Artificial Tendons And Ligaments Market Size, Share & Trends Analysis Report By Application (Knee Injuries, Shoulder Injuries, Foot & Ankle Injuries), By End Use (Hospitals, Outpatient Facilities), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-821-3

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

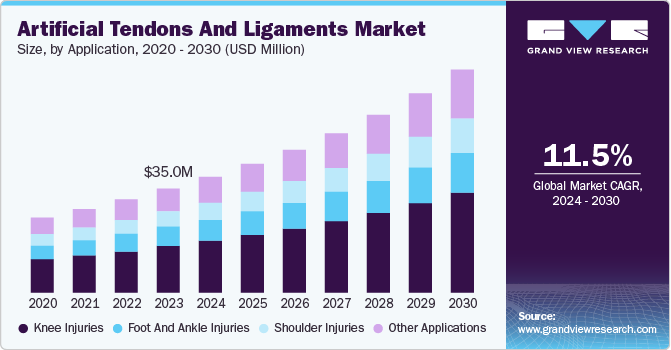

The global artificial tendons and ligaments market size was valued at USD 35.0 million in 2023 and is projected to grow at a CAGR of 11.5% from 2024 to 2030. The rising number of sport injuries, increased spending on orthopedic solutions, and the rise in interest in minimally invasive surgery are some of the factors driving market growth worldwide.

The increasing incidence of sports-related injuries globally is a major contributor to the market growth, as the demand for effective repair solutions continues to rise. Moreover, technological advancements in biomaterials and surgical techniques are enhancing the performance and reliability of artificial tendons and ligaments, expanding their applications in various medical fields.

As older adults are more susceptible to musculoskeletal disorders, the demand for tendon and ligament replacements is increasing. The shift towards minimally invasive surgical procedures, which offer reduced recovery times and complications, is propelling the adoption of artificial tendons and ligaments. The improved healthcare infrastructure in emerging economies is also contributing to market expansion, as patients gain access to specialized orthopedic care.

The market is also driven by patient preference for advanced treatment options. Increased awareness and preference for innovative, durable solutions are driving patient demand for artificial tendons and ligaments. Companies are actively expanding their global footprint in the market, leveraging innovation to drive growth. For instance, in July 2024, Enovis expanded its presence in South Africa by combining the strengths of Mathys Medical, LimaCorporate, and P&R, offering a broader range of medical technology solutions.

The development of synthetic ligament grafts that can connect with natural bones and provide knee support is a significant area of focus, with research institutions and companies working to create materials with high tensile strength, abrasion resistance, and no immune response. By addressing these challenges and opportunities, the industry can unlock its full potential and provide patients with more effective treatment options.

Application Insights

Knee injuries accounted for the largest market revenue share of 44.8% in 2023 due to the rise in incidents of Anterior Cruciate Ligament (ACL) injuries. The majority of ACL tears occur in sports that involve sudden movements, such as jumping, acceleration, and deceleration. According to Corewell Health, over 70% of ACL tears occur without physical contact or impact. According to a 2023 NCBI study, approximately 1 in 3,500 individuals in the U.S. suffer from ACL injuries, with a staggering 400,000 ACL reconstructions performed annually.

Foot and ankle injuries is expected to grow significantly with a CAGR of 11.5% during the forecast period. The demand for artificial tendons and ligaments for foot and ankle injuries is rising, driven by the growth of sports-related activities and accidents. Despite being less prevalent than knee injuries, the foot and ankle area is experiencing increased demand due to improved surgical success rates and prosthetic technologies.

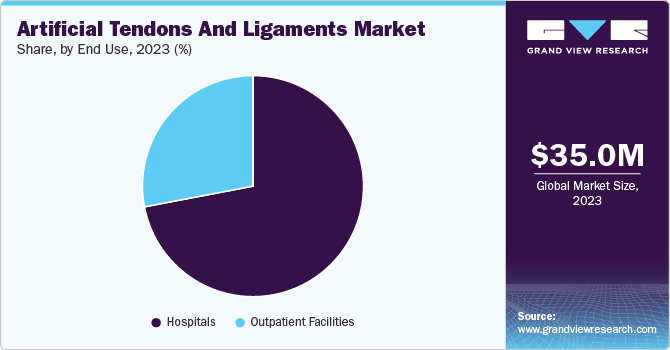

End Use Insights

Hospitals dominated the market and accounted for a share of 71.6% in 2023. The growing number of tendon repairs done in outpatient facilities with short hospital stays is fueling the use of synthetic tendons and ligaments. Surgeons require tendon grafts as a necessary device for repairing severe injuries. Medical facilities such as clinics and hospitals provide various reconstruction and repair services, which also influence market growth.

Outpatient facilities are projected to grow at the fastest CAGR of 11.7% over the forecast period. More recent surgical procedures in regard to tendon and ligament repair are minimally invasive and consequently result in shorter recovery periods and enable more outpatient surgeries. Outpatient surgeries are less expensive in terms of cost as compared to the hospitals, which is why they catch the attention of patients along with the insurance companies. Outpatient centers bring a lot of benefits with shorter waiting time and possibly a better healing atmosphere than in the hospital.

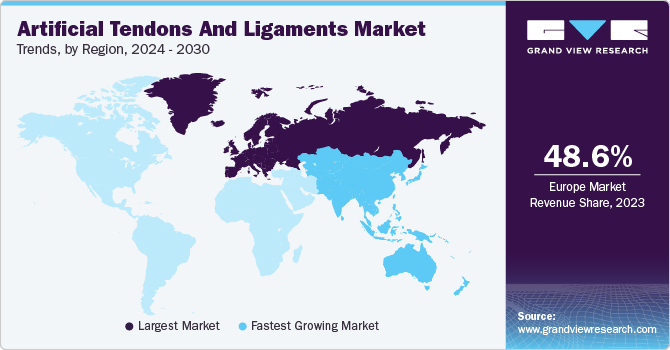

Regional Insights

Europe artificial tendons and ligaments market dominated the global artificial tendons and ligaments market in 2023, accounting for a revenue share of 48.6%. The increase in government efforts to encourage sports, the growth in events highlighting the latest sports technologies, the rise in sports injuries and knee replacements, the expansion of the medical device sector, the affordable prices for medical devices, and partnerships between various entities are all contributing to market growth in the region.

UK Artificial Tendons And Ligaments Market Trends

The UK artificial tendons and ligaments market is expected to grow rapidly in the coming years. The UK has a strong sporting culture, leading to a higher number of sports-related injuries that can damage tendons and ligaments. The UK healthcare system is increasingly adopting minimally invasive techniques, which are well-suited for implanting artificial tendons and ligaments.

North America Artificial Tendons And Ligaments Market Trends

North America artificial tendons and ligaments market is anticipated to witness significant growth during the forecast period. The availability of more tendon replacement options, combined with regulatory approvals, is attracting consumers to artificial tendons and ligaments. The growing elderly population, increasing use of minimally invasive surgeries, and favorable reimbursement policies will drive the growth of the regional industry, further solidified by a robust healthcare infrastructure.

The U.S. artificial tendons and ligaments market dominated the North America market with a share of 91.2% in 2023. The country’s prominent culture of sports participation results in a significant incidence of ligament tears and tendon ruptures, primarily affecting young athletes. This demand drives the need for repair solutions, including artificial tendons and ligaments. The U.S. healthcare system’s substantial investment in orthopedic solutions, particularly in procedures such as tendon and ligament repair, further underscores the market’s potential.

Asia Pacific Artificial Tendons And Ligaments Market Trends

Asia Pacific artificial tendons and ligaments market is projected to be the fastest-growing region in the global artificial tendons and ligaments market, registering a CAGR of 12.0% over the forecast period. Significant investments in R&D by global market leaders and increasing public awareness about artificial tendons, ligaments, and ACL surgeries are propelling this sector. It is predicted that China and India will grow at a fast rate, although Australia & Japan have well-developed markets in this segment. Arthroscopic procedures such as in the knee, ankle and the shoulder require autologous, allogenic ligaments.

China artificial tendons and ligaments market is expected to grow rapidly over the forecast period. China’s rapidly ageing population, characterized by high prevalence of tendon and ligament degeneration, drives demand for surgeries using artificial implants. The growing middle class, with increasing disposable income, is more likely to opt for advanced medical treatments, such as artificial tendons and ligaments, fueling the market’s growth.

Key Artificial Tendons And Ligaments Company Insights

Some key companies in the artificial tendons and ligaments market include COUSIN SURGERY; Smith+Nephew; Zimmer Biomet; Xiros Ltd. (Neoligaments); and Orthomed; among others. Companies are implementing various strategic actions, such as consolidations, takeovers, and collaborations with other prominent firms.

-

Cousin Surgery, a French medical device company, which offers implant solutions for visceral and spinal surgery. The company partners with surgeons, universities, and research labs to develop new devices. The company’s spinal surgery offerings include the BDyn and IntraSPINE devices, providing alternative surgical solutions that promote patient mobility and reduce postoperative pain.

-

Smith+Nephew is a global medical technology company, headquartered in the UK, with offers advanced wound management, sports medicine, and orthopedic reconstruction. Its sports medicine division offers a range of artificial ligaments and tendons, including the LARS system, used in various surgical procedures to treat sports-related injuries and degenerative conditions.

Key Artificial Tendons and Ligaments Companies:

The following are the leading companies in the artificial tendons and ligaments market. These companies collectively hold the largest market share and dictate industry trends.

- COUSIN SURGERY

- Smith+Nephew

- Zimmer Biomet

- Xiros Ltd. (Neoligaments)

- Orthomed

- Shanghai PINE&POWER Biotech

- Arthrex Inc.

- Corin Group

- Enovis Corporation (Mathys AG Bettlach)

- Stryker

- GROUP FH ORTHO

View a comprehensive list of companies in the Artificial Tendons And Ligaments Market.

Recent Developments

-

In July 2024, Stryker acquired Artelon, which specializes in soft tissue fixation products, enhancing its portfolio and competitive edge in the foot and ankle and sports medicine segments.

-

In May 2024, Enovis opened a new medical device production plant in San Daniele, Italy, in May 2024, doubling production capacity and creating over 100 jobs, solidifying its position in the industry.

-

In February 2024, Smith+Nephew unveiled its expanded Sports Medicine portfolio at the 2024 AAOS Annual Meeting, featuring the CARTIHEAL AGILI-C Cartilage Repair Implant and REGENETEN Bioinductive Implant, demonstrating its leadership in enabling biological healing.

-

In January 2024, Arthrex Inc., a pioneer in minimally invasive surgical technology, previously launched TheNanoExperience.com, a patient-centered website highlighting the benefits of Nano arthroscopy, an innovative orthopedic technique that enables rapid recovery and reduced pain.

Artificial Tendons And Ligaments Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 38.8 million |

|

Revenue forecast in 2030 |

USD 74.6 million |

|

Growth rate |

CAGR of 11.5% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Application, end use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Norway, Sweden, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait |

|

Key companies profiled |

COUSIN SURGERY; Smith+Nephew; Zimmer Biomet; Xiros Ltd. (Neoligaments); Orthomed; Shanghai PINE&POWER Biotech; Arthrex Inc.; Corin Group; Enovis Corporation (Mathys AG Bettlach); Stryker; GROUP FH ORTHO |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

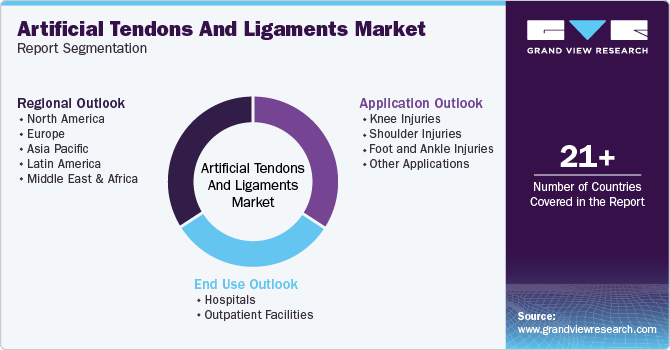

Global Interleukin Inhibitors Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global artificial tendons and ligaments market report based on application, end use, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Knee Injuries

-

Shoulder Injuries

-

Foot and Ankle Injuries

-

Other Applications

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Outpatient Facilities

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."