Artificial Intelligence in Manufacturing Market Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Technology, By Application, By End Use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-190-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2025 - 2030

- Industry: Technology

Market Size & Trends

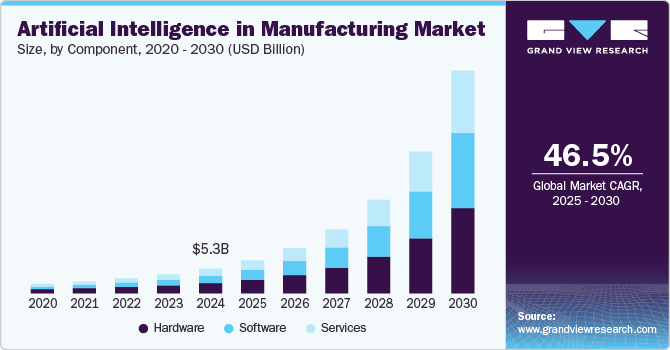

The global artificial intelligence in manufacturing market size was estimated at USD 5.32 billion in 2024 and is projected to grow at a CAGR of 46.5% from 2025 to 2030. The ongoing implementation of advanced technological innovations within production facilities leads to market growth. These include analytics, augmented reality, virtual reality, smart packaging, and additive manufacturing. Digital transformation initiatives across various sectors contributed to this valuation by laying the groundwork for future AI-driven services.

The fourth industrial revolution, Industry 4.0, is centered on the application of cyber-physical models and digital integration across the linked value chain. This fundamental change has accelerated the development of advanced technological capabilities and the widespread proliferation of digital ecosystems, particularly in the industrial sector. The growing digital revolution in manufacturing not only creates new opportunities in a variety of fields but also increases efficiency by tapping pre-existing values more efficiently. This transition correlates with the adoption of artificial intelligence in the Manufacturing sector, enabling innovation and efficiency benefits throughout production processes.

The advancement of automation within the manufacturing sector and the increasing demand for integrating big data are driving the expansion of AI in the manufacturing market. In addition, the extensive utilization of machine vision cameras in various manufacturing applications such as machinery inspection, material movement, field service, and quality control are a significant driver propelling the growth of artificial intelligence in manufacturing. Furthermore, major market players are implementing diverse strategies, such as introducing new products and fostering innovation, to broaden their product portfolios and uphold competitiveness in the rapidly evolving market. For instance, in February 2025, Tata Consultancy Services (TCS) collaborated with Salesforce to empower businesses in the manufacturing and semiconductor sectors to leverage AI and cloud computing effectively. This partnership aims to unlock data-driven insights, enhancing sales processes and field service operations through initiatives such as the Semiconductor Sales Accelerator, Seller for the Future, and Digital Field Service.

Component Insights

The hardware segment led the market and accounted for 41.6% of the global revenue in 2024. Developments in dedicated AI chips and processors played a crucial role in the AI in manufacturing industry. These hardware advancements were tailored to meet the specific computational requirements of AI algorithms, resulting in quicker and more effective processing of complicated datasets. Businesses were allocating resources to create specialized hardware specifically optimized for tasks related to machine learning, which consequently improved efficiency and allowed for the implementation of more advanced AI applications within manufacturing settings. These specialized chips were instrumental in managing complex neural network computations, thus facilitating the progression of AI-centric operations across the industry.

The software segment is expected to grow at the highest CAGR during the forecast period. Software solutions offer extensive applicability across a diverse spectrum of production processes owing to their exceptional versatility and adaptability. Given its innate flexibility, software stands out as the optimal choice for a sector characterized by varied requirements. The swift development, testing, and deployment capabilities inherent in software enable rapid implementation—a crucial advantage in the manufacturing landscape. This adaptability proves indispensable in an industry that necessitates prompt responses to fluctuations in AI in the manufacturing market and technological advancements. Furthermore, software integration into existing industrial machinery and workflows is notably straightforward and seamless.

Technology Insights

The machine learning segment accounted for the largest market revenue share in 2024, due to its demonstrable effectiveness in enhancing operational efficiency and reducing downtime. The analysis of past equipment data by Machine Learning algorithms enables the prediction of potential machinery failures before they occur. This foresight allows manufacturers to proactively schedule maintenance activities. This shift from reactive to proactive maintenance empowers manufacturers to optimize their resources, minimizing unexpected downtimes and maximizing overall operational dependability. The reduction of costs coupled with dependable operations made machine learning the front-runner in artificial intelligence in manufacturing industry.

The computer vision segment is expected to register the fastest CAGR during the forecast period. Artificial intelligence integrated with computer vision techniques enhances task efficiency. Through computer vision, robots gain improved understanding of their surroundings within factory premises, enabling safer navigation around humans. In smart manufacturing environments, AI-driven computer vision aids in detecting faults and flaws in product outcomes, subsequently streamlining factory workflows. For instance, Micron Technology Inc. specializes in crafting precise memory technology on silicon wafers, a process prone to imperceptible defects. To address this challenge, the company has implemented AI-based computer vision methods in its manufacturing facilities, effectively identifying defects and significantly enhancing manufacturing efficiency and effectiveness.

Application Insights

The production planning segment accounted for the largest market revenue share in 2024. AI-powered production planning systems were transforming demand prediction by incorporating sophisticated predictive analytics. These systems employed machine learning algorithms to scrutinize historical data, market trends, and diverse influential variables for generating precise forecasts of demand. Leveraging these insights, manufacturers optimized inventory levels, refined production schedules, and allocated resources with greater effectiveness, culminating in cost reductions and heightened operational efficiency.

The predictive maintenance & machinery inspection segment is expected to register the fastest CAGR during the forecast period. AI-powered predictive maintenance systems placed a growing emphasis on remote monitoring and diagnostics. Employing AI algorithms, manufacturers were able to remotely observe equipment status, identify irregularities, and promptly diagnose potential problems in live scenarios. For instance, General Motors utilizes AI driven predictive analytics to optimize vehicle production by analyzing historical performance and real-time data from its robotics and conveyor systems. The AI model identifies anomalous patterns that may indicate potential malfunctions, enabling early detection and swift intervention. This emerging trend facilitated proactive decision-making, enabling timely maintenance or repairs to be conducted without the necessity for physical inspection, thereby mitigating disruptions in production operations.

End Use Insights

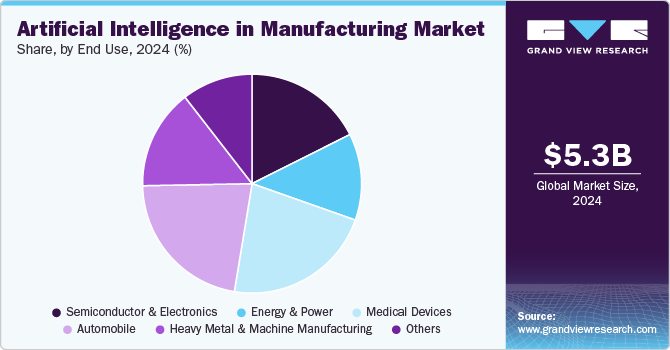

Medical device end use led the market in 2024. AI holds significant potential in medical device manufacturing due to its technology, encompassing quality control, yield optimization, and predictive maintenance, among other functionalities. Implementing machine learning and computing enhances engineers' roles by enabling learning from errors and improving precision. Medical device manufacturers can employ AI in diverse ways, including ensuring device quality and predictive maintenance based on data analysis.

The automobile sector is projected to witness the highest growth rate over the forecast period, driven by the integration of AI technology with advanced connectivity elements. This integration has enhanced Vehicle-to-Vehicle (V2V) and Vehicle-to-Infrastructure (V2I) communication, introducing sophisticated AI assistants that provide real-time traffic updates and predictive navigation, improving driving experience and safety. For instance, in October 2024, Elon Musk introduced Tesla's Cybercab robotaxi, marking a significant step towards autonomous vehicles and AI-driven transportation solutions, aligning with Tesla's broader strategy to transform the transportation sector with efficient and safe mobility solutions.

Regional Insights

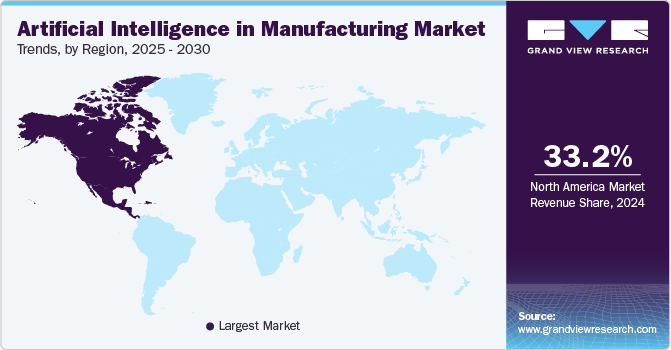

North America dominated the market and accounted for 33.2% share in 2024. The regional market's revenue growth is propelled by the presence of top-tier companies producing high-performance hardware components essential for running advanced AI models. The U.S. government's National Strategy for Advanced Manufacturing serves as a strategic blueprint outlining initiatives to revitalize the manufacturing sector, fortify national supply chains, bolster national security, and encourage investments in research and development. This strategy prioritizes research endeavors encompassing machine learning, data privacy, encryption, and risk assessment, aiming to facilitate the integration of AI within manufacturing processes. Moreover, it seeks to institute industry-wide standards, best practices, and software solutions to foster innovative business models that harness production data while ensuring data security and safeguarding intellectual property rights.

U.S. Artificial Intelligence in Manufacturing Market Trends

The U.S. artificial intelligence in manufacturing market dominated the regional market in 2024 due to its pioneering role in AI innovation. This stems from a robust ecosystem of major technology firms and startups, coupled with considerable government funding that accelerates the development and deployment of AI solutions. This emphasis on research and development, combined with a skilled workforce, allows for rapid advancements and widespread adoption of AI across diverse manufacturing sectors

Europe Artificial Intelligence in Manufacturing Market Trends

Europe artificial intelligence in manufacturing market is expected to grow at a significant CAGR during the forecast period, driven by increased investments in AI research and development, particularly in countries such as Germany, France, and the UK. Key sectors such as healthcare, automotive, and manufacturing are increasingly adopting AI, contributing to market expansion. Supportive government policies and initiatives designed to foster AI innovation are also expected to stimulate market growth, alongside Europe's commitment to ethical AI development and data privacy

Asia Pacific Artificial Intelligence in Manufacturing Market Trends

Asia Pacific is anticipated to witness the highest CAGR in the artificial intelligence in manufacturing market during the forecast period 2025 - 2030. The Asia Pacific region made significant strides in advancing smart manufacturing in line with Industry 4.0 principles. The countries such as China, Japan, India in this region focused on leveraging AI-driven technologies to digitalize and enhance production procedures. With a strong emphasis on integrating IoT devices, AI analytics, and cyber-physical systems, the objective was to establish sophisticated factories capable of adaptive manufacturing, predictive analysis, and immediate data-informed decision-making. This strategic move positioned the region as a leader in technological innovation within the manufacturing sector.

China artificial intelligence in manufacturing market dominated the regional market in 2024 fueled by significant investments in AI research and development from both governmental and private entities. China's expansive population and abundant data resources provide a strong foundation for training and refining AI models. Strong governmental support for AI innovation, combined with a rapidly expanding technology sector, has further accelerated growth within artificial intelligence in manufacturing industry, with widespread adoption of AI across industries such as e-commerce, finance, and transportation

Key Artificial Intelligence in Manufacturing Company Insights

Some of the key players operating in the market include Microsoft Corporation, IBM Corporation, Amazon.com, Inc., and Google LLC (Alphabet Inc.)

-

Microsoft Corporation offers a wide range of AI capabilities and solutions, such as industrial Internet of Things, cloud computing, AI, and other smart manufacturing technologies. It also offers Azure Time Series Insights and Azure Digital Twins & Simulation, which helps in generating data representations of products, assets, and factories and helps in improving the process.

-

The IBM Maximo Application Suite uses AI algorithms to evaluate equipment performance and forecast maintenance requirements in industrial environments. The primary objective of the AI applications in this suite is to study correlations between asset reliability and various maintenance procedures to improve equipment uptime, reduce breakdowns, and increase overall operational productivity.

Spark Cognition Inc., General Vision Inc., and Sight Machine are some of the emerging market participants in the artificial intelligence in manufacturing industry.

- Spark Cognition specializes in AI-driven predictive analytics, focusing on various industries. They provide AI-powered predictive maintenance solutions that utilize machine learning algorithms to forecast equipment failure and optimize operations in manufacturing plants. This helps in reducing downtime, enhance productivity, and improve safety by analyzing data from sensors and other sources to predict potential issues before they occur.

- General Vision Inc. offers machine vision systems that use AI algorithms for quality control, defect detection, and automated inspection processes in manufacturing facilities. Their technology enables high-speed and precise inspection, improving product quality and production efficiency in various manufacturing sectors.

Key Artificial Intelligence In Manufacturing Companies:

The following are the leading companies in the artificial intelligence in manufacturing market. These companies collectively hold the largest market share and dictate industry trends.

- AIBrain Inc.

- Amazon Web Services

- Aquant Inc.

- Cisco Systems Inc

- General Electric Company

- General Vision Inc.

- Google LLC (Alphabet Inc.)

- IBM Corporation

- Intel Corporation

- Micron Technology Inc.

- Microsoft Corporation

- Mitsubishi Electric Corporation

- NVIDIA Corporation

- Oracle Corporation

- Rethink Robotics

- Rockwell Automation Inc

- SAP SE

- Siemens AG

- Sight Machine

- Spark Cognition Inc.

Recent Developments

-

In February 2025, Ikigai Capital, an investment group, declared a USD 1 million investment in Ariprus Digicon, an AI technology company specializing in industrial digitization. This funding aims to support the development of adaptable AI agents that can replicate the expertise of domain specialists, thereby improving automation and efficiency in manufacturing processes.

-

In February 2025, Stellantis announced an expanded partnership with Mistral AI to integrate artificial intelligence (AI) into its operations. This collaboration leverages Mistral AI’s expertise in large language models (LLMs) and AI-driven automation to enhance projects spanning manufacturing, engineering, fleet data analysis, and internal car sales.

-

In October 2023, Google Cloud introduced specialized Generative AI solutions tailored for healthcare and manufacturing industries, with the objective of improving efficiency and facilitating digital transformation. This initiative signifies a significant stride in harnessing artificial intelligence in manufacturing industry-specific progress.

-

In April 2023, Siemens collaborated with Microsoft to enhance industrial AI, transforming the management of product lifecycles. The integration of Siemens' Teamcenter software with Microsoft Teams and Azure OpenAI Service's language models aims to boost innovation and effectiveness. This collaboration facilitates smooth cross-departmental cooperation, propelling progress in design, engineering, manufacturing, and product operations, representing a substantial advancement in integrating industrial technologies.

Artificial Intelligence in Manufacturing Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 7.09 billion |

|

Revenue forecast in 2030 |

USD 47.88 billion |

|

Growth rate |

CAGR of 46.5% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2017 - 2022 |

|

Forecast period |

2025 - 2030 |

|

Report updated |

March 2025 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, technology, application, end use, and region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; Mexico; KSA; UAE; South Africa |

|

Key companies profiled |

Amazon Web Services; Cisco Systems Inc; General Electric Company; Google LLC (Alphabet Inc.; IBM Corporation; Intel Corporation; Microsoft Corporation; Mitsubishi Electric Corporation; NVIDIA Corporation; Oracle Corporation; Rethink Robotics; Rockwell Automation Inc; SAP SE; Siemens AG |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Artificial Intelligence in Manufacturing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global artificial intelligence in manufacturing market report based on component, technology, application, end use, and region.

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Software

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Machine Learning (ML)

-

Computer Vision

-

Context Awareness

-

Natural Language Processing

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Material Movement

-

Predictive Maintenance & Machinery Inspection

-

Production Planning

-

Field Services

-

Quality Control & Reclamation

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2017 - 2030)

-

Semiconductor & Electronics

-

Energy & Power

-

Medical devices

-

Automobile

-

Heavy Metal & Machine Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."