- Home

- »

- Healthcare IT

- »

-

ASC Revenue Cycle Management Market Size Report, 2030GVR Report cover

![ASC Revenue Cycle Management Market Size, Share & Trends Report]()

ASC Revenue Cycle Management Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Integrated, Standalone), By Product (Software, Services), By Delivery Mode, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-359-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

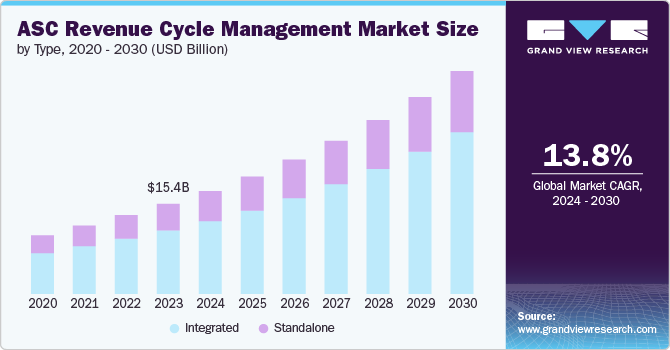

The global ASC revenue cycle management market size was estimated at USD 15.36 billion in 2023 and is expected to expand at a grow of 13.76% from 2024 to 2030. This growth is attributed to the increasing patient volume, integration of advanced technologies, and focus on cost containment and operational efficiency. According to the Centers for Medicare & Medicaid Services (CMS), in 2023, the Medicare Fee-for-Service (FFS) estimated improper payment rate was 7.38%, or USD 31.2 billion, highlighting the need for efficient revenue cycle management to minimize claim denials and maximize reimbursements.

The growing trend towards outpatient procedures rather than inpatient hospital stays has led to a higher demand for specialized software solutions for handling the increased volume of patients. Such facilities require efficient revenue cycle management tools to cope with the boost in patient flow and related billing operations. For instance, monitoring month-to-date collections and cases yet to be billed is crucial for these facilities to achieve their financial goals and determine potential issues.

The rapid technological advancements in Revenue Cycle Management (RCM) solutions are contributing to the market growth. Advanced RCM software platforms offer automated coding assistance, predictive analytics for revenue forecasting, real-time claims tracking, and integration with Electronic Health Records (EHR) systems. These technological innovations enhance operational efficiency and enable ambulatory surgery centers (ASC)s to adapt to regulatory requirements and industry standards. The updates aim to enhance operational efficiency and financial performance.

Moreover, the market players are adopting several strategies to increase their market presence, and market share, further contributing to the market’s growth. For instance, in April 2022, HST Pathways, a prominent provider of comprehensive software solutions for the ASC, acquired Simplify ASC. This strategic move signifies HST Pathways’ commitment to enhancing its offerings and expanding its market presence within this sector. Simplify ASC is known for its revenue cycle management solution, which complements HST Pathways’ existing suite of ASC management tools. These tools include scheduling and registration, clinical charting, claims management, inventory management, compliance, and reporting functionalities.

Type Insights

The integrated segment held the largest share of 70.45% in 2023 and is anticipated to grow rapidly over the forecast period. The integration of various functions such as billing, scheduling, coding, and collections into a single platform streamlines operations, reduces errors and enhances efficiency. This integrated approach minimizes manual interventions, improves communication between different departments, and ensures a seamless flow of information throughout the revenue cycle process. In addition, integrated solutions offer real-time data access and analytics capabilities, enabling healthcare facilities to make informed decisions promptly. The increasing focus on cost reduction, regulatory compliance, and patient satisfaction in ambulatory surgery centers further fuels the demand for integrated solutions.

The standalone segment is expected to witness significant growth in the market. Standalone solutions are popular in ASCs for their specialized features that cater to unique needs. They offer comprehensive services such as billing, coding, and compliance management, all within a single platform. Their growth is driven by the rise of the adoption of RCM in ASCs, demand for integrated solutions, and benefits such as scalability and cost-effectiveness. In addition, the shift towards value-based care and changes in healthcare reimbursement regulations is expected to boost the adoption of standalone solutions.

Product Insights

The services segment held the largest share of 67.07% in 2023 and is growing at the fastest CAGR over the forecast period. The growing need for specialized expertise, leading these centers to outsource functions such as coding and billing to skilled professionals is contributing to the high segment share. Outsourcing helps to maintain accuracy and timeliness in operations, enabling the centers to concentrate on their primary clinical tasks. Full-service solutions that handle the entire revenue cycle are gaining popularity among these surgery centers to outsource contributing to the growth of the segment.

The software held the second largest share in the market. The growth is driven by the rising integration of digital technology in healthcare, the demand for streamlined patient scheduling, and the necessity for precise billing. RCM systems streamline claims management process, improve patient processing by automating the manual tasks. These software facilitates the management of appointments, billing, and revenue cycles, significantly improving workflow efficiency and operational productivity.

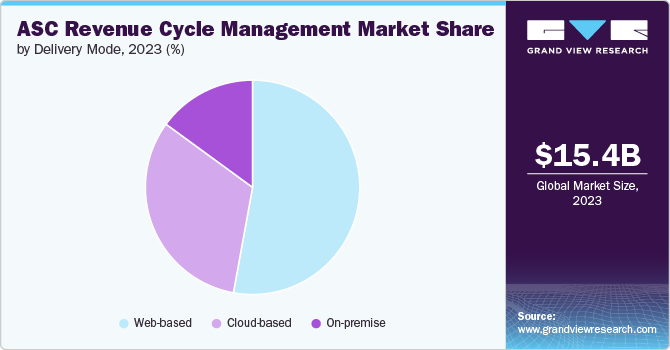

Delivery Mode Insights

The web-based segment accounted for the largest share of 52.87% in 2023. This segment involves web-based solutions that can be installed off-site and managed by a third party, offering affordability and ease of deployment. Their cost-effectiveness and flexibility allow for easy access and management of medical data, patient portals, electronic medical records, and other essential healthcare functions without additional hardware or storage. As the healthcare industry continues to prioritize digital transformation and interoperability, web-based RCMs are expected to witness high adoption among ASCs due to their proven track record of enhancing operational efficiency, and increased accessibility.

The cloud based segment is anticipated to witness significant growth over the forecast period. Cloud-based RCM solutions are preferred for its flexibility, scalability, and cost-saving benefits. This can be due to the need to access healthcare data remotely, advance data protection, efficiently recover from disasters, and cost reduction of physical infrastructure. Cloud-based solutions facilitate easy access to patient and billing information from anywhere, ensuring better collaboration. For Instance, in March 2021, HST Pathways, a prominent provider of cloud-based software systems for surgical centers nationwide, entered into strategic partnership with Waystar, a leading healthcare payments software company. This collaboration aims to streamline the revenue cycle management process for outpatients.

Regional Insights

North America ASC Revenue Cycle Management Market Trends

The ASC revenue cycle management market in North America accounted for 55.06% share in 2023. This is attributed to the increasing adoption of advanced technologies, rising healthcare expenditure, and well-established healthcare infrastructure. The market is characterized by high competition among key players, leading to continuous innovation and product launches to stay competitive.

U.S. ASC Revenue Cycle Management Market Trends

The market in the U.S. is expected to grow substantially over the forecast period. The market is witnessing a surge in product launches and technological advancements aimed at streamlining revenue cycle processes and improving overall operational efficiency in ASCs. These software are tailored specifically for ASCs, offering a comprehensive solution to efficiently manage various aspects of a surgery center.

Europe ASC Revenue Cycle Management Market Trends

The Europe ASC revenue cycle management market is expected to witness lucrative growth over the forecast period. This is driven by factors such as government initiatives to digitize healthcare systems, increasing adoption of EHRs, and a growing geriatric population with complex healthcare needs. With the implementation of regulations such as the General Data Protection Regulation (GDPR), European ASCs emphasize ensuring compliance and data security in their RCM processes. This includes adopting secure data storage and transmission methods, implementing robust access controls, and regularly auditing their systems to identify and mitigate potential vulnerabilities.

Asia Pacific ASC Revenue Cycle Management Market Trends

Asia Pacific ASC revenue cycle management market is anticipated to witness the fastest CAGR over the forecast period. This is attributed to rapid urbanization, increasing disposable income levels, and a growing awareness about the benefits of outpatient surgical procedures. The region’s aging population and the rising prevalence of lifestyle-related diseases drive the demand for efficient revenue cycle management systems to enhance operational efficiency and maximize revenue generation for ASCs.

Key ASC Revenue Cycle Management Market Company Insights

Key players operating in the market leverage advanced technologies, specialized expertise, and innovative solutions to help ASCs streamline their revenue cycle management processes, improve financial performance, and enhance patient care.

Key ASC Revenue Cycle Management Companies:

The following are the leading companies in the ASC revenue cycle management market. These companies collectively hold the largest market share and dictate industry trends.

- BillingParadise

- Epic Systems Corporation

- NXGN Management, LLC

- Oracle (Cerner Corporation)

- Regent Surgical

- Serbin Medical Billing.

- Surgical Information Systems

- Surgical Notes

- SYNERGEN Health

- Veradigm LLC

Recent Developments

-

In January 2024, Veradigm Inc. acquired Koha Health, a full-service revenue cycle management company, to enhance its revenue cycle services in the ambulatory healthcare market.

-

In May 2023, National Medical Billing Services, a provider of RCM solutions for ASCs, surgical hospitals, anesthesia groups, and surgical clinics, changed is name to Nimble Solutions. The company's rebranding effort reflects its commitment to agility, innovation, and client satisfaction.

-

In January 2022, National Medical Billing Services, a healthcare revenue cycle management company specializing in the ASC market, acquired mdStrategies, a comprehensive medical coding company focusing on ASCs. This strategic acquisition is poised to significantly enhance National Medical’s capabilities in serving ASCs and further solidify its position as a leader in the industry.

ASC Revenue Cycle Management Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 17.55 billion

Revenue forecast in 2030

USD 38.03 billion

Growth rate

CAGR of 13.76% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, product, delivery mode, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

BillingParadise; Epic Systems Corporation; NXGN Management, LLC; Oracle (Cerner Corporation); Regent Surgical; Serbin Medical Billing.; Surgical Information Systems; Surgical Notes; SYNERGEN Health; Veradigm LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Revenue Cycle Management Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ASC revenue cycle management market report based on type, product, delivery mode and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Integrated

-

Standalone

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Services

-

-

Delivery Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premise

-

Web-based

-

Cloud-based

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global ASC revenue cycle management market size was estimated at USD 15.36 billion in 2023 and is expected to reach USD 17.55 billion in 2024.

b. The global ASC revenue cycle management market is expected to grow at a compound annual growth rate of 13.76% from 2024 to 2030 to reach USD 38.03 billion by 2030.

b. North America dominated the market, with a share of 55.06% in 2023. This is attributed to the increasing adoption of advanced technologies, rising healthcare expenditure, and well-established healthcare infrastructure.

b. Some key players operating in the ASC revenue cycle management market include BillingParadise; Epic Systems Corporation; NXGN Management, LLC; Oracle (Cerner Corporation); Regent Surgical; Serbin Medical Billing.; Surgical Information Systems; Surgical Notes; SYNERGEN Health; Veradigm LLC

b. Key factors that are driving the ASC revenue cycle management market growth include increasing patient volume, integration of advanced technologies, and focus on cost containment and operational efficiency.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.