AI In Networks Market Size, Share & Trends Analysis Report By Component (Hardware, Software), By Deployment (Cloud, On-premises), By Technology, By Application, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-472-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

AI In Networks Market Size & Trends

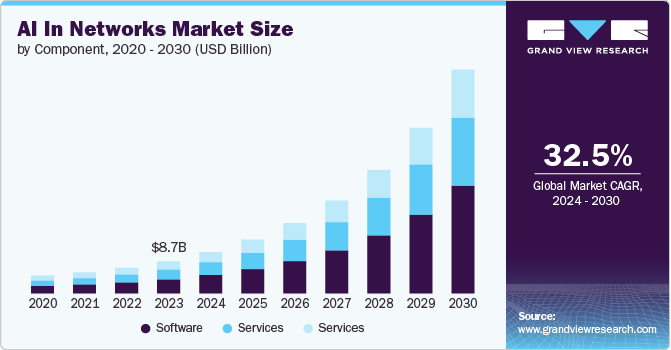

The global AI in networks market size was estimated at USD 8.67 billion in 2023 and is expected to grow at a CAGR of 32.5% from 2024 to 2030. The exponential data growth generated by IoT devices, cloud computing, and digital services has created a pressing need for advanced network management solutions. AI technologies help optimize bandwidth, reduce latency, and enhance overall network performance to handle this growing traffic. In addition, organizations are increasingly seeking automation to reduce operational costs and improve efficiency. AI-driven solutions can automate routine network management tasks, such as monitoring, troubleshooting, and configuration, allowing IT teams to focus on more strategic initiatives.

The rise in cyber threats has made network security a top business priority. AI can enhance cybersecurity by providing real-time threat detection, anomaly identification, and automated responses to security incidents, making networks more resilient against attacks. Businesses seek real-time insights from their network data to make informed decisions. AI technologies enable predictive analytics, allowing organizations to anticipate issues before they arise and optimize network performance accordingly.

The introduction of 5G networks and the growth of edge computing require advanced network management solutions. AI plays a crucial role in managing the complexities of these technologies, ensuring seamless connectivity and low latency for applications like autonomous vehicles and smart cities. Furthermore, organizations can achieve significant cost savings by leveraging AI for network management through improved resource allocation and reduced downtime. AI helps identify inefficiencies and streamline processes, leading to better utilization of network resources.The market growth is fueled by organizations' efforts to leverage advanced technologies that enhance network capabilities and meet the evolving demands of digital transformation.

Component Insights

The software segment led the market in 2023, accounting for over 43.0% share of the global revenue. Increased adoption of AI technologies, growing need for real-time data processing, automation of network management, and cloud migration are primarily contributing to the segment’s growth. Moreover, AI software solutions are often customizable and scalable, allowing organizations to tailor them to their specific needs and expand their capabilities as requirements evolve. Furthermore, the ability of AI software to integrate seamlessly with existing network infrastructure and management systems makes it a valuable asset for organizations looking to enhance their current capabilities without extensive overhauls.

The services segment is anticipated to grow significantly over the forecast period. Organizations seek tailored solutions aligning with their business objectives and network requirements. Services providers offer customization, ensuring that AI solutions are optimized for unique operational needs. Moreover, continuous AI system monitoring, maintenance, and updates are essential to ensure optimal performance. Managed services help organizations maintain their networks efficiently. Furthermore, as organizations move to cloud and edge computing environments, there is an increased need for services that support the management and optimization of these networks, driving growth in the services segment.

Deployment Insights

The cloud segment accounted for the largest market revenue share in 2023. Cloud-based solutions offer scalability, allowing organizations to adjust their resources based on demand easily. This flexibility is crucial for handling varying workloads and accommodating future growth. Moreover, cloud deployment reduces the need for significant upfront investments in hardware and infrastructure. Organizations can adopt a pay-as-you-go model, which helps manage operational costs effectively. Furthermore, cloud solutions provide remote access to network management tools, enabling teams to collaborate effectively regardless of location. These factors collectively contribute to the increasing adoption of cloud deployment in the market.

The on-premises segment is anticipated to exhibit a significant CAGR over the forecast period. Numerous factors, such as data privacy and security, customization and control, and reduced dependence on internet connectivity, are the prominent driving factors of the on-premises segment. Although initial investment costs may be higher, organizations may find long-term cost savings through on-premises solutions. This applies to businesses with predictable workloads that prefer capital expenditure over ongoing operational costs. Furthermore, on-premises solutions do not rely on internet connectivity for operations, making them ideal for environments with unstable or limited internet access.

Technology Insights

Machine learning (ML) accounted for the largest market revenue share in 2023. As networks become more complex due to integrating IoT devices, cloud services, and 5G technologies, ML algorithms can analyze vast amounts of data to optimize performance and manage network operations effectively.ML enables real-time analysis of network data, allowing for quick decision-making and proactive management of network resources. This capability is essential for maintaining optimal performance and minimizing downtime. Organizations are increasingly adopting ML to automate routine network management tasks, such as monitoring, configuration, and troubleshooting. This reduces the need for manual intervention and improves operational efficiency.

The deep learning segment is anticipated to exhibit significant CAGR over the forecast period. The increasing volume of data generated by various sources, such as IoT devices and cloud services, creates an optimal environment for deep learning algorithms to analyze and extract valuable insights, thereby improving network management capabilities. Deep learning techniques, especially neural networks, excel at recognizing patterns and making predictions based on complex datasets. This capability improves tasks such as traffic management, anomaly detection, and network optimization. Moreover, developing powerful GPUs and specialized hardware for deep learning facilitates faster processing and training of models, making it more feasible to implement deep learning solutions in network applications.

Application Insights

The network optimization segment accounted for the largest market revenue share in 2023. Various factors, such as increased data volume, demand for real-time performance monitoring, and network management automation, are primarily driving the segment's growth. Moreover, organizations can achieve significant cost savings by optimizing network resources and reducing downtime. AI solutions help identify inefficiencies, enabling better resource allocation and utilization. Optimized networks lead to improved user experiences, as latency and downtime are minimized. Organizations increasingly focus on providing seamless connectivity for users, driving demand for network optimization solutions.

The network cybersecurity segment is anticipated to exhibit the highest CAGR over the forecast period. The rising frequency of cyberattacks, including ransomware, phishing, and advanced persistent threats (APTs), necessitate advanced cybersecurity measures. AI enhances threat detection and response capabilities, making it essential for organizations. In addition, AI technologies can analyze vast amounts of network data in real-time, identifying anomalies and potential threats faster than traditional methods. This capability is crucial for timely intervention and risk mitigation. Furthermore, AI-driven automation allows for quicker responses to security incidents, reducing the need for manual intervention. Automated processes help streamline security operations and enhance incident response times.

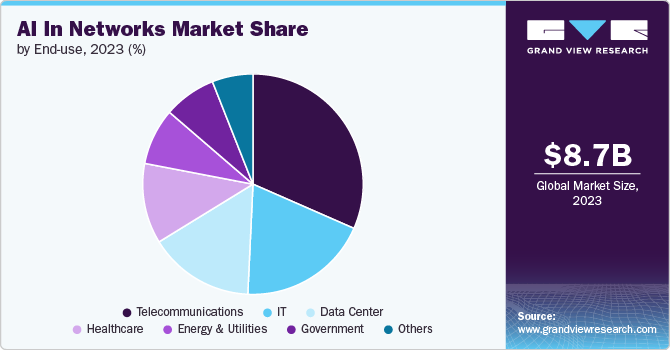

End-use Insights

Telecommunications accounted for the largest market revenue share in 2023. AI-driven predictive maintenance allows telecom providers to anticipate and address network issues before they lead to service disruptions. This approach reduces downtime and maintenance costs, enhancing operational efficiency. In addition, AI technologies enable telecom companies to analyze customer data and behaviors, allowing for personalized services and targeted marketing strategies. Improved customer experience leads to higher satisfaction and retention rates. Furthermore, telecom operators utilize AI for advanced data analytics, enabling better decision-making and strategic planning. Insights from network data can drive innovations in service offerings and operational improvements.

The IT segment is anticipated to exhibit a significant CAGR over the forecast period. Increased complexity of IT infrastructure, growing need for real-time data processing, automation of network management, and increased adoption of cloud services are driving the segment's growth. Moreover, AI enables the automation of routine tasks such as monitoring, configuration, and troubleshooting, allowing IT teams to focus on strategic initiatives and improving overall operational efficiency.AI solutions help organizations reduce operational costs by identifying inefficiencies, optimizing resource allocation, and minimizing downtime through predictive maintenance.

Regional Insights

North America dominated the market with a revenue share of over 40.0% in 2023. Its well-established technological ecosystem with advanced IT infrastructure enables rapid adoption of AI solutions for network management. Moreover, with an increasing number of cyber threats, organizations in North America prioritize advanced security measures. AI technologies provide effective solutions for threat detection and response, driving demand in the market.

U.S. AI In Networks Market Trends

The AI in networks market in the U.S. is anticipated to exhibit a significant CAGR over the forecast period. The presence of major technology companies and startups focused on AI innovation fosters a competitive environment that accelerates the development and deployment of AI-driven network solutions. Moreover, companies in the country are adopting AI to automate network management tasks, improve operational efficiency, and reduce costs, driving the demand for AI in networks.

Europe AI In Networks Market Trends

The AI in the networks market in Europe is expected to witness significant growth over the forecast period. European organizations face stringent data protection regulations, such as GDPR. AI solutions help ensure compliance by automating data management processes and enhancing security measures. Moreover, European governments and enterprises are investing heavily in digital transformation initiatives. AI technologies are essential for optimizing network performance, enabling advanced applications, and driving growth in the market.

Asia Pacific AI In Networks Market Trends

The AI in networks market in Asia Pacific is anticipated to register the highest CAGR over the forecast period. Various countries in Asia-Pacific are experiencing significant digital transformation across various industries, increasing the demand for advanced network solutions to support new technologies and services. Moreover, the rapid increase in internet users and mobile device adoption creates higher data traffic, necessitating efficient network management powered by AI technologies.

Key AI In Networks Company Insights

Key AI in networks companies include Nokia, Cisco Systems, Inc., and Huawei Technologies Co., Ltd. Companies active in the market are focusing aggressively on expanding their customer base and gaining a competitive edge over their rivals. Hence, they pursue various strategic initiatives, including partnerships, mergers & acquisitions, collaborations, and new product/ technology development. For instance, in June 2024, Huawei Technologies Co., Ltd., an ICT infrastructure and smart devices provider, announced an initiative to integrate AI into networks; this strategy aims to create a RAN Intelligent Agent ecosystem in partnership with network operators to boost network efficiency. The initial phase targets engaging 1,000 site engineers and expanding to 10,000 locations in cities such as Guangzhou, Hangzhou, Shenzhen, Jinan, and Bangkok over six months.

Key AI In Networks Companies:

The following are the leading companies in the AI in networks market. These companies collectively hold the largest market share and dictate industry trends.

- Arista Networks, Inc.

- Broadcom

- Cisco Systems, Inc.

- Extreme Networks

- Huawei Technologies Co., Ltd.

- IBM Corporation

- Juniper Networks, Inc.

- Nokia

- Telefonaktiebolaget LM Ericsson

- ZTE Corporation

Recent Developments

-

In September 2024, Telefonaktiebolaget LM Ericsson collaborated with T‑Mobile USA, Inc., a wireless network operator, and NVIDIA Corporation, a developer of graphics processing units (GPUs), to create a joint AI-RAN Innovation Center. The AI-RAN Innovation Center is set to propel the standardization and widespread acceptance of AI-RAN technologies across the industry. The center would concentrate on improving network performance, reliability, and efficiency.

-

In September 2024, Nokia launched the Event-Driven Automation (EDA) platform, marking a significant advancement in AI. This innovative platform, leveraging Kubernetes, transforms data center network operations by offering a highly dependable, simplified, and flexible solution for managing the lifecycle of data center networks. Nokia EDA is designed to eliminate human errors in network operations, significantly reducing network interruptions and downtime for applications and cutting operational efforts by up to 40%.

-

In June 2024, Cisco Systems Inc. collaborated with NVIDIA Corporation, a developer of graphics processing units (GPUs), and launched Nexus HyperFabric AI Clusters, a simplified Data Center Infrastructure Solution tailored for Generative AI. The solution merges Cisco Systems Inc.'s and NVIDIA Corporation's technological advancements to streamline the implementation of generative AI applications. It ensures comprehensive IT visibility and analytics throughout the entire AI infrastructure stack.

AI In Networks Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 11.19 billion |

|

Revenue forecast in 2030 |

USD 60.60 billion |

|

Growth rate |

CAGR of 32.5% from 2024 to 2030 |

|

Actual data |

2017 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion/million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, deployment, technology, application, end- use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA |

|

Key companies profiled |

Arista Networks, Inc.; Broadcom; Cisco Systems, Inc.; Extreme Networks; Huawei Technologies Co., Ltd.; IBM Corporation; Juniper Networks, Inc.; Nokia; Telefonaktiebolaget LM Ericsson; ZTE Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global AI In Networks Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global AI in networks market report based on the component, deployment, technology, application, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Software

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

Cloud

-

On-premises

-

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Machine Learning

-

Natural Language Processing

-

Computer Vision

-

Deep Learning

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Network Optimization

-

Network Cybersecurity

-

Network Predictive Maintenance

-

Network Troubleshooting

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Telecommunications

-

IT

-

Data Center

-

Healthcare

-

Government

-

Energy & Utilities

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global AI in networks market size was estimated at USD 8.67 billion in 2023 and is expected to reach USD 11.19 billion in 2024.

b. The global AI in networks market is expected to grow at a compound annual growth rate of 32.5% from 2024 to 2030 to reach USD 60.60 billion by 2030.

b. North America dominated the AI in networks market with a share of 40.7% in 2023. Its well-established technological ecosystem and advanced IT infrastructure enable the rapid adoption of AI solutions for network management. Moreover, with an increasing number of cyber threats, organizations in North America prioritize advanced security measures.

b. Some key players operating in the AI in networks market include Arista Networks, Inc.; Broadcom; Cisco Systems, Inc.; Extreme Networks; Huawei Technologies Co., Ltd.; IBM Corporation; Juniper Networks, Inc.; Nokia; Telefonaktiebolaget LM Ericsson; and ZTE Corporation.

b. The exponential growth of data generated by IoT devices, cloud computing, and digital services has created a pressing need for advanced network management solutions. AI technologies help optimize bandwidth, reduce latency, and enhance overall network performance to handle this growing traffic. In addition, organizations are increasingly seeking automation to reduce operational costs and improve efficiency.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."