- Home

- »

- Pharmaceuticals

- »

-

Asia Pacific Active Pharmaceutical Ingredients Market, Report, 2030GVR Report cover

![Asia Pacific Active Pharmaceutical Ingredients Market Size, Share & Trends Report]()

Asia Pacific Active Pharmaceutical Ingredients Market Size, Share & Trends Analysis Report By Type Of Synthesis (Biotech, Synthetic), By Type Of Manufacturer (Captive, Merchant), By Type, By Application, By Country, And Segment Forecast, 2024 - 2030

- Report ID: GVR-4-68040-311-7

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

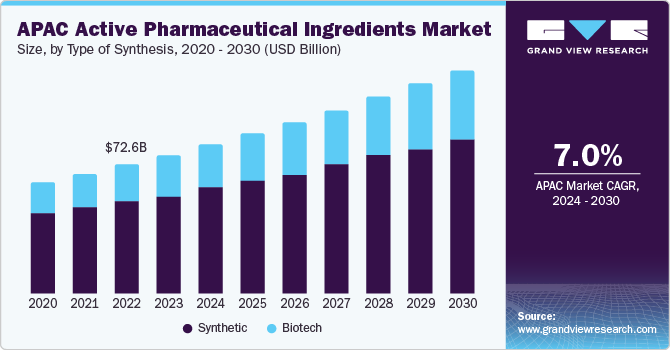

The Asia Pacific active pharmaceutical ingredients market size was estimated at USD 78.3 billion in 2023 and is projected to grow at a CAGR of 7.0% from 2024 to 2030. This growth is attributed to the increasing prevalence of chronic diseases, an aging population, and the trend toward outsourcing active pharmaceutical ingredients (API) production. In addition, the incorporation of biologics in disease management and a growth in regulatory approvals are also driving the market. Furthermore, the termination of patents for significant drugs and the cost benefits of manufacturing in countries such as China and India are expected to continue driving market growth in the region.

The Asia Pacific active pharmaceuticals ingredients market accounted for a revenue share of 33.0% in the global active pharmaceuticals ingredients market. Active Pharmaceutical Ingredients play an essential role across various sectors, with pharmaceutical manufacturing leading the demand. The support from the nutraceutical, cosmetics, and veterinary medicine industries further underscores this importance.

According to the Pharmaceutical Research and Manufacturers Association, investments in the API sector, especially in China and India, have surged, with funding from the government and private sectors exceeding $5 billion in the past year. In addition, the regulatory environment for APIs in the Asia-Pacific region varies significantly across countries. Yet, efforts by the International Council for Harmonisation (ICH) to standardize regulations globally are notable. Agencies like Singapore’s Health Sciences Authority (HSA) and India’s Central Drugs Standard Control Organization (CDSCO) enforce rigorous standards to ensure APIs' quality, safety, and efficacy.

Furthermore, outsourcing Active Pharmaceutical Ingredient (API) manufacturing to the Asia-Pacific region represents a pivotal growth opportunity for its market. Countries like India and China have emerged as global epicenters for producing APIs, attributed to their capacity to provide high-quality and cost-effective solutions. This transition towards outsourcing is primarily motivated by the industry’s aim to diminish manufacturing expenses, harness specialized production capabilities, and enhance supply chain efficiencies.

Types of Synthesis Insights

The synthetic active pharmaceutical ingredients led the market and accounted for the largest market share of 69.7% in 2023. This growth is attributed to the affordability of synthetic APIs, which are vital for price-sensitive marketplaces and contribute to their widespread adoption. In addition, ongoing investments in research and development enhance synthetic methodologies through green chemistry, ensuring compliance with global environmental standards and contributing to the segment’s growth. The regulatory environment in the Asia Pacific, characterized by streamlined approval processes for synthetic APIs, further accelerates the market's growth.

The biotech API also held a significant market share in 2023 owing to the growing prevalence of chronic diseases, an aging population, and the trend toward outsourcing API production. Furthermore, the incorporation of biologics in disease management, regulatory sanctions, and the expiration of patents for essential drugs are also contributing to the segment’s growth.

Types of Manufacturers Insights

The captive API dominated the market and accounted for the largest revenue share of 50.0% in 2023. This growth is attributed to the increasing technological advancements, improving manufacturing competencies, and the necessity to meet the demand for bulk APIs. Furthermore, the captive API segment is expected to dominate the market due to the huge investment by major market players, further driving the growth of captive API manufacturers.

Merchant API witnessed substantial growth in 2023 owing to the rising trend towards outsourcing API production, the growth of contract manufacturing organizations (CMOs) in the region, and the need for cost-effectiveness. In addition, the merchant segment's growth is further strengthened by CMOs' increasing experience in meeting the pharmaceutical industry's strict quality standards.

Types Insights

The innovative APIs segment dominated the market with a substantial revenue share in 2023. This growth can be attributed to increased funding and favorable regulations for research and development (R&D) facilities, allowing the pipeline to be filled with several novel, innovative products. As a result, a significant number of these innovative APIs are expected to be launched in the near future.

The generic APIs segment also held a significant revenue share in 2023 and are anticipated to experience the fastest growth over the forecast period. This growth is primarily driven by the expiration of patents for various branded molecules, creating a high-growth opportunity for generic API manufacturers.

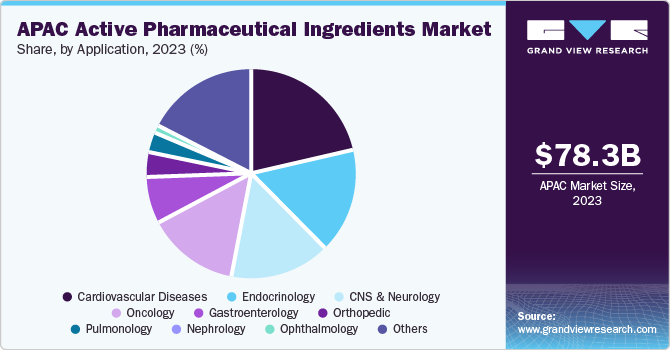

Application Insights

The cardiovascular diseases segment accounted for the largest market share of 21.2% in 2023. This growth is attributed to the increasing prevalence of cardiovascular diseases, particularly in younger populations, and the rising geriatric population. Furthermore, factors such as hypertension, high cholesterol, smoking, and obesity contribute significantly to the growth of this segment.

The endocrinology segment registered a substantial revenue share in 2023 owing to the growing prevalence of endocrine disorders such as diabetes, thyroid disorders, and hormonal imbalances, mainly in the aging population. Furthermore, the increasing consciousness about early diagnosis and treatment of endocrine conditions, coupled with the development of new therapies and APIs targeting these disorders, is driving the market growth.

Country Insights

China Active Pharmaceuticals Ingredients Market Trends

The China active pharmaceuticals ingredients market dominated the market and accounted for the largest revenue share of 34.0% in 2023. This growth is attributed to the increasing prevalence of chronic diseases, such as cardiovascular disorders and cancer is increasing demand for innovative drugs. In addition, the country's large-scale production capacity and favorable regulatory environment, including the National Medical Products Administration's guidance on API manufacturing, are attracting global players to establish operations in China, which in turn is driving the growth of the market in the country.

India Active Pharmaceuticals Ingredients Market Trends

The active pharmaceutical ingredients market in India witnessed substantial growth in 2023 owing to the country's large-scale production capacity, skilled workforce, and favorable regulatory environment, which are attracting worldwide players to establish operations in India. In addition, the increasing adoption of generic drugs and growing expenditure on healthcare are also contributing to market growth.

Key Asia Pacific Active Pharmaceutical Ingredients Company Insights:

Key players in the market include Dr. Reddy’s Laboratories Ltd and Cipla Inc.

-

Dr. Reddy's Laboratories Ltd. manufactures and markets a wide range of products, including active pharmaceutical ingredients, biosimilars, generic formulations, and proprietary products. The company's products are indicated for various therapeutic areas, such as gastrointestinal disorders, cancer, pain, cardiovascular diseases, central nervous system disorders, infectious diseases, and pediatric diseases.

-

Cipla Inc. is a leading pharmaceutical business that manufactures and markets a wide range of products, including active pharmaceutical ingredients (APIs), generic formulations, and proprietary products. The company's products are specified for various therapeutic areas, such as respiratory disease, cardiovascular disease, arthritis, diabetes, depression, and various other medical conditions. The company has an important presence in over 80 countries and is known for its affordable medicines.

Reyoung Pharmaceutical, and GC Biopharma Corp. are other participants in the Asia Pacific Personal Care Contract Manufacturing market.

- GC Biopharma Corp manufactures and promotes a wide range of products including plasma protein therapeutics, vaccines, over-the-counter (OTC) drugs, and prescription drugs. The business focuses on evolving treatments for various diseases such as cancer, tuberculosis, and rare bleeding disorders, and has a noteworthy presence in the international market.

Key Asia Pacific Active Pharmaceuticals Ingredients Companies:

- Dr. Reddy’s Laboratories Ltd.

- Sun Pharmaceutical Industries Ltd.

- Cipla Inc.

- Aurobindo Pharma.

- Asymchem Laboratories

- Reyoung Pharmaceutical

- CSPC Pharmaceutical Group Limited

- Otsuka Pharmaceutical Australia Pty Ltd.

- GC Biopharma Corp.

- Chong Kun Dang Pharmaceutical Corporation

Recent Developments

-

In June 2024, Sun Pharmaceutical Industries Limited acquired a 9.61% stake in HaystackAnalytics Pvt. Ltd. The acquisition includes a cash consideration of INR 330 million, which is expected to be used to procure common equity in HaystackAnalytics. This planned move aims to swell Sun Pharmaceutical's presence in the marketplace.

-

In January 2023, Dr. Reddy's Laboratories Ltd. acquired the trademark rights for the breast cancer drug Primcyv from Pfizer India. Primcyv contains the active ingredient palbociclib, a CDK 4/6 inhibitor used in combination with an aromatase inhibitor for treating HR+, HER2- metastatic breast cancer. With this move Dr. Reddy's is expected to manufacture and market the drug locally, with plans to retail it at a significant reduction in price to increase patient access.

Asia Pacific Active Pharmaceuticals Ingredients Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 84.2 billion

Revenue forecast in 2030

USD 125.5 billion

Growth rate

CAGR of 7.0% from 2024 to 2030

Base year for estimation

2023

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Types of synthesis, types of manufacturers, types, application, and country

Regional Coverage

Asia Pacific

Country Coverage

China; India; South Korea; Japan; Australia; Indonesia; Taiwan; Thailand; Malaysia; Vietnam

Key companies profiled

Dr. Reddy’s Laboratories Ltd.; Sun Pharmaceutical Industries Ltd.; Cipla Inc.; Aurobindo Pharma.; Asymchem Laboratories; Reyoung Pharmaceutical; CSPC Pharmaceutical Group Limited; Otsuka Pharmaceutical Australia Pty Ltd.; GC Biopharma Corp.; Chong Kun Dang Pharmaceutical Corp.

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Active Pharmaceuticals Ingredients Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Asia Pacific active pharmaceuticals ingredients market report based on types of synthesis, types of manufacturers, types, application, and country:

-

Type of Synthesis Outlook (Revenue, USD Billion, 2018 - 2030)

-

Synthetic

-

Biotech

-

-

Type of Manufacturers Outlook (Revenue, USD Billion, 2018 - 2030)

-

Captive APIs

-

Merchant APIs

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Innovative APIs

-

Generic APIs

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cardiovascular Diseases

-

Endocrinology

-

CNS and Neurology

-

Oncology

-

Gastroenterology

-

Orthopedic

-

Pulmonology

-

Nephrology

-

Ophthalmology

-

Others

-

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)

-

Asia Pacific

-

China

-

India

-

South Korea

-

Japan

-

Australia

-

Indonesia

-

Taiwan

-

Thailand

-

Malaysia

-

Vietnam

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."