Artificial Intelligence As A Service Market Size, Share & Trends Analysis Report By Technology (Machine Learning, Computer Vision), By Service Type (Software, Services), By Organization Size, By Deployment, By Vertical, By Offering, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-002-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Market Size & Trends

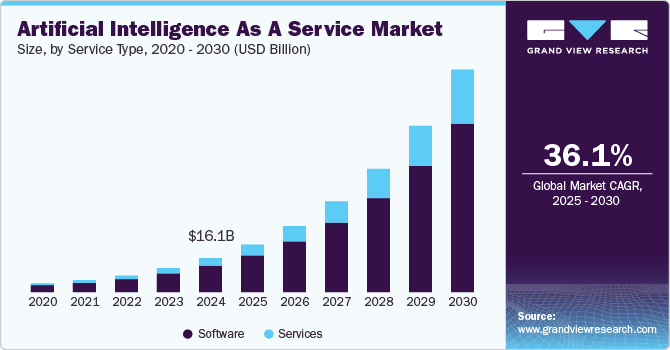

The global artificial intelligence as a service market size was estimated at USD 16.08 billion in 2024 and is projected to grow at a CAGR of 36.1% from 2025 to 2030. The rise of cloud computing, the expansion of big data, and the increasing need for automation across sectors like healthcare, finance, retail, and manufacturing are major factors driving this trend. Future opportunities lie in the development of more customizable AI solutions, improved data privacy, and integration with emerging technologies like the Internet of Things (IoT) and 5G. As businesses continue to seek innovative ways to leverage AI, the AIaaS market is expected to play a critical role in democratizing AI and driving digital transformation globally.

AIaaS allows businesses to access AI technologies, such as machine learning, natural language processing, and computer vision, without the need for in-house expertise or infrastructure. This model is particularly appealing for small to medium-sized enterprises, as it reduces the costs and complexities of implementing AI.

Enterprises are investing extensively in AI services these days to unlock the power of their businesses. They are implementing solutions to execute activities ranging from forecasting, planning, and predictive maintenance to customer service chatbots and other applications. The growing advancement of technology in recent years has resulted in a new threat scenario, compelling firms to explore advanced defensive tactics. Security experts will have tremendous resources to secure sensitive networks and avoid future data breaches if AI is integrated into cybersecurity. As AI performs more enterprise activities, firms will see a massive transformation in their business activities. Such factors are likely to boost market growth during the forecast period.

Increasing demand for machine learning services in the form of application programming interfaces (API) and software development kits (SDK), along with the rising number of innovative startups, are factors expected to aid market growth. For instance, in April 2023, CHATCRYPTO, a blockchain enterprise, introduced its latest innovation, the ChatCrypto token, a deflationary AI token. This token serves as a key to access blockchain as a service (BaaS), AIaaS, and the rental of high-performance computing (HPC) power through their infrastructure as a service (IaaS). The ChatCrypto token aims to establish a sustainable and resilient ecosystem, fostering stability for both the platform and its users.

Technology Insights

Based on technology, the machine learning (ML) segment led the market with the largest revenue share of 40.7% in 2024, due to its ability to analyze vast datasets and deliver actionable insights, which has become crucial for businesses across sectors. Companies are increasingly leveraging ML algorithms for tasks like predictive analytics, recommendation systems, and fraud detection. The ease of integrating ML models with cloud-based platforms has further fueled its adoption, enabling businesses to deploy scalable, cost-effective solutions without the need for extensive infrastructure. In addition, advancements in automated machine learning (AutoML) have made it easier for companies to develop and deploy models, even with limited AI expertise.

The natural language processing (NLP) segment is predicted to foresee at a significant CAGR during the forecast period.Businesses are increasingly adopting NLP for customer service automation, sentiment analysis, and language translation, driven by the need to enhance user experiences and streamline operations. The rise of conversational AI, including chatbots and virtual assistants, has been a significant factor, as these tools rely on NLP to understand and respond to human language effectively. In addition, advancements in Large Language Models (LLMs) have improved the accuracy and versatility of NLP solutions, making them more accessible to companies of all sizes. This surge in demand is propelling rapid market growth within the NLP segment.

Service Type Insights

Based on service type, the software segment accounted for the largest market revenue share of 77.6% in 2024. Companies are investing in AI software to enhance data analytics, automate business processes, and improve decision-making across sectors like healthcare, finance, retail, and manufacturing. The growth of cloud-based software platforms has made it easier for businesses to deploy AI tools without the need for extensive infrastructure, driving widespread adoption. In addition, advancements in AI software development, such as AutoML and pre-trained models, have simplified the integration and customization of AI solutions, enabling businesses to implement and scale AI capabilities quickly.

The services segment is predicted to foresee at a significant CAGR during the forecast period. As businesses increasingly adopt AI, many lack the in-house expertise to implement and scale these technologies effectively. AI service providers offer critical consulting, integration, and maintenance services, helping companies navigate the complexities of AI deployment. In addition, the demand for custom AI solutions tailored to specific industry needs has led to a surge in professional services, including training, data management, and model tuning. This trend is further driven by the growing focus on AI ethics, data privacy, and compliance, where expert guidance is essential, fueling growth in the services segment.

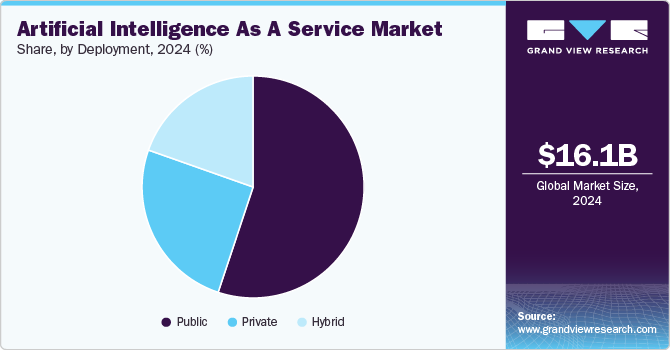

Deployment Insights

Based on deployment, the public cloud segment led the market with the largest revenue share of 55.1% in 2024. Public cloud platforms enable businesses of all sizes to leverage AI technologies without significant investments in infrastructure, making it easier to experiment and scale AI solutions. Furthermore, the flexibility of public cloud environments allows companies to quickly deploy and manage AI models, adjust computing resources on demand, and integrate with other cloud-based applications. The increasing reliance on remote work and digital transformation is further driving the shift towards public cloud deployments.

The hybrid segment is anticipated to witness at a significant CAGR during the forecast period.Businesses are increasingly adopting hybrid solutions to maintain control over sensitive data by keeping it on private servers while leveraging the scalability and cost-efficiency of the public cloud for other AI workloads. This approach ensures greater flexibility, enhanced data security, and compliance with regulatory requirements, making it especially appealing for industries like healthcare, finance, and government. Moreover, hybrid models support seamless integration with existing on-premises infrastructure, enabling companies to gradually scale their AI initiatives without disrupting their core systems, which is driving their rapid adoption and growth.

Organization Size Insights

Based on organization size, the large enterprises segment led the market with the largest revenue share of 73.5% in 2024.Large enterprises have the resources to implement advanced AI solutions across various business functions, including customer service, supply chain optimization, and predictive maintenance. They are also adopting AI to gain a competitive edge by enhancing customer experiences, improving operational efficiency, and making data-driven decisions. In addition, large enterprises are more likely to seek customized, scalable AI solutions that can be integrated with their existing systems. The need for robust data security, compliance, and continuous innovation further drives their preference for AIaaS, as it allows them to leverage cutting-edge AI technologies without extensive in-house development.

The SMEs segment is anticipated to exhibit at the fastest CAGR over the forecast period. AIaaS enables SMEs to adopt AI technologies without the need for substantial investments in infrastructure or technical expertise. This has empowered SMEs to streamline operations, enhance customer engagement, and gain data-driven insights, helping them compete with larger companies. The flexibility of AIaaS allows SMEs to pay for services as needed, making it easier to experiment and scale AI deployments based on business growth.

Vertical Insights

Based on vertical, the BFSI segment led the market with the largest revenue share of 20.4% in 2024, due to the sector's increasing focus on automation, risk management, and personalized customer experiences. Financial institutions are adopting AIaaS to streamline operations, detect fraud, enhance compliance, and improve decision-making through advanced data analytics. AI-powered chatbots and virtual assistants are also being used to provide efficient customer service and support. In addition, AIaaS solutions enable banks and insurers to analyze vast amounts of data for credit scoring, investment forecasting, and underwriting, leading to more accurate and timely insights. The ability to deploy scalable, cloud-based AI solutions without major infrastructure investments is driving rapid adoption in the BFSI sector.

Healthcare providers are increasingly leveraging AIaaS solutions for applications such as predictive analytics, medical imaging analysis, and personalized treatment plans. AI technologies facilitate the analysis of vast amounts of patient data, enabling early disease detection and improved clinical decision-making. In addition, AI-powered tools are being used to enhance patient engagement through chatbots and telemedicine services. The ongoing push for digital transformation in healthcare, coupled with the need for cost reduction and enhanced patient outcomes, is driving the rapid adoption of AIaaS solutions within the sector.

Offering Insights

Based on offering, the software as a service (SaaS) segment led the market with the largest revenue share of 62.4% in 2024.SaaS solutions allow businesses to access AI technologies without the need for significant upfront investments in hardware or software. This model enables companies to easily integrate AI capabilities into their existing workflows, enhancing productivity and efficiency. Furthermore, the growing demand for cloud-based applications and the rapid adoption of subscription-based pricing models make SaaS offerings particularly appealing for businesses of all sizes.

The infrastructure as a service (IaaS) segment is anticipated to exhibit at the fastest CAGR over the forecast period. IaaS enables organizations to access powerful virtual machines, storage, and networking capabilities without the need for significant capital investments in physical infrastructure. This flexibility allows businesses to experiment with AI technologies, scale their operations based on demand, and optimize resource allocation efficiently. As more organizations adopt AI solutions for applications such as machine learning, data analysis, and model training, the demand for robust IaaS platforms is increasing, driving significant market growth in this segment.

Regional Insights

North America dominated the artificial intelligence as a service (AIaaS) market with the largest revenue share of 46.2% in 2024. North American companies are at the forefront of AI adoption, leveraging AIaaS solutions to enhance operational efficiency, drive innovation, and improve customer experiences. The presence of major cloud service providers and AI startups fosters a competitive environment that accelerates the development and deployment of AI technologies. In addition, industries such as healthcare, finance, and retail are increasingly integrating AIaaS to streamline processes and gain insights from large datasets.

U.S. Artificial Intelligence As A Service Market Trends

The AIaaS market in the U.S. is expected to grow at a significant CAGR from 2025 to 2030, driven by its strong technological ecosystem and significant investments in artificial intelligence research and development. U.S. businesses are increasingly leveraging AIaaS to enhance operational efficiencies, improve customer engagement, and derive insights from big data. In addition, a robust startup culture and ongoing government initiatives to promote AI innovation contribute to the rapid market growth in the U.S.

Europe Artificial Intelligence As A Service Market Trends

The artificial intelligence as a service (AIaaS) market in the Europe region is expected to witness at a significant CAGR over the forecast period. The European Union's commitment to promoting AI development through strategic initiatives and funding further supports the market growth. The emphasis on data privacy and ethical AI practices also drives organizations to seek AIaaS solutions that align with regulatory requirements, positioning Europe for significant growth in this sector.

Asia Pacific Artificial Intelligence As A Service Market Trends

The AIaaS market in the Asia Pacific region is anticipated to register at the fastest CAGR over the forecast period, driven by rapid industrialization and the increasing adoption of digital technologies across various sectors. Countries like China, India, and Japan are heavily investing in AI research and development, aiming to enhance productivity and innovation. The proliferation of startups and tech companies in APAC is accelerating the development and deployment of AIaaS solutions, making them more accessible to businesses of all sizes.

Key Artificial Intelligence As A Service Company Insights

Some key players in the global market, such as Amazon Web Services, Inc., Salesforce, Inc., IBM Corporation, and Intel Corporation. Companies operating in the market are implementing a variety of strategic initiatives, such as forming partnerships, pursuing mergers and acquisitions, fostering collaborations, and developing innovative products and technologies. This proactive approach not only enhances their market presence but also enables them to respond effectively to the evolving demands of security and compliance. By leveraging these strategies, these industry leaders are well-positioned to capitalize on growth opportunities, drive innovation, and maintain a robust competitive advantage in the rapidly evolving AIaaS landscape.

-

Amazon Web Services, Inc. (AWS) is one of the prominent players operating in the AIaaS market, offering a comprehensive suite of AI and machine learning services. AWS provides tools like Amazon SageMaker for building, training, and deploying machine learning models, alongside services for NLP, computer vision, and robotics. Its robust cloud infrastructure ensures scalability and reliability, making it accessible to businesses of all sizes. AWS continually innovates through regular updates and the introduction of new features, fostering an environment that encourages developers to integrate AI capabilities seamlessly.

-

Salesforce, Inc. is renowned for its innovative AI capabilities integrated into its Customer Relationship Management (CRM) platform. Through its Einstein AI, the company provides businesses with advanced analytics, predictive insights, and automation tools that enhance customer engagement and streamline operations. The platform allows users to leverage AI for tasks such as lead scoring, personalized marketing, and customer support optimization. Salesforce, Inc. actively invests in AI research and development, continuously expanding its offerings to meet the evolving needs of organizations.

Key Artificial Intelligence As A Service Companies:

The following are the leading companies in the artificial intelligence as a service market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon Web Services, Inc.

- Salesforce, Inc.

- IBM Corporation

- Intel Corporation

- BigML, Inc.

- Fair Isaac Corporation

- Microsoft

- Google LLC

- SAP SE

- Siemens

Recent Developments

-

In October 2024, Singtel, a leading telecommunications conglomerate based in Singapore, officially launched RE:AI, a new AI cloud service aimed at enhancing the scalability, accessibility, and affordability of AI for enterprises and the public sector. With this AIaaS offering, Singtel is addressing the high costs and complexities typically associated with AI. By utilizing Singtel's patented 5G MEC orchestration platform, RE:AI enables customers to effortlessly deploy, manage, and scale AI applications, thereby facilitating smoother AI adoption across various sectors.

-

In September 2024, Deloitte Touche Tohmatsu Limited, a British multinational professional services network, announced the release of AI Factory as a Service. This scalable, comprehensive suite of GenAI capabilities is built on the NVIDIA AI platform and includes NVIDIA NIM Agent Blueprints, NVIDIA AI Enterprise software, and accelerated computing, along with Oracle’s enterprise AI technology. This integration enables a robust ecosystem of technology providers to deliver tailored GenAI workflows.

-

In September 2024, Salesforce, Inc. unveiled AI-powered innovations for its Service Cloud, designed to enhance the resolution of customer and employee cases. The company highlighted its ongoing efforts to expand its comprehensive suite of AI-driven Service Cloud solutions, ensuring that customers, employees, and HR professionals have access to essential information 24/7, allowing for faster and more cost-effective case resolutions. The latest innovations include step-by-step resolution plans for service representatives, tools to monitor customer sentiment, and AI-driven recommendations aimed at improving the overall customer experience.

Artificial Intelligence As A Service Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 22.49 billion |

|

Revenue forecast in 2030 |

USD 105.04 billion |

|

Growth rate |

CAGR of 36.1% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2017 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Technology, service type, deployment, organization size, vertical, offering, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA |

|

Key companies profiled |

Amazon Web Services, Inc.; Salesforce, Inc.; IBM Corporation; Intel Corporation; BigML, Inc.; Fair Isaac Corporation; Microsoft; Google LLC; SAP SE; Siemens |

|

Customization scope |

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Artificial Intelligence As A Service (AIaaS) Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the artificial intelligence as a service market report based on technology, service type, deployment, organization size, vertical, offering, and region:

-

Technology Outlook (Revenue, USD Billion, 2017 - 2030)

-

Machine learning (ML)

-

Computer Vision

-

Natural Language Processing (NLP)

-

Others

-

-

Service Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Software

-

Data Storage and Archiving

-

Modeler and Processing

-

Cloud and Web-Based Application Programming Interface (APIs)

-

Others

-

-

Services

-

-

Deployment Outlook (Revenue, USD Billion, 2017 - 2030)

-

Public

-

Private

-

Hybrid

-

-

Organization Size Outlook (Revenue, USD Billion, 2017 - 2030)

-

Large Enterprises

-

SMEs

-

-

Vertical Outlook (Revenue, USD Billion, 2017 - 2030)

-

BFSI

-

Healthcare and Life Sciences

-

Retail

-

IT & Telecommunication

-

BFSI

-

Manufacturing

-

Energy & Utility

-

Others

-

-

Offering Outlook (Revenue, USD Billion, 2017 - 2030)

-

SaaS

-

PaaS

-

IaaS

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global artificial intelligence as a service market size was estimated at USD 16.08 billion in 2024 and is expected to reach USD 22.49 billion in 2025.

b. The global artificial intelligence as a service market is expected to grow at a compound annual growth rate of 36.1% from 2025 to 2030 to reach USD 105.04 billion by 2030.

b. North America dominated the artificial intelligence as a service market with a share of 46.2% in 2024. North American companies are at the forefront of AI adoption, leveraging AIaaS solutions to enhance operational efficiency, drive innovation, and improve customer experiences.

b. Some key players operating in the artificial intelligence as a service market include Amazon Web Services, Inc.; Salesforce, Inc.; IBM Corporation; Intel Corporation; BigML, Inc.; Fair Isaac Corporation; Microsoft; Google LLC; SAP SE; Siemens

b. Key factors driving the artificial intelligence as a service market include the rising demand for machine learning services in the form of the software development kit (SDK) and application programming interface (API), as well as the growing number of innovative startups.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."