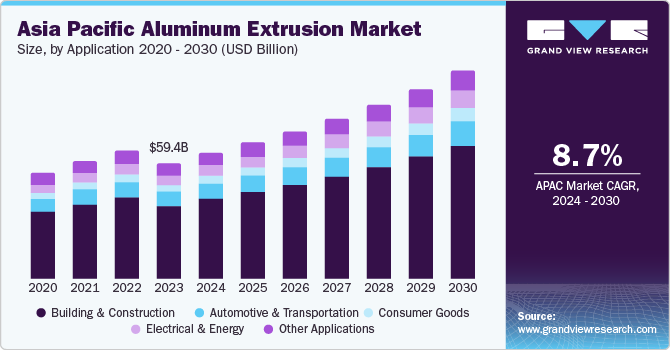

The Asia Pacific aluminum extrusion market size was valued at USD 59.39 billion in 2023 and is projected to grow at a CAGR of 8.7% from 2024 to 2030. This growth is attributed to several key driving factors including the region’s rapid industrialization and urbanization, coupled with increasing demand for lightweight and durable materials in various industries such as automotive, construction, and electronics. Additionally, advancements in extrusion technology and the development of high-strength alloys are further fueling market growth.

Moreover, the shift towards sustainable practices and the recycling of aluminum products are contributing to the market expansion. However, the market also faces challenges such as fluctuating raw material prices and stringent environmental regulations. Despite these hurdles, the Asia Pacific aluminum extrusion market is poised for significant growth in the coming years.

Regulatory frameworks significantly influence the Asia Pacific aluminum extrusion market, often dictating the pace and scale of industry growth. For instance, in India, regulations concerning cross-border imports and exports have extended production lead times and disrupted traditional supply chains, compelling manufacturers to seek alternative solutions. This has led to a shift in market dynamics, with companies exploring advanced technologies like IoT and AI to counterbalance the challenges and enhance manufacturing efficiency and productivity.

In a parallel context, the European Commission’s imposition of anti-dumping duties on aluminum extrusions from China, ranging from 21.2% to 32.1%, is a strategic move to safeguard EU industries and ensure fair competition. This could potentially recalibrate Chinese export tactics and exert a significant influence on regional market dynamics. These instances highlight the profound ramifications regulatory interventions can impose on market mechanisms, from supply chain modifications to the reconfiguration of global trade alliances.

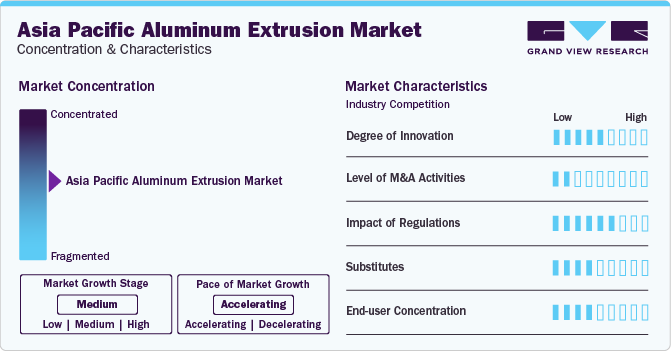

Market Concentration & Characteristics

The Asia Pacific Aluminum Extrusion Market is characterized by a moderate degree of innovation despite the absence of significant recent advancements. Companies operating in this market are persistently exploring advanced technologies to enhance manufacturing efficiency and productivity. For instance, the integration of artificial intelligence (AI) and machine learning (ML) in the aluminum extrusion industry, although still in its nascent stages in the Asia Pacific region, is gaining traction. ML enables equipment to utilize data and learn operations, potentially leading to processes with minimal human interaction and reduced on-site accidents.

The threat of substitutes is relatively low, despite the presence of alternative materials. Major substitutes include plastic and steel, both of which can compete directly with aluminum extrusions in certain applications. However, the unique performance and efficiency advantages of aluminum extrusion products, such as their lightweight nature, high strength, and corrosion resistance, mitigate the threat posed by these substitutes.

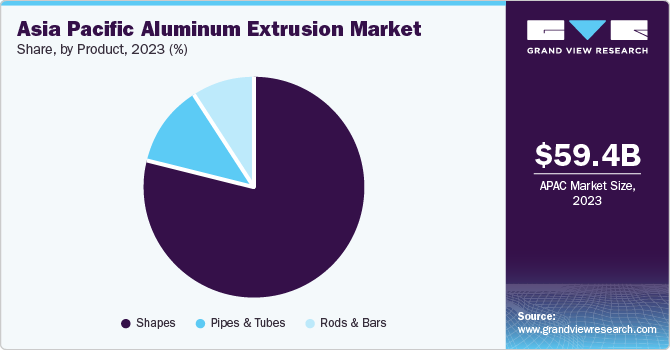

Product Insights

The shapes segment dominated the Asia Pacific market in 2023 with around 79% revenue share. This dominance can be attributed to the versatility and wide range of applications of extruded aluminum shapes. They are extensively used in various industries such as construction, automotive, and electronics due to their lightweight, durability, and resistance to corrosion. The high demand for these shapes, coupled with their diverse usage, has propelled this segment to the forefront of the market.

Pipes & tubes is the fastest-growing product segment and is expected to register a CAGR of 10.3%, in revenue terms, from 2024 to 2030. This rapid growth can be attributed to the increasing use of aluminum pipes and tubes in various industries, including construction, automotive, and HVAC. The lightweight nature and high strength-to-weight ratio of aluminum make it an ideal material for these applications. Furthermore, the growing emphasis on energy-efficient and sustainable construction practices is likely to further fuel the segment growth over the forecast period.

Application Insights

The building & construction segment dominated the market in 2023 with more than 63% revenue share. This can be attributed to the extensive use of aluminum extrusions in the construction industry due to their durability, corrosion resistance, and aesthetic appeal. They are used in a variety of applications in this sector, including window frames, door frames, roofs, and curtain walling. The growth in the construction industry, particularly in emerging economies in the Asia Pacific, is likely to continue driving the demand for aluminum extrusions over the coming years.

Electrical & energy is the fastest-growing product segment in the Asia Pacific aluminum extrusion market with a CAGR of 10.2% from 2024 to 2030. This surge can be traced back to the escalating demand for energy-efficient solutions and the rising adoption of renewable energy sources. Aluminum extrusions, due to their lightweight nature and high conductivity, find extensive application in the fabrication of solar panels, wind turbines, and other renewable energy systems. The ongoing shift towards sustainable energy sources is anticipated to further propel the demand for aluminum extrusions in this sector.

Country Insights

China Aluminum Extrusion Market Trends

China held the largest market share in 2023, accounting for a substantial 69% of the total revenue. This dominance can be attributed to the country’s vast manufacturing base, coupled with its rapid urbanization and industrialization. Furthermore, China’s strong emphasis on infrastructure development and its booming construction industry have also contributed to its leading position in the market.

India Aluminum Extrusion Market Trends

On the other hand, India is anticipated to witness the fastest growth in terms of revenue, with a CAGR of 10.1% projected for the period 2024-2030. This rapid growth can be attributed to India’s burgeoning construction and automotive sectors, which are major consumers of aluminum extrusions. The country’s ongoing urbanization and industrialization, along with government initiatives promoting infrastructure development, are expected to further drive the demand for aluminum extrusions.

Key Asia Pacific Aluminum Extrusion Company Insights

The Asia Pacific aluminum extrusion market is characterized by a moderate level of concentration with several key players operating in the region. Some key players operating in this market include LB Aluminium Berhad, Jindal Aluminium, and China Zhongwang Holdings Limited:

-

LB Aluminium Berhad is an aluminum extrusion manufacturer based in Malaysia. It has a wide range of products that are used in various sectors such as construction, automotive, and electronics.

-

China Zhongwang is a manufacturer of aluminum extrusion products based in China. It has a significant market share in the Asia Pacific region and its products are used in industries such as transportation, machinery, and equipment.

Key Asia Pacific Aluminum Extrusion Companies:

- LB Aluminium Berhad

- Jindal Aluminium

- China Zhongwang Holdings Limited

- Hindalco Industries

- Superfine Group

- KAMCO Aluminium

- ELITE Group of Companies

- Arconic Inc.

- Bonnell Aluminum

- Constellium N.V.

Recent Developments

-

In September 2023, Hindalco Industries Limited partnered with Metra SpA to improve its production of large-size aluminum extrusion and fabrication technology used in building high-speed aluminum rail coaches in India. This partnership will enable Hindalco Industries to utilize advanced technologies and enhance its manufacturing capabilities, thus catering to the increasing demand for high-quality aluminum rail coaches in the Indian market.

-

In February 2024, Jindal Aluminium launched a state-of-the-art fabrication division in Bangalore, India, after successfully introducing an eco-friendly powder coating unit. This move will allow Jindal Aluminium to expand its value-added offerings by providing cutting-edge fabrication services to its customers.

-

In December 2023, Hindalco Industries announced its plan to expand its manufacturing capacity of fine-quality aluminum foil used in rechargeable batteries. This expansion is aimed to cater to the rapidly growing market for electric vehicles (EVs) and energy storage systems.

Asia Pacific Aluminum Extrusion Market Scope

Report Attribute

Details

Market size value in 2024

USD 65.15 billion

Revenue forecast in 2030

USD 107.73 billion

Growth rate

CAGR of 8.7% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, country

Country Scope

China, India, Japan, South Korea

Key companies profiled

LB Aluminium Berhad; Jindal Aluminium; China Zhongwang Holdings Limited; Hindalco Industries; Superfine Group; KAMCO Aluminium; ELITE Group of Companies; Arconic Inc.; Bonnell Aluminum; Constellium N.V.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Aluminum Extrusion Market Report Segmentation

This report forecasts revenue and volume growth and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific aluminum extrusion market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Shapes

-

Rods & Bars

-

Pipes & Tubes

-

-

Application Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Building & Construction

-

Automotive & Transportation

-

Consumer Goods

-

Electrical & Energy

-

Other Applications

-

-

Country Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

China

-

India

-

Japan

-

South Korea

-

Frequently Asked Questions About This Report

b. The Asia Pacific aluminum extrusion market size was estimated at USD 59.39 billion in 2023 and is expected to be USD 65.15 billion in 2024.

b. The Asia Pacific aluminum extrusion market, in terms of revenue, is expected to grow at a compound annual growth rate of 8.7% from 2024 to 2030 to reach USD 107.73 billion by 2030.

b. The shapes segment dominated the Asia Pacific aluminum extrusion market with a revenue share of 79% in 2023, on account of several factors including their versatility and wide range of applications in various industries such as construction, automotive, and electronics.

b. Some of the key players operating in the Asia Pacific aluminum extrusion market include LB Aluminium Berhad; Jindal Aluminium; China Zhongwang Holdings Limited; Hindalco Industries; Superfine Group; KAMCO Aluminium; ELITE Group of Companies; Arconic Inc.; Bonnell Aluminum; Constellium N.V.

b. Key factors that are driving the Asia Pacific aluminum extrusion market growth include the region’s rapid industrialization and urbanization, coupled with increasing demand for lightweight and durable materials in various industries such as automotive, construction, and electronics

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."