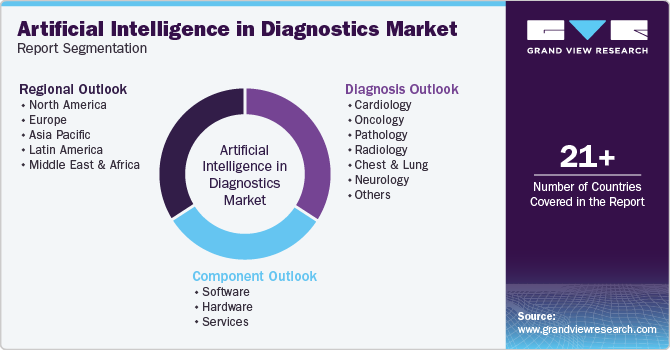

Artificial Intelligence In Diagnostics Market Size, Share & Trends Analysis Report By Component (Software, Hardware, Services), By Diagnosis (Cardiology, Oncology, Pathology, Radiology, Chest And Lung, Neurology), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-871-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

The global artificial intelligence in diagnostics market size was estimated at USD 1.59 billion in 2024 and is expected to grow at a CAGR of 22.46% during the forecast period. Market growth is attributed to advancements in machine learning and deep learning, which enable faster and more accurate diagnostic solutions. In oncology, cardiology, and neurology, the growing demand for early disease detection, among other areas, has led to increased adoption of AI technologies. For instance, in February 2024, Royal Philips introduced the Philips CT 5300, an advanced AI-powered CT system designed for diagnostics, interventional procedures, and screenings. The adaptable X-ray CT system enhances diagnostic accuracy, streamlines workflows, and optimizes system availability.

The COVID-19 pandemic highlighted gaps in healthcare infrastructure, prompting accelerated adoption of digital technologies like AI for diagnostic accuracy and data analysis. This shift eased clinicians’ administrative and operational burdens. The rise of healthcare startups, bolstered by increased funding and investment, further fueled market growth, as these startups swiftly implemented AI-powered systems. Favorable government support and private investment also played a role. For instance, in May 2020, Arterys secured USD 28 million in Series C funding from Temasek Holdings and Benslie Investment Group to expand its product offerings.

In September 2020, Aidoc secured USD 20 million in Series B funding led by Peg Capital, highlighting the focus on innovative AI-driven diagnostics strategies among key players. For example, in June 2020, GE Healthcare launched its AI-based Thoracic Care Suite for detecting chest anomalies. AliveCor received FDA approval for its Kardia AI V2 in November 2020 for advanced ECG diagnostics. The medical diagnostics market is evolving rapidly, with widespread adoption of advanced solutions like AI-based algorithms.

Moreover, advancements in healthcare IT infrastructure and regular technological developments in cloud storage, computer processing, and machine learning algorithms support the integration of AI-powered systems in diagnostics to provide efficient & accurate diagnosis, allowing care providers to devise timely & adequate treatment plans. Pathology and radiology services are witnessing a widespread adoption of AI-based algorithms. For example, AI-powered radiology solutions can collect multiple datasets from imaging modalities and accurately analyze them from the radiologist.

Furthermore, several AI-powered tools are used to diagnose chronic kidney disease (CKD) & kidney function tests, and various chronic diseases. For instance, in May 2024, Premier, Inc. partnered with AstraZeneca to launch the Uncover CKD - Care Collective initiative. The aim is to determine patients with undiagnosed CKD, raise awareness among healthcare providers, and assist U.S. health systems in improving their CKD diagnosis, treatment, and management strategies. Leveraging Premier’s PINC AI technology and services platform, the initiative seeks to address the increasing prevalence of undiagnosed CKD and its associated economic burden on the U.S. healthcare system.

Case Study: Automated Detection and Classification of Bone Marrow Cells

Background and Objective:

-

Objective: Automate bone marrow aspirate smear analysis to replace manual differential cell counts.

-

Importance: This diagnostic tool aids in detecting hematological conditions by quantifying hematopoietic cells.

Solution Development:

-

Model Creation: 20 patient slides with bone marrow aspirates were digitized, pseudonymized, and uploaded to the Aiforia platform.

-

Algorithm Training: Aiforia was used to identify nine primary cell types with human validation for accuracy.

-

Cloud-Based: Remote accessibility enabled continuous collaboration without software installation.

Outcomes and Benefits:

-

Efficiency: Significant reduction in labor-intensive cell counts.

-

Future Applications: Potential expansion to other hematopathology areas.

Market Concentration & Characteristics

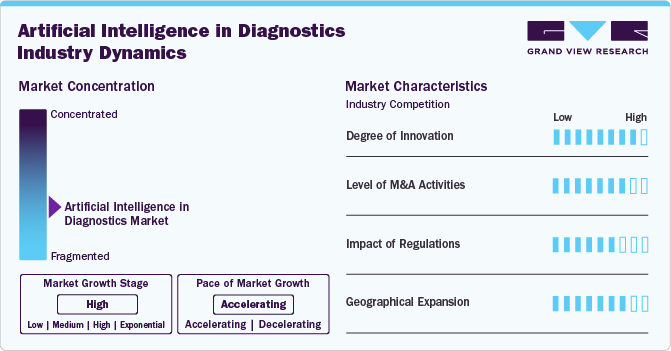

The chart below illustrates the relationship between industry concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, level of partnerships & collaborations activities, degree of innovation, impact of regulations, and regional expansion. The market is consolidated, with the presence of key providers dominating the market. The degree of innovation is high, and the level of merger & acquisitions activities is high. The impact of regulations on industry is high, and the regional expansion of the industry is moderate.

Technological advancements driven by the increasing demand for early and accurate disease detection, improving patient outcomes, further results in significant innovations. For instance, in April 2024, Prenosis, Inc. announced that its Sepsis ImmunoScore received marketing authorization from the U.S. FDA through the De Novo pathway. It is an AI-powered software as a medical device (AI SaMD) designed to enhance early sepsis diagnosis and prognosis. This marks the first FDA marketing authorization of an AI-based diagnostic tool for sepsis, addressing the longstanding diagnostic challenges posed by this complex condition in the U.S. healthcare system.

The M&A activities, such as mergers, acquisitions, and partnerships, enable companies to expand geographically, financially, and technologically. For instance, in July 2024, GE HealthCare announced an acquisition of Intelligent Ultrasound Group PLC's clinical AI software division for approximately USD 51 million. Intelligent Ultrasound specializes in AI-driven image analysis tools to enhance ultrasound technology’s efficiency and diagnostic capability.

The industry has a significant impact of regulations, which are overlooked by several regulatory bodies, as per the region. For instance, the FDA issued a guidance draft in April 2023 to establish a regulatory framework for AI/ML-based devices. The draft outlines the least burdensome approach for continuously improving ML-based Device Software Functions (ML-DSF). The aim is to enhance patient access to secure and effective AI/ML-based devices, ensuring the promotion and protection of general health.

The industry's regional expansion activities are moderate, driven by an increasing demand for AI in the diagnostics market in the emerging nations. For instance, in March 2018, Microsoft announced expansion of its healthcare initiative in India by using AI. The new initiative by Microsoft and Apollo Hospital was to create new machines learning AI algorithms in cardiology segment to help doctors structure data and use algorithms to begin treatment while the disease is in the nascent stage.

Component Insights

Based on components, the software solutions segment dominated the market with a revenue share of 45.81% in 2024 and is expected to witness the fastest growth rate during the forecast period. The segment dominance has been driven by advancements in machine learning algorithms that improve diagnostic accuracy, along with rising demand for efficient, real-time analysis of medical imaging data. It is supported by healthcare providers' increased adoption of AI-driven solutions to streamline workflows and enhance diagnostic precision. For instance, in October 2024, deepc announced a partnership with the AI Centre for Value-Based Healthcare (AI4VBH) at King's College London and Guy's and St Thomas' NHS Foundation Trust to advance the adoption of radiology AI across the NHS. This collaboration aims to enhance diagnostic speed and accuracy in key areas, including heart failure, dementia, and cancer. Over five years, AI4VBH has developed secure data platforms to support AI model development and deployment, improving access to high-quality electronic health data essential for AI-driven healthcare advancements.

Hardware segment is anticipated to grow at a significant CAGR over the forecast period. The growth is primarily driven by the increasing demand for advanced imaging and diagnostic tools that improve patient outcomes and streamline workflows. For instance, in October 2024, Alimetry obtained an oversubscribed USD 18 million, A2 financing round to commercialize its gut health monitoring wearable device, capitalizing on grown adoption by an increasing cohort of US hospitals. The device provides accurate diagnosis and analysis of gut ailments, which are challenging to solve using conventional testing and diagnostics.

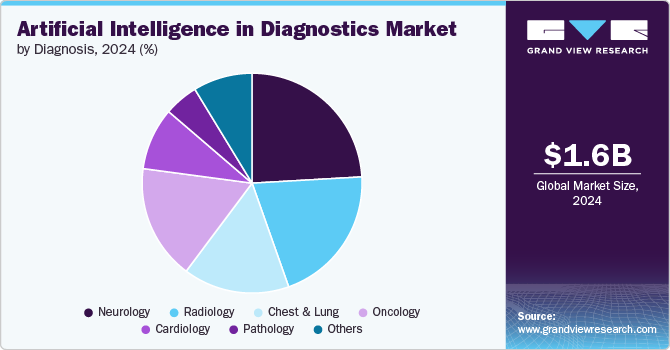

Diagnosis Insights

Neurology had a significant revenue share of 24.09% in 2024. The segment's dominance is attributed to the increasing prevalence of neurological disorders, such as Alzheimer's and Parkinson's disease, which necessitate early and accurate diagnosis. Moreover, advancements in AI technologies, particularly in imaging and data analysis, enhance the ability to identify complex neurological conditions, improving patient outcomes. For instance, in August 2024, neurologists from the University of Nebraska Medical Center (UNMC) advanced the field of dementia diagnostics through AI research. This study developed a diagnostic computer model utilizing medical records from 51,269 participants, incorporating data such as exam findings, test results, and MRI scans from nine medical databases. The comprehensive dataset includes information on both common and rare forms of dementia, including Alzheimer's disease and Lewy body dementia.

The oncology segment is expected to grow at the fastest CAGR during the forecast period. Cancer diagnosis and treatment have significantly developed over the last decade. The increasing use of technologically advanced solutions for the detection of cancer, majorly at early stages, is contributing to market growth. For instance, in September 2024, Ibex Medical Analytics introduced new advancements to its AI-driven product platform, developed in collaboration with expert pathologists worldwide. The platform's widely deployed AI algorithms, already known for accuracy and robustness in clinical pathology, have been refined using large, diverse datasets and insights from international experts. Validated by live customers and clinical studies, the improved algorithms offer enhanced reliability and versatility across various tissue types, including breast, prostate, and gastric, identifying numerous tissue morphologies.

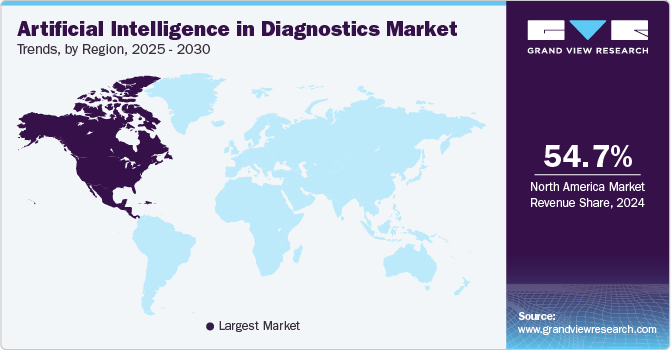

Regional Insights

North America artificial intelligence in diagnostics market dominated in 2024 with the largest share of 54.74%. Growing government initiatives and business strategies, including mergers & acquisitions, portfolio expansions, collaborations by market players, and funding opportunities by various organizations to promote AI implementation in the diagnostics field, are contributing to the accelerated growth in the region. For instance, in August 2024, the Advanced Research Projects Agency for Health (ARPA-H) introduced a funding opportunity through the Performance and Reliability Evaluation for Continuous Modifications and Usability of Artificial Intelligence (PRECISE-AI) program. This initiative aims to enhance the capabilities of AI tools in clinical settings by enabling the detection of misalignments with their training data and implementing auto-correction mechanisms.

U.S. Artificial Intelligence in Diagnostics Market Trends

The artificial intelligence in diagnostics market in the U.S. held the largest revenue share in 2024. The growth is driven by advanced healthcare infrastructure, substantial investment in research and development, and a focus on improving patient outcomes. Moreover, tech companies and healthcare providers' strategic initiatives promote innovation, enhancing diagnostic accuracy. For instance, in October 2024, Invenio Imaging announced that the U.S. FDA granted Breakthrough Device Designation for its NIO Lung Cancer Reveal image analysis module. This module is designed to assist physicians in evaluating bronchoscopic lung forceps biopsies by detecting cell and tissue morphology indicative of cancer in images obtained from fresh, unprocessed biopsy specimens using the NIO Laser Imaging System.

Europe Artificial Intelligence in Diagnostics Market Trends

The artificial intelligence in diagnostics market in Europe is poised to grow at a significant CAGR over the forecast period. Healthcare systems in Europe are overburdened due to increasing costs, rising incidence of cancer cases, increasing demand for healthcare facilities, and stagnating or shrinking healthcare workforce. The industry also faces issues due to structural inefficiencies in certain European countries. The move to value-based healthcare is expected to strengthen patient outcomes at a more sustainable cost. Incorporating AI into innovative medical technologies can help address the pressing healthcare issues. In addition, increasing investments in AI in healthcare are driving the market growth.

The artificial intelligence in diagnostics market in the UK is expected to grow significantly over the forecast period. The growth is fueled by government initiatives to modernize healthcare systems and reduce operational costs. Partnerships between various healthcare institutes and industry players contribute to research advancements and practical applications of AI technologies. For instance, in October 2024, Optellum announced it had obtained joint funding from the National Institute for Health and Care Research (NIHR) and the Office for Life Sciences (OLS) under a new USD 159.95 million (EUR 148 million) cancer initiative. This funding is to support a study evaluating the effectiveness of its AI product in the early diagnosis of lung cancer.

The artificial intelligence in diagnostics market in Germany is expected to grow substantially over the forecast period. The growth is divern by increasing strategic initiatives undertaken by market players. For instance, in September 2024, Mindpeak collaborated with Roche to integrate its advanced AI algorithms with Roche's Digital Pathology Open Environment. The collaboration enhances cancer diagnostics by advancing clinician capabilities in improving patient care and expanding the reach of personalized medicine solutions.

Asia Pacific Artificial Intelligence in Diagnostics Market Trends

The artificial intelligence in diagnostics market in Asia Pacific is expected to grow significantly over the forecast period. Increasing patient pool, growing acceptance of cloud computing, and rising number of partnerships & collaborations are among the factors primarily driving the market growth. For instance, in October 2024, Nanyang Technological University and the National Healthcare Group in Singapore announced a partnership to develop voice AI technology and a community intervention program to detect early signs of depression in older people. This initiative seeks to leverage advanced AI capabilities to enhance mental health support for older adults.

The artificial intelligence in diagnostics market in China is poised to grow substantially over the forecast period. China is increasing application of AI in healthcare system, which is rapidly improving disease diagnosis and treatment accuracy in country-level hospitals. For instance, in July 2023, a Hong Kong project secured USD 5 million to leverage AI and genomics for enhanced mental health diagnosis and treatment. This innovative integrated solution transitions from traditional symptom-based methodologies to a data-driven approach, utilizing AI to improve diagnostic accuracy and therapeutic effectiveness.

Key Artificial Intelligence in Diagnostics Company Insights

The global artificial intelligence in diagnostics industry is highly competitive, with the presence of key players such as Cancer Center.ai, Microsoft, Tempus AI, Inc., and FLATIRON HEALTH, among others. Key players are involved in new product launches, acquisitions, and partnerships to gain a competitive edge in the market.

Key Artificial Intelligence in Diagnostics Companies:

The following are the leading companies in the artificial intelligence in diagnostics market. These companies collectively hold the largest market share and dictate industry trends.

- Siemens Healthineers

- Zebra Technologies Corp.

- Riverain Technologies

- Vuno, Inc.

- Aidoc

- NovaSignal Corporation (previously known as Neural Analytics, acquired by NeuraSignal, Inc.)

- Imagen

- Digital Diagnostics, Inc.

- GE Healthcare

- AliveCor Inc.

- F. Hoffmann-La Roche Ltd

Recent Developments

-

In September 2024, Roche announced the expansion of its digital pathology platform by integrating over 20 advanced AI algorithms from eight new partners. These strategic collaborations are designed to enhance the capabilities of pathologists and scientists in cancer research and diagnosis, utilizing advanced AI technology to improve diagnostic efficiency and accuracy.

-

In July 2024, AWS and GE HealthCare collaborated to enhance healthcare outcomes by leveraging industry-specific AI foundation models (FMs) and innovative applications. This partnership aims to unlock critical healthcare information, paving the way for advanced wellness solutions.

-

In October 2023, NeuraSignal acquired NovaSignal, the original developer of the NovaGuide system. This robot-assisted transcranial Doppler (raTCD) system operates without human direction for data acquisition, potentially increasing access to critical data for clinicians to detect right-to-left shunt (RLS).

AI In Cancer Diagnostics Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 1.97 billion |

|

Revenue forecast in 2030 |

USD 5.44 billion |

|

Growth Rate |

CAGR of 22.46% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, diagnosis, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan, India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait |

|

Key companies profiled |

Siemens Healthineers; Zebra Technologies Corp.; Riverain Technologies; Vuno, Inc.; Aidoc; NovaSignal Corporation (previously known as Neural Analytics, acquired by NeuraSignal, Inc.); Imagen; Digital Diagnostics, Inc.; GE Healthcare; AliveCor Inc.; F. Hoffmann-La Roche Ltd |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Artificial Intelligence In Diagnostics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global artificial intelligence in diagnostics market report based on component, diagnosis, end use, and regions.

-

Component Outlook (Revenue, USD Million; 2018 - 2030)

-

Software

-

Hardware

-

Services

-

-

Diagnosis Outlook (Revenue, USD Million; 2018 - 2030)

-

Cardiology

-

Oncology

-

Pathology

-

Radiology

-

Chest and Lung

-

Neurology

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global artificial intelligence in diagnostics market size was estimated at USD 1.59 billion in 2024 and is expected to reach USD 1.97 billion in 2025.

b. The global artificial intelligence in diagnostics market is expected to grow at a compound annual growth rate of 22.46% from 2025 to 2030 to reach USD 5.44 billion by 2030.

b. North America dominated the AI in diagnostics market with a share of 54.74% in 2024. Growing government initiatives and business strategies, including mergers & acquisitions, portfolio expansions, collaborations by market players, and funding opportunities by various organizations to promote AI implementation in the diagnostics field, are contributing to the accelerated growth in the region.

b. Some key players operating in the AI in diagnostics market include Siemens Healthineers; Zebra Technologies Corp.; Riverain Technologies; Vuno, Inc.; Aidoc; NovaSignal Corporation (previously known as Neural Analytics, acquired by NeuraSignal, Inc.); Imagen; Digital Diagnostics, Inc.; GE Healthcare; AliveCor Inc.; F. Hoffmann-La Roche Ltd.

b. Key factors that are driving artificial intelligence in diagnostics market growth include advancements in machine learning and deep learning, which enable faster and more accurate diagnostic solutions. Growing demand for early disease detection, in oncology, cardiology, and neurology, among other areas, has led to increased adoption of AI technologies.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."