- Home

- »

- Plastics, Polymers & Resins

- »

-

Asia Pacific Aerosol Market Size And Share Report, 2024GVR Report cover

![Asia Pacific Aerosol Market Size, Share & Trends Report]()

Asia Pacific Aerosol Market Size, Share & Trends Analysis Report Material (Steel, Aluminum, Others), By Type (Bag-in-Valve, Standard), By Application (Personal Care, Household, Automotive & Industrial, Food, Paints, Medical, Others), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-320-3

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Asia Pacific Aerosol Market Size & Trends

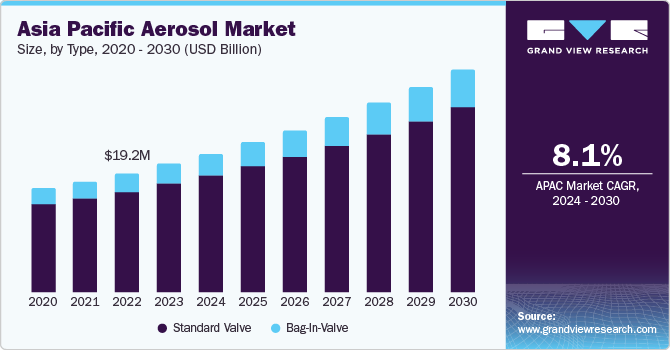

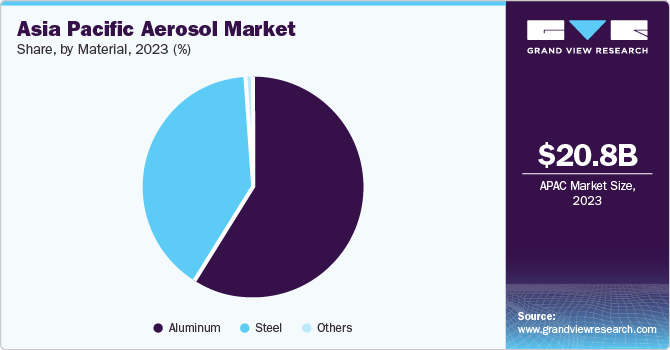

The Asia Pacific aerosol market size was estimated at USD 20.8 billion in 2023 and is expected to grow at a CAGR of 8.1% from 2024 to 2030. This growth is attributed to a rise in the number of young middle-class individuals in emerging nations, such as India and China, having substantial disposable income. A strong online presence has resulted in an increased need for personal care items like deodorants, hair mousse, and shaving foams. Furthermore, increasing demand for household insecticides and plant protection products in countries with tropical climates, such as Bangladesh, India, and Indonesia, is further driving the market growth in the region.

The Asia Pacific aerosol market accounted for a share of 24.7% of the global aerosol market revenue in 2023. The demand for aerosol-based paint applications is driven by the increasing private and public expenditures on infrastructure development in countries, such as China and India. In addition, changing lifestyles, a focus on gender-specific products, and rising consumer spending in developing countries, such as China and India, are driving demand for aerosol products in the personal care sector, particularly deodorants and hair care products, thereby driving market growth. Furthermore, the pharmaceutical industry is experiencing a growing demand for aerosol products due to the rising prevalence of respiratory diseases like asthma and COPD, with aerosol propellants being widely used to deliver medications for these conditions.

Favorable government policies and investment-friendly environments in countries, such as China and India, present lucrative growth opportunities for the market. The increasing disposable income levels and rapid industrialization in the region also contribute to the market's growth. Furthermore, the growth is being driven by the rising demand for convenience foods, growth in manufacturing, and robust retail sales. As consumers spend more on packaged food and beauty products, the aerosol cans market is poised to benefit significantly.

Type Insights

The standard valve type segment led the market and accounted for the largest share of 83.9% in 2023. This growth is attributed to rapid urbanization, increasing disposable incomes, and evolving lifestyles in the region, which contribute to a rising demand for aerosol-based personal care and household products. In addition, manufacturers focus on affordability and convenience by offering smaller pack sizes and value-added features to cater to price-sensitive customers, further increasing the demand for standard valves in the market.

Bag-on-valve held a significant market share in 2023 owing to the increasing production of spray products, particularly in the cosmetics and personal care industries. In addition, the region's strong economic development, population growth, and rising consumer spending on personal care items drive the demand for eco-friendly and convenient packaging solutions, such as Bag-on-Valve.

Application Insights

The personal care application segment dominated the market and accounted for the largest market share of 34.2% in 2023. This growth is due to the growing millennial population with higher disposable income, increased focus on personal hygiene and grooming, and growing demand for cosmetic and personal care products. Moreover, the suitability of using aerosol products and their integration into various personal care items is also contributing to the segment expansion.

The household segment held a significant revenue share in 2023 owing to the changing lifestyles, increased consumer spending, and the preference for products made from aerosol cans, driven by shifting consumer preferences and increasing prevalence of chronic obstructive airway diseases.

Material Insights

The aluminum segment led the market and accounted for the largest revenue share of 58.8% in 2023. This growth is attributed to its eco-friendly nature, recyclability, and strong packaging properties. In addition, the increasing disposable income levels, industrialization trends, and consumer spending on packaged food and beauty care products in the region further boost the demand for aluminum aerosol cans. These factors, coupled with aluminum's aesthetic appeal and durability, position it as a preferred material choice in the regional market.

Steel also held a significant market share in 2023 owing to its strength, cost-effectiveness, and adaptability. Furthermore, steel aerosol cans offer strong protection for products, cater to numerous industries, and are preferred for their widespread utility and affordability, putting them as a prominent choice in the region.

Country Insights

China Aerosol Market Trends

The China aerosol marketaccounted for the largest market share of 40.7% in 2023. This growth is driven by rapid urbanization, which leads to lifestyle changes and increased demand for aerosol products, especially in urban areas. The expanding middle class with disposable income fuels the market for aerosol-based cosmetics, air fresheners, and cleaning products. Moreover, China's position as the largest vehicle producer in the Asia Pacific boosts the demand for aerosol-based automotive refinishing products, offering efficient and cost-effective solutions for vehicle maintenance.

Japan Aerosol Market Trends

The aerosol market in Japan held a significant revenue share in 2023 owing to the efficient delivery of respiratory drugs to older persons with illnesses, such as COPD and asthma, through aerosol-based inhalers. In addition, aerosol sanitizers and disinfectants are also frequently utilized in healthcare institutions to keep the environment hygienic and sterile, which further drives the market's expansion.

Key Asia Pacific Aerosol Company Insights

The aerosol market in Asia Pacific is moderately concentrated, with both domestic and international companies present. To stay ahead of the competition, major businesses are implementing strategies, including joint ventures, product launches, and acquisitions. The market's growth in the region is being driven by the increasing demand for household and personal care goods.

Key players in the market include Toyo Aerosol Industry Co., Ltd., and Guangdong Theaoson Technology Co., Ltd.

-

Guangdong Theaoson Technology Co. Ltd. deals in aerosol product development, research, manufacturing, sales, and value-added services. Research, development, and sales efforts are focused on producing aerosol products for car care, beauty care, household, industry, and disinfection by Theaoson, a 150-acre company with a 24 million yuan registered capital

GS Chem Co., Ltd., Ikezaki Tekindo Tama, and Shanghai Golden Aerosol Co., Ltd. are some other participants operating in the Asia Pacific aerosol market

-

GS Chem Co., Ltd. offers its local and foreign customers services for formulation, blending, aerosol filling, and liquid filling through a full-service contract filling process. To ensure the manufacturing of safe and convenient aerosol products at their CGMP-certified facility, GS Chem offers end-to-end solutions for aerosol formulation and filling by utilizing cutting-edge technology and contemporary facilities

Key Asia Pacific Aerosol Companies:

- Toyo Aerosol Industry Co., Ltd.

- Ikezaki Tekindo Tama

- Om aerosol

- Miracle Aerosol Industries

- Bakshi Aerosole Private Limited

- Guangdong Theaoson Technology Co. Ltd.

- Jinxing Aerosol Valve Manufacture Co., Ltd

- Shanghai Golden Aerosol Co., Ltd.

- GS Chem Co., Ltd.

- JEONGSEOK CHEMICAL CORPORATION

Recent Development

-

In May 2024, Theaoson launched a new 600ml Portable Fire Extinguisher for Cars and Cooking Fires with 3C certification. The product is an aerosol-based product designed to extinguish Class A, B, and F fires, making it suitable for use in cars and kitchens. It is certified with the 3C certification, ensuring its quality and safety

Asia Pacific Aerosol Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 22.5 billion

Revenue forecast in 2030

USD 36.0 billion

Growth rate

CAGR of 8.1% from 2024 to 2030

Base year for estimation

2023

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, material, application, country

Regional Coverage

Asia Pacific

Country Coverage

Japan; China; India

Key companies profiled

Toyo Aerosol Industry Co., Ltd.; Ikezaki Tekindo Tama; Om Aerosol; Miracle Aerosol Industries; Bakshi Aerosole Private Ltd.; Guangdong Theaoson Technology Co. Ltd.; Jinxing Aerosol Valve Manufacture Co., Ltd; Shanghai Golden Aerosol Co., Ltd.; GS Chem Co., Ltd.; Jeongseok Chemical Corp.

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Aerosol Market Report Segmentation

This report forecasts revenue growth at a regional and country level and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific aerosol market report based on type, material, application, and country

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Bag-In-Valve

-

Standard Valve

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Steel

-

Aluminum

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Personal Care

-

Household

-

Automotive & Industrial

-

Food

-

Paints

-

Medical

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Japan

-

China

-

India

-

Frequently Asked Questions About This Report

b. The Asia Pacific aerosol market was estimated at USD 20.8 billion in 2023 and is expected to reach USD 22.5 billion in 2024.

b. The Asia Pacific aerosol market is expected to grow at a compound annual growth rate of 8.1% from 2024 to 2030, reaching USD 36.0 billion by 2030.

b. The China aerosol market accounted for the largest market share of 40.7% in 2023. This growth is driven by rapid urbanization, which leads to lifestyle changes and increased demand for aerosol products, especially in urban areas. T

b. The key market player in the aerosol market includes Henkel AG & Co., KGaA; S. C. Johnson & Son, Inc.; Procter & Gamble; Unilever; Honeywell International Inc.; Akzo Nobel N.V.; Beiersdorf AG; Estée Lauder Inc.; Oriflame Cosmetics Global SA.

b. The Asia Pacific aerosol market is anticipated to be driven by the rise in the number of young middle-class individuals in emerging nations, such as India and China, with substantial disposable income. A strong online presence has resulted in an increased need for personal care items like deodorants, hair mousse, and shaving foams. Furthermore, increasing demand for household insecticides and plant protection products in countries with tropical climates, such as Bangladesh, India, and Indonesia, is further driving the market growth in the region.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."