AI-based Clinical Trials Solution Provider Market Size, Share & Trends Analysis Report By Therapeutic Application, By Clinical Trial Phase, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-456-6

- Number of Report Pages: 118

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

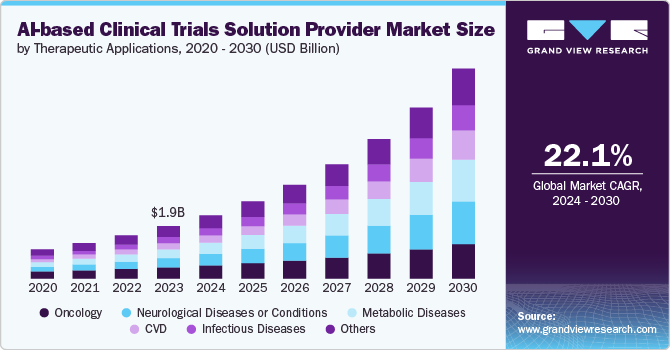

The global AI-based clinical trials solution provider market size was estimated at USD 1.9 billion in 2023 and is projected to grow at a CAGR of 22.1% from 2024 to 2030. The growing adoption of AI-based platforms to enhance the efficacy and productivity of trials at various stages drives the market for AI-based clinical trial solution providers. Moreover, supportive initiatives by the public and private sectors for different therapeutic areas are crucial in driving market growth. Furthermore, market players undertake several strategic initiatives to expand in the market. For instance, in June 2024, EQT announced its acquisition of a majority stake to support the expansion of CluePoints, a prominent provider of AI-driven software solutions for data interrogation and analytics in clinical trials.

Using AI in drug trials enhances the clinical outcomes, cost, and time required for drug trials, as drug development is a cost-intensive and time-consuming process. For instance, in January 2024, Accenture revealed a strategic investment through Accenture Ventures in QuantHealth, a company specializing in AI-driven clinical trial design. QuantHealth's cloud-based platform simulates clinical trials, enabling pharmaceutical and biotech firms to expedite and optimize the development of treatments in a cost-efficient manner.

Moreover, AI is instrumental in reducing bias in medical data. For instance, Genentech partnered with Stanford University to employ an open-source AI system to mitigate bias in drug trials. In addition, as the industry shifts from traditional to technology-based approaches, major pharmaceutical companies increasingly adopt AI technologies in clinical trials, thereby driving market growth.

Furthermore, the rising penetration of AI in drug trials and the availability of AI-based solutions help in different aspects of clinical trials, such as patient enrichment & enrollment, drug trial design, investigator & site selection, medication adherence, and patient monitoring, among others, are fueling the market growth. Patient eligibility and enrollment are some of the important steps for the success of the overall drug trial. As per the research, 85% of the drug trials are stalled during patient recruitment, and 30% end early due to recruitment failure. The AI-based platforms are beneficial in lowering this hindrance. Hence, numerous researchers use AI for drug trials, fostering market growth.

The COVID-19 pandemic accelerated the use of AI-based technologies in drug development. The increased adoption of advanced solutions for analyzing patient data and facilitating drug discovery and development has significantly boosted the penetration of AI in this sector. CROs, pharmaceutical companies, and academia have shifted from conventional approaches to AI-based solutions to improve clinical outcomes and reduce the time and cost of drug trials. In addition, decentralized drug trials gained momentum as many traditional trials were halted due to COVID-19, prompting key players to leverage available patient data.

Case Study: Clinical Trial Organizations Adopting AI to Enhance Patient Identification

A clinical trial organization aimed to reduce the time required to identify eligible patients by transitioning from manual chart reviews.

Problem:

-

Research coordinators typically use structured data like ICD codes to identify qualified patients for clinical trials.

-

Clinicians then review and combine this data with information from patient charts.

-

This manual process is time-consuming, takes hundreds of hours, and is prone to inefficiencies and errors.

-

As a result, 40% of clinical trial sites under-enroll compared to their plans, and 10% of sites fail to enroll a single patient.

Goal:

The customer aimed to determine if Mendel could replace manual chart reviews to achieve two objectives:

Test:

-

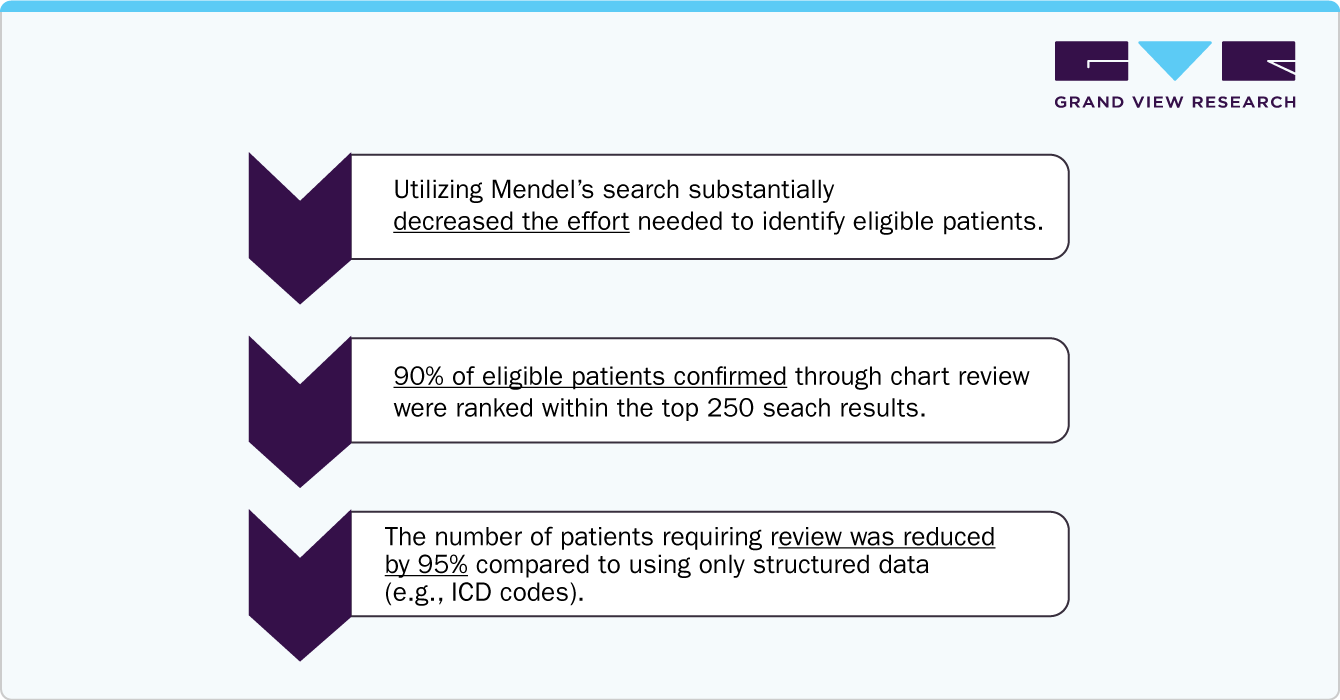

The organization manually reviewed 5,000 charts across two clinical sites for an oncology trial, identifying 26 eligible patients in one week.

-

Using Mendel’s clinically smart search and advanced query builder, the organization indexed 17,354 patients' clinical data in the same two sites within three days.

Result:

Market Concentration & Characteristics

The degree of innovation in the AI-based clinical trials solution providers industry is high. Technological advancements include enhanced machine learning algorithms for patient matching, real-time data analytics for trial optimization, and predictive modeling tools for protocol design. These advancements streamline clinical trial processes on several levels. For instance, in April 2024, Research Solutions launched its new Clinical Trial Landscape software solution, making clinical trial information more insightful, accessible, and actionable. This product family uses AI to transform how medical affairs specialists, medical science liaisons, and clinical development teams study, assess, and synthesize numerous clinical trials and suitable data to map the overall landscape.

The M&A activities, such as mergers, acquisitions, and partnerships, enable companies to expand geographically, financially, and technologically. For instance,in December 2023, ConcertAI announced the acquisition of CancerLinQ, formerly a subsidiary of the American Society of Clinical Oncology (ASCO). Alongside this acquisition, ASCO would uphold a multi-year collaboration agreement with CancerLinQ. This initiative aims to advance CancerLinQ's utilization of next-generation AI, analytics, real-world data, and other technologies to enhance cancer care and accelerate clinical research.

The regulatory impact on AI-based clinical trials solution providers industry is significant. The industry is subject to oversight by various regulatory authorities across different countries. For instance:

FDA Guidance Draft (April 2023):

-

The FDA issued a guidance draft to establish a regulatory framework for AI/ML-based devices.

-

Objective: To enhance patient access to secure and effective AI/ML-based devices, ensuring the promotion and protection of general health

-

The draft outlines the least burdensome approach for the continuous improvement of ML-based Device Software Functions (ML-DSF)

Geographic expansion drives the AI-based clinical trials solution providers market by enabling access to diverse resources, increasing market penetration and revenue, and fostering regulatory compliance and standardization. It also promotes partnerships and collaborations, improves localized healthcare outcomes, and necessitates investment in technological infrastructure.

Clinical Trial Phase Insights

Phase II segment dominated the market with a revenue share of 45.5% in 2023, owing to the presence of many registered clinical trials active in the second phase. The growing use of AI-based tools for data collection and analysis during drug trials contributes significantly to the segment's growth. In addition, this segment commands a higher revenue share as it facilitates the improvement, determination, and validation of measures related to AI-based tools during this phase.

However, the Phase-I segment is expected to witness the fastest growth over a forecast period. The increasing complexity and costs of early-stage drug development necessitate more efficient and accurate trial methodologies, which AI-based solutions provide. These solutions enhance patient recruitment, optimize trial design, and improve data analysis, accelerating drug development. Moreover, the high failure rates in Phase I trials drive the demand for AI tools to predict outcomes better and identify potential issues early.

Therapeutic Application Insights

The oncology segment dominated the market with the largest revenue share of 21.6% in 2023. The high prevalence of cancer globally and the large number of drug trials in the field of oncology are contributing to the adoption of AI-enabled technologies. Furthermore, numerous players are designing and adopting AI tools for oncology-based clinical trials, driving the segment growth. For instance, in January 2022, Hematology-Oncology Associates of Central New York and Deep Lens partnered to expand a drug trial program. In the program, the VIPER provided by Deep Lens will be used to pre-screen all patients to identify qualified patients for clinical trials.

The cardiovascular disease (CVD) segment is expected to grow at the fastest CAGR over the forecast period. The market growth is attributed to the high prevalence and significant mortality associated with CVD, which drives substantial investment in research and development. Moreover, increasing penetration of AI-based platforms for analyzing CVDs with a new approach is a major factor contributing to the segment growth. Additionally, the ability of AI to integrate and analyze diverse data sources, such as genomics, imaging, and electronic health records, facilitates more precise and personalized treatment approaches, further boosting the adoption of AI technologies in this segment.

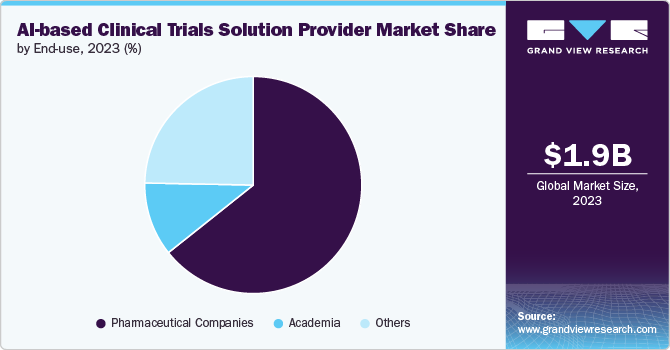

End-use Insights

The pharmaceutical companies segment dominated the market, with the largest share of 64.3% in 2023. The rising adoption of AI-based technologies for the better development of diagnostic and biomarkers, to identify new drug targets, and the overall process of drug development and clinical trials by major pharmaceutical players is one of the major factors contributing to the segment growth. Moreover, these major pharmaceutical players collaborate with the AI vendor to leverage AI technology for R&D and the overall drug discovery process, driving growth. For instance, in May 2024, Sanofi, OpenAI, and Formation Bio announced a collaboration to develop AI-based software to accelerate drug development and enhance the efficiency of delivering new medicines to patients. The partnership would integrate software, data, and customized models to create bespoke solutions throughout the drug development lifecycle. This initiative is the first in the pharmaceutical and life sciences industries.

However, the other segment is expected to grow at the highest CAGR over the forecast period owing to the rising trend of adoption of AI-enabled solutions by contract research organizations, government agencies, etc. The rising participation of CROs and other organizations in developing and adopting AI-based platforms and technologies useful in drug discovery and development, along with clinical trials, is anticipated to boost the market growth over the forecast period.

Regional Insights

North America AI-based clinical trials solution provider Marketdominated the global market with a revenue share of 43.4% in 2023. The growth is due to its advanced healthcare infrastructure, substantial investments in AI and biotechnology, and the presence of leading pharmaceutical companies. In February 2024, using funds from Genome Canada and data from the OICR-supported Ontario-wide Cancer Targeted Nucleic Acid Evaluation (OCTANE) clinical trial, the Ontario researchers team designed a software platform, PMATCH. This platform utilizes machine learning, AI, to match patients with precision medicine trials in near real-time. PMATCH compares detailed genomic and health data against clinical trial eligibility requirements and recommends trials for specific patients based on the latest cancer research data.

U.S. AI-based Clinical Trials Solution Provider Market Trends

The U.S. AI-based clinical trials solution providers market is primarily driven by technological advancements, which lead to prominent players launching new products. For instance, in June 2024, Medidata launched Clinical Data Studio, an AI-powered platform to modernize clinical trial data management. This comprehensive workspace facilitates data integration, management, and transformation, featuring AI-assisted data reconciliation, anomaly detection, self-serve data listings, and risk-based quality management. The platform supports holistic data and risk strategies through advanced workflows and visualizations.

Europe AI-based Clinical Trials Solution Provider Market Trends

The market growth is attributed to technological advancements, the availability of advanced healthcare infrastructure, and supportive initiatives by regulatory authorities in the region. For instance, EFPIA backs the European Medicines Regulatory Network's (EMRN) measured approach to AI, which incorporates existing methods, research practices, and established requirements for other drug development tools, such as traditional statistical methods and model-informed drug development.

The AI-based clinical trials solution providers market in UK held a significant market share in 2023, owing to the development of AI-based solutions for clinical trials in various healthcare domains. For instance, in June 2024, a team led by UCL and Moorfields Eye Hospital researchers developed a new AI system to reduce the cost and time of recruiting patients for clinical trials targeting advanced age-related vision loss.

Germany AI-based clinical trials solution providers marketis witnessing investments in technological advancements in wearable pulse oximeters, which is driving the market growth. For instance, in September 2023, Merck KGaA announced two new strategic collaborations with Exscientia and BenevolentAI to leverage AI-driven design and discovery capabilities, enhancing its research efforts. These partnerships aim to generate novel drug candidates with first-in-class and best-in-class potential in neurology, oncology, and immunology. AI integration throughout R&D, from target identification through clinical trials and product lifecycle management, aims to revolutionize drug discovery and development, accelerating the delivery of new medicines to patients with greater efficiency and success rates.

Asia Pacific AI-based Clinical Trials Solution Provider Market Trends

The AI-based clinical trials solution providers market in Asia Pacific is expected to grow at the fastest CAGR during the forecast period, owing to the increasing adoption of AI-based tools and supportive governmental initiatives across the healthcare sector. Clinical trial recruitment is rapidly expanding in Asia due to a sizable patient base and lower trial costs. Moreover, Asia Pacific is favored by biotechnology firms in various clinical phases due to its rapid patient enrollment capabilities, particularly in fields such as infectious diseases, oncology, metabolic conditions, immune-oncology, and rare diseases. The region offers cost-effective clinical research opportunities and boasts experienced investigators and research teams, further enhancing its attractiveness to global biotechnology companies.

The AI-based clinical trials solution providers market in Japan is driven by the increasing efforts of universities and market players to integrate AI-based solutions in clinical trials. For instance, in October 2023, Mount Sinai's Icahn School of Medicine entered a memorandum of understanding (MoU) with the Chiba Institute of Technology (CIT) to explore AI applications in CVD research. This collaboration aims to streamline clinical trials, accelerate advancements in patient care, and expedite the introduction of potential new treatments for heart patients.

The AI-based clinical trials solution providers market in Australia is expected to grow significantly during the forecast period owing to the increasing number of strategic initiatives market players undertake. For instance, in February 2024, Ryght partnered with Avance Clinical, a CRO specializing in conducting high-quality clinical trials across Australia, North America, and New Zealand for global biopharma firms. Through this collaboration, Avance Clinical would leverage Ryght's advanced GenAI technology. This technology harnesses specialized large language models (LLMs) designed for the sector to analyze real-time and intricate data streams, providing valuable insights to clinical research teams.

Key AI-based Clinical Trials Solution Provider Company Insights

The growing market demand is expected to attract new entrants in the future, driven by rising awareness and acceptance of AI-based technologies for clinical trials. Key market players are also expanding their solution portfolio through strategic initiatives such as mergers, acquisitions, collaborations, and increased R&D investments in AI-driven clinical trial platforms. For instance, in March 2021, Datavant and Saama Technologies, Inc. collaborated to integrate patient journey mapping across diverse real-world and clinical datasets using Saama's Life Science Analytics Cloud (LSAC). These efforts are expected to accelerate the adoption of AI solutions across the industry over the forecast period.

Key AI-based Clinical Trials Solution Provider Companies:

The following are the leading companies in the AI-based clinical trials solution providers market. These companies collectively hold the largest market share and dictate industry trends.

- Unlearn.ai, Inc.

- Saama

- Antidote Technologies, Inc.

- Phesi

- Deep6.ai

- Innoplexus

- Mendel Health Inc.

- Intelligencia AI

- Median Technologies

- SymphonyAI

- BioAge Labs, Inc.

- AiCure

- Consilx

- DeepLens.AI

- HaloHealth

- PHARMASEAL

- Ardigen

- Trials.ai

- Koneksa Health

- Euretos

- BioSymetrics, Inc.

- Verily (Google LLC)

- Aitia

- IBM

- Exscientia

Recent Developments

-

In May 2024, Phesi announced enhancements to its AI-driven Trial Accelerator platform by introducing the Patient Burden Score. This feature allows sponsors to enhance protocol and study structure by anticipating the number of visits a trial participant may need to make to an investigator site, the procedures to be conducted, and the data accumulated and documented during each visit.

-

In October 2023, Mendel launched Hypercube, an AI copilot that allows life sciences and healthcare organizations to examine their extensive patient data using simple language through a chat-like interface.

-

In January 2023, Deep 6 AI partnered with Graticule to develop research algorithms and real-world data services to improve patient identification and prioritization for clinical trials across various disease indications. Their initial algorithm automates patient screening for a cardiovascular medical device trial. This technology, combined with rapid implementation services, is being piloted at sites within the Deep 6 AI research network to expedite trial completion.

AI-based Clinical Trials Solution Provider Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 2.4 billion |

|

Revenue forecast in 2030 |

USD 7.8 billion |

|

Growth rate |

CAGR of 22.1% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Therapeutic applications, clinical trial phase, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; U.K.; Germany; Spain; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; Mexico; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Unlearn.ai, Inc.; Saama; Antidote Technologies, Inc.; Phesi; Deep6.ai; Innoplexus; Mendel Health Inc.; Intelligencia AI; Median Technologies; SymphonyAI; BioAge Labs, Inc.; AiCure; Consilx; DeepLens.AI; HaloHealth; PHARMASEAL; Ardigen; Trials.ai; Koneksa Health; Euretos; BioSymetrics, Inc.; Verily (Google LLC); Aitia; IBM; Exscientia |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

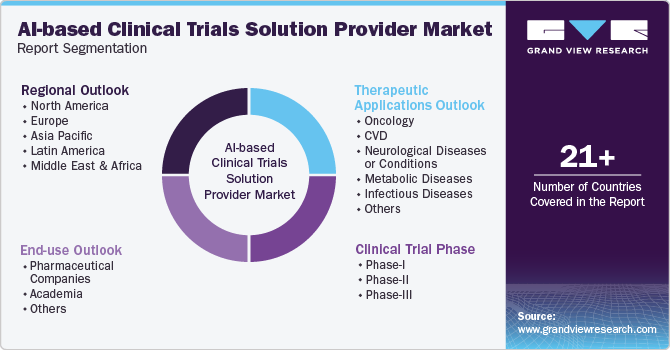

Global AI-based Clinical Trials Solution Provider Market Report Segmentation

This report forecasts revenue growth and provides at global, regional, and country levels an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global AI-based clinical trials solution provider market report based on therapeutic applications, clinical trial phase, end-use, and region:

-

Therapeutic Applications Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

CVD

-

Neurological Diseases or conditions

-

Metabolic diseases

-

Infectious diseases

-

Others

-

-

Clinical Trial Phase (Revenue, USD Million, 2018 - 2030)

-

Phase-I

-

Phase-II

-

Phase-III

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical Companies

-

Academia

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. In 2023, based on therapeutic applications, the oncology segment dominated the AI-based clinical trials solution provider market and accounted for the largest revenue shaxre of 21.6%.

b. The pharmaceutical companies segment dominated the AI-based clinical trials solution provider market and accounted for the largest revenue share of 64.3% in 2023.

b. North America dominated the AI-based clinical trials solution provider market and accounted for the largest revenue share of 43.4% in 2023.

b. The global AI-based clinical trials solution provider market size was estimated at USD 1.95 billion in 2023 and is expected to reach USD 2.37 billion in 2024.

b. The global AI-based clinical trials solution provider market is expected to grow at a compound annual growth rate of 22.1% from 2024 to 2030 to reach USD 7.8 billion by 2030.

b. The phase-II segment dominated the AI-based clinical trials solution provider market and accounted for the largest revenue share of 45.5% in 2023.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."