- Home

- »

- Advanced Interior Materials

- »

-

Asia Pacific Air Purifier Market Size, Industry Report, 2030GVR Report cover

![Asia Pacific Air Purifier Market Size, Share & Trends Report]()

Asia Pacific Air Purifier Market Size, Share & Trends Analysis Report By Technology (HEPA, Activated Carbon), By Application, By Coverage Range, By Sales Channel, By Type, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-278-7

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Asia Pacific Air Purifier Market Size & Trends

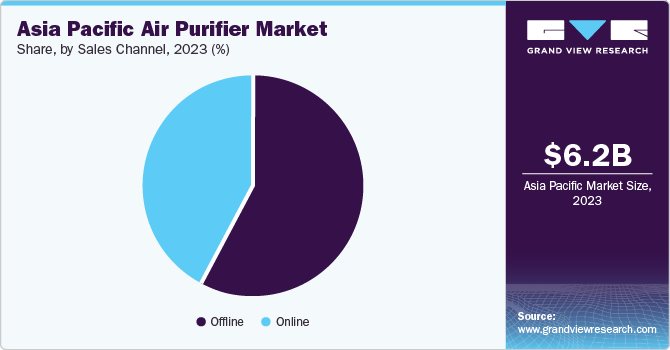

The Asia Pacific air purifier market size was estimated at USD 6.2 billion in 2023 and is expected to grow at a CAGR of 7.8% from 2024 to 2030. The Asia Pacific region faces a threatening environmental crisis, with nearly 90% of its population breathing air exceeding the World Health Organization's (WHO) safety standards. As air pollution continues to pose a major public health concern, individuals and communities are increasingly turning to air purifiers as a crucial tool to combat the detrimental effects of polluted air. These devices offer a tangible solution for improving indoor air quality and mitigating the health risks associated with air pollution.

Asia Pacific held a 38.9% revenue share of the global air purifier market. Open burning of household waste, seasonal agricultural burning practices, rapid urban development, reliance on coal-based energy sources, especially in the ASEAN countries, and seasonal forest fires are responsible for a substantial increase in air contaminants. However, the live PM2.5 monitoring, subsidies for technologically advanced air cleaning units, and legal actions taken by the governments are projected to stimulate market growth over the coming years.

The Association of Southeast Asian Nations (ASEAN) has made rapid progress in raising Occupational Safety and Health (OSH) standards within Southeast Asia. The efforts of the OSHNET, the platform to drive collaboration among regional OSH centers and agencies, have been important in the region. Mandated policies by agencies for employers to maintain worker safety in industries and commercial places are expected to drive the demand for air purifiers in Southeast Asia.

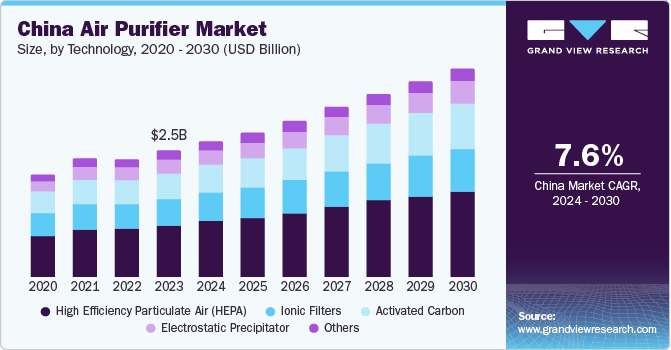

Technology Insights

High-Efficiency Particulate Air (HEPA) dominated the market contributing to over 40.0% of the total market value in 2023. HEPA filters, primarily composed of submicron glass fibers, represent a category of extended surface mechanical filters with a texture resembling blotter paper. Originally developed by American scientists in collaboration with the Manhattan Project to capture radioactive particles during the atomic bomb manufacturing process, HEPA filters found applications in factories and laboratories, safeguarding workers against respiratory issues.

Activated carbon air purifier is anticipated to grow at the fastest CAGR of 8.9% during the forecast period. Activated carbon is mostly placed in air purifiers in the form of packets. The air containing contaminants is passed through the activated carbon in the purifier, wherein adsorption of the particles occurs, ensuring purified air output. The presence of a high level of activated carbon in the purifier aids in faster adsorption, increasing the lifespan of the purifier, and effective removal of all airborne particles. This is expected to augment the penetration of activated carbon in the global air purifier market.

Application Insights

The commercial applications segment dominated the market contributing to over 55.0% of the total revenue value in 2023. It is also anticipated to be the fastest growing segment during the forecast period. Air purifiers have witnessed a significant surge in adoption within commercial applications, driven by a growing awareness of indoor air quality and its impact on occupants' health and well-being. The emphasis on creating a safe and comfortable indoor environment has led businesses to explore air purifier, particularly in sectors where the concentration of pollutants can be higher.

Other commercial applications of the air purifier include sports arenas, museums, movie theatres, and shopping malls. Air purifiers are becoming increasingly popular in the aforementioned indoor spaces, due to their ability to improve indoor air quality and create a healthier environment for occupants. Sports arenas are often crowded places where large numbers of people gather for events such as concerts, sports matches, and exhibitions. The high levels of human activity and traffic can result in poor air quality, which can affect the health and wellbeing of attendees. Air purifiers can help to remove pollutants and allergens from the air, creating a more comfortable and enjoyable experience for those in attendance.

Coverage Range Insights

The 250-400 sq. ft. coverage range air purifiers held the largest market share of over 40% in 2023. These air purifiers are naturally larger and more powerful than models that cover smaller areas, making them effective at removing pollutants from the air in larger spaces. These air purifiers have advanced features, such as Wi-Fi connectivity, real-time air quality monitoring, and multiple fan speeds.This capacity of air purifier is generally used in commercial kitchens, restaurants, cafes, and museum rooms to maintain air quality.

Below 250 sq. ft. coverage range air purifiers are expected to grow at the fastest CAGR of 8.6% during the forecast period. These types of air purifiers are installed in small bedrooms, small offices, small commercial businesses, bathrooms, cars, and nurseries. This is because air purifiers with a coverage range of below 250 sq. fit. are effective at removing pollutants, such as dust, pollen, and pet dander, from the air, making them a good choice for people with allergies or respiratory issues. Increasing product launches and customized air purifiers for personal vehicles are likely to propel the segment’s growth.

Type Insights

Standalone/portable air purifiers dominated the segment with a 66.0% market share in 2023. It is also expected to be the fastest-growing segment during the forecast period. The adoption of standalone/portable air purifiers is increasing across the world, owing to their various advantages and attractive features. Compact sizes, lightweight, easy maintenance, and cost-effectiveness are some of the attractive features of this type of air purifier. The demand for portable air purifiers is driven significantly by rising health consciousness, increasing disposable income, and new product launches. For instance, in November 2023, Nirvana Being launched the first MESP portable air purifier in the Indian market. The new product uses Micro-electrostatic Precipitator (MESP) technology for air purification.

Sales Channel Insights

The offline channel segment contributed to over 50.0% of the total market value in 2023. New construction projects and investments in retail stores by the key players are expected to have a significant impact on the market growth. Retailers, such as Bed Bath & Beyond, were planning to open around 1,000 new retail stores.

The online sales channel segment is expected to grow at a CAGR of 8.7% during the forecast period. The sales of air purifiers through the online sales channel have been growing rapidly in recent years, with more and more consumers choosing to purchase air purifiers through e-commerce platforms. Online sales channels offer a wider selection of products than brick-and-mortar stores, making it easier for consumers to find the air purifier that best suits their needs and budgets.

Country Insights

China Air Purifier Market Trends

The China air purifier market held 40.0% revenue share in 2023. According to the World Health Organization, air pollution remains a major concern in China, with sources like industry, transportation, and household fuel use contributing to fine particles harmful to human health. According to Centre for Research on Energy and Clean Air (CREA), 2023 witnessed a rise in PM2.5 levels for the first time since 2013, with over half the provincial capitals exceeding national standards. In a positive step, Beijing's new action plan for 2025 sets a stricter air quality target, exceeding the current national standard. The high health burden and ongoing air quality challenges create a strong demand for air purifiers in China.

Japan Air Purifier Market Trends

The air purifier market in Japan held 18.8% market share in 2023. The air purifier market in Japan is projected to witness robust growth over the forecast period. The growth is primarily attributed to the rising government efforts to curb air pollution by introducing stringent guidelines and regulations for indoor air quality. Furthermore, the government has introduced indoor air quality standards along with numerous air pollution control campaigns, which are projected to positively impact the market.

Key Asia Pacific Air Purifier Company Insights

The market for air purifier in Asia Pacific region is highly competitive due to the presence of both local and international manufacturers.

Key Asia Pacific Air Purifier Companies:

- Philips Domestic Appliances and Personal Care Company Ltd.

- A.O. Smith (China) Water Heater Co., Ltd.

- Xiaomi Corporation

- Beijing Yadu Environmental Protection Technology Co., Ltd.

- Sharp Business (China) Co., Ltd

- Panasonic Ecology Systems Co., Ltd

- Daikin (China) Investment Co., Ltd.

- LG Electronics (China) Co. Ltd.

- Blueair (Shanghai) Sales Co. Ltd.

- Molekule

Recent Developments

-

In January 2023, Molekule completed all stock merger transactions with AeroClean Technologies, a company that specializes in air hygiene technology. As a result of the merger, the combined company now offers the most extensive selection of FDA-cleared air purification devices that are patented and proprietary. These products cater to the rapidly expanding global air purifier market.

Asia Pacific Air Purifier Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 10.5 billion

Growth rate

CAGR of 7.8% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, coverage range, sales channel, application, type, country

Regional scope

Asia Pacific

Country scope

Japan; China; South Korea; Malaysia; Singapore

Key companies profiled

Philips Domestic Appliances and Personal Care Company Ltd.; O. Smith Water Heater Co., Ltd.; Xiaomi Corporation; Beijing Yadu Environmental Protection Technology Co., Ltd.; Sharp Business Co., Ltd; Panasonic Ecology Systems Co., Ltd; Daikin (China) Investment Co., Ltd.; LG Electronics (China) Co. Ltd.; Blueair (Shanghai) Sales Co. Ltd.; Hanwha Azdel Inc.; Grupo Antolin; Lear Corporation; Owens Corning; Quadrant AG; Royal DSM N.V.; TEIJIN LIMITED

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Air Purifier Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the Asia Pacific air purifier market report based on technology, application, coverage range, type, sales channel, and country:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

High Efficiency Particulate Air (HEPA)

-

Activated Carbon

-

Ionic Filters

-

Electrostatic Precipitator

-

Others

-

-

Coverage Range Outlook (Revenue, USD Million, 2018 - 2030)

-

Below 250 Sq. Ft.

-

250-400 Sq. Ft.

-

401-700 Sq. Ft.

-

Above 700 Sq. Ft.

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

Hypermarkets/Supermarkets

-

Retail Stores

-

Specialty Stores

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Retail Shops (Mercantile)

-

Offices

-

Healthcare Facilities

-

Hospitality

-

Schools & Educational Institutions

-

Laboratories

-

Transport (railway stations, metros, bus stops, airports)

-

Others

-

-

Residential

-

Industrial

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Standalone/Portable

-

In-duct/Fixed

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Japan

-

China

-

South Korea

-

Malaysia

-

Singapore

-

Frequently Asked Questions About This Report

b. Factors such as increasing air pollution and the growing need to combat the detrimental effects of polluted air drive the Asia Pacific air purifier market

b. The Asia Pacific air purifier market size was estimated at USD 6.2 billion in 2023 and is expected to reach USD 6.69 billion in 2024

b. The Asia Pacific air purifier market is expected to grow at a compound annual growth rate of 7.8% from 2024 to 2030 to reach USD 10.5 billion by 2030

b. The commercial applications segment dominated the market with a share of 55.0% in 2023, owing to the growing awareness of indoor air quality and its impact on occupants' health and well-being

b. Some key players operating in the Asia Pacific air purifier market include Philips Domestic Appliances and Personal Care Company Ltd.; O. Smith Water Heater Co., Ltd.; Xiaomi Corporation; Beijing Yadu Environmental Protection Technology Co., Ltd.; Sharp Business Co., Ltd; Panasonic Ecology Systems Co., Ltd; Daikin (China) Investment Co., Ltd.; LG Electronics (China) Co. Ltd.; Blueair (Shanghai) Sales Co. Ltd.; Hanwha Azdel Inc.; Grupo Antolin; Lear Corporation; Owens Corning; Quadrant AG; Royal DSM N.V.; TEIJIN LIMITED

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."