AI In Cybersecurity Market Size, Share & Trends Analysis Report By Type (Network Security, Endpoint Security), By Offering, By Technology (Machine Learning, Natural Language Processing), By Application, By Vertical, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-974-5

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

AI In Cybersecurity Market Size & Trends

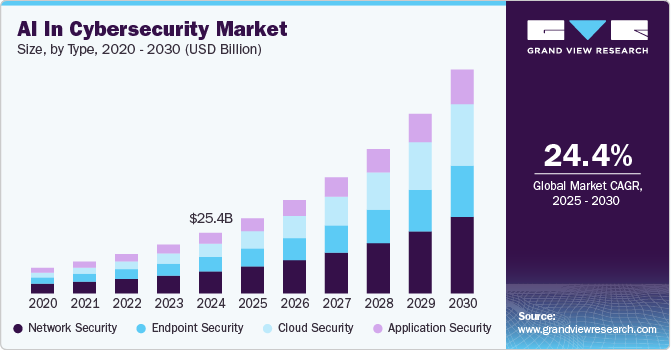

The global AI in cybersecurity market size was estimated at USD 25.35 billion in 2024 and is expected to witness a CAGR of 24.4% from 2025 to 2030. AI technologies, including natural language processing and machine learning, are increasingly used to enhance cybersecurity measures. These tools help protect systems, detect vulnerabilities, and respond to potential threats more efficiently. The growing number of cyberattacks targeting high-tech firms, defense organizations, and government agencies highlights the demand for sophisticated AI-driven solutions. Such advancements aim to address evolving challenges in securing sensitive data and critical infrastructure.

The AI in cybersecurity industry is expanding due to the seamless integration of AI technologies with existing cybersecurity frameworks. Organizations prefer solutions that complement their current systems, ensuring minimal disruption and maximum efficiency. AI enhances endpoint security, network monitoring, and access control, making it indispensable in layered defense strategies. Cloud-based AI solutions provide scalability, enabling small and large enterprises to deploy advanced security tools. These integrations also support compliance with evolving regulations, strengthening trust among stakeholders. As a result, businesses increasingly adopt AI technologies to enhance their overall security posture.

The increasing frequency and complexity of cyber threats drive the market growth. Cybercriminals use advanced techniques, necessitating AI solutions capable of staying ahead of evolving attacks. AI-powered tools analyze vast amounts of data to detect hidden threats and respond swiftly to breaches. Governments and enterprises face mounting pressure to protect critical infrastructure, pushing investments in AI technologies. These solutions are particularly effective in countering ransomware, phishing, and advanced persistent threats. The escalating need for robust defense mechanisms ensures sustained growth in this market segment.

Type Insights

The network security segment is anticipated to account for a substantial share of the global market accounting for 36.3% of total revenue in 2024, due to its critical role in protecting enterprise infrastructure. Solutions such as firewalls, intrusion detection systems, and virtual private networks remain fundamental to safeguarding networked environments. Organizations prioritize these tools to secure endpoints, prevent unauthorized access, and mitigate risks from external threats. As digital transformation accelerates, businesses increasingly invest in network security to protect data exchanged across complex systems. This sustained demand ensures network security maintains its significant influence in the cybersecurity landscape.

Cloud security is gaining momentum as businesses migrate more operations to cloud platforms, increasing exposure to potential risks. Solutions customized for cloud environments, such as encryption, identity management, and threat monitoring, address these vulnerabilities effectively. The scalability of cloud security tools appeals to organizations of all sizes, driving widespread adoption. Compliance requirements and the growing reliance on Network Security and multi-cloud strategies further boost the need for robust cloud security measures.

Offering Insights

The services segment held a prominent revenue share of 34.9% in 2024, due to the increasing reliance on specialized expertise for deploying and managing AI-driven solutions. Managed AI security services offer continuous monitoring, advanced threat detection, and incident response tailored to an organization’s unique needs. Businesses prefer these services to avoid the complexity of maintaining in-house AI expertise and infrastructure. Service providers also help integrate AI tools seamlessly into existing security frameworks, maximizing efficiency and minimizing disruption. Subscription-based and scalable service models appeal to enterprises of all sizes, ensuring widespread adoption. This growing demand solidifies the services segment as a key growth driver.

The hardware segment is gaining traction in the AI in cybersecurity industry as organizations invest in specialized tools to support AI-driven systems. Devices such as AI-optimized processors, edge computing hardware, and security appliances enhance the performance of AI models in detecting and responding to threats. The rise of IoT and edge devices requires robust hardware solutions to handle real-time data processing and ensure secure environments. Organizations also favor hardware-based AI solutions for their ability to operate independently of cloud infrastructure, addressing latency and compliance concerns. Technological advancements in AI hardware, such as GPUs and TPUs, further encourage adoption.

Technology Insights

The machine learning segment dominates the market due to its unparalleled capability to identify and adapt to evolving threats. By analyzing vast amounts of data, machine learning models can detect patterns, predict vulnerabilities, and respond to cyberattacks in real time. Its applications include anomaly detection, phishing prevention, and malware analysis, making it indispensable across industries. Organizations prefer machine learning for its ability to reduce false positives and enhance the accuracy of threat detection. Continuous advancements in algorithms and training methodologies further solidify its dominance. This technology's scalability and adaptability ensure its sustained relevance in cybersecurity solutions.

Context-aware computing is emerging as a growing area in AI-driven cybersecurity, focusing on understanding and reacting to user behavior and environmental factors. This approach enhances threat detection by analyzing the context of interactions, such as device usage, location, and time, to identify anomalies. Organizations are adopting context-aware solutions to provide more personalized and precise security measures, reducing unnecessary alerts. The integration of this technology into authentication systems strengthens access control by adapting to real-world conditions. Increasing demand for adaptive security in IoT and mobile environments drives its adoption.

Application Insights

Fraud detection and anti-fraud solutions dominate the AI in cybersecurity market due to their critical role in combating financial and identity-related crimes. These tools utilize machine learning to detect unusual transactions, identify fake accounts, and prevent fraudulent activities in real time. Industries such as banking, e-commerce, and insurance heavily invest in these solutions to protect customer data and ensure compliance with regulations. The ability to analyze vast amounts of transactional data and flag anomalies enhances the reliability of these systems. As cybercriminals develop sophisticated techniques, the demand for robust fraud detection mechanisms remains high. This ensures the continued dominance of fraud detection and anti-fraud technologies in the cybersecurity market.

Unified Threat Management (UTM) is rapidly growing as organizations seek comprehensive solutions to address multiple cybersecurity needs within a single platform. UTM systems integrate features like firewalls, intrusion detection, anti-virus, and content filtering, streamlining security operations. Businesses appreciate the simplicity and cost-effectiveness of managing diverse security functions through a centralized solution. With increasing cyber threats, UTM adoption rises, particularly among small and medium-sized enterprises that need scalable yet affordable protection. Enhanced AI capabilities within UTM tools improve threat detection and response times, driving their popularity. This growing reliance on consolidated security systems positions UTM as a key area of expansion in the cybersecurity market.

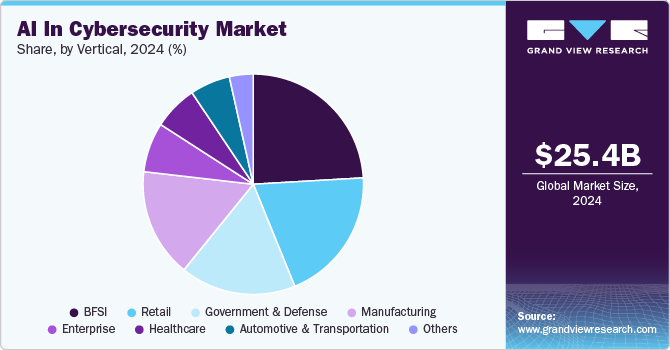

Vertical Insights

The enterprise sector dominates the market due to its need for robust and scalable solutions to protect vast networks and sensitive data. Large organizations invest heavily in AI-driven tools for threat detection, endpoint security, and risk management to address complex cybersecurity challenges. Compliance requirements and the high cost of data breaches drive enterprises to prioritize advanced security technologies. These businesses utilize AI to secure critical infrastructure, safeguard intellectual property, and ensure business continuity. The scalability of AI solutions allows enterprises to adapt quickly to evolving threats and changing environments. This focus on comprehensive protection solidifies the dominance of the enterprise segment in the market.

The retail sector is experiencing rapid growth in adopting AI in cybersecurity to combat increasing threats, particularly those targeting e-commerce platforms. Retailers use AI to detect fraud, secure payment systems, and protect customer data, which are crucial for maintaining trust. With the rise of online shopping and omnichannel strategies, retailers face heightened risks from phishing, ransomware, and other cyberattacks. AI-powered tools also help monitor supply chains and prevent disruptions caused by cybersecurity breaches. The adoption of cloud-based security solutions offers scalability and flexibility for businesses of varying sizes. This growing focus on securing digital transactions and customer interactions drives the expansion of AI adoption in the retail sector.

Regional Insights

North America AI in cybersecurity market leads the global industry accounting for leading share of 31.5% in 2024. North America leads the market, driven by the region's advanced technological infrastructure and high adoption rates across industries. Regulatory frameworks, such as the CCPA, encourage organizations to adopt sophisticated cybersecurity measures. The growing threat landscape, including ransomware and nation-state attacks, propels demand for AI-powered tools. With the presence of major tech companies and research institutions, North America remains at the forefront of innovation in AI cybersecurity.

U.S. AI In Cybersecurity Market Trends

The U.S. AI in cybersecurity market dominates the global industry due to its robust digital economy and frequent high-profile cyberattacks. Enterprises and government agencies increasingly adopt AI to protect sensitive data and mitigate risks. The country’s focus on public-private partnerships fosters advancements in AI-driven threat detection technologies. Rising investments in AI for defense and national security highlight its critical role in cybersecurity strategies.

Europe AI In Cybersecurity Market Trends

Europe’s AI in cybersecurity industry is growing steadily, supported by stringent regulations such as GDPR, which emphasize data protection. Organizations in the region adopt AI tools to ensure compliance and prevent costly breaches. Countries such as Germany, France, and the UK are leading adopters, driven by their advanced industrial sectors and digitized economies. The increasing reliance on AI to secure IoT devices and critical infrastructure further accelerates its adoption.

Asia Pacific AI In Cybersecurity Market Trends

The Asia Pacific region is experiencing rapid growth in AI in the cybersecurity industry, fueled by digital transformation and increasing cyber threats. Countries such as China, India, and Japan invest in AI solutions to protect critical infrastructure and secure fast-growing online services. The proliferation of IoT devices and cloud-based applications drives demand for advanced cybersecurity measures. Government initiatives to enhance cybersecurity frameworks support the adoption of AI-powered tools across industries.

Key AI In Cybersecurity Company Insights

Some of the key companies in the AI in cybersecurity market include Acalvio Technologies, Inc.; Amazon Web Services, Inc.; and IBM Corporation. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Amazon Web Services (AWS) has made significant advancements in AI-driven cybersecurity by offering a suite of machine learning-powered tools designed to detect and respond to threats. Their solutions, such as Amazon GuardDuty and AWS Security Hub, use AI to analyze and identify anomalous behavior across cloud infrastructures. AWS also integrates AI into its broader cloud services, enabling businesses to scale their security capabilities efficiently.

-

IBM Corporation integrates AI into cybersecurity through its IBM Security portfolio, including IBM QRadar and Watson for Cyber Security. Their AI-driven solutions use natural language processing and machine learning to analyze vast amounts of security data, detect advanced threats, and automate incident responses. IBM also collaborates with enterprises to deploy AI-enhanced cybersecurity solutions across various industries, helping organizations reduce risks and improve compliance.

Key AI In Cybersecurity Companies:

The following are the leading companies in the AI in cybersecurity market. These companies collectively hold the largest market share and dictate industry trends.

- Acalvio Technologies, Inc.

- Amazon Web Services, Inc.

- Cylance Inc. (BlackBerry)

- Darktrace

- FireEye, Inc.

- Fortinet, Inc.

- IBM Corporation

- Intel Corporation

- LexisNexis

- Micron Technology, Inc.

Recent Developments

-

In October 2024, SentinelOne, Inc., a U.S.-based cybersecurity company, has extended its collaboration with AWS to integrate generative AI into its cybersecurity solutions, utilizing Amazon Bedrock to power its Purple AI cybersecurity analyst. This collaboration enhances SentinelOne's Singularity Platform on AWS Marketplace, enabling customers to access AI-driven security protection, streamline investigations, and improve threat detection and response.

-

In August 2024, IBM Corporation introduced a generative AI-powered Cybersecurity Assistant within its Threat Detection and Response Services. It is designed to enhance threat investigation and response through historical correlation analysis and a conversational engine. Built on IBM's Watsonx platform, the assistant accelerates threat investigations and automates operational tasks.

-

In July 2024, IBM Corporation strengthened its collaboration with Microsoft to assist clients in modernizing security operations and protect Network Security cloud identities by integrating AI-powered security technologies into their solutions. Their partnership uses AI tools, such as IBM’s Threat Detection and Response (TDR) Cloud Native service, to enhance threat detection, automate remediation, and optimize cloud security for clients.

-

In March 2023, Acalvio Technologies partnered with Carahsoft Technology Corp., a software company in the U.S., to deliver its advanced cyber deception technology, including the ShadowPlex Active Defense Platform, to U.S. government agencies through Carahsoft’s public sector contracts. This partnership enables government organizations to enhance their cybersecurity posture with AI-powered threat detection, disruption, and intelligence capabilities.

AI In Cybersecurity Market Report Scope

|

Report Attribute |

Details |

|

Market Application value in 2025 |

USD 31.48 billion |

|

Revenue forecast in 2030 |

USD 93.75 billion |

|

Growth rate |

CAGR of 24.4% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segment scope |

Type, offering, technology, application, vertical, region |

|

Region scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; KSA; UAE; South Africa |

|

Key companies profiled |

Acalvio Technologies, Inc.; Amazon Web Services, Inc.; Cylance Inc. (BlackBerry); Darktrace; FireEye, Inc.; Fortinet, Inc.; IBM Corporation; Intel Corporation; LexisNexis; Micron Technology, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global AI In Cybersecurity Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global AI in cybersecurity market report based on type, offering, technology, application, vertical, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Network Security

-

Endpoint Security

-

Application Security

-

Hardware Security

-

-

Offering Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Machine Learning

-

Natural Language Processing (NLP)

-

Context-aware computing

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Identity and Access Management

-

Natural Language Processing (NLP)

-

Data Loss Prevention

-

Unified Threat Management

-

Fraud Detection/Anti-Fraud

-

Threat Intelligence

-

Others

-

-

Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Retail

-

Government & Defense

-

Manufacturing

-

Enterprise

-

Healthcare

-

Automotive & Transportation

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global AI in cybersecurity market size was estimated at USD 25.35 million in 2024 and is expected to reach USD 31.48 billion in 2025.

b. The global AI in cybersecurity market is expected to grow at a compound annual growth rate of 24.4% from 2025 to 2030 to reach USD 93.75 billion by 2030.

b. North America dominated the artificial intelligence in cybersecurity market with a share of 31.5% in 2024. This is attributable to the surge in network-connected devices with the growing footfall of IoT, 5G, and Wi-Fi 6, along with constant research and development initiatives.

b. Some key players operating in the AI in cybersecurity market include Acalvio Technologies, Inc., Amazon Web Services, Inc., Cylance Inc. (BlackBerry), Darktrace, FireEye, Inc., Fortinet, Inc., IBM Corporation, Intel Corporation, LexisNexis, Micron Technology, Inc.

b. Key factors that are driving artificial intelligence in cybersecurity market growth include Increasing Demand for Advanced Cybersecurity Solutions and Privacy, Growing adoption of IoT and increasing number of connected devices, and Increased use of social media for business functions.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."