- Home

- »

- Medical Devices

- »

-

Asia Pacific Advanced Wound Care Market, Report, 2030GVR Report cover

![Asia Pacific Advanced Wound Care Market Size, Share & Trends Report]()

Asia Pacific Advanced Wound Care Market Size, Share & Trends Analysis Report By Product (Moist, Antimicrobial), By Application (Chronic Wounds, Acute Wounds), By End-use, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-237-0

- Number of Report Pages: 200

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

The Asia Pacific advanced wound care market size was estimated at USD 2.13 billion in 2023 and is projected to grow at a CAGR of 5.4% from 2024 to 2030. Major factors contributing to the market growth are the increasing demand for reducing hospital stays, the rising incidence of chronic wounds, and the rising number of surgeries in the region. The increasing incidence of chronic diseases such as diabetes, cancer, and other autoimmune diseases is anticipated to increase the incidence rate of chronic wounds in Asia Pacific.

The increasing demand to decrease hospital stays in the Asia Pacific is propelling growth for the wound care market through several mechanisms. As healthcare costs rise and governments emphasize cost-effective healthcare delivery, there is a concerted effort to adopt wound care products that expedite healing and minimize the need for prolonged hospitalization.

Technological advancements in infection care, including advanced dressings and negative pressure wound therapy systems, enable healthcare providers to manage injuries outside traditional hospital settings effectively. For instance, in September 2022, MIMEDX Group, Inc., developer of placental biologics, received approval from the Japanese Ministry of Health, Labor and Welfare (JMHLW) to reimburse EPIFIX. This approval indicates a significant milestone in treating refractory or difficult-to-heal lower extremity diabetic and venous ulcers. EPIFIX offers a transformative solution for patients suffering from these debilitating conditions by leveraging advanced placental biologics technology.

The increasing incidence of chronic injuries is a driving force propelling the market growth. With factors like aging populations, lifestyle changes, and the prevalence of chronic conditions such as diabetes and obesity on the rise in the region, there is a corresponding increase in the occurrence of chronic infections like diabetic foot ulcers and pressure ulcers. These infections often necessitate specialized and advanced wound care treatments to facilitate healing and prevent complications. For instance, according to the World Health Organization (WHO), China is experiencing one of the most rapid increases in its elderly population globally, with projections indicating that by 2040, individuals over 60 will constitute 28% of the population, driven by extended life expectancy and declining birth rates. This demographic transformation presents challenges and prospects for public health and socioeconomic progress, particularly in establishing an inclusive system addressing older people's health and social requirements, ensuring equitable healthcare access irrespective of geographic location.

The rising number of surgeries across the region is one of the primary factors for propelling the growth of the global advanced wound care market. As healthcare infrastructure expands and access to surgical intervention improves, there is a parallel increase in post-operative injury management requirements. Surgical procedures, ranging from elective surgeries to complex interventions, often necessitate advanced wound management solutions to facilitate optimal healing and reduce the risk of complications.

This surge in surgical interventions, coupled with the rising prevalence of chronic diseases and age-related conditions, underscores the growing demand for advanced infection care products and therapies such as bioactive dressings, negative pressure wound therapy, and cellular and tissue-based treatments. For instance, according to the Janssen Asia Pacific, the region accounts for half of the globe's new cancer diagnoses, with a projected 36% rise in cancer-related deaths by 2030. The region boasts the highest occurrence rates of liver and stomach cancers worldwide, while prostate cancer has emerged as a prominent male cancer in select Asian nations.

Market Concentration & Characteristics

The market growth stage is medium, with an accelerating pace. The market's high degree of innovation is driven by technological advancements, increasing demand for effective wound management solutions, and a growing focus on research and development to address the region's diverse healthcare needs. For instance, in October 2023, DuPont announced DuPont Liveo MG 7-9960, a novel silicone soft skin adhesive (SSA) tailored for advanced wound care and long-term medical device attachment, boasting enhanced adhesion and minimized cyclic properties, addressing the need for improved adhesion and patient comfort.

The Asia-Pacific advanced wound care market is distinguished by a high frequency of product launches by leading industry players. Companies are consistently introducing innovative wound care solutions to address the growing demand for effective and efficient treatment options. For instance, in February 2023,3M introduced its novel medical adhesive for use with a variety of sensors, long-term medical wearables, and health monitors. This adhesive can adhere to the skin for up to 28 days. This initiative was expected to expand the company’s product portfolio.

This dynamic environment is driven by the increasing prevalence of chronic wounds, rising healthcare expenditure, and heightened awareness about advanced wound management techniques. The continuous influx of new products enhances the competitive landscape, providing healthcare professionals with a broader range of options to improve patient outcomes and streamline wound care practices across the region.

The market exhibits a high degree of innovation, with companies continually developing cutting-edge technologies and novel treatment modalities. Innovations such as bioengineered skin substitutes, advanced wound dressings, and smart wound care devices are rapidly transforming the market. This focus on innovation aims to improve healing rates, reduce treatment costs, and enhance patient quality of life, solidifying the region's position as a hub for advanced wound care solutions.

The Asia-Pacific advanced wound care market is also marked by numerous regulatory approvals, facilitating the introduction of new and innovative products. Regulatory bodies in the region are actively evaluating and authorizing advanced wound care solutions to ensure they meet safety and efficacy standards. This regulatory support accelerates the availability of cutting-edge treatments, enhancing the market's growth and offering patients access to superior wound care options.

The Asia Pacific market is also subject to increasing regulatory scrutiny. This is due to concerns about the need to ensure patient safety, product efficacy, and compliance with evolving standards and regulations across different countries in the region. As the demand for advanced wound care solutions grows, regulatory bodies are intensifying their oversight to uphold quality standards, assess product safety, and monitor advertising and labeling practices to safeguard patient welfare and promote transparency within the industry. For instance, in January 2024, Avanos Medical, Inc. recalled specific lots of MIC Gastric-Jejunal Feeding Tube Kits due to potential sterility issues in the Nurse Assist supplied pre-filled syringes, which may risk infection if non-sterile water contacts surgical sites, affecting the feeding tube's inflation.

Product expansion in the Asia Pacific advanced wound care market is rapidly accelerating, driven by key players introducing a variety of innovative solutions. For instance, in January 2023, Convatec Group PLC announced the introduction of ConvaFoam in the U.S. ConvaFoam is the simpler dressing solution for wound management as it can be used on a wide range of wound types at any point in the wound healing process. Moreover, this trend is fueled by rising healthcare needs, increasing incidences of chronic wounds, and greater investment in healthcare infrastructure. As companies expand their product portfolios, healthcare providers gain access to cutting-edge wound care technologies, enhancing patient treatment outcomes across the region.

The Asia-Pacific market is highly fragmented, with numerous players vying for market share. Competitive analysis reveals that companies differentiate themselves through innovative product launches, strategic partnerships, and targeted marketing efforts. Key players focus on technological advancements and expansion of their product portfolios to meet diverse patient needs, enhancing their competitive edge in this dynamic market.

The Asia-Pacific market is experiencing significant regional expansion, driven by the growing healthcare infrastructure and rising patient awareness in countries like China, India, and Japan. Leading companies are investing in these markets to establish a stronger presence, leveraging the region's rapid economic growth and increasing demand for advanced wound care solutions. This expansion is further fueled by strategic partnerships, local manufacturing, and tailored marketing strategies to cater to the diverse needs of the Asia-Pacific population.

Product Insights

The moist segment led the market with the largest revenue share of 55.08% in 2023. The product is segmented into moist, antimicrobial, and active products. The moist segment is further segmented into foam dressings, Superabsorbent Dressings, film dressings, hydrocolloid dressings, alginate dressings, hydrogel dressings, collagen dressings, charcoal dressing, wound contact layers, greasy gauzes, and other advanced dressings. This high percentage can be attributed to an increasing geriatric population in many Asian countries, coupled with rising incidences of chronic diseases such as diabetes, which has led to a higher prevalence of chronic injuries that require advanced wound care solutions, including moist products. For instance, in October 2022, Healthium Medtech (Apax Partners), a provider of medical devices specializing in surgical, post-surgical, and chronic care solutions, introduced its injuries dressing collection, TheruptorTM Novo, specifically designed for treating chronic diseases such as diabetic foot ulcers and leg ulcers. This portfolio enhances Healthium's already robust lineup of patented products in the advanced wound dressing sector.

The active segment is expected to grow at the fastest CAGR of 6.77% over the forecast period. The active segment is further segmented into biomaterials, skin-substitute, and growth factors. The advancements in healthcare infrastructure and rising healthcare expenditure in countries across the region have facilitated greater access to advanced wound care products, including active infection dressings, which offer benefits such as faster healing and reduced risk of infection. For instance, medical care costs in the Asia Pacific rose from 7.2% in 2022 to a high of 9.9% in 2023, indicated by the WTW Global Medical Trends Survey, with expectations for the insurer-reported cost trend to plateau at 9.9% in 2024, reflecting stability impacted by regional market variations, where some areas experience minimal changes while others show slight fluctuations in costs from 2023 to 2024.

End-use Insights

The hospitals segment held the largest market share in terms of revenue in 2023. This is attributable to the higher incidence of chronic diseases such as diabetes and cardiovascular conditions. As older individuals are more prone to injuries, hospitals experience a surge in patients requiring advanced wound care, leading to increased adoption of advanced wound care products and treatments. According to the Agency for Science, Technology, and Research (A*STAR), chronic infections afflict approximately 2-6% of populations in developed nations, constituting a substantial economic burden on healthcare systems.

In Australia, they account for 2% of the total national health expenditure, while in Wales, they represent 5.5% of NHS spending. The management of injuries incurs significant costs, encompassing expenses related to frequent consultations and dressing changes by healthcare providers. This burden is anticipated to escalate with demographic shifts, including an aging population and a rising prevalence of conditions such as diabetes and obesity in Singapore. As such, there is a pressing need for effective strategies to address the growing impact of trauma on healthcare resources and patient well-being.

The home care segment is projected to grow at the fastest CAGR of 6.15% over the forecast period owing to factors such as the technological advancements in the market eventually leading to the market growth. For instance, in October 2021, a groundbreaking development by researchers at the National University of Singapore (NUS) created a smart bandage capable of identifying multiple biomarkers for onsite monitoring of injuries. Collaborating with clinical experts from Singapore General Hospital, the team introduced a wearable sensor that facilitates real-time assessment of infections at the point of care, transmitting data wirelessly to a dedicated app. This innovative sensor technology can swiftly detect temperature, pH levels, bacterial presence, and specific inflammatory factors associated with traumas, providing rapid and precise wound evaluation within a mere 15-minute timeframe.

Application Insights

Based on application, the chronic wounds segment accounted for the largest revenue share of 59.33% in 2023. The application is segmented into chronic wounds and acute wounds. The chronic wounds segment is further segmented into diabetic foot ulcers, pressure ulcers, venous leg ulcers, and other chronic wounds. This is attributable to technological advancements, encompassing a range of solutions, such as advanced injury dressings, negative pressure wound therapy systems, products, and topical oxygen therapy devices, among others. These technologies offer improved efficacy, enhanced infection healing outcomes, and greater patient comfort than traditional trauma care methods. In addition, advancements in telemedicine and remote monitoring technologies enable healthcare providers to deliver timely interventions and personalized care to patients with infections, further driving regional market growth. For instance, in November 2023, in South Korea, the NATROX O₂ topical oxygen therapy device, engineered by Inotec AMD-a spinout from Cambridge University-was launched. The device received approval from the Korean Ministry of Food & Drug Safety (MFDS) for shipment and sale within the country. Kove, serving as its distribution partner in South Korea, was expected to oversee its market introduction. Smaller in size than an iPhone, the device employs oxygen to promote infection healing by delivering continuous topical oxygen therapy (cTOT), offering a non-invasive and comfortable solution primarily designed to aid in healing chronic wounds.

The acute wounds segment is expected to grow at the fastest CAGR of 5.71% over the forecast period. It is further segmented into surgical and traumatic wounds and burns. The integration of artificial intelligence (AI) is a significant driving force behind the growth of the segment. AI-powered telemedicine platforms facilitate remote injury monitoring and consultation, improving access to specialized trauma care expertise, particularly in remote or underserved areas.

The integration of AI enhances clinical decision-making and patient outcomes and drives efficiency and cost-effectiveness in infection management across the region. For instance, in June 2023, Singaporean researchers created a wearable infection health monitoring patch called PETAL, which utilizes AI to detect deteriorating injury conditions and alert medical staff for timely intervention. This innovative wearable technology, developed collaboratively by scientists from the National University of Singapore (NUS) and the Agency for Science, Technology, and Research (A*STAR), aims to enhance burns care management.

Country Insights

The advanced wound care market in Asia Pacific is expected to grow significantly, owing to the rising geriatric population in the region, the rising incidence of injuries and burns, and the rising number of surgeries in the region. The increasing incidence of chronic diseases such as diabetes, cancer, and other autoimmune diseases is anticipated to increase the incidence rate of chronic wounds in Asia Pacific. For instance, in January 2022, Wounds Australia offered a solution fund totaling USD 2 million to be allocated over four years. This fund aims to establish a nationwide media and digital initiative focused on chronic wound prevention and treatment, leveraging the platform provided by Wound Awareness Week.

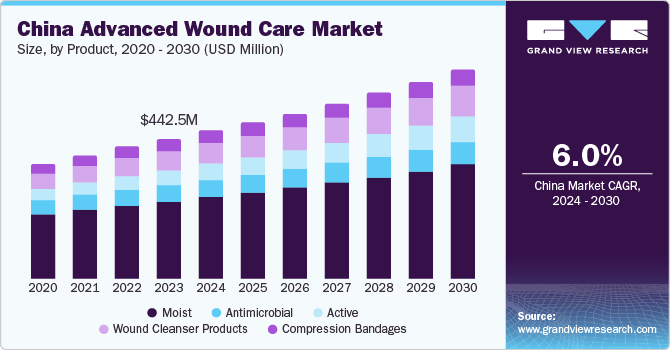

China Advanced Wound Care Market Trends

The China advanced wound care market had a revenue share of 20.7% in 2023. The country's growth can be attributed to its large aging population requiring advanced treatments and its rapid adoption of innovative wound care technologies, positioning it as a key player in the region’s healthcare sector. Moreover, major players are expanding their market presence by enhancing their product portfolio and widening distribution channels nationwide.

In addition, collaborations & partnerships with healthcare providers and hospitals are helping key players strengthen their market position. For instance, in April 2023, Gunze and Essex Bio-Technology Ltd. entered into an agency contract for PELNAC absorbable dressing, an invention by Gunze. As per the agreement's regulations, Essex Medipharma was recognized as PELNAC's sole agent in Mainland China for five years, from 2023 to 2027. Such initiatives are expected to boost market growth over the forecast period.

India Advanced Wound Care Market Trends

The India advanced wound care market is expected to witness the fastest CAGR of 6.78% during the forecast period. Several factors, including the increasing prevalence of chronic disorders and rising medical tourism, are driving market growth in this nation. The demand for advanced wound care products, such as foam dressings, alginate dressings, and wound cleansers, is increasing due to economic development, urbanization, and rising healthcare awareness, resulting in a rise in healthcare expenditure in the country. Continuous advancements in technology in the manufacture of advanced wound care products, compositions, and delivery methods are expected to propel the market growth in the coming years.

Key Asia Pacific Advanced Wound Care Company Insights

Some of the key players operating in the market include 3M, Smith & Nephew, Baxter, and Cardinal Health.

-

Smith & Nephew is a medical technology firm specializing in developing, manufacturing, and marketing medical devices for orthopedic reconstruction, trauma, sports medicine, ENT, and advanced wound management. Their product range includes knee and hip implants, robotics-assisted technologies, trauma-related products for fracture stabilization, soft tissue repair instruments, and wound care products catering to surgeons, nurses, physicians, and healthcare purchasers in hospitals and insurance networks

-

3M manufactures and supplies industrial products and solutions across diverse sectors. Their product portfolio encompasses display systems, advanced materials, office supplies, home improvement, personal safety equipment, roofing materials, and more. In addition, 3M provides solutions in medical, oral care, consumer health, food safety, and health information systems, catering to various industries, including automotive, electronics, healthcare, safety, energy, and consumer goods

-

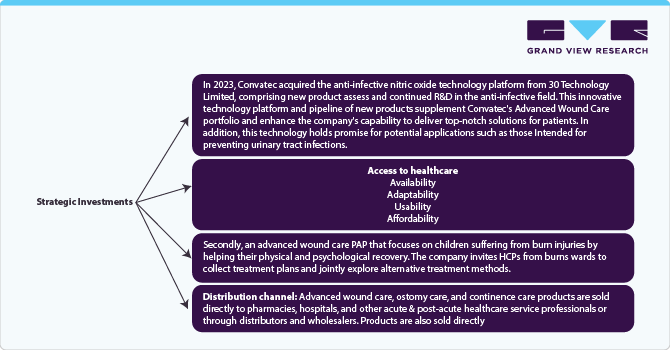

ConvaTec Inc. provides diverse medical products and technologies, catering to various healthcare needs, including wound care, continence management, and infusion therapy, servicing hospitals, home care agencies, and retail distributors globally. Strategic investments by the firm are showcased below:

-

Integra LifeSciences Corporation is a medical technology firm specializing in engineered collagen-based products, including surgical instruments, wound care, orthopedic hardware, implants, dermal regeneration products, and neurosurgery devices. Its solutions cater to orthopedic extremity surgery, neurosurgery, reconstructive, and general surgery, serving various healthcare settings such as hospitals, outpatient centers, and medical practices

-

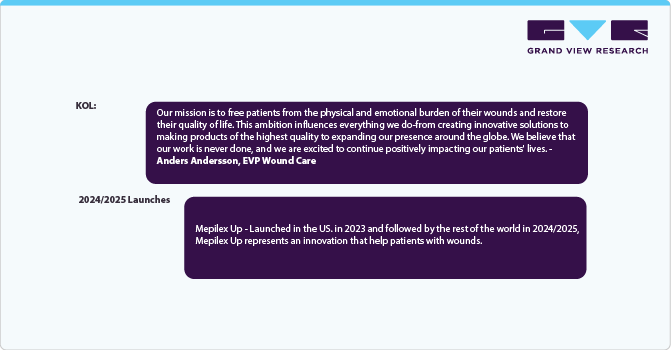

Mölnlycke Health Care AB, ConvaTec Inc., and Integra LifeSciences Corporation are some of the other market participants in the Asia Pacific market. Some of the insights from Mölnlycke Health Care AB:

“The wound care market worldwide has shown signs of recovery from the pandemic's effects and is experiencing a slightly accelerated growth compared to the pre-pandemic period. Nevertheless, COVID-19 caused setbacks in wound care delivery, resulting in the deterioration of many wounds. Furthermore, the pandemic underscored the importance of ensuring dependable supply chains and maintaining high-quality standards.”

Thus, due to such market activities by key companies, the demand for advanced wound care products among key customers will increase in the near future.

Key Asia Pacific Advanced Wound Care Companies:

- Mölnlycke Health Care AB

- 3M

- Smith & Nephew

- Baxter International

- Cardinal Health

- Medline Industries, Inc.

- ConvaTec Inc.

- Johnson & Johnson Services, Inc.

- Integra LifeSciences Corporation

- B. Braun Melsungen AG

- Coloplast Corp.

- Urgo Medical

Recent Developments

-

In July 2023, Smith & Nephew PLC introduced the REGENETEN Bioinductive Implant, accessible in India. The REGENETEN implant, a novel solution for rotator cuff surgeries, has been utilized in over 100,000 procedures.

-

In April 2023, 3M announced the U.S. FDA approval for 3M Veraflo Therapy dressings intended for hydromechanical removal of nonviable tissue.

-

In April 2023, Convatec Group PLC acquired 30 Technology Limited’s anti-infective nitric oxide technology platform, which includes new product assets and R&D. In addition to enhanced wound care, Convatec plans to explore the technical platform for use in other businesses.

Asia Pacific Advanced Wound Care Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 3.06 billion

Growth rate

CAGR of 5.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, country

Regional scope

Asia Pacific

Country scope

China; India; Australia; Singapore; Vietnam; Thailand; Indonesia; South Korea; Hong Kong; Malaysia

Key companies profiled

Mölnlycke Health Care AB; 3M; Smith & Nephew; Baxter International; Cardinal Health; Medline Industries, Inc.; ConvaTec Inc.; Johnson & Johnson Services, Inc.; Integra LifeSciences Corporation; B. Braun Melsungen AG; Coloplast Corp.; Urgo Medical

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Advanced Wound Care Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific advanced wound care market report based on product, application, end-use, and country:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Moist

-

Foam Dressings

-

Adhesive

-

Non-adhesive Foam Dressings

-

-

Superabsorbent Dressings

-

Film Dressings

-

Hydrocolloid Dressings

-

Alginate Dressings

-

Hydrogel Dressings

-

Collagen Dressings

-

Charcoals Dressings

-

Wound Contact Layers

-

Greasy Gauzes

-

Other Advanced Dressings

-

-

Antimicrobial

-

Silver Dressings

-

Non-silver Dressings

-

Honey

-

Iodine

-

Chitosan

-

PHMB

-

Others

-

-

-

Active

-

Biomaterials

-

Skin-substitute

-

Growth factors

-

-

Wound Cleanser Products

-

Wetting Agents

-

Antiseptic

-

Moisturizers

-

Pulsed Lavage Systems

-

Disposable

-

Reusable

-

Semi Disposable

-

-

Others

-

-

Compression Bandages

-

Long-Stretch Elastic Bandages

-

Short-Stretch Bandages

-

Multi-layer Bandages

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Chronic Wounds

-

Diabetic Foot Ulcers

-

Pressure Ulcers

-

Stage 1

-

Stage 2

-

Stage 3

-

Stage 4

-

-

Deep Tissue Injury

-

Venous Leg Ulcers

-

Other Chronic Wounds

-

-

Acute Wounds

-

Surgical & Traumatic Wounds

-

Burns

-

1st Degree Burns

-

2nd Degree Burns

-

3rd Degree Burns

-

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Outpatient Facilities

-

Home Care

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

China

-

India

-

Australia

-

Singapore

-

Vietnam

-

Thailand

-

Indonesia

-

South Korea

-

Hong Kong

-

Malaysia

-

Frequently Asked Questions About This Report

b. The Asia Pacific advanced wound care market size was estimated at USD 2.13 billion in 2023 and is expected to reach USD 2.41 billion in 2024.

b. The Asia Pacific advanced wound care market is expected to grow at a compound annual growth rate of 5.4% from 2024 to 2030 to reach USD 3.06 billion by 2030.

b. Based on product, the moist segment dominated the market with a 55.08% share in 2023. This growth can be attributed to the rising incidences of chronic diseases such as diabetes, leading to the high prevalence of chronic injuries that drive demand for advanced wound care solutions, including moist products.

b. Some key players operating in the Asia Pacific advanced wound care market include Mölnlycke Health Care AB; 3M; Smith & Nephew; Baxter International; Cardinal Health; Medline Industries, Inc.; ConvaTec Inc.; Johnson & Johnson Services, Inc.; Integra LifeSciences Corporation; B. Braun Melsungen AG; Coloplast Corp.; Urgo Medical.

b. Key factors that are driving the market growth include increasing demand for reducing hospital stays, the rising incidence of chronic wounds, and the rising number of surgeries in the region.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."