- Home

- »

- Plastics, Polymers & Resins

- »

-

Aseptic Carton Packaging Market Size & Share Report, 2030GVR Report cover

![Aseptic Carton Packaging Market Size, Share & Trends Report]()

Aseptic Carton Packaging Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (Plastics, Paper & Paperboard), By Type, By Application, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-480-9

- Number of Report Pages: 160

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Aseptic Carton Packaging Market Trends

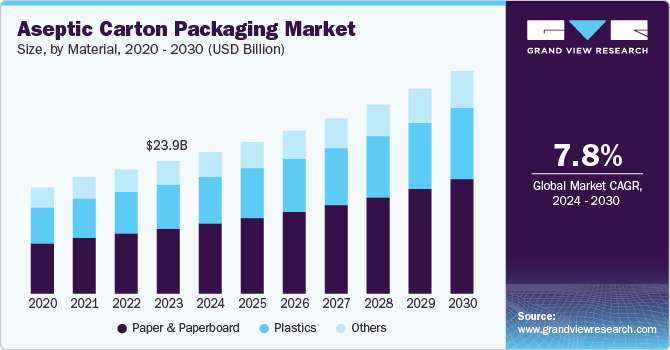

The global aseptic carton packaging market size was estimated at USD 23.98 billion in 2023 and is projected to grow at a CAGR of 7.8% from 2024 to 2030. Booming dairy and non-alcoholic beverage industry is driving the demand for the aseptic carton packaging across the globe. Additionally, increasing consumer preference for convenience is positively influencing the growth of the market.

The aseptic carton packaging market is driven by several key factors, including the increasing demand for extended shelf-life products, particularly in the food and beverage industry. Aseptic packaging involves sterilizing both the carton and the contents separately before sealing them in a sterile environment. This process eliminates the need for preservatives and refrigeration, which is highly beneficial for products such as dairy, juices, and non-alcoholic beverages. For example, milk and juice products can be stored for months without refrigeration, which appeals to consumers in both developed and developing markets where consistent refrigeration might not be available.

Another major driver is the rising consumer preference for convenience and on-the-go products. As lifestyles become more fast-paced, consumers are increasingly seeking easy-to-use, portable packaging solutions. Aseptic cartons, being lightweight, easy to transport, and offering resealability, meet these consumer demands. This trend is particularly noticeable in the growth of ready-to-drink (RTD) beverages and plant-based beverages, where aseptic packaging ensures product safety and longevity. Providing product safety without altering taste or nutritional content enhances its appeal among health-conscious consumers.

Moreover, sustainability is a significant driving factor in the aseptic carton packaging market. Aseptic cartons are primarily made from renewable resources, such as paperboard, and they have a lower environmental impact compared to plastic or glass packaging. The increasing consumer demand for environmentally friendly packaging has pushed companies to adopt aseptic cartons as a sustainable solution. For instance, in May 2023, Tetra Pak International S.A. and Lactogal Produtos Alimentares S.A. launched a new sustainable aseptic carton for milk, significantly reducing its carbon footprint by one-third and increasing the renewable content to 90%.

Material Insights

Paper & paperboard dominated the overall market with a revenue market share of over 49.0% in 2023 and is expected to witness robust growth with a CAGR of 8.6% over the forecast period. It provides the main structure of the carton, giving it rigidity and strength. These materials are derived from wood pulp and offer an eco-friendly alternative to plastic-heavy packaging. Hence, the growing consumer preference for sustainable and environmentally friendly packaging solutions is the primary driver for paper and paperboard in aseptic cartons.

Plastics play a critical role in aseptic carton packaging, primarily used as protective layers to prevent contamination and enhance product shelf life. These layers, often made of polyethylene, act as moisture barriers and contribute to the structural integrity of the packaging.

Type Insights

Standard/base shape dominated the overall market with a revenue market share of over 46.0% in 2023. This shape is commonly rectangular, providing a straightforward design that is easy to handle and stack. Standard-shaped cartons are versatile, being used for a range of food and beverage products such as milk, juices, and liquid dairy alternatives. Their broad acceptance in retail settings makes them a familiar sight for consumers.

Slim-shaped aseptic cartons offer a more compact and sleek design compared to the standard shape. They are often used for single-serve beverages, health drinks, and specialized dairy products like flavored milk or energy drinks. This shape is designed for convenience and portability, appealing to on-the-go consumers.

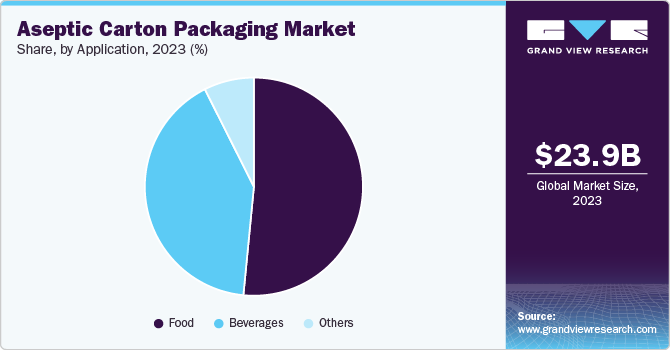

Application Insights

Food application segment dominated the market and accounted for the largest revenue share of over 51.0% in 2023. In the food segment of the aseptic carton packaging market, packaging is widely used for products such as dairy, soups, sauces, puree, and processed foods that require extended shelf life. Driving factors for the food segment include increasing consumer demand for ready-to-eat meals, convenience foods, and healthier options that maintain nutritional value over time.

In the beverages segment, aseptic carton packaging is primarily used for products such as juices, dairy drinks, energy drinks, and alcoholic beverages. These cartons maintain the taste, texture, and nutritional content of beverages by preventing contamination from external factors. Driving factors for the beverage segment include the rising consumption of health-conscious drinks, such as plant-based beverages and fortified juices, and the growing non-alcoholic beverage industry.

Distribution Channel Insights

Direct distributors dominated the overall market with a revenue market share of over 47.0% in 2023. Direct distributors are driven by the increasing focus on reducing intermediaries in the supply chain, which lowers costs and improves profit margins. The demand for more transparent relationships between packaging suppliers and end-users, as well as the ability to offer bespoke packaging solutions directly, further propels the use of direct distribution channels.

GPOs distribution channel segment is expected to witness robust growth with a CAGR of 8.5% over the forecast period. GPOs are collective purchasing bodies that negotiate prices on behalf of a group of companies or institutions. In the aseptic carton packaging market, GPOs pool the purchasing power of multiple food and beverage manufacturers, healthcare institutions, or retail chains to secure better pricing and terms from suppliers.

Regional Insights

North America aseptic carton packaging dominated the global market and accounted for the largest revenue share of over 30.0% in 2023. The growth is attributed to several key factors, including the region's strong focus on food safety, innovation in packaging technologies, and growing consumer demand for convenience. Aseptic packaging, which allows products to be stored without refrigeration, has gained traction in the U.S. and Canada, particularly in the food and beverage sector. With rising concerns about foodborne illnesses and the need to extend the shelf life of perishable goods, manufacturers are increasingly adopting aseptic packaging solutions.

U.S. Aseptic Carton Packaging Market Trends

Aseptic carton packaging market in the U.S. is primarily driven by expanding U.S. food & beverage industry. The industry's constant innovation drives the adoption of aseptic carton packaging. New product categories, such as plant-based milk alternatives, ready-to-drink coffee, and functional beverages, often utilize aseptic packaging to extend shelf life without preservatives. For instance, brands such as Califia Farms and Silk have successfully launched various plant-based milk products in aseptic cartons, appealing to health-conscious consumers while ensuring product freshness.

Europe Aseptic Carton Packaging Market Trends

Europe has stringent food safety regulations, which have boosted the demand for aseptic packaging. Aseptic processing and packaging techniques ensure that food and beverages remain sterile and have a longer shelf life without the need for preservatives or refrigeration. This is particularly important in Europe, where there's a growing consumer preference for clean label products with minimal additives. For example, the popularity of organic and natural products in countries such as Germany, France, and the UK has driven the need for packaging solutions that can maintain product integrity without chemical preservatives.

Aseptic Carton packaging market in the Germany is growing due to robust food and beverage industry, coupled with changing consumer preferences for convenient and on-the-go products. Aseptic carton packaging offers extended shelf life without the need for refrigeration, making it ideal for busy German consumers. This has resulted in the growth of products such as ready-to-drink coffee, smoothies, and protein shakes in aseptic cartons.

Asia Pacific Aseptic Carton Packaging Market Trends

The underdeveloped cold chain infrastructure in many parts of Asia Pacific region makes aseptic packaging an attractive option for food and beverage companies. In countries with tropical climates or less developed logistics networks, aseptic cartons provide a cost-effective way to distribute perishable products without the need for constant refrigeration. This has been particularly important in expanding market reach to rural and semi-urban areas.

Aseptic carton packaging Market in China is growing due to the booming food and beverage industry, increasing urbanization, and strong focus on sustainability. As one of the largest consumers of packaged goods globally, the country has witnessed a surge in demand for aseptic packaging, particularly in the dairy, juice, and non-alcoholic beverage sectors. The country's growing middle class is driving this demand, as consumers increasingly prefer convenient, on-the-go packaging solutions that ensure product freshness and extended shelf life without the need for preservatives or refrigeration.

Key Aseptic Carton Packaging Company Insights

The competitive environment of the aseptic carton packaging market is marked by the presence of several major players, including Tetra Pak International S.A., SIG, and Elopak, who dominate the global market with their extensive product portfolios and advanced technologies. These companies compete on factors such as innovation, sustainability, and cost efficiency, focusing on developing eco-friendly packaging solutions to meet the increasing demand for sustainable packaging in the food and beverage industry. Moreover, increasing production capacity and expansion initiatives are undertaken by major players to gain competitive edge in the market.

-

In October 2023, SIG introduced a new product called the SIG DomeMini, an on-the-go carton bottle designed to combine convenience with sustainability. This small carton pack offers the ease of a plastic bottle while being environmentally friendly, as it is primarily made from FSC-certified paperboard and produced using 100% renewable electricity. The SIG DomeMini is aimed at the growing market for on-the-go beverages, providing consumers with a sustainable option that helps reduce plastic waste. The carton is designed for recycling and features a resource-efficient, space-saving design. The filling machine for the SIG DomeMini can fill up to 12,000 packages per hour and can handle seven different volume sizes ranging from 180 to 350 ml.

-

In September 2023, SIG announced the establishment of its first aseptic carton plant in India, located in Ahmedabad, Gujarat. This marks SIG's 10th aseptic carton facility globally and is part of a significant investment plan totaling approximately USD 104.9 million, to be implemented by 2025. The plant will initially aim for a production capacity of up to 4 billion packages per year, with future expansions expected to increase this to 10 billion.

Key Aseptic Carton Packaging Companies:

The following are the leading companies in the aseptic carton packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Tetra Pak International S.A.

- SIG

- Elopak

- Nippon Paper Industries Co., Ltd.

- UFlex Limited

- IPI S.r.l.

- Greatview Aseptic Packaging Company Limited

- Mondi

- WestRock Company

- Heli Packaging Technology (Qingzhou) Co., Ltd

Aseptic Carton Packaging Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 25.62 billion

Revenue forecast in 2030

USD 40.31 billion

Growth rate

CAGR of 7.8% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, Volume in Kilotons, and CAGR from 2024 to 2030

Report coverage

Volume Forecast, Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Material, type, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Saudi Arabia; UAE

Key companies profiled

Tetra Pak International S.A.; SIG; Elopak; Nippon Paper Industries Co., Ltd.; UFlex Limited; IPI S.r.l.; Greatview Aseptic Packaging Company Limited; Mondi; WestRock Company; Heli Packaging Technology (Qingzhou) Co., Ltd

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aseptic Carton Packaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the aseptic carton packaging market report based on material, type, application, distribution channel, and region:

-

Material Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Plastics

-

Paper & Paperboard

-

Others

-

-

Type Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Standard / Base Shape

-

Slim Shape

-

Square Shape

-

Others

-

-

Application Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Food

-

Milk

-

Dairy Products and Ice Cream

-

Fruit and Vegetable Puree

-

Others

-

-

Beverages

-

Alcoholic Beverages

-

Non-Alcoholic Beverages

-

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Group Purchasing Organizations (GPOs)

-

Corporate Distributors

-

Individual Distributors

-

Direct Distributors

-

Others

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global aseptic carton packaging market was estimated at USD 23.98 billion in 2024 and is expected to reach USD 25.62 billion in 2025.

b. The global aseptic carton packaging market is expected to grow at a compound annual growth rate of 7.8% from 2025 to 2030, reaching around USD 40.31 billion by 2030.

b. Paper and paperboard dominated the overall market with a revenue market share of over 49.0% in 2023 and is expected to witness robust growth with a CAGR of 8.6% over the forecast period. Paper and paperboard provide the main structure of the carton, giving it rigidity and strength.

b. Key players in the market include Tetra Pak International S.A.; SIG; Elopak; Nippon Paper Industries Co., Ltd.; UFlex Limited; IPI S.r.l.; Greatview Aseptic Packaging Company Limited; Mondi; WestRock Company; and Heli Packaging Technology (Qingzhou) Co., Ltd.

b. The booming dairy and non-alcoholic beverage industries are driving the demand for aseptic carton packaging worldwide. Additionally, increasing consumer preference for convenience is positively influencing the growth of the aseptic carton packaging market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.