AI In Video Surveillance Market Size, Share & Trend Analysis Report By Offering, By Deployment, By End-use, By Use Cases, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-333-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

AI In Video Surveillance Market Trends

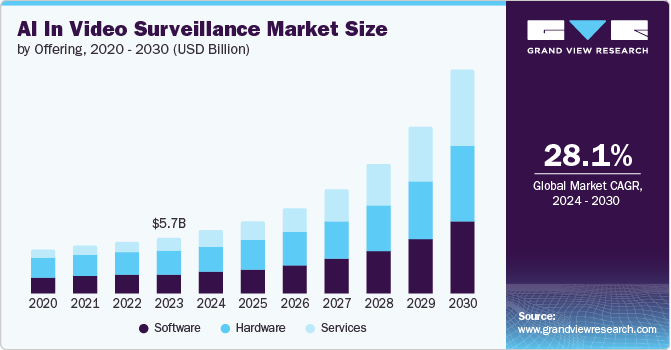

The global AI in video surveillance market size was valued at USD 5.74 billion in 2023 and is projected to grow at a CAGR of 28.1% from 2024 to 2030. The adoption of cloud-based video surveillance systems is on the rise, as they offer scalability, remote access, and reduced infrastructure costs compared to on-premises systems. Cloud-based solutions enable organizations to easily scale their video surveillance capabilities to meet changing needs without the need for significant upfront investments in hardware and IT infrastructure.

In addition, cloud-based systems provide remote access, allowing security personnel to monitor and manage video feeds from anywhere, improving responsiveness and efficiency. The integration of advanced Artificial Intelligence (AI) algorithms with cloud-based video surveillance further enhances the capabilities of these systems, enabling real-time analytics and intelligent monitoring to identify potential threats.

The demand for intelligent video analytics is growing as organizations seek to extract more value from their video surveillance data. AI-powered analytics can provide real-time insights, such as detecting suspicious activities, tracking people and vehicles, and generating actionable intelligence, which is driving the adoption of AI in video surveillance. By automating the analysis of video footage, AI-based analytics can help security personnel identify potential threats and respond more quickly while also providing valuable data for operational optimization and business intelligence. As organizations recognize the benefits of leveraging AI to enhance their video surveillance capabilities, the demand for these technologies is expected to continue growing.

The integration of AI-powered video surveillance systems with the Internet of Things (IoT) and edge computing is a key trend. This allows for distributed processing and decision-making at the edge, reducing the need for constant data transmission to the cloud and enabling faster response times for critical applications. By processing video data locally on IoT devices or edge computing platforms, AI-powered video surveillance systems can identify and respond to events in real-time without the latency associated with cloud-based processing. This integration with IoT and edge computing also enhances the scalability and resilience of video surveillance systems, as they can operate independently even in the event of network disruptions or cloud outages.

As the use of AI in video surveillance becomes more widespread, there are growing concerns about privacy, bias, and the ethical implications of these technologies. This has led to the development of regulatory frameworks and guidelines to ensure the responsible and ethical use of AI in video surveillance applications. Policymakers and industry organizations are working to establish guidelines and standards that address issues such as data privacy, algorithmic bias, and the transparency of AI-powered video analytics. These regulatory efforts aim to strike a balance between the security and operational benefits of AI-powered video surveillance and the protection of individual rights and civil liberties. As the adoption of AI in video surveillance continues to grow, the need for robust ethical frameworks and regulatory oversight will become increasingly important.

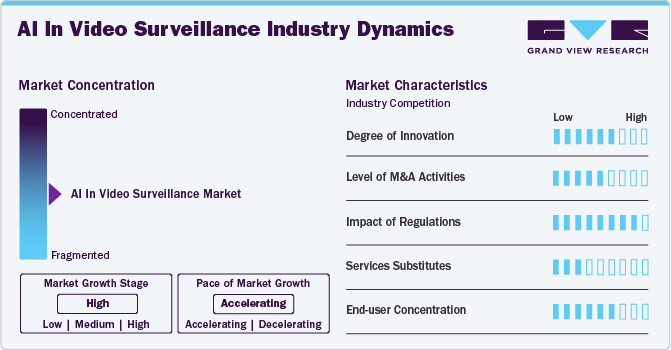

Market Concentration & Characteristics

The market is experiencing significant innovation, driven by advancements in deep learning and computer vision technologies. These advancements are enabling AI-powered video surveillance systems to perform advanced tasks like object detection, facial recognition, and behavior analysis with greater accuracy and efficiency. The growing adoption of AI in video surveillance is being fueled by the increasing demand for enhanced public safety and security, as well as the need for cost-effective and intelligent monitoring solutions. However, the trend of AI in video surveillance also faces challenges related to privacy concerns and ethical considerations, which must be addressed through robust regulations and guidelines.

The artificial intelligence (AI) in video surveillance market is witnessing a notable surge in merger and acquisition (M&A) activities as major players seek to consolidate their market position and expand their technological capabilities. Leading companies are actively acquiring AI-focused video analytics startups and consolidating with other video surveillance hardware manufacturers to integrate advanced AI and computer vision technologies into their offerings. These M&A trends reflect the industry's dynamic nature and the growing importance of AI-powered video surveillance solutions in addressing evolving security challenges.

The trend of AI in video surveillance is increasingly shaped by the impact of regulations as governments seek to balance the benefits of advanced surveillance with the need to protect privacy. Regulations have prompted providers to develop more privacy-preserving technologies and design systems that maintain security while adhering to privacy principles. Consequently, the market is evolving to meet the demands of a more regulated, privacy-conscious environment.

The trend of artificial intelligence in video surveillance is increasingly shaped by the emergence of service substitutes, such as video surveillance as a service (VSaaS) and managed security service providers, which are challenging the traditional hardware-centric business model. These service-oriented offerings eliminate the need for customers to invest in and manage the underlying video surveillance infrastructure, driving a shift in customer preferences towards more flexible, scalable, and cost-effective solutions. To stay relevant, AI in video surveillance providers are adapting their offerings by developing hybrid solutions, partnering with service providers, and investing in enhancing the intelligence, automation, and user-friendliness of their video surveillance services to meet the evolving market demands.

The trend in AI in video surveillance is witnessing a shift in end user concentration, expanding beyond the traditional security and surveillance sector. Businesses across industries like retail, transportation, and healthcare are increasingly deploying AI-powered video surveillance systems to enhance operational efficiency, improve customer experience, and optimize various processes. This diversification of end users is driven by the growing recognition of the benefits that AI-powered video surveillance can offer, but it also brings new challenges for providers to adapt their offerings to cater to the unique requirements of these diverse segments.

Offering Insights

The hardware segment led the market with a 41.9% share of the global revenue in 2023. The growing demand for AI in video surveillance is driven by the increasing use of cameras deployed worldwide due to rising security concerns across multiple verticals. The industry shift toward IP cameras has led to many hardware-based innovations that provide better low-light performance, object tracking, and in-built security. As the number of cameras installed globally continues to rise, the need for AI-powered video analytics to effectively process and interpret the vast amounts of video data generated will also increase. This trend is particularly evident in sectors like retail, transportation, and smart cities, where the deployment of video surveillance cameras has become more widespread to enhance security, improve operational efficiency, and enable data-driven decision-making.

The increasing sophistication of AI-driven video surveillance systems is pushing demand for specialized consulting and integration services. Organizations are seeking expert advice to integrate AI capabilities into their existing surveillance infrastructure efficiently and seamlessly. This integration involves not only the hardware but also the optimization of AI algorithms for specific applications, such as facial recognition or behavior analysis. As industries like banking, retail, and critical infrastructure adopt advanced security measures, consulting firms are pivotal in customizing solutions to meet stringent regulatory and operational requirements. Consequently, these services are evolving to offer more holistic support, including risk assessments and system audits.

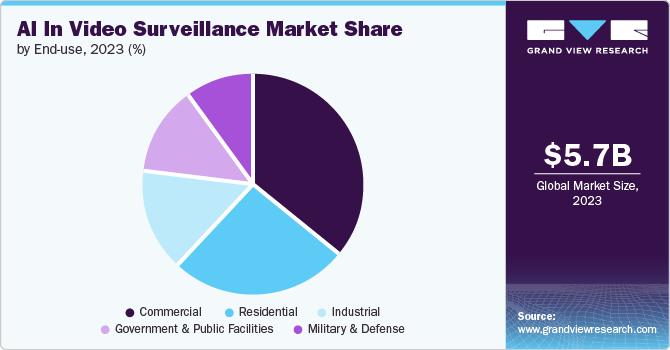

End-use Insights

The commercial segment held the highest revenue share in 2023. AI surveillance is increasingly being integrated with other smart building and business management systems, creating comprehensive, interconnected solutions. These integrations can include access control systems, allowing for more sophisticated entry management and employee tracking. In retail, AI surveillance can be linked with point-of-sale systems to correlate visual data with transaction information, helping to detect fraud or improve customer service. Smart building systems can use surveillance data to optimize energy usage based on occupancy patterns. This trend towards integration is making AI surveillance a central component of broader digital transformation initiatives in the commercial sector, enhancing overall operational efficiency and effectiveness.

The military & defense sectors are increasingly adopting AI-powered surveillance systems to enhance situational awareness, improve threat detection, and enhance operational efficiency. AI-driven video analytics can analyze vast amounts of video data in real time, enabling faster and more accurate threat detection and response. This trend is driven by the growing need for military & defense organizations to stay ahead of evolving security threats and make more informed decisions in high-stakes environments. The adoption of AI-powered surveillance systems is expected to continue to grow as the technology becomes more advanced and accessible, providing military & defense personnel with a powerful tool for enhancing their operational capabilities.

Deployment Insights

The cloud segment has the largest revenue share in 2023. The adoption of cloud-based AI surveillance systems is driven by their capability for remote accessibility and real-time monitoring from any location. This feature is particularly valuable for organizations with distributed sites or mobile security operations, enabling centralized management and monitoring across multiple locations. The cloud facilitates real-time data analysis and instant alerts, enhancing responsiveness to security incidents and operational anomalies. This trend is accelerating as mobile and remote work become more common, necessitating the ability to manage and access surveillance systems from anywhere, thereby improving overall security management and operational flexibility.

The on-premises approach is preferred by organizations that require highly customized surveillance solutions and need to integrate AI capabilities with existing legacy systems. This trend is particularly evident in large enterprises and critical infrastructure sectors where bespoke solutions can be designed to address unique operational and environmental conditions. On-premises systems offer greater flexibility for customization, including the ability to deploy specific AI algorithms and configure hardware to meet precise performance requirements. The ability to seamlessly integrate with legacy infrastructure without significant overhauls is a key advantage, allowing organizations to leverage existing investments while upgrading their surveillance capabilities.

Use Cases Insights

The intrusion detection segment held the highest market share of global revenue in 2023. The integration of cloud and edge computing with AI intrusion detection systems is becoming more prevalent, providing a balance between real-time processing and scalability. Edge computing allows for immediate analysis and response at the perimeter, reducing latency and bandwidth usage, while cloud integration facilitates centralized management and long-term data storage. This hybrid approach supports the deployment of AI analytics at the edge for quick threat detection and decision-making, complemented by cloud-based resources for more extensive analysis and archiving. This trend is particularly advantageous for large-scale surveillance networks, enabling flexible and efficient intrusion detection across diverse environments and locations.

Facial recognition technology can be a valuable tool in smart city initiatives, enhancing public safety by monitoring public spaces, transportation systems, and critical infrastructure. The use of facial recognition systems in crime prevention can help detect and alert security personnel to suspicious activities, reducing the risk of security breaches. Additionally, the integration of facial recognition systems with emergency response systems can provide real-time data and analytics to first responders, improving their ability to respond quickly and effectively to emergencies. These smart city initiatives leverage the power of facial recognition technology to create safer and more secure urban environments.

Regional Insights

North America AI in video surveillance market dominated in 2023 and accounted for a 33.8% global revenue share. The North America AI-driven video surveillance market is increasing demand for AI-powered video surveillance systems across various sectors, including retail, transportation, and financial services. The region's focus on public safety, the presence of leading technology companies and research institutions driving innovations in artificial intelligence and video analytics, and the increasing adoption of AI-powered surveillance systems are expected to continue fueling the market's expansion in North America.

U.S. AI In Video Surveillance Market Trends

The AI in video surveillance market in the U.S. has seen significant growth as cloud-based AI video surveillance systems become increasingly prevalent in the market. These solutions offer scalability, remote access, and reduced on-premises hardware requirements. Cloud platforms also enable easier integration of advanced AI analytics and facilitate centralized management of distributed camera networks.

Europe AI In Video Surveillance Market Trends

The AI in video surveillance market in Europe is witnessing the rise of smart home devices and the integration of AI-enabled cameras, which are driving the demand for AI-based video surveillance in European households. Homeowners are seeking advanced security solutions that can provide intelligent monitoring and analytics.

The UK AI in video surveillance market is revolutionizing threat detection in the UK. These systems can identify suspicious behavior patterns and alert security personnel in real time. Technology is being increasingly adopted in high-risk areas such as airports, train stations, and major public events.

The AI in video surveillance market in France is witnessing that most cities are increasingly adopting AI-powered surveillance systems to enhance public safety. These systems can detect unusual crowd behavior, identify potential criminal activities, and alert authorities in real time. Major cities like Paris and Lyon are at the forefront of implementing these technologies, especially in tourist-heavy areas and during large events.

The Germany AI in video surveillance market is supported by thegovernment for the use of CCTV and video surveillance systems, provided they comply with data protection regulations. This has created a favorable environment for the adoption of AI-based residential video surveillance.

Asia Pacific AI In Video Surveillance Trends

The Asia Pacific AI in video surveillance market is anticipated to register the fastest CAGR over the forecast period. Businesses in Asia Pacific are rapidly adopting AI-enabled surveillance cameras and video analytics solutions to enhance security, improve operational efficiency, and gain valuable business insights. Technologies like facial recognition, object detection, and behavior analysis are being widely deployed.

China AI in video surveillance market is anticipated to register a significant growth over the forecast period as the Chinese government is actively promoting the adoption of AI video surveillance systems equipped with weapon detection capabilities. This is part of a broader push to implement facial recognition and surveillance cameras in public spaces.

The AI in video surveillance market in India is anticipated to grow significantly over the forecast period. India's rapidly growing cities are facing significant traffic congestion challenges. AI-based vehicle identification and number plate recognition systems are being deployed to automate traffic monitoring, enforce traffic rules, and improve overall traffic management.

The Japan AI in video surveillance market has favorable conditions to grow in the coming years as the Japanese government has implemented stringent fire safety regulations, especially for commercial and public buildings. This is driving the adoption of advanced video surveillance systems with AI-powered Smoke & Fire Detection capabilities.

Middle East & Africa (MEA) AI In Video Surveillance Trends

The AI in video surveillance market in MEA is expected to grow in the coming years. Many governments in the MEA region, such as the UAE and KSA, have launched ambitious smart city programs that incorporate advanced video surveillance and parking management technologies. AI-powered parking monitoring is a key component of these initiatives.

Key AI In Video Surveillance Company Insights

Industry leaders are actively pursuing growth through a combination of new product development, strategic partnerships and agreements, product launches, mergers and acquisitions, and market expansion initiatives, for instance, in May 2022. Panasonic Entertainment has partnered with Leica, a leading producer of premium cameras and advanced technology, to develop innovative camera technologies and solutions. The joint initiative, named "L Square," combines the "L" from both companies' brands, "Lumix" and "Leica," to create cutting-edge products. By integrating Panasonic's video and digital expertise with Leica's optical and imaging capabilities, the companies aim to deliver groundbreaking solutions for the camera industry.

Key AI In Video Surveillance Companies:

The following are the leading companies in the AI in video surveillance market. These companies collectively hold the largest market share and dictate industry trends.

- Teledyne Technologies Incorporated

- Axis Communications AB

- Bosch Security and Safety Systems GmbH

- Genetec Inc.

- Honeywell International Inc.

- Huawei Technologies Co. Ltd.

- Ivideo

- Milestone Systems A/S

- NEC Corporation

- Panasonic Corporation

- Sensen.ai

- VIVOTEK Inc.

Recent Developments

-

In March 2023, Honeywell International Inc. completed the first phase of the Safe City project in Bengaluru, installing over 4,100 video cameras at 3,000 strategic locations across the city. These cameras are designed to quickly identify serious situations and facilitate faster police response while also being linked to a command center that leverages machine learning (ML) and artificial intelligence (AI) to enhance situational awareness and support informed decision-making.

-

In July 2023, Dahua Technology introduced AcuPick Search Technology, a groundbreaking innovation that significantly enhances the efficiency and accuracy of video search capabilities. This technology empowers users to quickly locate specific individuals, vehicles, and information by leveraging front-end and back-end AI innovations. With a single reference image, even if crucial details are not visible, AcuPick can help reduce the time spent searching for a specific person or vehicle captured on security footage.

-

In May 2022, Motorola Solutions, Inc. expanded its video security capabilities through the acquisition of Videotec S.p.A., a leading provider of ruggedized video security solutions based in Italy. This strategic move enables Motorola to broaden its portfolio of cameras and solutions, enhancing its ability to secure and support the unique environments of complex, mission-critical industries.

AI In Video Surveillance Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 6.51 billion |

|

Revenue forecast in 2030 |

USD 28.76 billion |

|

Growth Rate |

CAGR of 28.1% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2017 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Offering, deployment, end-use, use cases, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, China, Japan, India, South Korea, Australia, Brazil, UAE, Saudi Arabia (KSA), South Africa |

|

Key companies profiled |

Teledyne Technologies Incorporated, Axis Communications AB, Bosch Security and Safety Systems GmbH, Genetec Inc., Honeywell International Inc., Huawei Technologies Co. Ltd., Ivideo, Milestone Systems A/S, NEC Corporation, Panasonic Corporation, Sensen.ai, VIVOTEK Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

AI In Video Surveillance Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global AI in Video Surveillance market report based on offering, deployment, end-use, use cases, and region.

-

Offering Outlook (Revenue, USD Million, 2017 - 2030)

-

Software

-

Hardware

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

On-premises

-

Cloud

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Commercial

-

Residential

-

Military & Defense

-

Government & Public Facilities

-

Industrial

-

-

Use Cases Outlook (Revenue, USD Million, 2017 - 2030)

-

Weapon Detection

-

Facial Recognition

-

Intrusion Detection

-

Smoke & Fire Detection

-

Traffic Flow Analysis

-

Parking Monitoring

-

Vehicle Identification

-

Others (Anomaly detection and Behavior Recognition, Object detection and tracking, Industrial Temperature Monitoring)

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global AI in video surveillance market was estimated at USD 5.74 billion in 2023 and is expected to reach USD 6.51 billion in 2024.

b. The global AI in video surveillance market is expected to grow at a compound annual growth rate of 28.1% from 2024 to 2030, reaching USD 28.76 billion by 2030.

b. North America dominated the AI in video surveillance market with a share of 33.6% in 2024. The region's focus on public safety, the presence of leading technology companies and research institutions driving innovations in artificial intelligence and video analytics, and the increasing adoption of AI-powered surveillance systems are expected to continue fueling the market's expansion in North America.

b. Some key players operating in the AI in video surveillance market include Teledyne Technologies Incorporated, Axis Communications AB, Bosch Security and Safety Systems GmbH, Genetec Inc., Honeywell International Inc., Huawei Technologies Co. Ltd., Ivideo, Milestone Systems A/S, NEC Corporation, Panasonic Corporation, Sensen.ai, VIVOTEK Inc.

b. Key factors driving market growth include Rising security threats propelling the adoption of AI-powered video surveillance for advanced threat detection in real time, and Smart city initiatives with integrated AI security systems fueling market growth.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."