Artificial Intelligence In Construction Market Size, Share & Trends Analysis Report By Offering (Solution), By Application, By Stage, By Deployment, By Industry, By Organization Size, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68038-139-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

AI In Construction Market Size & Trends

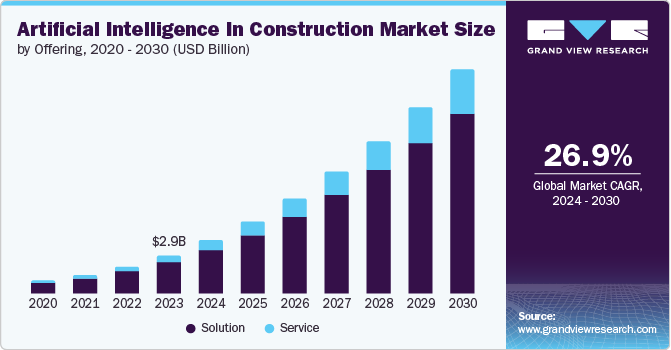

The global artificial intelligence in construction market size was valued at USD 2.93 billion in 2023 and is projected to grow at a CAGR of 26.9% from 2024 to 2030. This growth is driven by artificial intelligences (AI) numerous benefits in the construction sector, such as preventing cost overruns by predicting budgets based on historical data and assisting in creating predictive models according to timelines. This makes mega-construction projects more cost-effective. Artificial intelligence (AI) also enhances 3D model-based processes, reducing the workload of engineers, construction professionals, and architects. It improves project planning through robots that capture 3D scans of construction sites and feed data to help management address on-site problems.

Another major driving force of this market is the monitored risk control on the job sites, which makes it resourceful as it gives assurance on controlling risk factors so that the contractors and sub-contractors can focus on creating productive work on the sites. Moreover, advanced AI applications, such as autonomous construction machinery, augment on-site efficiency by automating labor-intensive tasks such as bricklaying and concrete pouring. Simultaneously, AI-driven workforce optimization addresses labor shortages through intelligent workload distribution, performance analysis, and resource allocation. AI's multifaceted benefits in construction drive substantial demand for related products and services, fueling market expansion.

AI significantly enhances data quality and learning by processing information from diverse sources, including mobile devices, drones, and Building Information Modeling (BIM) systems. These data-driven insights optimize organizational operations. For instance, in the construction industry, AI-powered robots in off-site factories accelerate project timelines by prefabricating components, allowing on-site teams to focus on core construction activities. Moreover, AI's analytical capabilities provide valuable post-construction insights into the performance of structures such as buildings, roads, and bridges, informing maintenance strategies and optimizing asset management.

Offering Insights

Solution offerings dominated the market with a revenue share of 81.7% in 2023. This growth is primarily driven by significant advancements in AI technologies, including Natural Language Processing (NLP), deep learning, and machine learning. These innovations are transforming construction organizations by automating processes, expediting decision-making, and providing tailored support to professionals.

The services offering segment is expected to grow at a CAGR of 28.1% from 2024 to 2030. This growth trajectory is primarily driven by the escalating adoption of AI-powered solutions to enhance operational efficiency and project outcomes. Key applications include leveraging deep learning to optimize Building Information Modeling (BIM) through early-stage cost and time estimation and utilizing IoT sensors to capture and analyze vast datasets for improved safety, planning, and overall project management. Furthermore, Industry 4.0 technologies, such as voice integration in BIM, are reshaping the construction landscape. The UK government's mandate for BIM Level 2 on public projects underscores the increasing emphasis on digitalization and data-driven approaches.

Application Insights

The project management applications segment accounted for the 36.2% market revenue share in 2023. This growth is primarily driven by the integration of machine learning algorithms. By analyzing historical data, these algorithms provide critical insights into cost, timelines, and risks, optimizing scheduling, resource allocation, and overall project productivity. Consequently, construction organizations are realizing substantial profit gains.

The risk management applications segment is expected to grow the fastest at a CAGR of 30.5% from 2024 to 2030. This expansion is primarily driven by the increasing adoption of health and safety analytics (HSA), which leverages advanced data analytics to proactively address industry-specific risk factors. Notably, the construction sector, characterized by heightened risk profiles, stands to benefit significantly from AI and digital technologies. These innovations facilitate identifying and mitigating risks through IoT-enabled solutions, including sensor-based systems, wearable devices, and UAVs. By optimizing supervision and proactive safety management, these technologies offer a robust approach to risk prevention within the construction industry.

Stage Insights

The construction stage segment accounted for the 45.2% revenue share in 2023. This substantial growth is attributable to the pivotal role of AI technologies in revolutionizing construction processes. By automating workflows, informing on-site decision-making, and augmenting the productivity of professionals, AI is significantly enhancing overall construction efficiency. As a result, the industry's increasing reliance on AI to optimize resource allocation and streamline operations drives robust demand for related products and services within this segment.

The pre-construction stage segment is anticipated to grow the fastest with a CAGR of 28.3% from 2024 to 2030. This expansion is primarily driven by the increasing efficiency of repetitive pre-construction tasks through automation. AI technologies are playing a pivotal role in accelerating design generation, optimizing planning processes, and providing valuable insights derived from BIM. The broad spectrum of AI applications within the pre-construction phase is a key catalyst for this segment's substantial growth.

Deployment Insights

The cloud deployment segment accounted for the largest market revenue share of 55.6% in 2023. The factors responsible for the segment growth are attributed to features of cloud deployment in the construction market, such as scalability and quick adaptability in large and heavy building projects, which also makes the project more cost-effective. Advanced technologies have evolved in developing the private cloud features, which enables construction organizations to tackle data safety and privacy issues.

The on-premises deployment segment is expected to see significant growth with a CAGR of 13.9% from 2024 to 2030. The factors driving this expected growth are the heavy usage of this segment in data security, ensuring regulatory compliance, and on-site decision-making. With this usage, the benefits of on-premises deployment are that it has a high initial setup cost, and once setup is done, it is cost-effective in long-run construction as it avoids recurring subscription fees; on-premises deployment doesn’t need high-speed internet, which makes them a valuable product in construction at remote areas with network connectivity problems.

Industry Insights

The resident industry held the largest market revenue share of 43.7% in 2023 owing to the solutions offered by AI technologies in this segment. These solutions optimize resource allocation through data-driven insights, enable project managers to monitor sites remotely using IoT sensors and digital technologies, and facilitate predictive maintenance planning post-construction.

Public infrastructure industry is expected to grow at a CAGR of 29.3% from 2024 to 2030. This expansion is primarily driven by the increasing adoption of AI to enhance operational efficiency, reduce costs, bolster safety protocols, optimize asset utilization, and improve decision-making capabilities. By leveraging AI, construction companies can significantly elevate performance and deliver superior infrastructure solutions. AI’s multifaceted benefits are fueling robust demand for these technologies and driving substantial growth within the sector.

Organization Size Insights

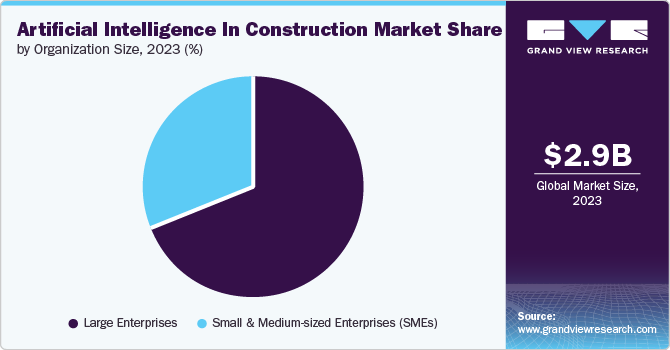

The large enterprise organizations segment accounted for the largest market revenue share of 69.4% in 2023. The factors contributing to the growth are attributed to the numerous benefits of using AI in this segment, such as improving quality control, enhanced risk management, achieving sustainability, and overall enhancement of operational efficiency, which makes AI a valuable asset for this segment and growing this segment significantly.

Small & Medium-sized Enterprises (SMEs) organizations segment is expected to grow the fastest with a CAGR of 28.3% from 2024 to 2030. The driving forces for this expected growth are attributed to the increasing competition in the market which gives a huge opportunity for innovation and gaining a competitive advantage in the market. With the assistance of AI technologies small & medium enterprises are enhancing their ability to make affordable, flexible, customized projects with quality assurance and better risk management which grows the market share of this organization leading to overall growth of this segment.

Regional Insights

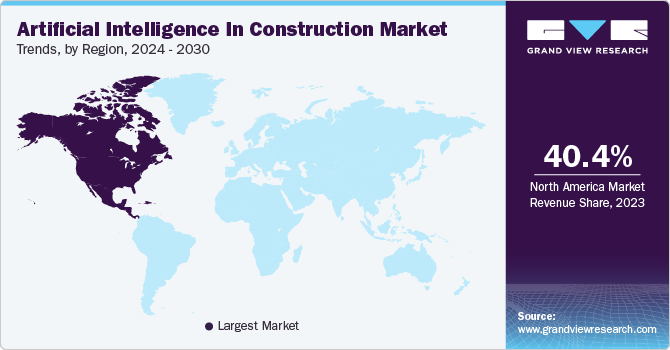

North America Artificial Intelligence in construction market dominated the market with 40.4% share in 2023. The factors responsible for this growth are attributed to the huge investments in technology and heavy usage of AI in project management, risk management, supply chain management, and many more fields which is increasing the demand for the product and growing the market in the region significantly.

U.S. Artificial Intelligence In Construction Market Trends

The U.S. dominated the North American AI in the construction market with a share of 75.3% in 2023 due to real-time collaborations, stringent regulatory compliances, and technological advancements which led to a surge in the demand for the product and the growth of the market significantly in the country.

Europe Artificial Intelligence In Construction Market Trends

Europe's AI in the construction market was identified as a lucrative region in 2023 owing to the surge in the demand for the product in the region due to the vital role played by AI technologies in increasing environmental sustainability, cost-efficiencies, and improved productivity results.

UK AI in the construction market is expected to grow rapidly in the coming years due to changing consumer demand for sustainability, and geopolitical stability which are growing the market in this country significantly.

Asia Pacific Artificial Intelligence In Construction Market Trends

Asia Pacific AI in the construction market is anticipated to witness significant growth pertaining to the growing economy, and rapid urbanization that has increased the demand for the construction market and led to the growing demand for the product in the region and growing the market of this area significantly.

China's AI in the construction market held a substantial market share in 2023 owing to government support, heavy funding for R&D technology, automation demands, and growing competition in the market of this country.

Middle East & Africa Artificial Intelligence In Construction Market Trends

Middle East & Africa AI in the construction market is expected to grow fastest, with a CAGR of 30.1% from 2024 to 2030. The factors contributing to this expected growth are attributed to the growing competition construction market which has led to a growth in the demand for technological advancement, sustainable construction practices, risk management, enhanced resource allocation, data security, and many more. This surge in demand has been growing the market in this region significantly.

Key Artificial Intelligence in Construction Company Insights

Some of the key companies in artificial intelligence (AI) in the construction market include Microsoft, Oracle, SAP SE, and many more. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Microsoft, has been in this market by providing AI solutions such as Copilot, dynamics 365, and Microsoft Azure AI which streamlines daily tasks such as client management, marketing, regulatory compliances, and others.

-

Oracle, is collaborating with industries such as Rosedin Electric to create innovative labs in this field and driving innovation in the market. They offer data-driven decision-making software such as the oracle construction intelligence cloud services.

Key Artificial Intelligence in Construction Companies:

The following are the leading companies in the AI in Construction market. These companies collectively hold the largest market share and dictate industry trends.

- Autodesk Inc.

- International Business Machines Corporation

- Microsoft

- Oracle

- SAP SE

- Trimble Inc.

- ALICE Technologies Inc.

- BuildingConnected

- The Access Group

- Doxel.

Recent Developments

-

In May 2024, Microsoft announced an investment worth USD 4.4 billion to accelerate France's adoption of AI in the construction market by training people and supporting start-ups in the field.

-

In April 2024, EIL, Engineers India Limited, announced their partnership with Detect Technologies Private Limited to deploy real-time AI-based monitoring solutions at EIL construction sites globally.

Artificial Intelligence In Construction Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 4.06 billion |

|

Revenue forecast in 2030 |

USD 16.96 billion |

|

Growth rate |

CAGR of 26.9% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Offering, application, stage, deployment, industry, organization size, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, South Korea, Australia, Brazil, Saudi Arabia, UAE, South Africa |

|

Key companies profiled |

Autodesk Inc.; International Business Machines Corporation; Microsoft; Oracle; SAP SE; Trimble Inc.; ALICE Technologies Inc.; BuildingConnected; The Access Group; Doxel |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Artificial Intelligence In Construction Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global artificial intelligence (AI) in construction market reports based on offering, application, stage, deployment, industry, organization size, and region:

-

Offering Outlook (Revenue, USD Million, 2018 - 2030)

-

Solution

-

Service

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Asset Management

-

Project Management

-

Risk Management

-

Schedule Management

-

Supply Chain Management

-

Others

-

-

Stage Outlook (Revenue, USD Million, 2018 - 2030)

-

Pre-construction

-

Construction-stage

-

Post-construction

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-premises

-

-

Industry Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Public Infrastructure

-

Heavy Construction

-

Others

-

-

Organization Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Small & Medium-sized Enterprises (SMEs)

-

Large Enterprises

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."